2012 Most Admired Company Survey

Winners in a Downturn

Source:cw

The new standard bearers of Taiwanese business are those able to show imagination and dexterity, and provide customers with innovative new value.

Views

Winners in a Downturn

By Jimmy HsiungFrom CommonWealth Magazine (vol. 508 )

The 2012 CommonWealth Magazine Most Admired Company Survey is hot off the presses. These companies that are able to grasp the honor of recognition as "benchmark enterprises" represent not merely excellence in their respective fields, but perhaps more importantly, the innate quality that makes winners even in an economic downturn.

The global economy, still reeling from the continually mounting European debt crisis, keeps plumbing new depths. In early October, the International Monetary Fund revised its forecast for global economic growth downward from 3.5 percent to 3.3 percent, its lowest growth forecast since 2009.

Taiwan's domestic economy is similarly weary. In late September, the Council for Economic Planning and Development's color-coded indicator for business performance in August continued to show "blue" – indicating a recessionary economy – for the tenth consecutive month. That streak eclipsed the nine straight "blue lights" of 2008 after the outbreak of the global financial crisis.

Once recession becomes the new norm, the overall fundamental soundness of a company is the key to its achieving benchmark status.

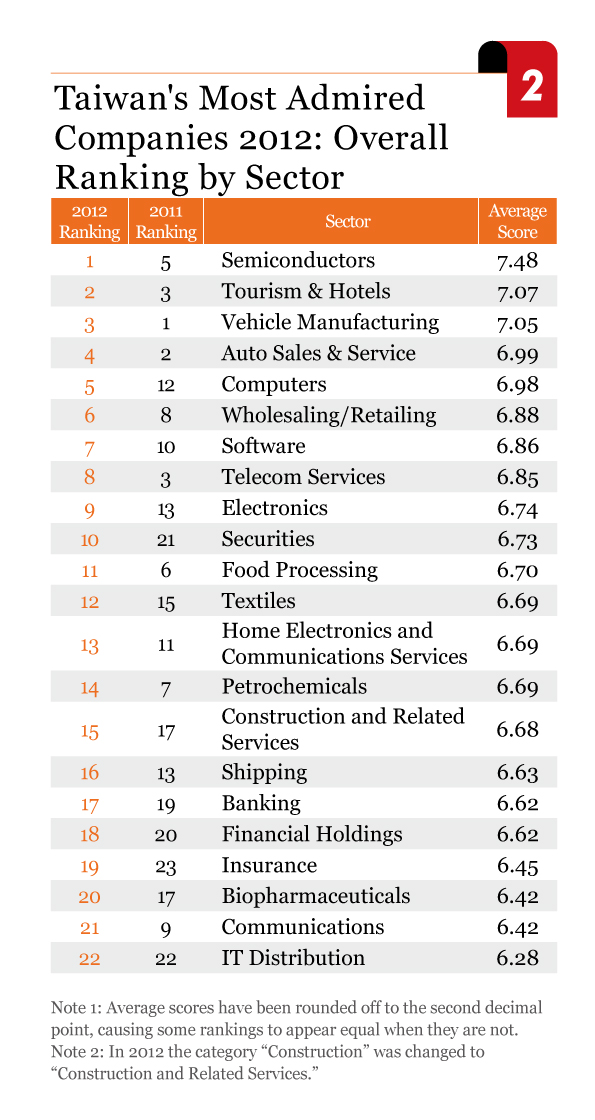

Taiwan Semiconductor Manufacturing Co. chairman Morris Chang, a real stickler for a company's fundamentals, once again led his company in taking home the coveted title of Taiwan's Most Admired Company. (Table 1) In fact, TSMC was top-ranked, not only overall, but in every single indicator in the survey.

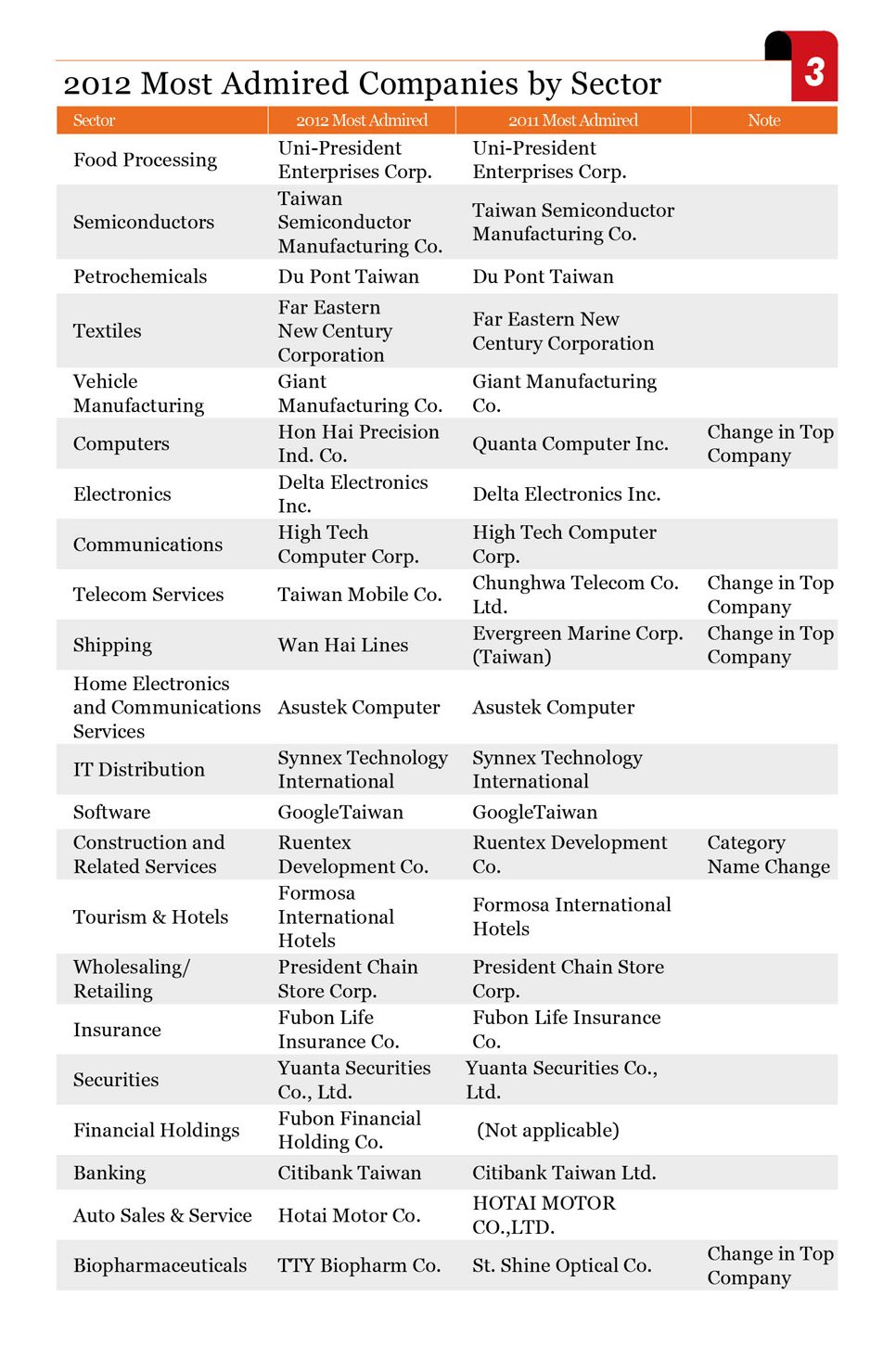

Of the top ranked companies across 22 different sectors, nearly all are familiar faces – exceptional, fundamentally strong corporations with a long history of ascendancy in their industries. (Table 3)

But four sectors have seen a new leader claim the top position. In the computer industry, Hon Hai, which last year saw its top ranking fall to Quanta Computer, has reasserted itself at the top this year.

In the biopharmaceuticals sector, top honors this year go to TTY Biopharm. Last year's top company in the category, St. Shine Optical Co., Ltd., dropped to fourth, while ScinoPharm Taiwan, Ltd., moved up to second.

In maritime shipping, Wan Hai Lines has bested venerable old salts Yang Ming Marine Transport Corp. and Evergreen Marine Corp. to take top honors for the first time.

In the telecom sector, Taiwan Mobile edged out long-running top dog Chunghwa Telecom to become the industry's new standard bearer.

Elsewhere, one company worth taking a closer look at is Fubon Group, because they've managed to come up winners across the board, from financial holdings and insurance to telecoms.

Fubon, which last year had relinquished its leading position among financial holding companies amidst a fraud scandal involving its subsidiary Taiwan Sport Lottery Corp., has returned to ensconce itself firmly atop the throne once again this year. Two other companies under the Fubon flag, Fubon Life and Taiwan Mobile, are also the standard-bearer companies in their respective sectors.

A more detailed inspection of the rankings leads to the conclusion that this year's Most Admired Companies possess the physical and mental capacity to surpass their competitors in the midst of an economic decline.

The Greater the Slump, the More Need to Invest

"We are now undergoing a relatively drawn out, low-growth period," TSMC chairman Morris Chang said in an interview with CommonWealth Magazine prior to his departure for the Autumn meetings of the Asia Business Council in Bangkok.

Chang goes so far as to invoke the specter of the United States at the start of the Great Depression in 1929 in a reminder to all that the tough days upon us may not be over so fast.

"Right now I expect that next year and maybe even the year after will not be so good," Chang worries. "Don't think that this is just another economic cycle like in the past that will last two or three years at most and then we'll see a recovery."

But if you thought the tough times had prompted Chang to usher in an era of penny-pinching and belt-tightening at TSMC, you'd be dead wrong.

TSMC's investment outlays this year have topped US$8.5 billion, far in excess of the roughly US$2 billion in average annual investments for the 2007-2009 period.

"Next year [investment] won't be far off this year," Chang reveals.

As Chang sees it, investing when times are tough is the best way to widen the gap between oneself and one's competitors.

Back in June of 2009, Chang returned from retirement to man the helm as CEO, facing the cresting global financial tsunami with aplomb. The first thing the crafty veteran did was authorize a massive increase in capital investment and R&D spending.

Chang is well-aware that a new and formidable opponent has emerged on his heels. Three months before Chang's return, Advanced Micro Devices (AMD) spun off its manufacturing unit to form GlobalFoundries, led by state-owned Abu Dhabi technology venture capital fund Advanced Technology Investment Co., to enter the specialized chip foundry businesses.

Shortly thereafter, GlobalFoundries acquired Singapore-based chipmaker Chartered Semiconductor. Like a super typhoon forming out of the blue, it took aim straight at TSMC.

Without underestimating the competition and without locking down the cash to see how things would shake out, the first thing Chang did was dig in his heels and turn to meet the opponent head-on to preserve TSMC's position as the leading global wafer foundry.

Despite the noise surrounding the emergence of GlobalFoundries, TSMC's market share has not only shown no decline, but has even grown from around 45 percent in 2009 to nearly 50 percent in the first half of this year, observes Ivan Lin, deputy director of Content Business for Trendforce Technology.

Although GlobalFoundries has quickly established a 12-percent market share and now approaches United Microelectronics as an up-and-coming global player, its relatively paltry NT$100 billion in operating revenue last year amounts to less than a quarter of what TSMC took in.

"GlobalFoundries is an extremely capable competitor, but we've swept them aside," Chang says, puffing on his pipe, with nary a hint of satisfaction.

He's well aware that the competition never ends, particularly as far as TSMC is concerned, what with a "new" competitor, even bigger than Samsung or GlobalFoundries, forming up on horizon. That would be industry giant Intel, which has begun getting more actively involved in the foundry business in recent years. Consequently, TSMC will be ramping up its capital investment over the next year or two.

New Competitors in New Forms

In a downturn, competition does not evaporate simply because the pace of growth has slowed; on the contrary, this is when more and more competitors one has never crossed paths with before turn up. This is just the sort of thing that happened in the tourism and hospitality industry.

With an influx of tourists from China spurring growth in the island's tourism industry, more and more five-star international hotel chains have begun looking to get a foothold in Taiwan.

In this year's Most Admired Company Survey, aside from the Regent Taipei retaining its top spot as the most admired tourist hotel, both the Grand Hyatt Taipei and the Far Eastern Plaza Hotel, which tied for second place last year, fell out of the top three in the category. Debuting at second this year was W Hotel Taipei in its first appearance in the annual survey.

"There's going to be an ongoing shakeout within Taiwan's hotel industry over the next couple of years," predicts Chung-Hsing Huang, executive director of the EMBA program at National Taiwan University.

Huang believes Taiwan's hotel industry, long accustomed to going it alone, "will be increasingly co-opted by international brands."

Once harmonious competitors now find themselves at each other's throats as they vie for overlapping market segments in a shrinking economy. This year Wan Hai Lines, previously content with its coastal routes, barged into the leadership spot in maritime shipping after getting into the ocean-going shipping business, long the operational domain of Yang Ming and Evergreen.

With the cost of fuel skyrocketing and freight prices stagnant, "route" management has heated up to the boiling point.

"Synergizing long haul and short haul operations has now become an industry-wide trend," says Wan Hai Lines chairman Chen Po-ting.

A third-generation scion of the Wan Hai founding family, Chen broke free from the operational corner the company had long since painted itself into. In 2001, he overruled internal dissent and opened a U.S. Route, following shortly thereafter with South American and European routes. The move not only extends Wan Hai's reach beyond Asia into the rest of the world, but also means the company's fortunes aren't entirely subject to the economic vagaries of any given region.

"The worse things get, the more you need to shake off that inertia of past success," says PwC Taiwan executive director Liu Jing-ching. The competition is forever changing, and the composition of one's own product line must constantly evolve too.

Provide Diverse, Innovative Client Services

We can also see in the winners in this year's Most Admired Company Survey a trend toward companies becoming more "operationally service-oriented."

Chiu Yi-chia, an associate professor at National Chengchi University's Graduate Institute of Intellectual Property, says Taiwanese businesses have to move away from the prior practice of aggressive cost-cutting or mere pursuit of technology innovation. The deeper the downturn, the more you need to figure out how to provide that extra, intangible value for the client.

Chiu noted that Hon Hai Precision Ind. Co. (Foxconn), the Most Admired Company in the computer sector this year, didn't become a benchmark company because of outside approval of its vertical integration and "total solution" hype.

"What everybody admires about Hon Hai is their ability to keep coming up with the resources to provide the client with more services," Chiu says.

Coming in at number three this year in the rankings of Taiwan's most prestigious names in business, MediaTek Inc. is looking to return to former glory by leveraging its prowess in virtual-hardware integration services.

In the most recent October figures from market research organization Strategy Analytics, market share for MediaTek's smartphones in the China market has jumped from fifth to third, beating out Broadcom and Texas Instruments and trailing only Samsung and Qualcomm.

As Trendforce's Ivan Lin sees it, MediaTek didn't just come out with a more energy-efficient model powered by lower-cost chipsets – even better, it's providing a whole laundry list of client services.

At one time, it took at least six months for a new-generation smartphone to get from R&D to store shelves, but MediaTek has been able to shave that to three months for clients, Lin elaborates.

Lin says clients need only check off items on a menu of functions and types provided by MediaTek, which can also walk clients through an expedited design process. This has allowed quite a few small "bandit phone" companies to gain entry into the market.

"MediaTek has been an example of disruptive innovation, not just in terms of its product but also in its chain retailing operations," PwC Taiwan's Liu observes.

Deft, Unexpected Gambits

If you want to stand out in an arena of intense competition, abandoning conventional ways and thinking is even more imperative. There's no better example of that than this year's big benchmark winner Fubon Group.

Lin Shih-chieh, deputy director of the Financial Research Institute at the Taiwan Academy of Banking and Finance, says relative to other industries, the financial sector has always been subject to greater legal regulation and restrictions, and most financiers have played it low-key and conservative. But Tsai Ming-chung, chairman of both Fubon Financial and Taiwan Mobile, is apparently a rather more innovative and imaginative thinker than your average domestic financial titan.

With a portfolio that spans finance, telecoms and media, Tsai has not only incrementally realized his envisioned "financial department store" empire, he's also a skilled acquisition pirate, aggressively getting into the market in times of crisis and downturn.

From Fubon Bank's acquisition of TaipeiBank in 2005, to Fubon Life's buying out ING Life at the height of the financial crisis, to Fubon Financial's recent move to buy China's First Sino Bank, whenever things are looking bleak, Tsai is at the ready to seize the opportunity to continue building his empire.

In particular, Fubon, with its purchase of First Sino, has ruffled some feathers among those in financial circles looking to get a toehold in China.

"In one stroke he eclipsed years of maneuvering by other banks in China," the Financial Research Institute's Lin Shih-chieh says. In acquiring First Sino, with its dozen or so branches, Fubon has positioned itself deftly, given that under existing regulations bank branches in China must be profitable for two consecutive years before any new branches may be opened.

When the economic downturn stops being an excuse, the business that can make itself a winner on the downward slope will be the enterprise prepared to ascend.

Translated from the Chinese by Brian Kennedy

About the Survey

For the 2012 Most Admired Company Survey, CommonWealth Magazine identified 22 sectors that are influential on the future direction of Taiwanese industry, based on the categories and criteria of the CommonWealth Magazine 2012 Survey of Taiwan's Top 1000 Enterprises.

The list of enterprises included in the survey was limited to companies ranked high in terms of revenue, and incorporated the recommendations of experts on each respective industry. Based on these principles, 217 enterprises were rated this year by both industry peers and experts, according to ten indicators including foresight, innovative capability and talent cultivation. Each company then received an overall ranking based on the average of its scores for each indicator.

Industry peers were selected from CommonWealth Magazine's database of Taiwan's Top 1000 Enterprises. Experts from the banking, securities, investment consulting, investment trust and accounting sectors, as well as research institutions and academia were asked to participate in the expert rating.

All the industry peers responding to the Most Admired Company Survey were also asked to cast a vote for the Most Admired Entrepreneur.

The survey was conducted between Aug. 30 and Sept. 25, 2011. With 3,072 questionnaires sent out and 1,675 valid responses, the survey had a response rate of 55 percent. Industry peers accounted for 933 valid responses, and experts for the remaining 742. For the Most Admired Entrepreneur portion, 856 valid responses were received.