Top 2000 Survey: Manufacturing

Profits High Due to Apple and Oil

Source:CW

Taiwan's high-tech manufacturers benefitted from the success of Apple's iPhone 6 in 2014, while the 50% drop in oil prices was a boon to conventional industries.

Views

Profits High Due to Apple and Oil

By Elaine HuangFrom CommonWealth Magazine (vol. 572 )

The year 2014 brought a boom for Taiwan's top 2000 manufacturers as performance indicators rose across the board and the number of badly performing companies dropped. As for overall performance, the manufacturing sector posted a three-year high for revenue growth, average profit margin, average return on equity (ROE), and total number of profitable companies. Likewise, a three-year low was reached for the total number of loss-making companies and average debt to equity ratio.

Two main factors drove this boom – Apple Inc. and cheap oil.

High-Tech Stocks Soar on Apple Orders

"2014 was a high-tech boom year, with Apple being the main factor," notes Robert Cheng, chairman of Merrill Lynch Taiwan.

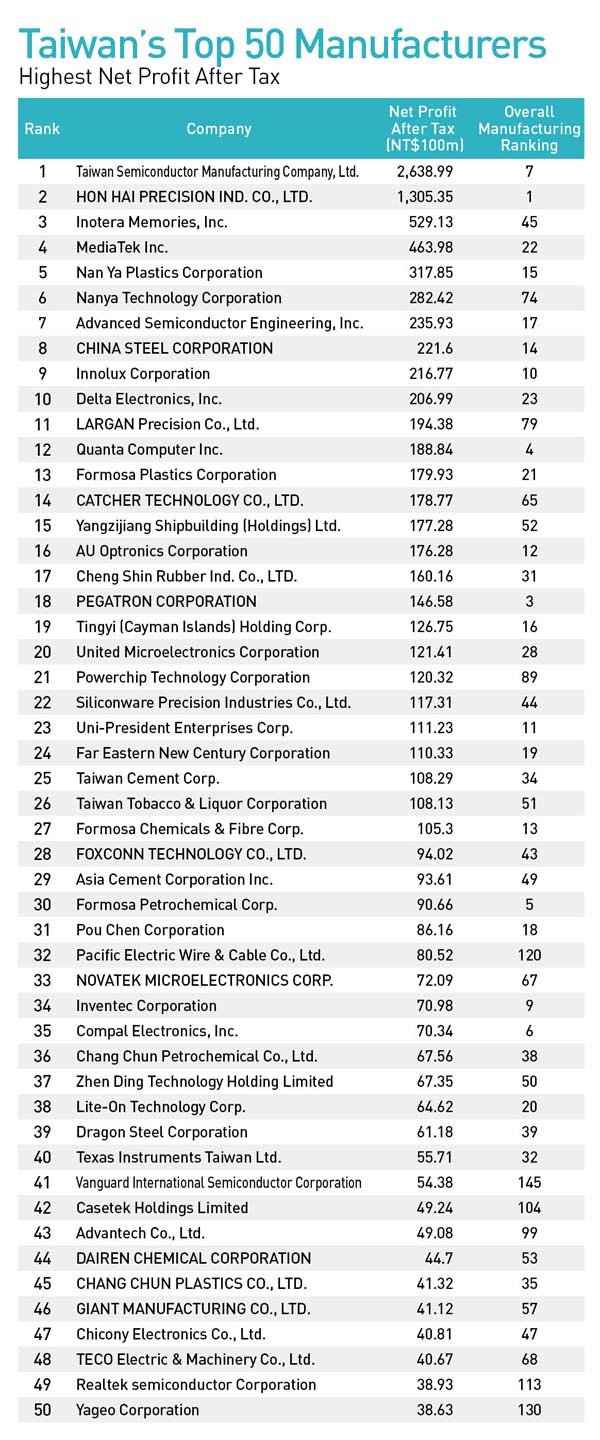

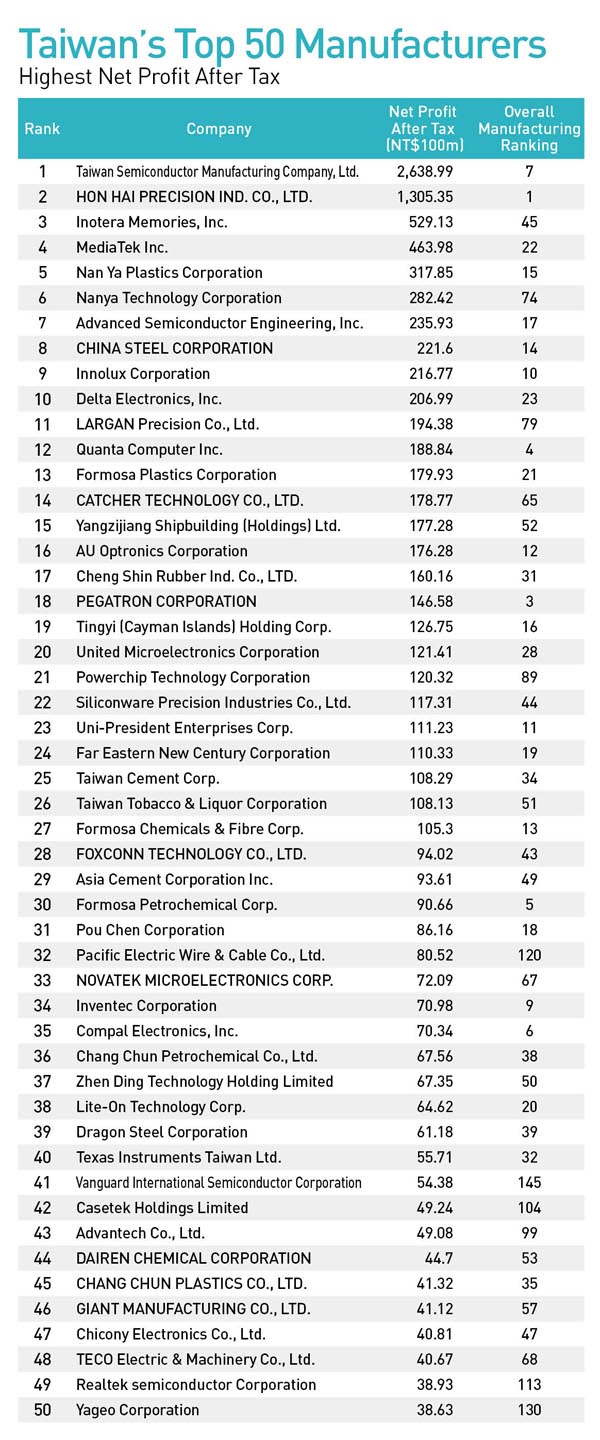

Apple's iPhone 6 and iPhone 6 Plus, released last year, became hot-selling gadgets. With more than 70 million iPhones shipped per quarter, Apple outstripped its biggest rival South Korean smartphone maker Samsung. "This boosted the entire Apple supply chain in Taiwan; they enjoyed a year-round boom," observes Cheng. The overall ranking of the top 2,000 manufacturers reflects this trend.

The Foxconn Technology Group, the sector's standard-bearer and Apple's closest cooperation partner for many years, registered revenue in excess of NT$4 trillion, about 26 percent of Taiwan's GDP.

Thanks to large orders for the assembly of iPhones and iPads, the annual revenue of contract manufacturer Pegatron Corp. broke the NT$1 trillion mark for the first time. Pegatron defended its third place in the overall sector rankings behind unchallenged champion Foxconn and Taiwan's petrochemicals giant CPC Corporation, which came in second for the third year in a row.

"(Our strategy is) equal emphasis on design and manufacturing, striving for high efficiency and high yields," notes Pegatron CEO Jason Cheng in listing the strengths that it took to win Apple as customer. A company needs to stay abreast of technological developments, he says, to increase its own value and become indispensable within the supply chain.

This is also the secret behind Taiwanese manufacturers' ability to remain in the Apply supply chain over time. Largan Precision Co. Ltd., which makes smartphone camera lenses, and leading chassis maker Catcher Technology Co. Ltd. have also thrived on Apple orders.

Largan, whose shares hit an all-time high of NT$3,000 on Taiwan's stock market in April, leapfrogged to 79th place in 2014 up from 125th a year earlier.

Catcher, which is famous for its laptop and mobile phone metal casings, staged a rapid ascent over the past three years from 104th place in 2011 to 65th in 2014. Both companies continue to invest in R&D to defend their crucial positions within the supply chain.

Two more bright spots in the sector are the display and DRAM industries, which were previously written off as doomed. Last year both industries bottomed out and staged a recovery.

"The display industry is subject to economic cycles. After a massive recession during the past three years, demand began to pick up last year. The DRAM industry, on the other hand, underwent some consolidation that led to a restructuring of the industrial order," Cheng points out.

As they embarked on the road to recovery, the "two tigers" of the display industry, Innolux Corporation and AU Optronics Corp. (AUO), last year posted their highest profits since 2008.

Innolux, which has been diversifying its product line, was particularly profitable with net income after tax increasing four-fold from NT$5.1 billion in 2013 to NT$21.6 billion. As a result, the display maker won 10th place, returning to the top ten of the manufacturing industry.

Innolux announced in March that a syndicated loan deal it had been negotiating with banks was approved, solving the company's financial constraints. Pointing to the nearly 400,000 jobs that the upstream and downstream display industry provides in Taiwan, Innolux Chairman Hsing-chien Tuan notes that constantly improving competitiveness is a prerequisite for the entire industry's long-term success.

Falling Oil Prices Help Conventional Industries

The textile, shoe, car parts and related industries also showed stellar performance last year.

"The prices of raw materials are all on the decline, and the appreciating U.S. dollar and the economic recovery are helping exports," notes Danny Ho, CEO at consulting firm Danny Material Intelligence.

Last year, the price of cotton, which had hit a record high of US$2 per pound in 2011, fell to an average of 65 cents. The lower raw material prices brought down costs for fabric and apparel makers, which in return improved their profit figures.

Leading apparel maker Makalot Industrial Co. Ltd., which provides fast fashion brands such as Target, Gap and Zara, has climbed up in the rankings from 198th to 169th place. Right on its heels is Eclat Textile Corporation Ltd., the world's largest manufacturer of knitwear and Taiwan's most profitable textile company. Eclat, which posted record profits last year, grabbed 170th place, up from 191st in 2013.

Eclat, which counts international sports and leisurewear brands such as Under Armour and Lululemon among its customers, is a leading supplier of functional, stretchable textiles. Buoyed by the economic upswing in the United States, Eclat registered a massive growth in sales last year.

The Feng Tay Group, a sports shoes contract manufacturer, posted double-digit revenue growth as it won new customers and expanded its production capacity. The company's revenue exceeded NT$40 billion for the first time, catapulting it up in the rankings from 87th place in 2013 to 77th place last year.

On the other hand, consumption and economic growth were stimulated by falling oil prices. At one point, the oil price hit rock bottom at half its original price. As a result, demand for automobiles and car parts increased in the North American market.

Bicycle, motorcycle and car part manufacturers such as Sanyang Motor Co. Ltd, Merida Industry Co. Ltd., TYC Brother Industrial Co. Ltd. and Depo Auto Parts. Ind. Co. Ltd. all moved up in the rankings on the back of an export boom that can be attributed to a stronger U.S. dollar and lower oil prices.

Following the sunny business climate of 2014, clouds of uncertainty are hanging over the high-tech industry in 2015. In the first quarter of the year, demand for notebooks was sluggish, and sales targets for the iPhone 6 were adjusted downward. Suppliers hope for another peak season with the release of Windows 10, slated for the second half of the year. However, an unexpected turn of events cannot be ruled out.

The trend toward cheap raw material and low oil prices seems to be continuing in 2015. For conventional industries this constitutes a good opportunity to rebuild strength and embark on a stable growth path.

Translated from the Chinese by Susanne Ganz