What an India-Taiwan FTA entails

Source:shutterstock

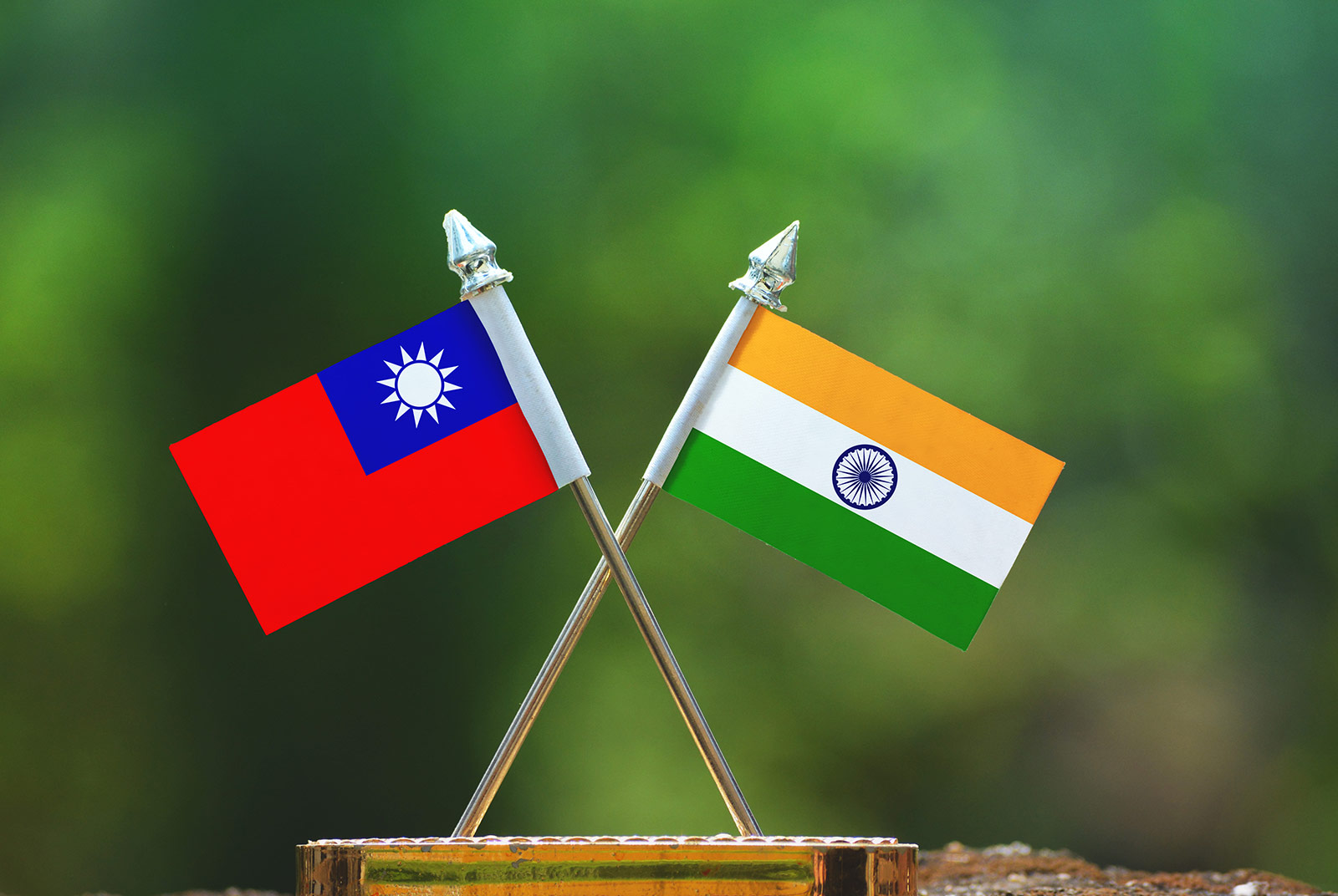

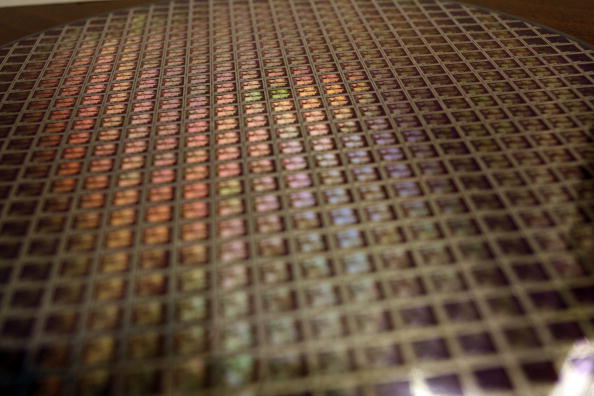

Lacking laborers and manufacturing partners, the semiconductor industry from Taiwan has encountered a new dilemma. Could India as a manufacturing partner be the best pick for Taiwanese companies?

Views

What an India-Taiwan FTA entails

By Arpita Duttaweb only

Amid Taiwan’s labor drought and hunt for a manufacturing partner for offshoring China-based-Taiwanese businesses, India could be one of the preferred destinations due to its abundant talent pool and enormous market size. To some extent, it is fair to say that choosing India as a manufacturing partner could be the best pick for Taiwanese companies.

We have noticed that India and Taiwan have been accelerating their engagement since the early 21st century. Taiwan's New Southbound Policy and Indian “Act East” initiative are working as the guiding stars to encourage and deepen the engagement between India and Taiwan. It is obvious that any synergic collaboration has to be framed in binding consensus. And both signed bilateral investment agreements, in 2002 and 2018.

In order to stimulate and promote more productive collaborations, it is necessary to spell out the mutual commitments in more concrete terms. Therefore, it is expected that the inking of an FTA would be a worthy step to remove all avoidable trade and investment barriers and would lead to being a paradigm shift in the tariff regime.

(Source: CommonWealth Magzine)

(Source: CommonWealth Magzine)

With a high need for a steady chip supply, India is encouraging more Taiwanese semiconductor firms to choose India as their manufacturing partner. We have noticed that India’s proactive inbound-investment strategy has paid great attention to Taiwan.

India vows to create a manufacturing hub by encouraging more inbound investment, and the Production Linked Incentive Scheme (PLI) is a lucrative offer to make this idea a reality. Through the scheme, the Indian government offers incentives linked to manufacturing performance. Any eligible manufacturing companies can claim such incentives based on their incremental sales value over the base year. The government has identified 14 sectors, such as automobiles, electronics, aviation, textile, etc. for these performance rewards.

Recently, the government proposed Rs 76,000 crore (760 billion INR) as PLI for semiconductor design, manufacturing, and display fabrication (fab) units. In witness thereof, on meeting the performance demand, Foxconn and Wistron, two major Taiwanese companies have been chosen for the PLI scheme in 2021, and it is expected that many more Taiwanese companies will have that eligibility to enjoy the PLI benefits. With an increasing number of such investment and trading collaborations, India and Taiwan are planning to secure this ecosystem by signing an FTA.

It is obvious that FTA will ensure some degree of liberalization in trade and manufacturing operations through eliminating maximum possible tariffs, trade barriers, quotas, and subsidies of both jurisdictions. The main aim of the FTA is to create more value-added platforms for long-term investment opportunities by ensuring international standards.

However, both parties need to realize that the FTA will stipulate only minimum levels of protection in some sensitive areas such as intellectual property, data protection, etc. Therefore, both parties need to investigate their national inequalities and establish a basic safeguarding framework for businesses. For example, it is a well-known fact that IP acts as a shield for a business during technology transfer and regional marketing.

However, this IP could be a double-edged sword due to India and Taiwan's national inequalities. For example, on one hand, India and Taiwan's yearly patent applications and their cross-country IP applications are not accounted enough to support the demand for technology transfer. On the other hand, while more cross-country IP applications are encouraged, companies might find a hidden pitfall in patent laws.

Indian compulsory licensing and Taiwanese patent linkage system are much-disputed IP mechanisms. Taiwan IP law prevents marketing approval of generic drugs until the expiration of patents. However, Indian Patent Law allows a third party to produce a patented product within the lifespan of a patent through compulsory licensing. Therefore, companies might need both governments' alertness while the FTA is drafted.

To ensure the most attainable outcome of this FTA, a thorough talk with company General Counsels and legal and IP attorneys of both jurisdictions should be crucial before the initiation of the whole process.

About the author:

Arpita Dutta is a legal consultant at ‘Louis International Patent Office’, ‘Louis & Charles's Attorneys at Law’ and ‘STARTBOARD Incubator’. Her background has been civil and corporate laws in India. In Taiwan, she has been providing legal support in seasoned industries for corporate and IP disputes and the investors for their intended ventures in India and Taiwan. She is a guest lecturer at the National Taipei University of Technology and Chang Gung University.

Have you read?

- TSMC Finds Acquiring Land Tougher than Making Chips

- Semiconductors key to Taiwan’s industrial transformation

- Taiwan Hardware Firm Executive: the Future is in India

Uploaded by Ian Huang