Thriving in 4IR

These Countries are Best Prepared for the Future of Production

Source:Chien-Tong Wang

The rising tide of the Fourth Industrial Revolution (4IR) is altering the entire landscape of production. Old types of business models, techniques and workers will be fundamentally challenged. How are different countries in the world responding to this drastic transformation?

Views

These Countries are Best Prepared for the Future of Production

By Johan Aurik, Helena Leurentweb only

As the Fourth Industrial Revolution (4IR) gathers momentum, spurring the development of new techniques and business models that will fundamentally transform production, decision-makers across government, industry and society are confronted by a new set of uncertainties.

The sheer speed and scope of change associated with emerging technologies, such as additive manufacturing and the internet of things, has added yet another layer of complexity to an already challenging task: that of developing and implementing industrial strategies that promote both productivity and inclusive growth.

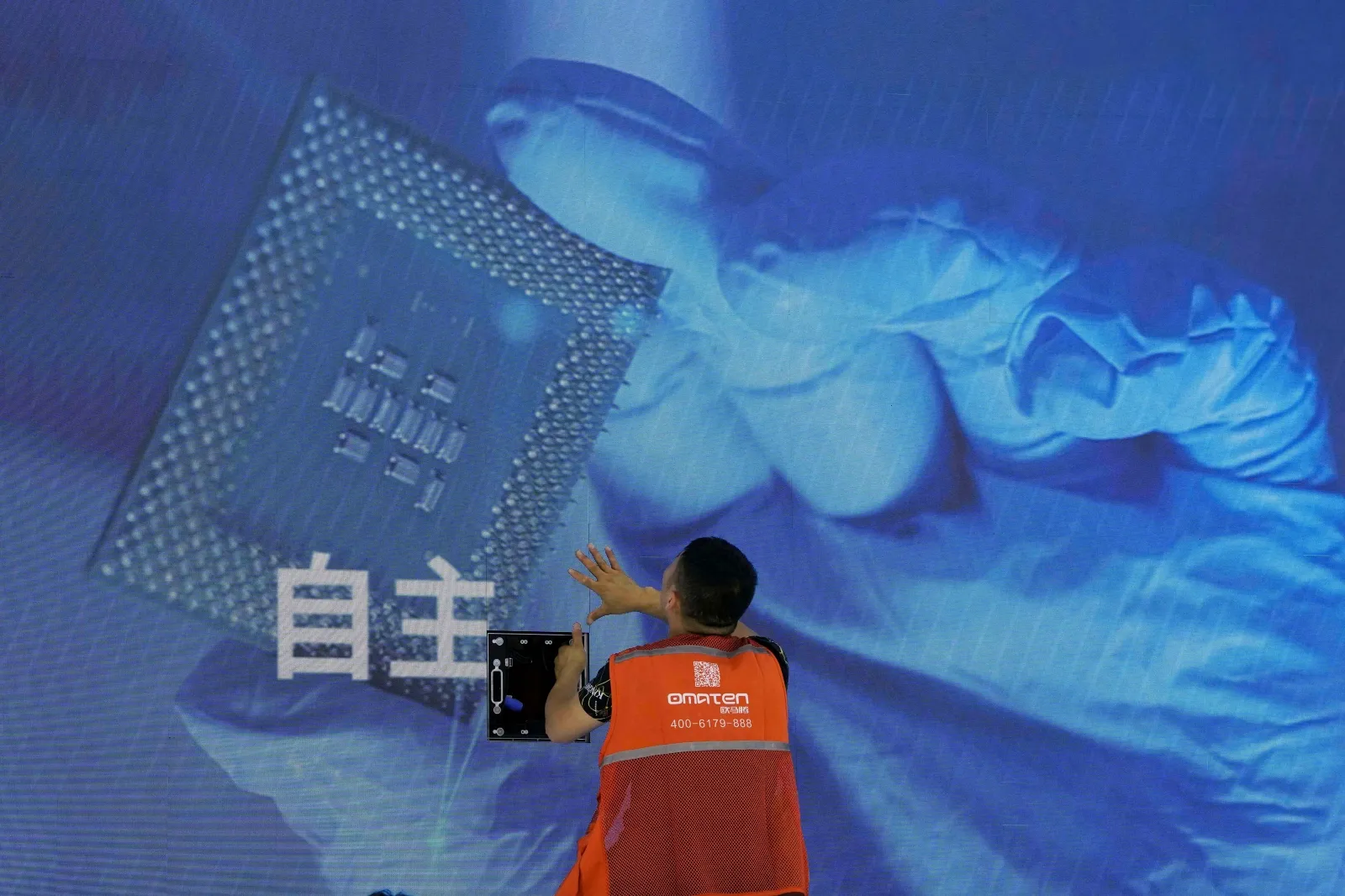

Grasping the future: The Fourth Industrial Revolution will change the nature of manufacturing. (Image: REUTERS/Edgar Su)

Grasping the future: The Fourth Industrial Revolution will change the nature of manufacturing. (Image: REUTERS/Edgar Su)

In the wake of this changing landscape, countries must rethink their industrial strategies. And there are pockets of progress. With the launch of Industrie 4.0 in 2011, Germany was one of the first countries to increase digitization and the interconnection of products, value chains, and business models to drive digital manufacturing forward. Japan’s Society 5.0 – a strategy to use emerging technology to transform not only production, but all of society – followed in 2016. Meanwhile, several major efforts launched during the past year, such as the new United Kingdom Industrial Strategy and the Singapore Smart Industry Readiness Index, demonstrate the need for action as countries seek to compete in the new environment.

However, it’s clear that all countries need to decide how best to respond to the new production landscape, or risk being left behind. How, and to what extent, does production feature in their national and regional strategies? How can they collaborate globally in what sometimes seems like a fracturing world? Which factors and conditions will have the greatest impact on the production systems they employ now? And how ready are they for the future?

A Patchy Landscape

The stark truth is that we are at the beginning of the transformation journey, and different pathways will emerge as countries navigate the transformation of production systems. No country – even the most advanced – has reached the frontier of readiness, let alone harnessed the full potential of the Fourth Industrial Revolution in production. Many others have yet to get off the starting blocks.

The question now has to be how we can help countries to not only understand how ready they are for the future of production, but to act on that understanding and build out the relevant strategies and policies that will enable them to take advantage of the opportunities that lie ahead.

The Diagnosis

One of the key steps in any transformation is, of course, understanding the current state. The Readiness for the Future of Production Report 2018 shares the results of an initial assessment developed and carried out by the World Economic Forum in collaboration with A.T. Kearney.

The assessment focused on 100 countries and economies, which together represent more than 96% of both global Manufacturing Value Add (MVA) and global Gross Domestic Product (GDP).

The analysis took in their current baseline of production today (the Structure of Production), and also the presence – or lack – of the key enablers that position them to capitalize on emerging technologies and transform production systems (the Drivers of Production).

Figure 1: Readiness Diagnostic Model Framework

Figure 1: Readiness Diagnostic Model Framework

Recognizing that each economy has its own unique development path and production objectives, they have been placed into one of four archetypes based on their scores across the Structure of Production and Drivers of Production elements. This provides a way of benchmarking between economies in a similar position and highlighting potential future pathways.

The archetypes that emerged, and the weighting across each category, paint a compelling portrait of today’s production landscape.

- Leading: Countries with a strong production base today that also exhibit a high level of readiness for the future through strong performance across all drivers. These countries also have the most current economic value at stake for future disruptions.

- Legacy: Countries with a strong production base today that are at risk for the future due to weaknesses across the Drivers of Production.

- High Potential: Countries with a limited production base today that score well across the Drivers of Production, indicating that capacity exists to increase production in the future depending on priorities within the national economy.

- Nascent: Countries with a limited production base today that exhibit a low level of readiness for the future through weak performance across all drivers.

Figure 2: Readiness Archetypes

Figure 2: Readiness Archetypes

So, what have we learnt from this initial assessment? Let’s look at some of the key results:

Figure 3: Global Map of the Readiness for the Future of Production Assessment Results

Figure 3: Global Map of the Readiness for the Future of Production Assessment Results

The Findings

There are 25 Leading countries, concentrated in Europe, North America and East Asia. All but two countries in this archetype are high-income economies. Together, they account for more than 75% of global Manufacturing Value Add (MVA) today and are well positioned to increase their share of the production market in the future.

However, the majority of the economies in the assessment actually showed a low level of readiness for the future of production. 58 of them fell into the Nascent archetype, including around 90% of the economies from Latin America, the Middle East and North Africa, Sub-Saharan Africa and Eurasia. As they account for just 10% of global MVA, these economies will need significant levels of investment if they are to reap any potential rewards from the new production landscape.

Of the remaining economies, 10 – including India, Mexico, Brazil, Indonesia and, perhaps surprisingly, Russia – are in the Legacy archetype. Many of them have benefited historically through offering lower-cost labor, but are at risk for future if they fail to define a strategy around production and develop the right capabilities across the drivers.

Australia and the United Arab Emirates join the final 7 countries in the High Potential archetype. All are high-income economies, and several are rich in natural resources. However, the challenge here is determining whether there is sufficient appetite at national level to create an advanced manufacturing base in the years to come.

The Implications

It is abundantly clear that different pathways will emerge as economies navigate their way through the transformation of production systems. Not all will pursue advanced manufacturing. Some who are next in line as low-cost labor destinations might instead choose to embrace traditional manufacturing opportunities in the near term. Others will adopt a dual approach, perhaps on a regional basis. Yet more will prioritize other sectors altogether.

What is most important is that each economy recognizes its own competitive advantages and makes wise trade-offs in forming a unique strategy that takes the effects of the Fourth Industrial Revolution into account. Because there is no doubt that these will be felt globally.

Forging a Way Ahead

Of course, even as individual economies start to get to grips with the future of production, there’s a bigger issue at stake. And this is that real readiness can only be achieved through solutions that address global – not just national, or regional – concerns. Globally connected production systems need not only the most sophisticated technologies, but for those technologies to be developed according to the same standards, norms and regulations.

Quite simply, they need to be able to talk to one another across any kind of boundary – be it technical, geographic or political – if we are to unlock their true potential. This presents a case for the relevant frameworks to be developed at sector level, rather than by individual nations. It also means that new approaches to collaboration between the public and private sectors are needed to accelerate the path to transformation.

In this vein, the World Economic Forum will continue to offer a platform for dialogue and action as the future of production becomes reality. The next step is a new transition framework that will help governments design their strategies in collaboration with the private sector, civil society and academia. With the readiness assessment serving as a diagnostic, the transition framework will support treatment of the diagnosis, enabling economies to progress on their transformation journeys.

Additional Reading

♦ Chronicling a 20-Year Decline

♦ Does ASEAN Still Have a Future in Manufacturing?

♦ Germany's Industry 4.0 Strategy

Original content can be found at the website of World Economic Forum.

♦ Which countries are best prepared for the future of production?

This article is reproduced under the permission of World Economic Forum (WEF) and terms of Creative Commons Attribution-NonCommercial-NoDerivs 4.0 Unported License (“CCPL”). It presents the opinion or perspective of the original author / organization, which does not represent the standpoint of CommonWealth magazine.