Top 2000 Survey: Financial Industry

Dawn of the Golden Era

Source:CW

On the back of financial deregulation and regional integration, the future has never looked rosier for Taiwanese banking, as financial institutions move to conquer new markets and take on the challenges of electronic finance and globalization.

Views

Dawn of the Golden Era

By Judy LinFrom CommonWealth Magazine (vol. 547 )

In 2013, the eagerly awaited waves began to roll in. Like surfers waiting out a long lull, Taiwan's financial firms leapt forward onto their surfboards paddling like mad to catch the next wave as it walled up.

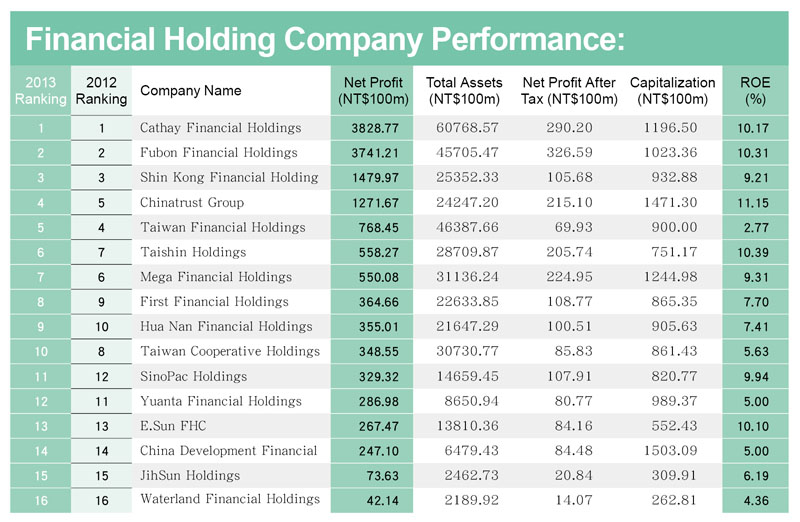

Last year, the largest number of financial holding companies posted profits in excess of NT$10 billion since CommonWealth Magazine began its Top 1000 Survey 28 years ago. (The survey was broadened to cover the Top 2,000 Companies in 2013.) Furthermore, the financial industry as a whole also posted historic high profits. Of the 16 ranked financial holding companies, nine posted more than NT$10 billion in profits last year, including eight whose profits reached a historic high, based on figures from the Top 100 Financial Enterprises Survey. The net profit after tax of the entire financial holdings industry increased 17 percent to NT$212.6 billion.

Financial Deregulation Boosts Profits

Total revenue in the financial industry increased 1.05 percent year-on-year to NT$4.76 trillion in 2013. Total net profit after tax reached NT$346.3 billion, up 15.38 percent from the previous year.

In terms of profitability the industry improved markedly both for return on equity (ROE) and return on assets. Cathay Life Insurance, in particular, saw the most dramatic improvements with a fourfold increase in net profit after tax and a ROE rise from 2.41 percent in 2012 to 10.49 percent last year.

Last year, insurers, security brokerages and banks alike rejoiced over the financial deregulation gifts from the Financial Supervisory Commission.

The life insurance industry was able to push up its rate of return and lower hedging costs thanks to relaxed restrictions on overseas investment, measures to encourage investment in public infrastructure, and the introduction of a forex revaluation reserve to manage exchange rate volatility.

The banking sector shone with marked profit growth at their overseas branches. The sector also benefitted from the launch of renminbi business at designated foreign exchange banks in Taiwan (domestic banking units) in February last year. Within less than a year, domestic banks had attracted 200 billion renminbi. On top of that, China saw a credit crunch that kept interest rates in the country high. As a result, banks deposited their renminbi stashes with the Taiwan Branch of the Bank of China, which offers comparatively high interest rates on such transferred deposits, enabling domestic Taiwanese banks to make a fortune by exploiting the interest rate spread.

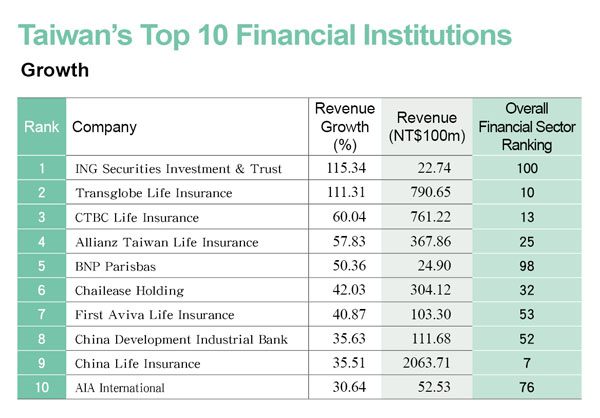

The securities brokerage sector has been able to recover from the curse of the securities gains tax, introduced in 2013, which reflects in sharply rising profits. However, when it comes to ranking in terms of revenue, the financial industry saw a minor reshuffle as revenue is calculated somewhat differently from before, since all listed companies began to use the International Financial Reporting Standards (IFRS) last year.

Life insurers were not able to boost sales as effectively as two years ago, when reports that certain insurance products would be phased out triggered a run on insurance policies. Nevertheless, they were able to realize considerable returns from investment in stocks and bonds, boosting profit growth.

The Talent and Capital Needed to Win the Asia Cup

"Now is the best time," declares Ho Shou-chuan, chairman of SinoPac Holdings Co., "Great opportunities, all kinds of possibilities lie ahead. These are hard to fathom if we simply rely on our past experiences."

China has implemented a string of measures to open up its domestic market to Taiwanese financial institutions in the wake of the Economic Cooperation Framework Agreement (ECFA) and the Memorandum of Understanding on Cross-straits Financial Supervision Cooperation. On top of that, Taiwanese banks have their sights set on other overseas markets where they see increasingly attractive opportunities.

Following the migration of Taiwanese businesses from China to Cambodia, Vietnam and Indonesia, the financial industry has taken note that intraregional trade in Southeast Asia is growing at a faster pace than GDP. This constitutes a good opportunity for expanding trade finance business, a field in which Taiwanese banks have traditionally excelled.

"If you want to compete for the Asia Cup, you need talent and capital," remarks Fubon Insurance chairman Victor Kung. Taiwanese insurance firms are not small in comparison with their industry peers in Southeast Asia. In addition, Taiwan's life insurance agents are well-known for their training, expertise and selling power, Kung says.

Opponents of the service trade agreement with China question the competitiveness of Taiwanese banks in China, arguing that they are too small and do not have enough capital. However, Chung Min-min, head of the recently opened Bank SinoPac Nanjing Branch, points out that the China business of Taiwanese financial institutions focuses on small and medium-sized enterprises, a niche market. While SMEs account for 90 percent of all Chinese companies, they find it extremely hard to get funding. Moreover, Taiwanese banks have a seven- to eight-year lead over their Chinese competitors when it comes to designing sophisticated financial instruments for rich individuals. This will come in handy once Taiwanese banks win permission to offer personal finance and wealth management services in China.

Next Step: Banking Industry Consolidation

Like a large seagoing vessel, Taiwan's financial industry is preparing to ride the waves and sail toward Asia as the fog in front of it begins to disperse. Jerry Yang, an analyst with Daiwa Capital Markets Hongkong, believes that the next big challenge will be further consolidation within Taiwan's financial industry. Moreover, Taiwanese banks must put into place proper risk management as they tackle the Chinese and Southeast Asian markets.

Jordan Chen, chief investment officer for Schroders Investment Management (Taiwan) Limited, warns that the upward adjustment of the business tax on financial institutions from 2 percent to 5 percent will eat into banks' profits. Other uncertainties include a devaluation of the renminbi, and disputed derivative products related to it. All these could put a damper on the industry's growth momentum.

On the other hand, Katherine Hu, a Taipei-based equity strategist at Merrill Lynch, points out that companies will have greater hedging needs to manage increasing renminbi volatility. Together with the opening of new financial business and financial instruments, banks will consequently see their profits rise. Therefore, she believes, it is unlikely that the financial industry will face shrinking profits.

The biggest question mark hanging over Taiwan's financial industry is whether the controversial service trade agreement with China and the Special Regulations for Free Economic Pilot Zones can smoothly pass legislative hurdles. The outcome will be decisive for the industry's development in the coming three to five years.

Translated from the Chinese by Susanne Ganz