Taiwan Needs More than TSMC

Source:iStockphoto

Seven of Korea’s ten most valuable companies are newcomers; in Taiwan, the number is zero out of ten. Taiwan’s economy and technology may seem to be in the lead, but is it really winning? A look at the respective lists of the ten most valuable companies reveals innovation in Korea, but only old faces in Taiwan. To beat Korea, Taiwan needs more than just TSMC.

Views

Taiwan Needs More than TSMC

By Liang-rong Chen/Sydney PengFrom CommonWealth Magazine (vol. 709 )

In 2017, Taiwan’s economy grew by 3.31%, narrowly beating Korea’s 3.16%. The next year, in a conversation with Taiwanese companies, President Tsai Ing-wen said that she took comfort in the fact Taiwan’s economy was growing faster than Korea, and that we were no longer the weakest of the Four Asian Tigers.

The gap grew in the following years. This year, due to Taiwan’s successful campaign thus far against COVID-19, it will most likely be one of the few countries in the world to achieve positive growth. The Directorate-General of Budget, Accounting and Statistics is projecting a growth of 1.56%. In contrast, the Asian Development Bank projects that Korea’s economy will shrink by 1%. The gap between Taiwan and Korea will be the largest it has been since the Asian financial crisis of 1997.

TSMC Makes Up 30% of Total Stock Trading Value on TAIEX

In recent years, business is booming at TSMC; it is widely accepted that the semiconductor giant is the main driving force behind Taiwan’s latest growth spurt. TSMC’s capital expenditure is expected to surpass US$17 billion this year, a new record for Taiwanese enterprises.

In the past, the most important investment in Taiwan’s private sector and the standard-bearer of Taiwan’s last economic growth was the Sixth Naphtha Cracker Project in Yunlin’s Mailiao County. In a period spanning over ten years, the Formosa Plastics Group invested more than NT$1.1 trillion dollars into the project. TSMC reached this milestone in just two years.

Toward the end of 2019, TSMC’s market value surpassed that of Korea’s guardian angel—Samsung Electronics.

In the past, the Taiwanese envied—and perhaps even resented—Korea for its famous smart phone and TV brand, which is popular the world over. Now the tables have turned; Korea is trying to catch up to Taiwan.

Last April, Korean President Moon Jae-In announced his latest industrial policy at Samsung’s R&D center: Korea is to lead the world’s semiconductor industry by 2030. He stated that the Korean government would draw up innovation strategies for various sectors to achieve this outcome.

Today, TSMC’s market value makes up 29.8% of all the listed companies on TAIEX, the Taiwan Stock Exchange. Out of Taiwan’s top ten companies, the total value of the other nine is roughly equivalent to only half of TSMC.

Not long ago, the Taiwan Institute of Directors published a report showing that the compound annual growth rate (CAGR) of the total value of listed companies on TAIEX grew by 14% in the fifteen years between 2005 and 2019. But without TSMC, the CAGR would only be 2%.

Allen Tsai (蔡鴻青), Founder and Executive Director of the Taiwan Institute of Directors, commented that Taiwan faces the crisis of putting all its eggs into one basket. This is especially clear if we compare the lists of the top ten most valuable companies in Taiwan and Korea.

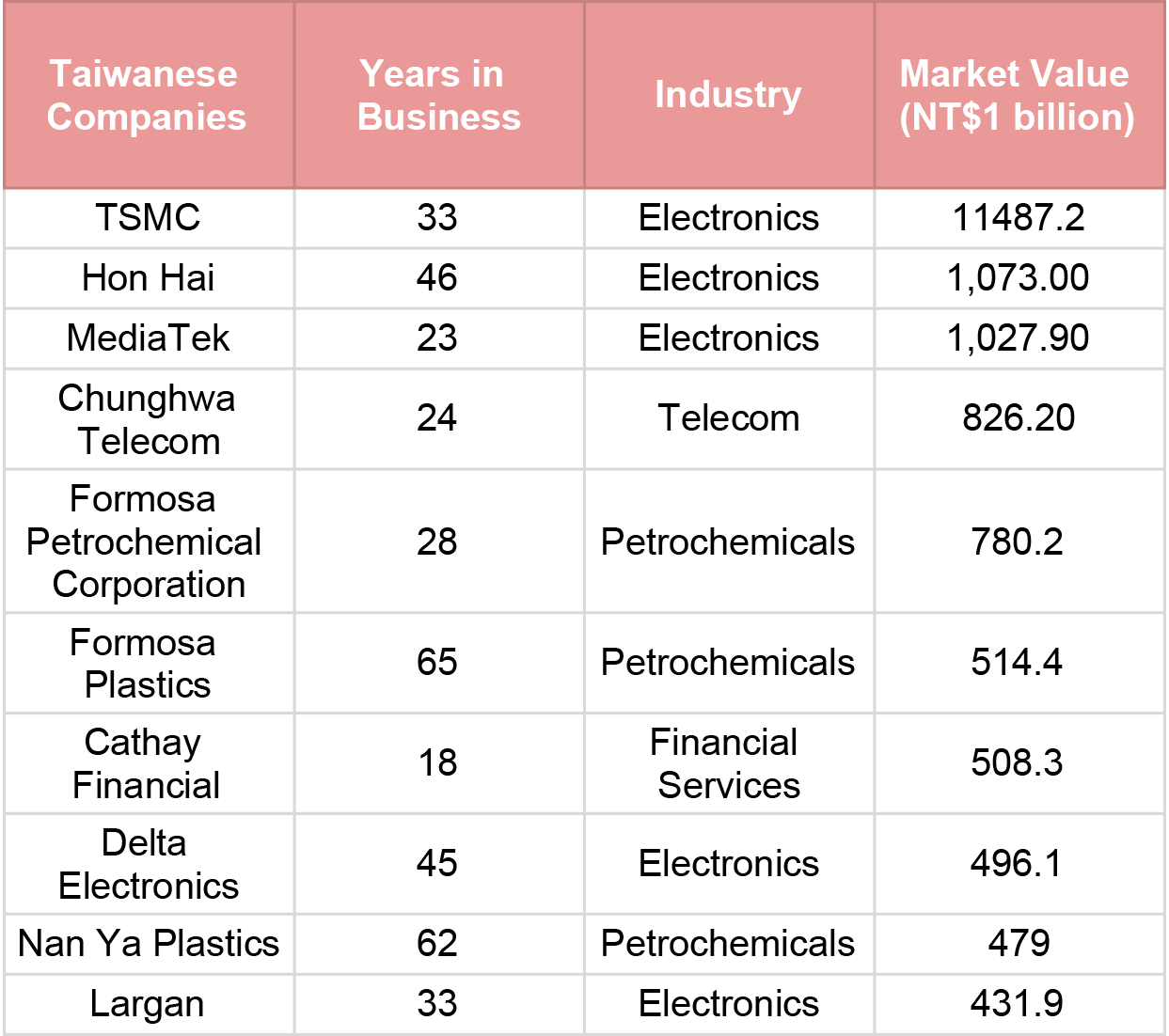

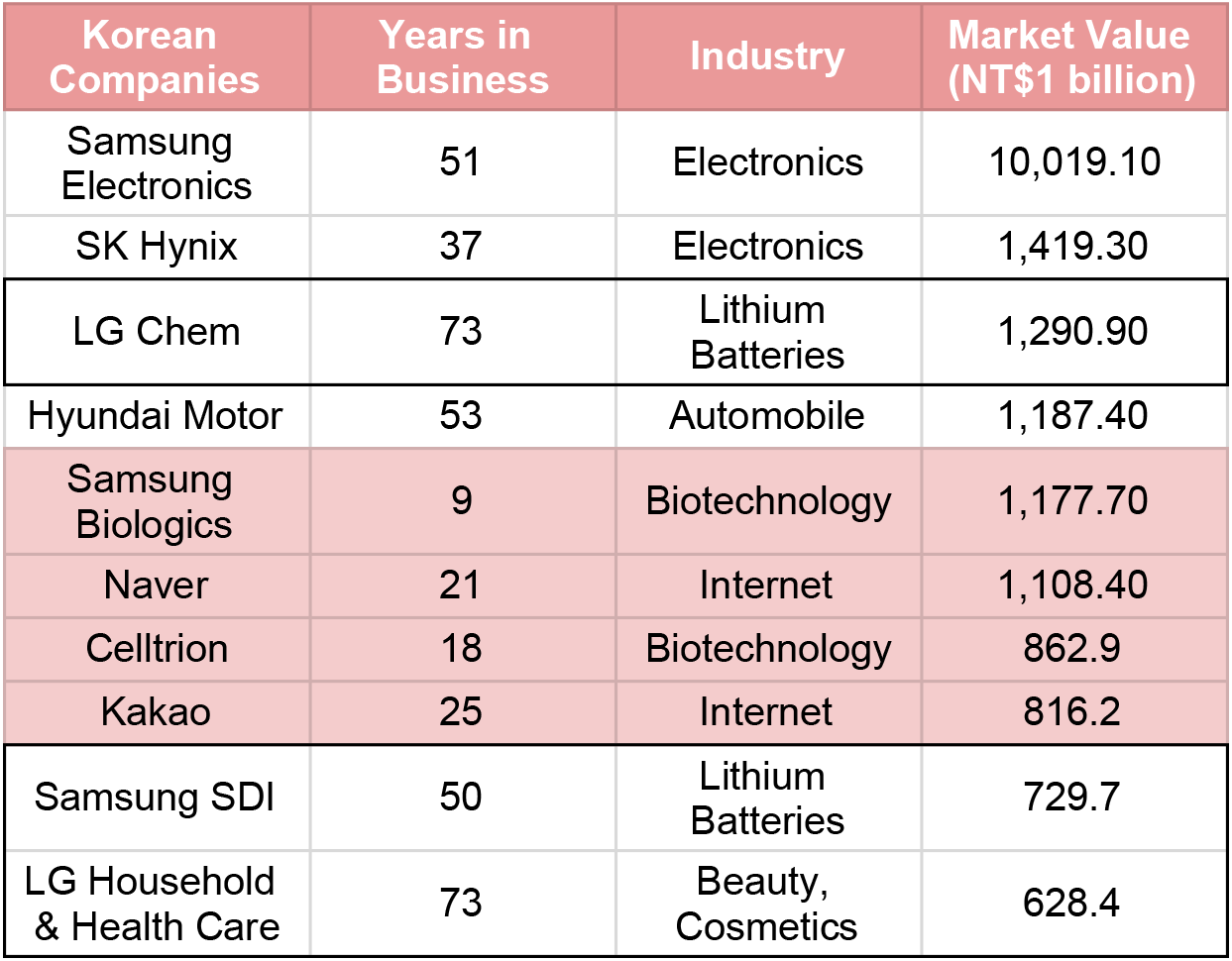

While it is true that both countries have their champions—TSMC in Taiwan, Samsung in Korea—most of the top ten in Taiwan are old faces with over three decades of history. They mostly engage in the TAIEX’s “holy trinity” of businesses: semiconductors, electronics, and petrochemicals. Not much has changed in the last ten, or even twenty years.

In contrast, Korea is constantly evolving.

Its old stars—heavy industries such as automotive, petrochemicals, and shipbuilding—are fading. Some have fallen out of the top ten. They’ve been replaced by the three new stars of the twenty-first century—lithium batteries, biotech, and internet companies. Six of the top ten belong to these three categories; in fact, each category has two representatives.

Among them, LG Chem and Samsung SDI are both large enterprises with familiar old names, but they’ve both transformed successfully. Along with SK Innovation, they rank number one, four, and five out of the world’s biggest automotive lithium-ion battery companies. Because of this, Korea is beating China and Japan in the battery business.

Here’s another example of an old name turning a new leaf. There’s a “young” Samsung on the list: Samsung Biologics, which was founded only nine years ago. Due to the pandemic, its stocks have soared, and it is now Korea’s fifth most valuable company.

However, Korea’s strongest biotech firm is not Samsung. It is Celltrion, founded by the legendary Seo Jung-jin, Korea’s second-richest man. His two companies are Celltrion, which comes in at number seven on the list and manufactures biosimilar drugs; and Celltrion Healthcare, which comes in at number twenty and distributes said drugs.

Besides these two giants, a former nobody that’s garnered a lot of international attention lately is the testing kit manufacturer Seegene. Its PCR-based COVID-19 testing kits helped Korea fight the pandemic through mass testing.

With orders pouring in from around the world, Seegene’s stock prices have grown by nearly ten times so far this year. Its market value is 7.2 trillion Korean Won (nearly NT$200 billion).

The biotech industry has become Korea’s newest growth engine. It is making headway around the globe. According to Korea’s Ministry of Food and Drug Safety, the export of Korean pharmaceuticals reached US$5.2 billion in 2019. Up to 70% are biosimilar drugs, which have been growing rapidly, at a rate of 18.8% every year for the past five years.

Kakao and Naver Leading Internet Services

Korea’s third burgeoning industry is internet services. The market leaders are Kakao and Naver. Line, which is uber popular in Taiwan, was created by Naver.

Koreans love to buy Korean, even online. Social media, search engines, multimedia platforms, ecommerce, and video games—most of these services are owned by companies in either the Kakao or Naver group.

Kakao Bank, Korea’s largest internet banking service, will go public next year. Its estimated market value is already over NT$1 trillion. That makes it bigger than all the brick-and-mortar financial institutions in Korea.

In comparison, during the last decade, only two newly listed Taiwanese companies saw their market values surpass one hundred billion dollars: Wiwynn Corp., a subsidiary of Wistron Group, and Hermes Microvision Inc., which has been sold to Dutch company ASML Holding.

New and old money in Korea are joining forces to spark creativity and ignite growth. Taiwan can no longer rely on only TSMC.

10 Old Faces vs. 7 New Businesses

Comparison of Taiwan and South Korea’s 10 biggest companies by market value

Electronics, Petrochemicals Still Dominate Taiwan’s Top 10

Internet, Biotech, Lithium Battery Companies Make the Top 10

Note: Figures as of Oct. 8, 2020

Have you read?

♦ In Search of the Next TSMC

♦ Does Taiwan Have Enough Power for TSMC?

♦ What Korea Is Doing Right… and Taiwan Is Not

Translated by Jack Chou

Edited by TC Lin

Uploaded by Penny Chiang