Top 2000 Survey: Service Industry

Merging Real and Virtual Worlds

Source:CW

Of the 27 service industries covered by the Top 2000 Survey, the telecom industry is the only sector that suffered shrinking revenue in 2014. The ability to precisely predict demand is crucial if companies want to win consumer support in the Internet era.

Views

Merging Real and Virtual Worlds

By Whitney HuangFrom CommonWealth Magazine (vol. 572 )

Taiwan posted a higher economic growth rate last year than it had during the previous two years. As private consumption picked up pace, the service sector, which most reflects basic needs such as food, clothing, housing, travel, education and entertainment, also performed well.

The total revenue of the 650 service industry enterprises that were included in the latest Top 2000 Survey topped NT$9.4 trillion last year, nearly a 6.7 percentage point increase year-on-year.

Moreover, about 70 percent, or 459 companies, registered revenue growth, while nearly 80 percent, or 511 enterprises, made money and posted earnings.The only unpleasant news for the industry was that the average profit margin shrank from 4.2 percent in 2013 to 3.9 percent last year.

The Internet as Game Changer

Digital China Holdings Limited, China's largest integrated IT services provider, made it into the top ten of the service sector despite being a total newcomer to the Top 2000 Survey. The company, which was spun off from China's Legend Group and has listed its Taiwan depositary receipts (TDR) on the local stock exchange, grabbed 7th place with an impressive revenue of NT$280 billion.

As a result, the enterprises that held ranks seven to ten in 2013 – Chunghwa Telecom, President Chain Store Corp, Mercuries and Associates Holding Ltd. and Hotai Motor Co. Ltd – were all pushed down one slot in the overall sector rankings, with Hotai even losing its spot among the exclusive top ten.

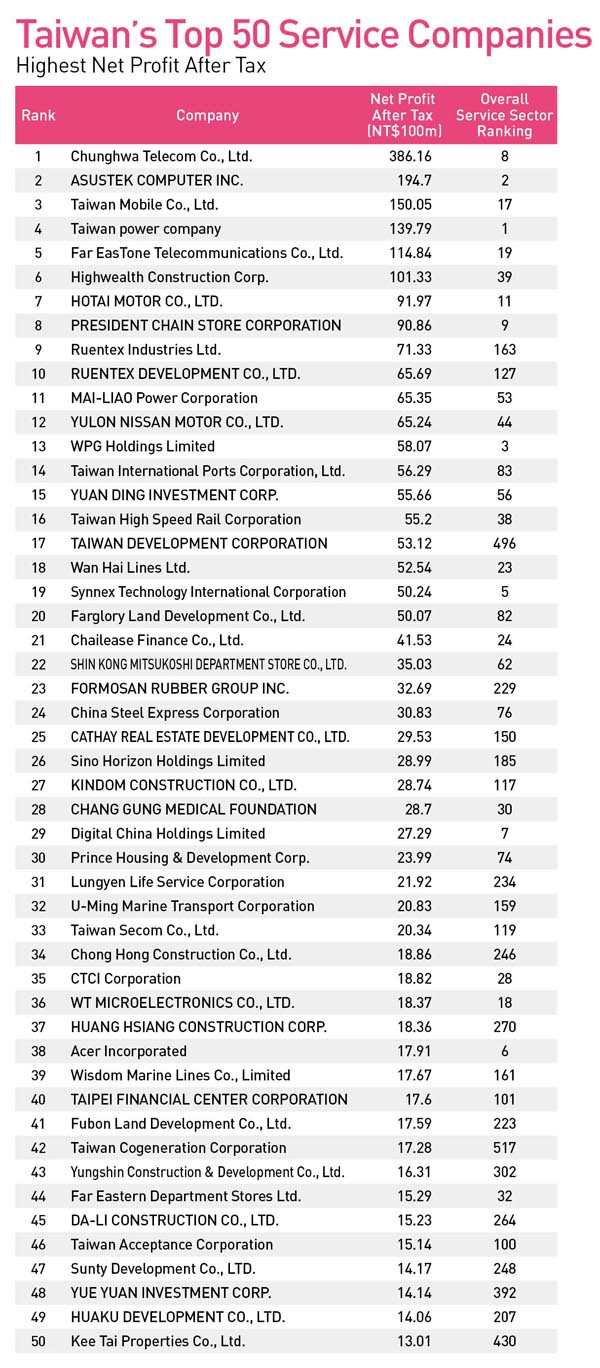

Chunghwa Telecom's revenue growth slowed down slightly from the previous year, but the former state enterprise still posted after-tax net earnings of NT$38.62 billion in 2014. Chunghwa Telecom not only clearly outstrips the other top-ten enterprises in terms of net earnings, it has also emerged as Taiwan's most profitable service company.

Still, the telecom industry is facing formidable challenges as free internet telephony eats into its profits.

Telecom service providers keep investing in infrastructure and R&D to prepare for advanced 4G and 5G mobile services. However, as one industry observer points out, telecom firms' core business profits will be squeezed as more and more people make free calls via free telephony tools such as Line, Skype and Facetime.

The figures don't lie. A comparison of the 27 industries in the service sector shows that only the telecom industry registered negative average revenue growth last year, with a decline of 9.4 percent. The average profit margin also declined by 8.8 percent. As a result, the telecom industry brings up the rear in the rankings for both indicators.

On the other hand, telecom firms posted an average net income of NT$9 billion last year, which leaves the other service industries in the dust. However, last year's earnings results still fell NT$450 million short of the industry's average net income in 2013.

Not only must the fast-changing telecom industry figure out how to attract customers; other service industries are facing the same issue.

Integrating Real and Virtual Worlds

The department store and retail industry posted an average revenue growth of just 4.4 percent and an average profit margin of about 6 percent last year.In comparison, the e-commerce sector, which still has ample room for growth, registered an average revenue growth of 9.7 percent and an average profit margin of 8.7 percent last year.

A Credit Suisse Securities report points out that Taiwan's entire retail sector achieved a compound annual growth rate of just 3.6 percent over the past five years. In contrast, the e-commerce industry turned in an excellent performance with a compound annual growth rate of around 23 percent.

The concept of omni-channel or multi-channel retailing is on the rise as companies integrate their brick-and-mortar stores with online shops and the divide between online and offline marketing becomes increasingly blurred.

"In the past, the service industry relied on mutual person-to-person contacts. However, now that you can buy things online, consumer habits and behavior have changed. The biggest challenge is how to integrate virtual and real world channels," remarks Jason Ke, audit partner at the Taipei office of international accounting firm Deloitte & Touche.

Ke observes that many retailers, be they convenience stores, supermarkets or department stores, develop e-commerce services in response to the integration of the virtual and real shopping worlds."While their ratio is not high yet, they are growing very quickly," Ke points out.

Jessica Yang, head of the Service Creation Center under the Institute for Information Industry (III), once told CommonWealth in an interview that companies pursuing growth must use multiple channels to create business opportunities, since certain product categories are already saturated in the traditional brick-and-mortar channels.

Companies staying on top of these trends have already taken action.

Faced with the growing dominance of retail portals Tmall and Taobao, Peter Huang, chairman of hypermarket chain RT Mart China, developed an online platform in China to win customers. Huang characterizes the venture as his "second time starting an enterprise."

On the other hand, in order to develop omni-channel marketing, the service industry needs to also focus on technology adoption and big data analysis to accurately identify the attributes and preferences of its target customers.

Richard Wu, executive vice president of Shin Kong Mitsukoshi Department Store Co. Ltd., mentioned at a media event earlier this year that his company will use big data analysis to strengthen its customer relations management and to provide different customer groups with targeted services and experiences. "More customized demand means increased marketing efficiency," Wu told reporters.

Following these trends, service industry enterprises are developing novel business models in the hope of providing customers with more diversified and valuable services.

Translated from the Chinese by Susanne Ganz