Lenovo Chairman Yang Yuanqing

Partnering with Taiwan to Innovate

Source:CW

China-based Lenovo has left Acer and Dell in the dust to become the world's second biggest computer brand. What have been its key strategies, and what is Taiwan's role in its continuing ascent?

Views

Partnering with Taiwan to Innovate

By Elaine HuangFrom CommonWealth Magazine (vol. 501 )

Yang Yuanqing, chairman and CEO of PC vendor Lenovo Group Ltd., arrived in Taiwan on July 4 with little fanfare. Six months earlier, his era at the helm of the computer giant officially began after he took over as chairman from Liu Chuanzhi.

"I've come to see some materials and semiconductor suppliers and makers of finished products," Yang said of his two-day visit whose itinerary was not disclosed. Much of his time was spent at the W Hotel in Taipei's posh Xinyi District meeting nonstop with top executives of companies in the computer supply chain, including Compal Electronics Inc. president Ray Chen, Pegatron Corp. chairman T.H. Tung, and Wistron Corp. chairman and CEO Simon Lin.

After a full day of discussions, Yang was hoarse when he met with CommonWealth Magazine for the only one-on-one interview he granted during his brief stay in Taiwan. At 47 years old, he may have been younger than all of the Taiwanese high-tech CEOs by at least 10 years, but his mannerisms and gestures exuded the confidence typical of a leader of a big multinational corporation.

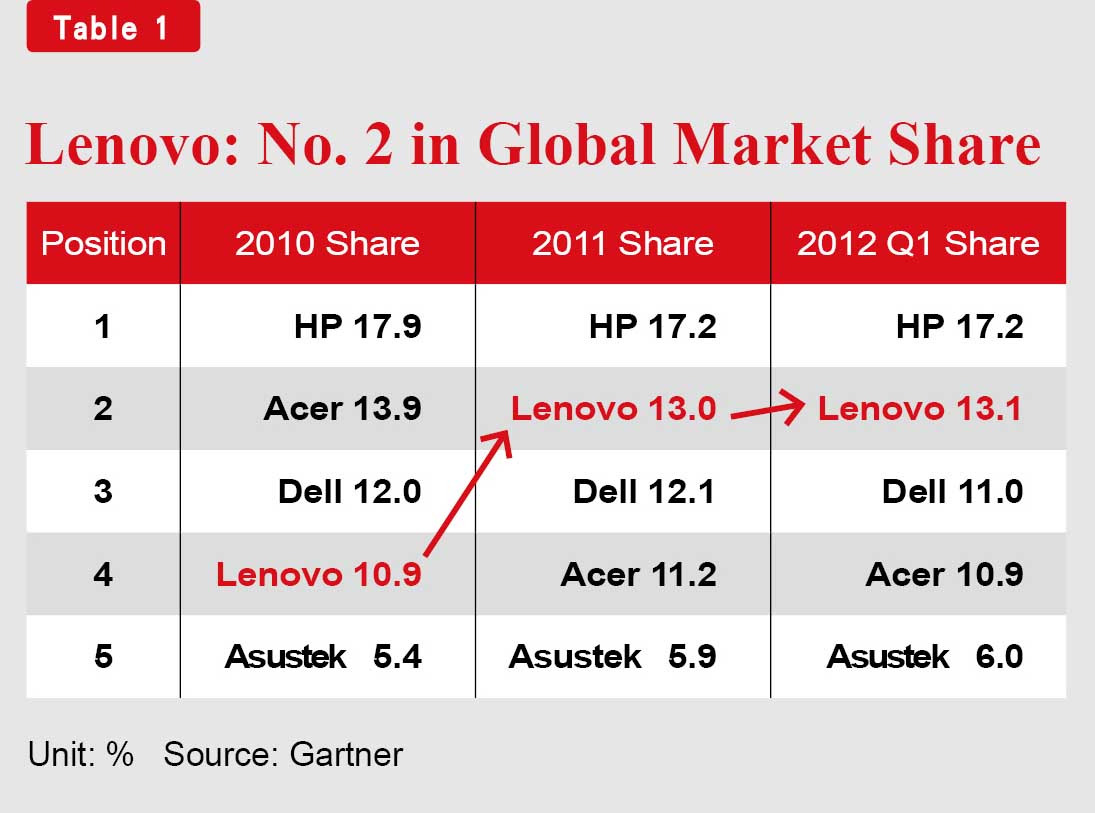

Though the computer industry suffered a downturn in 2011, Lenovo pushed aggressively to expand. It teamed up with Japanese computer brand NEC to launch Japan's biggest personal computer company and acquired German computer maker Medion AG to strengthen its presence in Europe. It also recruited former Acer Inc. CEO Gianfranco Lanci and invited former Sony CEO Nobuyuki Idea to sit on its board. By the end of the year, it had sped past Acer and then Dell to become the world's second-biggest PC vendor behind Hewlett-Packard. (Table 1)

This push into Asia and Europe was the second global assault engaged in by China's biggest PC vendor. The first came in 2004, when Lenovo acquired a unit three times its size – IBM's Personal Computing Division – planting the company's flag firmly into United States soil. Yang relocated to IBM's offices in North Carolina to familiarize himself with Western culture and to learn how a multinational corporation manages itself.

Yang has been a key initiator of Lenovo's two major forays into the outside world. "Lenovo epitomizes China's growth and development. It involves rapid learning and absorption and then confidently striding and expanding into the outside world," says Jason Hsuan, the chairman and CEO of PC monitor maker TPV Technology Ltd.

In May 2012, Lenovo beat Apple to the punch with the launch of a smart TV, which Yang described as symbolizing the company's move into the "PC+ era" and the final cog in its four-pronged strategy, after PCs, tablets and smartphones.

Liu Chuanzhi, who founded Lenovo with 200,000 renminbi, transformed its nature, from being a company primarily affiliated with the Chinese Academy of Sciences into a private-sector enterprise with a performance-based management system, listed on the Hong Kong stock exchange.

Now, "Yang Yuanqing's mission will be to lead Lenovo into the international arena, because he knows Lenovo can't simply be China's No. 1," Hsuan says.

Following are highlights from CommonWealth Magazine's exclusive interview with Yang Yuanqing.

Q: Lenovo is now the world's second biggest computer brand. What is your strategy for the future?

A: Our dream is to become the top company in this industry, and it's a dream that's very likely to come true, because Lenovo is clearly growing faster than its competitors in emerging markets, especially in China. We have stronger advantages.

Also, to maintain growth in the PC field, we have a "double-fisted strategy" to both protect and attack.

The core businesses we want to protect are our base in China and the global corporate market, the B2B market. At the same time, our targets of attack are consumer sales and emerging markets, such as India, Russia and China.

No. 1 in China, No. 1 in the World

I think the PC industry has already entered the "PC+" era.

In the past, we could not enter the mobile phone and television markets, but the "smart" trend has opened those markets to us. In 2002, Lenovo got into mobile phones, but we were always weighed down by three big powerhouses: Nokia, Motorola and Ericsson. But now in the smartphone era, Apple led the way in breaking past the big three, and we are now in the top three in China.

The television business also used to be a separate industry, but we are now entering the era of the smart TV, or the so-called big-screen PC, which is giving us many opportunities. So we want to fully capitalize on Lenovo's brand and distribution advantages in China to be the first to succeed in these new fields, especially in China.

That's because China is the world's biggest market for mobile phones, computers and televisions. If we can become the leading vendor in China, then we'll be the leading vendor in the world.

Q: But China already has dominant enterprises in all three fields. Does Lenovo have real advantages and opportunities?

A: Our edge is in hardware, and we also have brand and distribution advantages.

The convergence of the "three Cs" (computers, communication products, and consumer electronics) is an inevitable trend, and Lenovo has performed well in all three areas. In mobile phones, Lenovo had the third highest market share in China last month. No. 1 was Samsung, and numbers 2, 3, and 4 were Huawei, Lenovo, and ZTE. Aside from Samsung, the three big powerhouses I was just talking about – Nokia, Motorola and Sony Ericsson – have all fallen by the wayside.

In the tablet computer field, the iPad is the strongest player. Lenovo's Android tablet has a 50-percent market share in China, and it ranked fourth in the world last quarter. In terms of smart TVs, we were the first computer company to launch a model. China's market has enabled us to incubate these businesses.

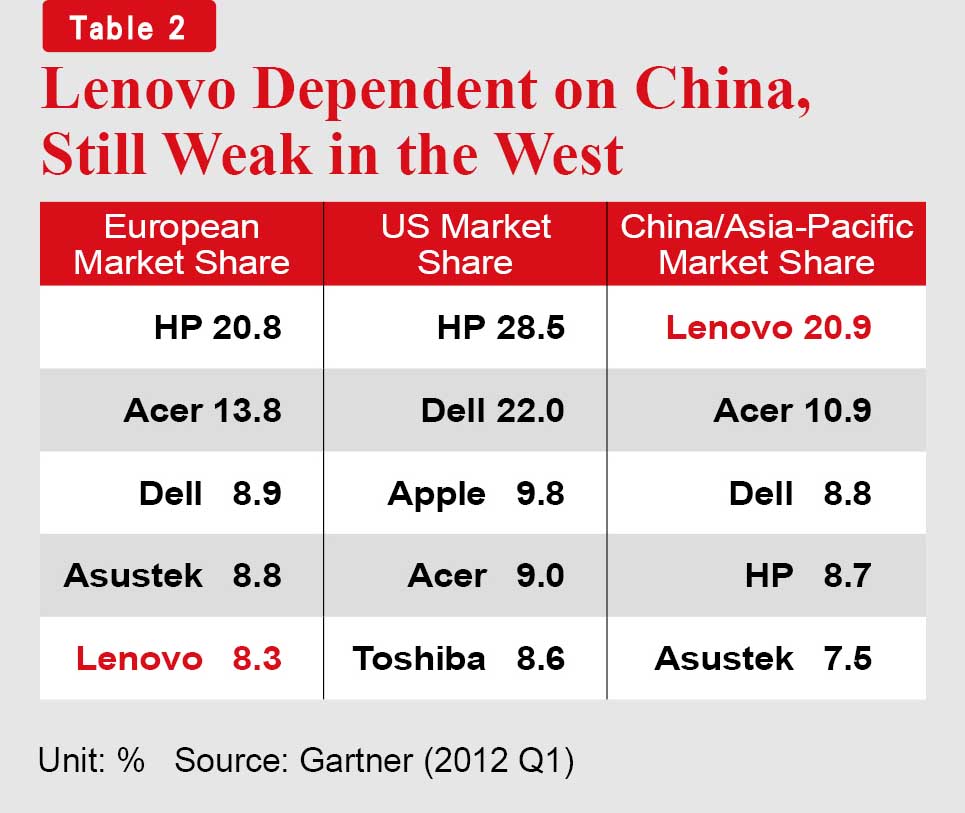

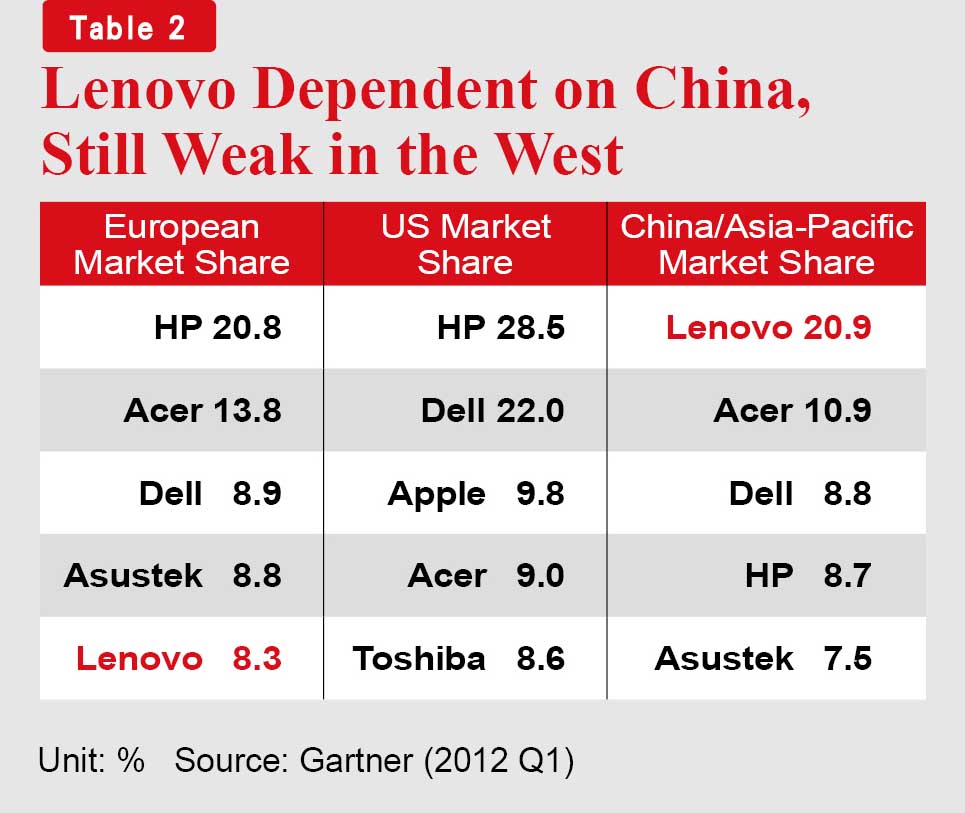

(For an overview of Lenovo's global market share, see Table 2. For an overview of Lenovo's profit and revenue growth, see Table 3)

Q: In 2004, Lenovo acquired IBM's Personal Computing Division. Then last year it bought Medion in Germany and set up a joint venture with NEC. What have you learned in the process? And how do you manage an international company?

A: We were forced into it. We had to jump into the ocean to learn to swim. (Laughs)

In the past, we had only swum in small rivers but never in the ocean. But our founder (Liu Chuanzhi) and I have big visions and aspirations, and we hope to make the company big and strong and turn it into a global enterprise.

Before we bought IBM's PC division, we had only done business in China and had no experience in running a global company. In fact, before the acquisition, we tried to gain a foothold overseas, but it was a struggle, because we didn't have a brand and it was hard to find good people. Through the acquisition, we grew exponentially.

Going It Alone Not an Option

Q: What is your deepest realization over the past seven years?

A: If you want a global company to succeed, you have to adapt to many different cultures.

Right from the start of negotiations, there were many clashes of culture. When IBM's people came to China for a meeting, we picked them up at the airport and took them to the meeting venue. We sent a car every day to pick them up at the hotel and bring them to the office. This is typical of China's hospitality and culture. But when we went to the United States for meetings, it was up to us to rent a car and get ourselves from the hotel to the office. This was the beginning of the differences.

Over the entire process, there were country-to-country and company-to-company cultural differences. At meetings, for example, in Chinese culture, people are generally quiet and only express their opinions when called on by the boss. But by the end of the meeting when the top brass has reached a conclusion, if I haven't spoken, it doesn't mean I completely agree. People lower down on the totem pole may still be muttering about the decisions.

In Western culture, everybody expresses their opinions of their own initiative, and they are all loud. There may be differences of opinion, but once a conclusion has been reached, everybody works in that direction. This is a huge cultural difference.

So in our initial meetings, it was the Americans who did all the talking and came up with the conclusions. We Chinese didn't say anything. The Americans would complain that even though conclusions were reached, the Chinese did not carry them out.

We later began to accommodate these cultural differences. The Chinese made an effort to express their opinions more freely. If a manager was a foreigner, he would give members of the Chinese team a chance to speak.

Q: It is easier for an acquisition to fail if a company ranked lower globally buys a company ranked higher. How did you overcome the cultural advantages and disadvantages?

A: We went through a very difficult process initially. Before completing the acquisition of IBM's Personal Computing Division in 2005, we had no international experience, and no experience managing an international business.

So before the deal was done, we decided that we could not be in charge of global operations. We had to humbly learn and not insist that everything was to be run by Chinese. As a result, we had two American CEOs (first IBM's Steve Ward and then Dell's William Amelio). I took a step back to become chairman of the board and focus on the company's strategic direction. We use people based on their abilities, their experience and their expertise. We are very diversified.

Comparing our management team to that we had eight years ago, it's as if we've been reincarnated. Lenovo is no longer a Chinese company. It's an international company.

Looking for Innovation Inspiration in Taiwan

Q: Do you have any special objectives for this visit to Taiwan?

A: Taiwan is an important IT and manufacturing center, and it's also a place of innovation. I came this time to see a number of companies involved in materials, semiconductors, and finished products. I saw a lot of innovative technology and products that can be integrated with Lenovo products in the future.

We aren't here simply to place orders but also to search for innovation inspiration. Let's innovate together.

I don't see the PC as a general commodity. Lenovo will position itself in the future as a leader of product innovation for Internet end-user devices and redefine the personal computers and smart TVs of the future.

Over the next 12 months, Lenovo will launch creative new products on the market, many of which will have resulted from cooperation with Taiwanese vendors.

Q: Since you seem to have a strong appreciation for Taiwanese vendors, are you considering acquiring any of them?

A: (Laughs heartily) Buying is always an option. We have accumulated a certain amount of experience with acquisitions by now, though I wouldn't dare to claim it's where we excel. But it's not the only option, either. Cooperation is the major trend. I don't believe that vertically integrated operations, where you do everything yourself, are the best model.

Samsung's Model Could Run into a Wall

Q: But everybody thinks Samsung's vertical integration model is great.

A: History tells us that in the end, models where you go it alone never succeed. Of course, vertical integration has its advantages. It's easier to fully cover the needs of customers and integrate innovation from different value chains. But I still believe that horizontal integration and an open framework will triumph in the end. But we still have to consider how to fully satisfy customers' needs and innovate.

I sell end products directly to the customer (Yang bangs on his chair for emphasis), so I understand the customer better than anybody. I have to identify customer needs and then bring suppliers together to innovate. When it comes to innovation, we've adopted an uncompromising attitude.

I believe that Samsung will face a very big challenge in the future. It sells components to me, but our brand businesses are in competition with each other. It will have to make trade-offs eventually. Taiwanese vendors have already made those choices, splitting up their brand and OEM businesses. I believe that the open model will ultimately emerge victorious.

Q: Was Lienpal (a manufacturing joint venture formed last year between Compal and Lenovo) established to work together on innovation?

A: The goal of setting up Lienpal was of course to give us a manufacturing cost advantage. But the most important objective was innovation.

The biggest problem we currently face is that we are unable to unite with our upstream component suppliers in pursuing innovation. The problem is that there is an ODM or OEM vendor separating us.

Now, by cooperating with Compal and breaking out of isolation, we can communicate directly with upstream suppliers. They talk to us about their advanced technology, and we present the information on customer needs that we have collected, and then use those to identify together the direction for future innovation. This way, our products can compete with those of vertically integrated vendors.

Translated from the Chinese by Luke Sabatier

Yang Yuanqing

Age: 47

Position: Lenovo Group Ltd. chairman and CEO

Education: Shanghai Jiao Tong University, University of Science and Technology of China (Master's in Computer Science)

Experience: General Manager, Lenovo CAD Division; Head, Lenovo Personal Computer Division; Lenovo Vice President

"