Top 2000 CEO Survey

No Confidence in Economy, Next President

Source:CW

Following a lackluster business year, Taiwan's CEOs are not only pessimistic about the economy and the investment climate next year, but also issued a vote of no confidence in the leadership potential of Taiwan’s three presidential candidates.

Views

No Confidence in Economy, Next President

By Yi-shan Chen, Yi-huan TuFrom CommonWealth Magazine (vol. 587 )

As the end of the year nears and employees eagerly await their year-end bonuses, how do Taiwan’s CEOs, at the forefront of a cutthroat corporate battlefield, view next year’s economy?

The answer is: Pessimistic about the economy and the investment climate, they have reservations about the capability of Taiwan's next president to lead economic transformation. They also loathe political infighting. The outcome of the CommonWealth Magazine Top 2000 CEO Survey on the Economic Outlook and Strategy for 2016 is both shocking and disturbing.

Majority Expects Economy to Grow Less than 2%

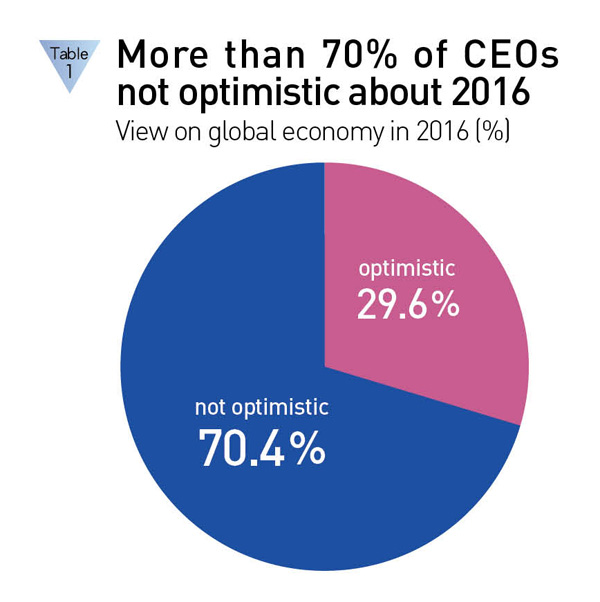

As many as 70 percent of company executives declared they are “not optimistic" or “not optimistic at all” about the world economy in 2016, the most pessimistic outlook since the eruption of the European sovereign debt crisis in 2009. (Table 1)

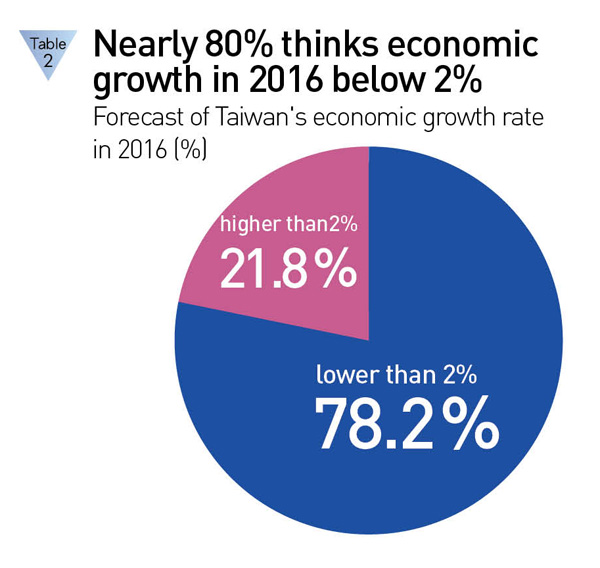

As one would expect, the pessimistic global outlook leads to a very conservative forecast of Taiwan’s economic prospects. As many as 78.2 percent of corporate leaders believe that Taiwan’s economic growth rate will stay below two percent in 2016. (Table 2)

There is clearly a no-confidence vote in the 2.32 percent gross domestic product growth rate forecast for 2016, issued by the Directorate-General of Budget, Accounting and Statistics in late November.

Among the 70 percent of the CEOs who are pessimistic about the economic outlook for 2016, 83.1 percent cite slowing economic growth in China as the main reason for their pessimism, followed by concern that European economies will not show much improvement in the short run.

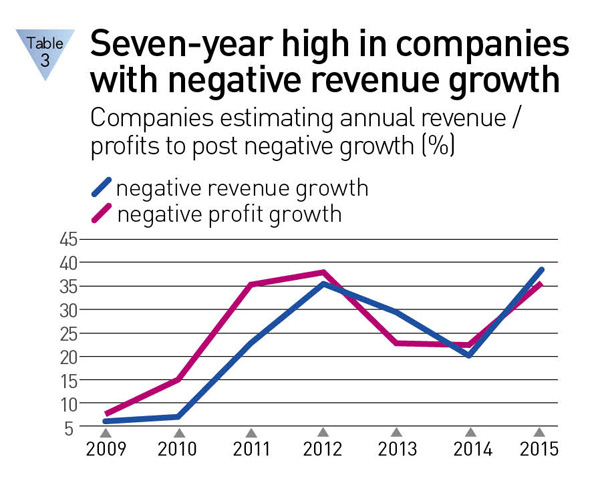

They are conservative about the Taiwanese economy because this year many companies saw their worst year in terms of results and profits since the inception of the CEO Survey in 2009.

Asked to assess the revenue and profit growth of their companies in 2015, 38.6 percent of the CEOs said their revenue posted negative growth, while 35.8 percent pointed to negative profit growth. These percentages represent the highest and second-highest values respectively in the survey’s seven-year history.(Table 3)

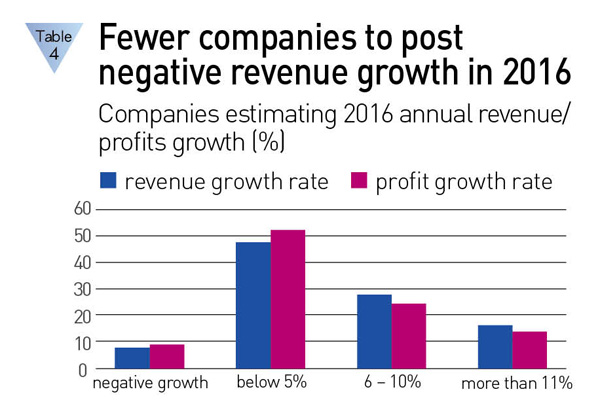

A 7.9-percent share of corporate leaders even expects revenue to shrink further in 2016, whereas nearly half of the respondents anticipate revenue to grow less than five percent next year. Nearly 10 percent expects company profits to shrink, while almost 50 percent foresee low growth rates. (Table 4)“This year has definitely been tougher than 2008,” notes Wang Shyi-chin, executive vice president and spokesperson for China Steel Corp.

Concern over Exclusion from Regional Integration

Wang observes that 2008 was an isolated incident, since the economy bounced back after the crisis as governments around the globe printed money to cover their deficits. But Wang thinks that this time the world economy faces structural problems such as overproduction in China. Reducing excess capacity pertains to economic restructuring. “I am not that optimistic about a [economic] turnaround in the future; it is hard to tell how long it will take," says Wang.

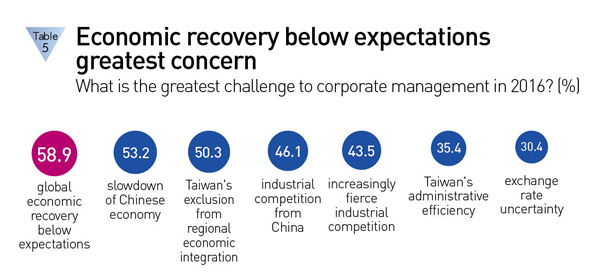

When asked what they consider the greatest challenge to corporate management in 2016, the business leaders cite as top concerns economic trends in China and the world as well as increasingly fierce industrial competition. It deserves attention that half of the CEOs list “Taiwan’s exclusion from regional economic integration” as their third biggest concern. (Table 5)

Pointing to the fact that 30 percent of the CEOs regard exchange rates as the biggest challenge, Chris Hung, director of the Market Intelligence and Consulting Institute under the Institute for Information Industry, says that the problem does not lie with Taiwan but with neighboring countries such as Japan, who keep their currency artificially low to boost exports.

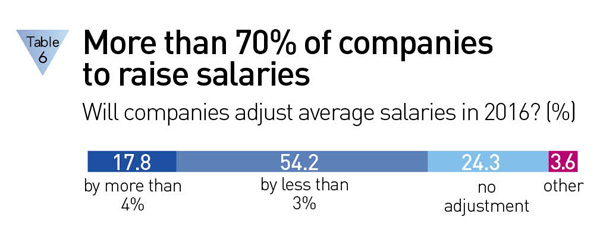

Against the backdrop of a pessimistic economic outlook, most corporate leaders, 54.2 percent, envisage salary hikes of less than 3 percent in 2016 compared to 24.3 percent who do not plan any pay rises. (Table 6)

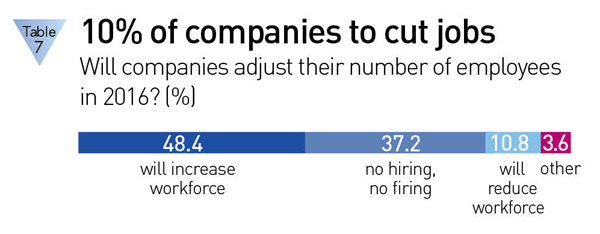

Nevertheless, prospects in the labor market are bleak for 2016. As many as 10.8 percent of the Top 2000 enterprises plan to downsize their Taiwanese workforce. Among foreign enterprises, the figure stands at an even higher 15.7 percent, the highest ratios since the European bond crisis. (Table 7)

Unable to Spearhead Economic Transformation?

Whom would the CEOs like to see lead Taiwan in these difficult times of economic transformation?

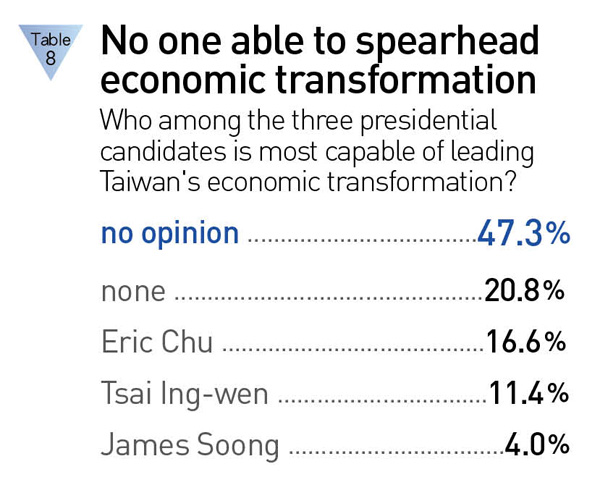

Asked to choose among Taiwan’s three presidential candidates – Eric Chu for the ruling Kuomintang (KMT), Tsai Ing-wen for the major opposition Democratic Progressive Party (DDPP) and James Soong for the People First Party (PFP) – the politician who is "most capable to lead Taiwan's economic transformation" as many as 47.3 percent voiced "no opinion," which means that the CEOs are either undecided or not willing to reveal their preference for a certain candidate. (Table 8)

Wang Yeh-lih, a political science professor at National Taiwan University, regards the high ratio of "undecided" respondents as a result of the “spiral of silence” effect. The spiral of silence refers to the fact that people tend to remain silent when they feel that their views run counter to the perceived majority opinion because they fear isolation or reprisals. Traditionally, the majority of corporate leaders believe that the KMT has more experience handling cross-strait policy and economic transformation. However, it is widely believed that Tsai from the DPP will win the upcoming presidential election in mid-January. Given that the political realities somewhat differ from what they would wish for, the CEOs have certain misgivings about the future.

On the other hand, although Wang believes that the general perception is that Tsai will win the election, the economic policy that Tsai would adopt after taking office remains unclear for many. Therefore, they do not know how to compare the three candidates.

Most surprisingly, of those who voiced an opinion a substantial 20.8 percent of the CEOs consider “none” of the three candidates capable of spearheading Taiwan’s economic restructuring, whereas 16.6 percent deem Chu most capable and 11.4 percent Tsai. Among the CEOs of foreign companies, an even higher ratio of 31.4 percent believes that "none" of the three candidates will be able to exercise leadership on economic transformation.

Wang explains that in the past, Taiwanese society generally held that the KMT had more expertise in dealing with economic problems. However, over the past eight years of KMT rule, the public has become very disappointed with the government's performance. For Taiwan’s large enterprises the KMT, which tends to protect business interests, is a familiar player. But they are much less sure what to expect from Soong and Tsai. “The economic teams of Soong and Tsai are not really complete. You can’t find a reason why they would do a better job," Wang says.

Good Administrator vs Cross-strait Whizz

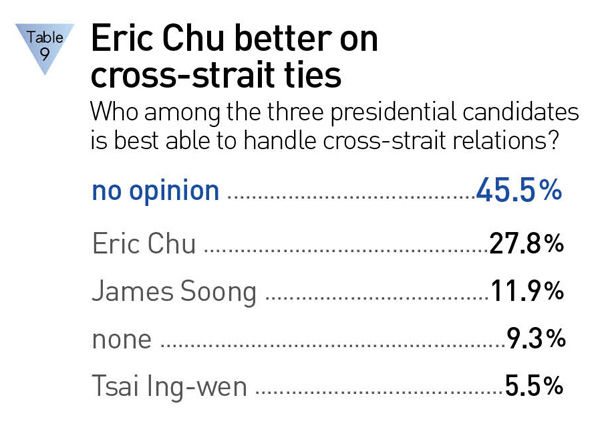

The spiral of silence remains at work when the CEOs are asked to decide who among the three presidential hopefuls "is most capable of handling cross-strait relations?" As much as 45.5 percent of CEOs chose the response "no opinion," whereas 27.8 percent picked Chu, 11.9 percent opted for Soong and just 5.5 percent selected Tsai. (Table 9)

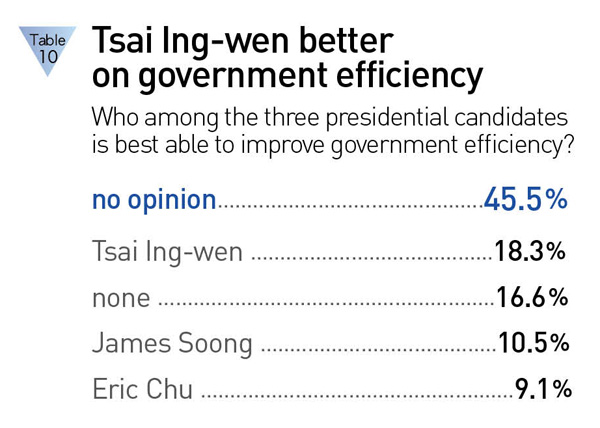

Despite her perceived cross-strait weakness, Tsai came out on top with regard to raising government efficiency. Some 18.3 percent of the CEOs believe that as president, Tsai would be able to improve the government’s administrative efficiency, while 16.6 percent think that none of the three candidates would be able to do so. Only 9.1 percent see such capacities in Chu. (Table 10)

Wang believes this lack of trust in Chu’s administrative abilities reflects the public’s disappointment with the past eight years of KMT rule. There is widespread hope that a fresh wind will blow across the island under the new administration. The ratio of those stating that “none” of the candidates would be able to improve administrative efficiency is only so high because the business leaders are so disappointed with the past, says Wang.

Hung Yao-nan, secretary general of the Cross-strait Policy Association (CSPA), posits that the DPP has consistently performed better than the KMT at the local government level. This works to the advantage of Tsai, who also has held posts in the central government bureaucracy.

As to the survey responses on cross-strait issues, Hung regards these as a reflection of “Communist China’s misgivings about the DPP”. The initiative on cross-strait relations lies with China. The CEOs are not sure yet whether Tsai will be a match for China.

"Presently, the DPP and the CPC [Communist Party of China] maintain a quite reasonable and restrained attitude," Hung points out. For the time being, China is only looking at Tsai’s cross-strait policy without holding her accountable for it; they are not playing the intimidation card. The DPP has also been quite rational about the Ma-Xi meeting, stating that both sides are creating rational interaction and retaining room for future interaction.

Pessimism on Investment

Almost half of all foreign companies believe that political infighting is the foremost challenge to the island's business environment.

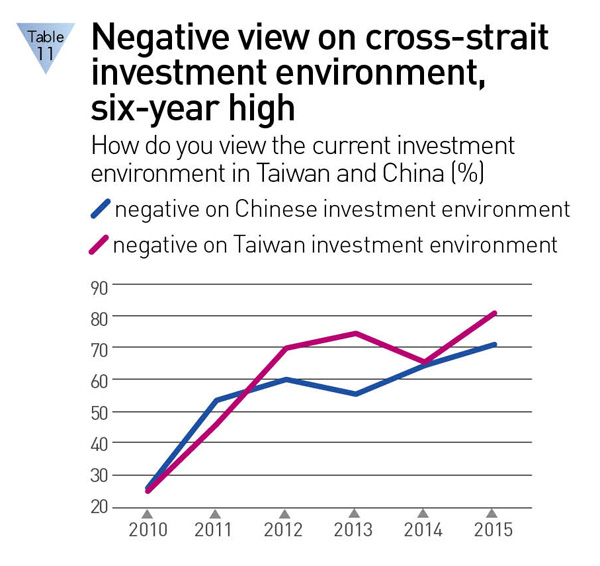

The ease of doing business is an important indicator of long-term economic competitiveness. In this survey, the CEOs' pessimism about the investment environment in Taiwan and China has reached a record high. (Table 11)

As many as 71.3 percent of the CEOs – a seven-year high - believe that the environment for investors in China is "rather bad" or "very bad." An even higher ratio, 81.1 percent, are negative about Taiwan's investment climate.

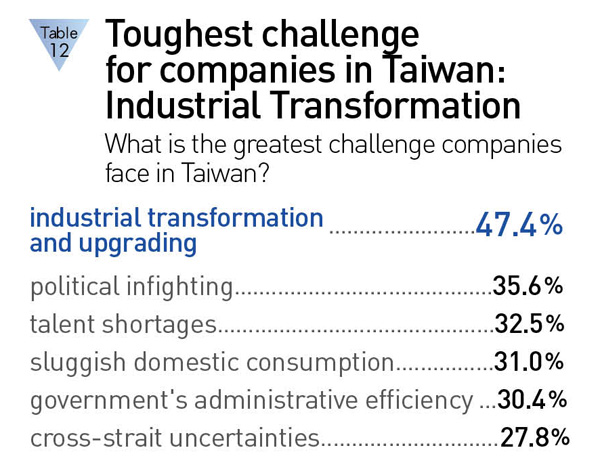

The CEOs listed as the biggest current challenges for Taiwan’s business environment the following issues, in declining order: Industrial transformation and upgrading were cited by 47.4 percent, followed by political infighting with 35.6 percent and talent shortages with 32.5 percent. (Table 12)

Significantly, foreign enterprises cite political infighting as the top concern, which shows that they attach greater importance to Taiwan’s democratic development than domestic companies do.

During a visit to Taiwan last year, Dominique V. Turpin, president of the International Institute for Management Development (IMD) in Lausanne, Switzerland, warned that fighting between political factions could undermine Taiwan’s competitiveness.

"Politics in Taiwan are tense. Taiwan is a very political country,” Turpin stated. He went even further to say that "Parties are very confrontational, I mean, almost destructive.”

For the first time, more than 30 percent of the CEOs point to a lack of talent as a challenge for doing business in Taiwan.

Global human resources consulting firm Towers Watson said in its latest 2014/2015 Global Remuneration Planning Report published in March that base salaries in Taiwan continue to lag even behind those of China.

Base salaries in Taiwan are around 30% higher for support levels. But at the junior management and professional grade level, base salaries in China overtake those in Taiwan. At the high end of the scale, senior executive base salaries in China are about 70% higher than in Taiwan, the report found.

"The critical reason for low pay is the conservative salary increase philosophy of Taiwanese enterprises,” said Sambhav Rakyan, Data Services practice leader at Towers Watson, who was in charge of the report.

He noted that even as Taiwanese enterprises are attempting to go global or transform from manufacturing to services, their remuneration philosophy remains unchanged. As a result, Taiwanese businesses face a serious talent retention issue. “If talent can find the same remuneration and value domestically, their first choice is definitely to stay in the local market,” remarks Charles Wang, general consultant of Towers Watson Taiwan. He believes Taiwanese enterprises need to ask themselves why they are failing to retain talent.

Impact from Regional Trade Blocs

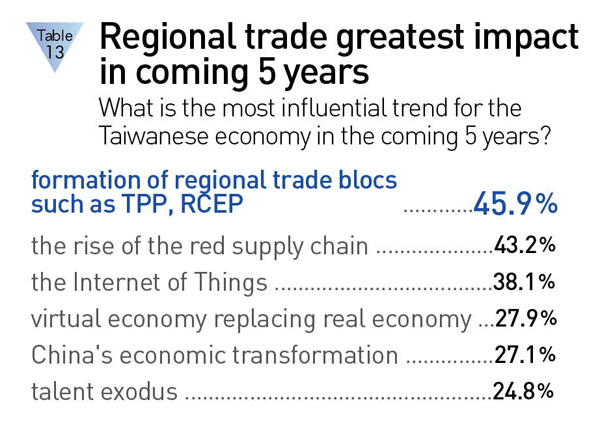

Which trends and innovations will have the greatest impact on Taiwan's economy in the coming five years? Almost one half, 45.9 percent, of the CEOs point to “the formation of regional trade blocs such as the TPP [Trans-Pacific Partnership] and the RCEP [Regional Comprehensive Economic Partnership],” while 43.2 percent worry about the rise of the so-called red supply chain, which refers to import substitution in China. (Table 13)

Another rather alarming fact is that, although most CEOs cite the launch of regional trade pacts as the most important trend, nearly 30 percent admit that they “don’t understand much” or “don’t understand at all” about the TPP and are therefore unable to assess its impact.

Translated from the Chinese by Susanne Ganz