Personal Finance

Four Investment Wizards Share Their Tips

As we begin a new year on the Chinese Lunar calendar, four of Taiwan’s most successful personal finance experts share their best investment secrets.

Views

Four Investment Wizards Share Their Tips

By Hsiang-Yi ChangFrom CommonWealth Magazine (vol. 366 )

"Financial freedom” sounds alluring in the face of daily rising prices, soaring costs for house loans, car loans, the education of our kids and the need for greater financial security after retirement. The problem is that financial freedom is easier said than done. And even if we understand investment concepts and market trends, it still requires a greater helping of wisdom to be able to realize them in our personal lives.

CommonWealth magazine has brought together several “personal finance wizards” – the general managers of three financial institutions, as well as a computer science and engineering postgraduate who won a virtual investment competition. Each member of the group differs in age, household circumstances, and income. How do they allocate their assets? Which investment targets do they favor? And what insider tips can they impart to us average investors?

“Only with active assets can you talk about personal finance.”

Kao Chao-yang

General manager of wealth management,

Fubon Financial Holding Co.

Kao Chao-yang, general manager of Fubon Financial Holding's wealth management business, launched his second career in personal finance after serving in a state-owned bank for more than 35 years. His own asset portfolio Kao lists a “fixed income instrument” that draws the envy of today's investors – a pension savings scheme with a preferential interest rate of as much as 13%.

“People shouldn't look at me only with envy, since back then I also worked very hard, starting with nothing and slowly accumulating some wealth, so that I can enjoy the financial freedom I have today,” says Kao, encouraging salaried workers to “think hard to find a way” to save their first batch of money for investment. “You should save a fixed amount of money regularly. It's even possible to save only small amounts and take out everything when the time comes up for an investment,” he explains. Kao's advice is to cultivate a habit of saving money on the one hand, while slowly honing one's skills in market observation through contacts with finance experts or investment institutions. “Only with active assets can you talk about personal finance,” he asserts.

The market-sensitive Kao makes the following observation about recent trends in Taiwan's investment climate: “Now we have a lot of international capital supply in the market, and the market growth cycle is exploding, so that for investors, both opportunities and risks have increased.”

But Kao's own international investments remain at just 20% of his entire asset allocation. “The reason is that I am approaching retirement age. I want to lower the risk and slowly shift to fixed income instruments or similar products,” Kao said.

As for his outlook for 2007, Kao believes that the global market will see no major ups or downs, but will still post slight growth. “Compared to last year, somewhat more caution is advised,” he says. Kao believes that for international investments, a 3:2 stock-to-bond ratio is most appropriate.

“If you don't have patience, don't invest in stocks and bonds.”

Ann Kao

managing director,

JP Morgan Asset Management Taiwan

“I belong to the so much talked-about 'sandwiched generation,'” caught between aging parents and three high school age kids, says Ann Kao, managing director of JP Morgan Asset Management Taiwan. Although Kao has to shoulder high fixed expenses every month, she does not show the slightest trace of worry as she confidently talks about her personal finances.

Why is Kao able to take her financial burden so easily? Perseverance is crucial in her personal finance approach. “In my investment philosophy I resemble a snail. After deciding a direction I keep moving forward no matter what difficulties come up,” Kao explains. Before making an investment, Kao first decides on her ultimate target (such as a NT$2 million education fund or a NT$14 million pension fund). Then she goes back to the beginning, looks for appropriate tools and a reasonable time frame, before putting her plans into action.

“For instance, if you invest a fixed amount on a regular basis in an investment fund, you shouldn't be anxious to stop paying into the fund before you have reached your personal finance target. That way you won't have to vex yourself all the time to decide what to buy after you have sold,” Kao said.

Kao has clear personal finance plans and targets. She has established an annualized return target of 10%. By investing in various fund products, she lowers risk. “I don't expect every fund that I buy to make money right now, because then later on they might all crash (at the same time),” Kao points out.

Given her risk diversion strategy, Kao can obviously take it easy selecting her investment targets. Since she is positive about the huge consumer power in Asia's emerging markets, she has already arranged for long-term investment there through the regular commitment of fixed amounts of money. Therefore, she can be relaxed regarding the recent craze for the rapidly growing yet highly risky Chinese market. “I don't need to make such a risky investment,” she says.

“I never let personal finance affect my life.”

Rita Hsu

General manager,

Allianz Global Investors Taiwan Ltd.

It is hard to imagine that the general manager of an investment trust company would insist that people should not waste a lot of time and energy on wealth management. But Rita Hsu, general manager of Allianz Global Investors Taiwan Ltd., definitely backs up her own personal finance philosophy.

“I don't let personal finance affect my life. It's fine just doing good risk control and asset allocation, because only by focusing on life and on work will you gain the sense of achievement that money can't buy,” Hsu says with a broad smile.

Hsu, whose age is hard to guess, differs in her investments from the average person who opts for savings deposits and bond funds. She has put some 30% of her assets into a “life cycle fund,” a special breed of the balanced fund. “These funds will automatically adjust asset allocation based on the investor's target retirement age, in order to control risk,” Hsu elaborates. Such funds are convenient for those investors who don't want to spend too much time researching how to divide their portfolio between stocks and bonds.

With regard to equity funds Hsu separates her portfolio between core investments, for a stable return, and satellite investments, where she is optimistic about long-term market development.

For core investment positions Hsu favors global equity funds or global balanced funds for gaining returns at a stable risk.

For her satellite investment positions, Hsu first sets targets (such as biotechnological and medical counters), and she only examines whether the long-term trends are positive, instead of trying to make money selling high and buying low. “I directly discard my monthly check sheets, and only take a good look once a year,” she says.

Moreover, Hsu points out that personal finance planning can not only be used to control one's cash stock management, but is also important for managing one's monthly cash flow.

“Society overly encourages consumption. We need to slow down and set personal finance planning goals for ourselves as soon as possible to avoid increasing our financial burdens in the future,” says Hsu. Her advise to career freshmen is to change their habit of investing only the money that is left over at the end of the month, instead regularly investing fixed amounts to force themselves to invest long-term. “That way you will very quickly have an opportunity to overtake your peers,” she predicts.

“No matter how much money you have, invest as soon as possible.”

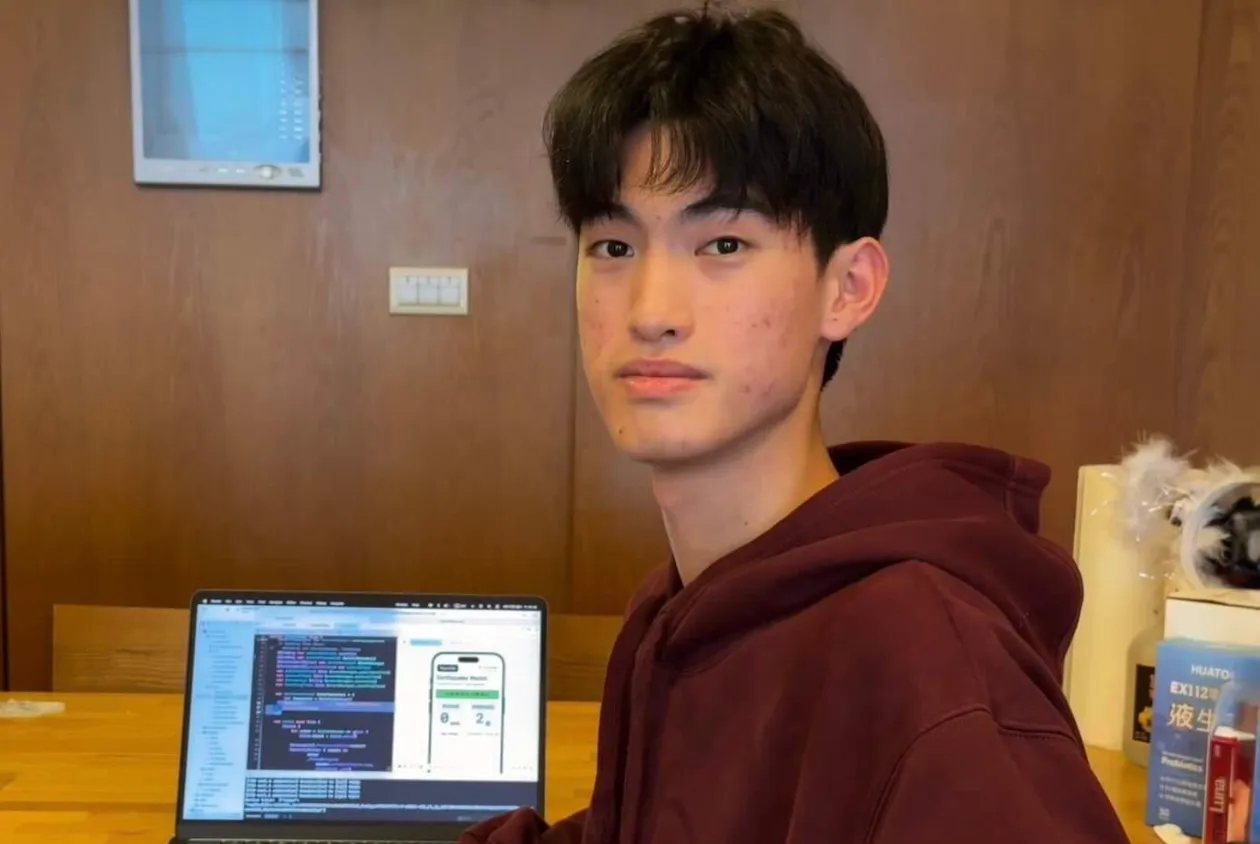

Liu Chih-Hsuan

Virtual investment champion

In the 2nd “King of New Investors” virtual investment competition hosted by Shin Kong Life Insurance, Liu Chih-Hsuan defeated more than 6,700 other young competitors by boldly building his portfolio around familiar electronic stocks. Liu yielded the highest estimated annualized return, which won him the top slot in the competition's individual category. In real life the personal finance approach of this virtual investment champion also tends to be bold and active. Liu has put just 10% of his assets into fixed income instruments.

Liu explains his boldness thusly: “Since I'm still a student and single, I don't have much financial pressure and can take a higher risk.” He has put the other 90% of his assets into emerging markets and energy-related mutual funds.

“No matter how you put it, around the world energy is getting scarcer,” he argues. Therefore Liu's long-term focus is the traditional energy development industry or companies doing R&D in the field of new alternative energies.

As a computer engineering student Liu has no background in finance, but he believes he has a knack for investment, because he is good with figures and has a first-hand understanding of Taiwan's electronics industry.

Moreover, he regularly browses trend analyses and stock market reports from Taiwan and abroad for further reference.

“No matter how much money you have, you should invest as soon as possible, seizing the time when you can still take a high risk,” Liu declares. “That way you will very quickly be able to learn from setbacks while developing risk diversion concepts and a certain acuity for the market. Then when your income increases in the future, you will be more confident about your personal finances,” he predicts.

Translated from the Chinese by Susanne Ganz

Chinese Version: 理財達人的4個錦囊