Top 2000 Survey: Financial Industry

Recovery, Deregulation Lead to Boon

Source:CW

The global economic recovery brought higher stocks and bonds profits, while relaxed regulations have encouraged financial interests to get off the island and embrace the greater Pacific region.

Views

Recovery, Deregulation Lead to Boon

By Jenny ChengFrom CommonWealth Magazine (vol. 572 )

How will 2014 be recorded in Taiwan's financial history? For starters, it was the most lucrative year in the history of the local financial industry.

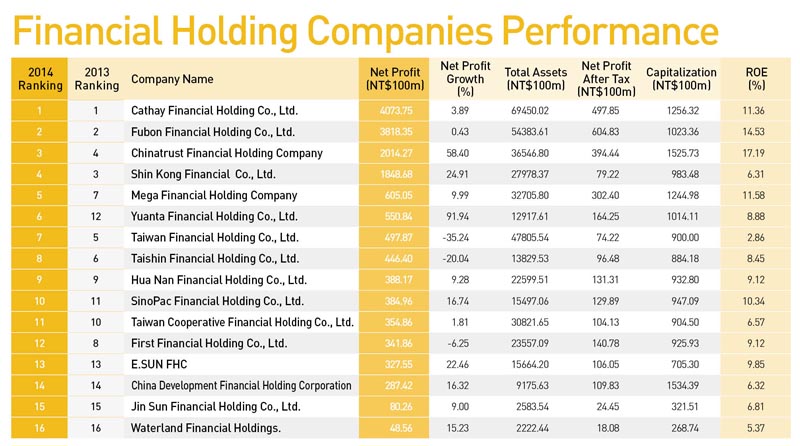

According to CommonWealth's 2015 rankings of the top 16 financial holding companies and top 100 financial firms, of the 16 holding firms surveyed, 11 recorded profits of over NT$10 billion, with 12 of them setting new record highs. The net after-tax profit of the entire financial holding companies reached NT$297.82 billion in 2015, a 40 percent leap over the previous year.

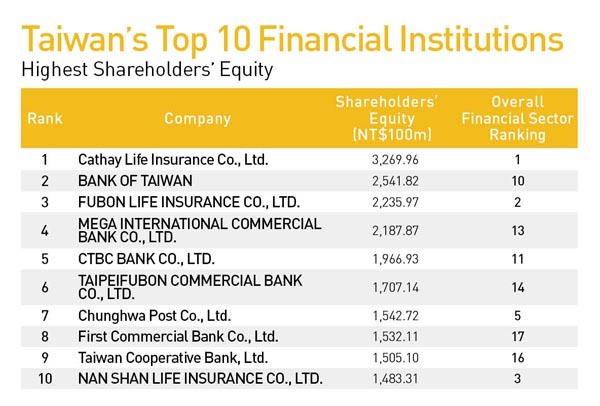

Operating in a nearly saturated market, the top 100 financial firms generated a combined NT$4.8 trillion last year, just 1.2 percent higher than 2013. However, net profits soared to NT$450.04 billion, a 30 percent gain.

Financiers Smile Again

Looking back on 2014, Taiwan's financiers smiled for the first time in ages. One reason is that they made a ton of money on the global stock and bond markets; another reason was the loosening of legal regulations that opened the way for new business initiatives.

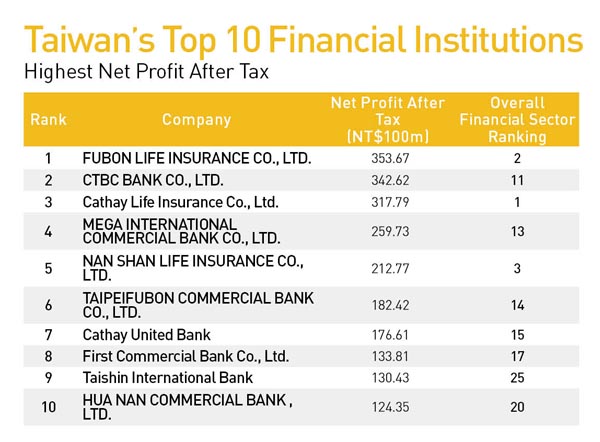

Thanks to hefty investment profits, the insurance industry was the most profitable member of the financial sector.

KGI Investment Advisory president Chu Yen-min relates that local life insurance industry profits are still derived from overseas investments. The global economic recovery of 2014 brought with it higher profits in the stock and bond markets, especially stocks. For Fubon Life, ranked second in the financial industry, stock market profits doubled last year.

In addition to investments, the life insurance industry further profited from real estate reassessment. Cathay Life yielded NT$20 billion in recognized assets due to real estate reassessment last year, while Fubon Life and Nan Shan Life recognized 1.4 billion and 1.6 billion in assets, respectively.

"The impact of loosened regulations last year was historically high," adds Chu Yen-min.

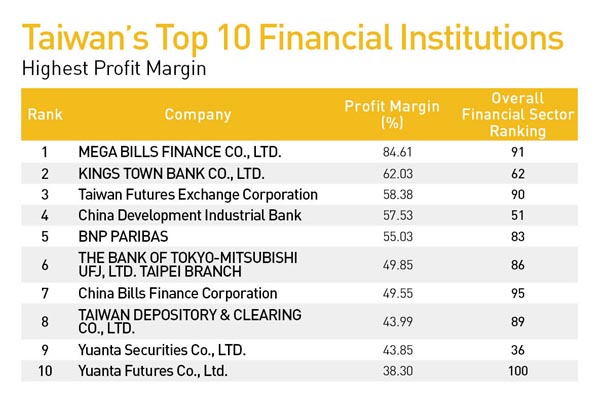

In October of 2014, the Financial Supervisory Commission (FSC) unveiled its "four arrows" directed at the securities industry. These included: lifting limits on day trading by excluding the use of leverage from the balance of margin loans and stock loans; increasing the GRETAI Securities Market's allotment of the balance for margin loans; and postponing legislation introducing a 0.1 percent tax on "big players" that sell over NT$1 billion in stocks in a given year, helping to ease uncertainty over the local bourse and boosting trade volume.

For the banking industry, the FSC relaxed restrictions on the business activities of offshore banking units (OBU) in early 2014, adopting a negative listing approach.

According to statistics, OBUs provided the greatest momentum and contribution to domestic banks in 2014, generating around NT$85 billion in profits, representing 27 percent of total profits made by the entire banking sector, a massive gain of 66 percent over the previous year. This year, the FSC is gradually easing restrictions on the OBU operations of securities and insurance firms.

Compete in the "Asia Cup"

The year 2014 will also go down as Year One of the Taiwanese financial industry's internationalization.

The government opened banking, securities, and insurance licensing in the 1990s, sending private capital flooding into the financial industry. Before long, nearly one hundred banks had sprung up, fighting it out on this small island, leading many finance people to lament that Taiwan's banks lacked any strategic differentiation.

FSC Chairman Tseng Ming-chung called on the local financial industry to go out and compete in the "Asia Cup," forging out across the Taiwan Strait, East China Sea, and South China Sea to China, the Malay Peninsula, the South China Sea islands, and down the Mekong River.

"Taiwan's financial industry must move forward into an era of strategic differentiation," says Jack Huang, partner-in-charge of the Taipei office of the Jones Day law firm.

Huang observes that Taiwanese financial firms' involvement in intra-Asian mergers is largely limited to stock acquisitions, leaving them with no controlling power over the company. He cites Fubon Financial, Chinatrust Financial, China Development Financial, and Yuanta Financial Holdings as a minority of financial firms that have taken a differentiated approach to acquisitions.

On April 9, the first Taiwanese-invested financial firm to operate retail business in China, Fubon Bank China, opened its flagship branch in the Lujiazui Financial District of Shanghai. Fubon China chairperson Hong Peili describes the niche the venture opens up as "local know-how with cross-strait experience."

A native of Shanghai, Hong Peili, a former China Banking Regulatory Commission official, is the first Communist Party member to serve as the chairperson of a Taiwanese-held financial firm. After leaving the Sichuan Banking Regulatory Commission, she led Fubon China in obtaining a retail banking license, permitting the firm to handle foreign currency and accept deposits from non-Chinese individuals. Plans are underway to expand to five to seven branches in China.

Accordingly, Fubon China took a strategic turn, initiating wealth management.

From Hong Kong to Xiamen, and finally making it to the front lines of Shanghai, Fubon China has undertaken a three-year plan. Spending big to establish a strong backend platform, 2015 is the first year of its efforts to win over market share.

Dennis Chan, president of Fubon Bank (China), relates that this year Fubon looks to add 30,000 individual accounts and 4,000 corporate accounts for 100 percent growth. In personal finance, the firm expects to primarily pursue wealth management. "There are 300,000 Taiwanese residents of Shanghai. Ten percent of them opening accounts with us is the base," he says.

Chan believes that entering the China market on the eve of the liberalization of savings interest rates has lessened Fubon's disadvantage of having few outlets. Meanwhile, the development of on-line financial services has further eroded the advantages conventional banks have held by operating numerous branches.

This is what has made Fubon China sanguine about its heavy investment in a backend platform, betting on the opportunities presented in wealth management.

Since acquiring Singapore-based AmFraser securities last year and changing its name to KGI Fraser, China Development Financial subsidiary KGI Securities has gained stronger leverage in Southeast Asian business.

Through KGI Fraser, KGI can now use Singapore as a hub for projecting business around the regional market, establishing cross-product platforms and linking up offerings from overseas operating bases in Taiwan, Hong Kong, Thailand, and Singapore.

KGI president Albert Ding has stressed that the international matrix management approach relies heavily upon local general managers and product executives at various overseas bases with deep knowledge of local markets to jointly oversee business operations, ensuring product alignment with local demands.

Opportunity and Risk

Whether growing through mergers or autonomously, Taiwan's financial industry faces new challenges as it ventures out into Asia.

Lee Hsin-chia, senior vice president of Fitch Ratings Taiwan, relates that while the interest spread of the overseas markets appears wide, it is an illusion resulting from inflation. In other words, exchange rates in countries with high inflation are largely unstable, such as the 20-30 percent devaluation of the Vietnamese dong in one year. "These represent the biggest risk in overseas mergers," says Lee.

As far as ratings agencies are concerned, merger price, capitalization increase approaches, fitness of acquisition targets, and cultural management all represent potential risks.

Entering the "Asia Cup" raises the risk for local financial industry interests, yet oddly favorable regulations keep coming down the pike. For instance, while the government previously forbade life insurance funds from being used in domestic mergers, lately it has encouraged the unrestricted use of insurance funds in overseas mergers.

From choice of strategy and management to risk control capacity, financial might, vision and performance capacity will determine how Taiwan's financial industry fares in the greater Asian market.

Translated from the Chinese by David Toman