No power shortage? Steelmakers beg to differ

Source:Chien-Tong Wang

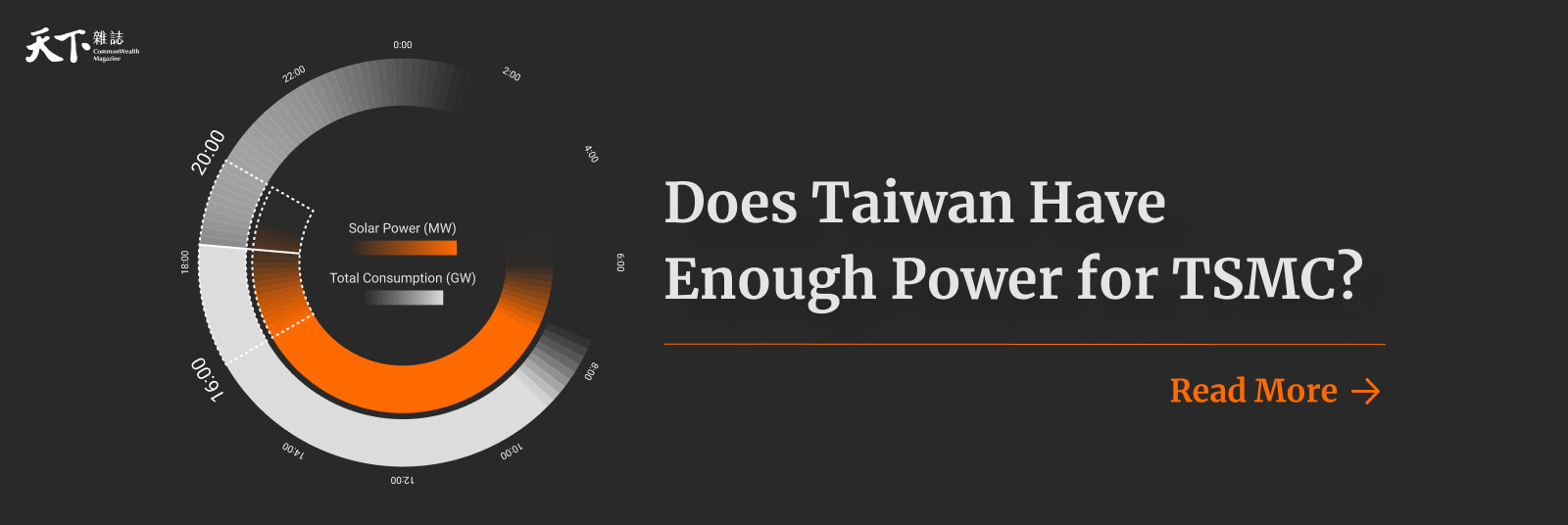

Taiwan’s government has insisted Taiwan has plenty of electricity. Many industrial parks would disagree, having faced repeated power outages in recent years while science parks remain unaffected. Why this world of power haves and have-nots?

Views

No power shortage? Steelmakers beg to differ

By Kwangyin Liu, Li Hsun TsaiFrom CommonWealth Magazine (vol. 745 )

March 4. A day after a massive power outage in Taiwan, a CommonWealth magazine reporter is at a petrochemical factory in Kaohsiung’s Dafa Industrial Park working on a story.

The phone of a factory manager being interviewed suddenly rings. The company’s Taipei headquarters is calling to pass on a message from Vice Premier Shen Jong-chin (沈榮津) that the vice president of state-run utility Taiwan Power Co. (Taipower) would like to give a call to the factory’s management.

“I don’t want to take their call,” the manager responded, his refusal well-founded.

His factory is one of Taiwan’s big power consumers that gets a phone call every afternoon, asking that it reduce its electricity usage to reduce the risk of an outage.

Taipower executives make their daily rounds of so-called “big power consumers” at around 2-3 p.m., hoping to squeeze out more electricity to get through the early evening period when Taiwan’s power supply is most vulnerable.

Not only are these old economy manufacturers badgered constantly by government officials, they end up on the short end of the stick during power outages, when rolling power cuts tend to bypass science parks and focus instead on classic industrial parks.

During a power outage on May 13, 2021, 29 of Taiwan’s 62 industrial parks faced rolling power outages. This year’s blackout on March 3 left 5.5 million households and countless manufacturers without power, but electricity continued to flow to the science parks that house semiconductor foundries. Why?

(Source: CommonWealth Magazine)

(Source: CommonWealth Magazine)

Taipower cited the “Regulations Governing Power Rationing during a Power Shortage Period,” established in 1995, which stipulate that when a power generator breakdown or trip leads to an electricity shortage and causes an imbalance in supply and demand, power outages must be rotated to different regions to protect the grid and avoid an even larger blackout.

Taipower differentiates among its customers, with “important” users, such as those in the national defense and transportation sectors, ultra-high voltage power customers, and areas around power plants exempt from power-rationing rolling blackouts.

The utility was unable to say how many semiconductor companies are in the “important” or “ultra-high voltage” categories, but it insisted that many companies in Taiwan’s science parks do not qualify for the UHV designation and are still subject to rolling power outages.

As Taiwan’s electricity supply has grown tighter, however, even the high-tech sector is not immune from getting calls from officials trying to persuade them to use less power, though they know full well their power will not be cut.

A manager at a major semiconductor vendor said the company’s factory in the Hsinchu Science Park received 14 calls in 2021 asking it to reduce its power load. It has generally responded by shutting off its air-conditioning system’s chillers and then running them off the factory’s generators.

That same factory had already received four calls through mid-March this year, indicating how stretched Taiwan’s electricity supply actually is.

“We’re willing to cooperate, because we’re afraid that if a problem occurs, Taiwan’s entire system could collapse,” the factory’s manager said.

In the past, only manufacturers that signed contracts with Taipower to be part of a demand response network in case of supply problems would receive appeals to lower their power consumption.

But that changed after Taiwan’s two major power outages in May 2021. Now, the economic affairs minister and Taipower vice president are personally calling major power consumers, begging them to lower their power loads. This lobbying group has become more organized, with each Taipower manager responsible for contacting a specific handful of companies.

Call strategy reflects power crunch

The U.S.-China trade war has led many Taiwanese companies with operations in China to invest in new capacity at home. Higher investment in Taiwan, however, has also meant rising electricity consumption.

According to figures from the Ministry of Economic Affairs’ Invest Taiwan office figures, the MOEA has approved applications from 255 companies to take part in a preferential plan for enterprises returning to Taiwan to invest.

That, in part, contributed to 6.28 percent economic growth in 2021, the highest since 2010, but also to the fastest growth in power consumption since 2010 at 4.68 percent.

(Source: Chien-Tong Wang)

(Source: Chien-Tong Wang)

Industrial power usage rose 7.07 percent, with consumption by the semiconductor sector alone soaring 9 percent. Yet those suffering the consequences for Taiwan’s unstable power network are non-high-tech companies located outside science parks.

Chen Jong-shun (陳中舜), an assistant research fellow at the Chung-Hua Institution for Economic Research’s Center for Green Economy, said the vast majority of manufacturers were originally willing to suffer in silence, in part because they feared that if they complained publicly, overseas clients would find out about Taiwan’s electricity problems and hold back on orders.

In addition, Chen said, they knew their insurance would cover them against losses caused by power disruptions.

“But now they can’t hold back because insurers are going to increase their premiums,” he said.

The last straw?

The major power outage on March 3 hit southern Taiwan particularly hard. Taiwan’s biggest steel producer, China Steel, was without electricity for a total of 8 hours, its most serious blackout in 50 years.

Hsu Wen-long (許文龍), the deputy secretary-general of the Manufacturers United General Association of Industrial Parks, observed that most of the industrial parks in southern Taiwan cater to old economy industries that have done little to prepare for electricity disruptions.

Northern and central Taiwan parks have faced less serious disruptions because many of them are science parks, and the companies in them are smaller and more vulnerable to power cuts, leading them to back up their systems with uninterruptible power supplies.

“The high-tech sector has all the advantages. They get discounts on electricity and water, and everything is taken care of for them, including land and environmental issues,” said Tsai Lien-sheng (蔡練生), the former secretary-general of Taiwan’s Chinese National Federation of Industries.

“TSMC, which is 70 percent foreign invested, has sucked up all of the electricity and water and even talent, but when there’s a blackout, its power is never cut.” he said bluntly.

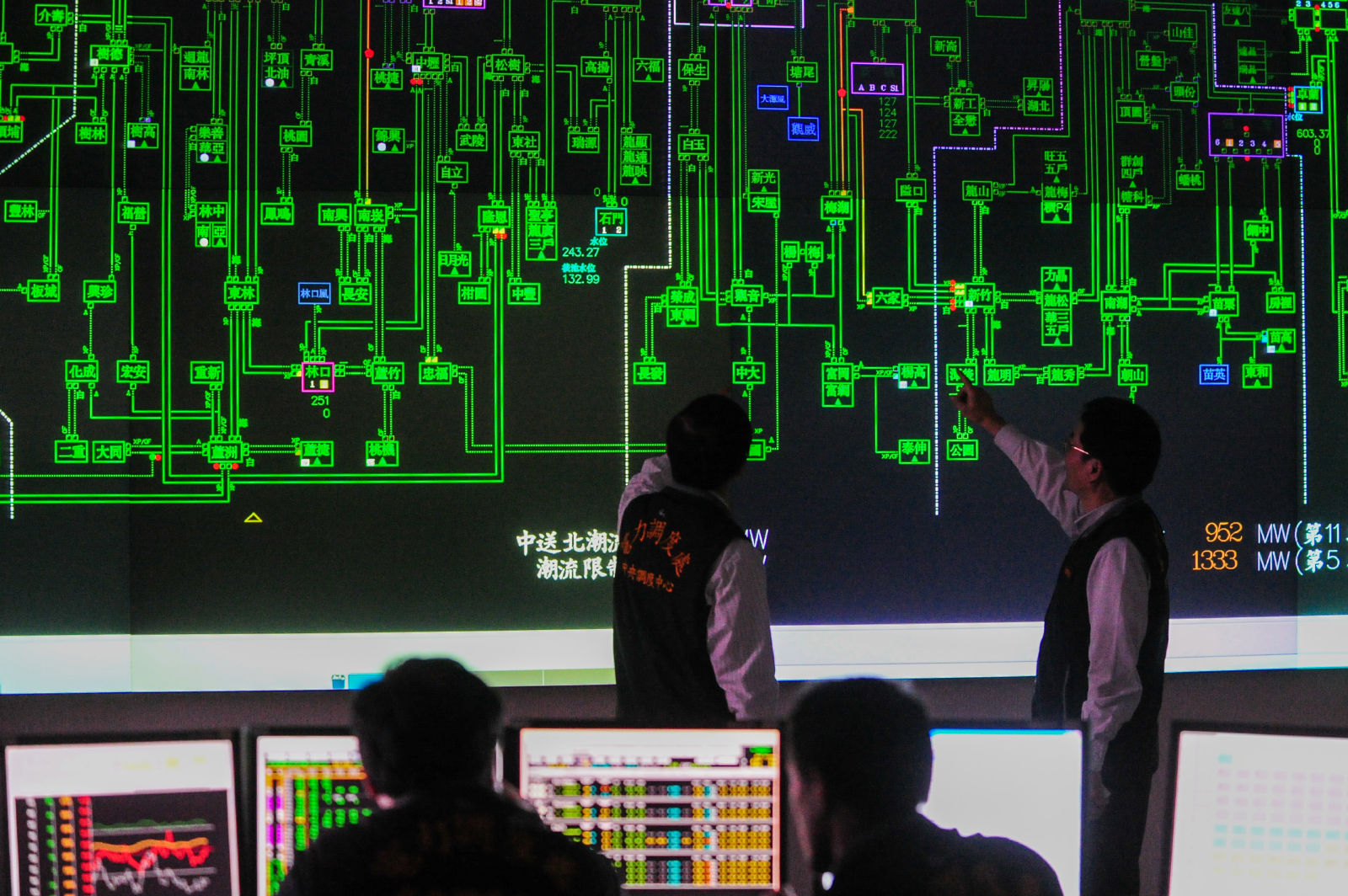

Power grid resilience a longstanding problem

The impact of the March 3 blackout was far greater than many people imagined, and a spotlight was once again cast on the lack of resilience of Taiwan’s power grid, a longtime sore spot.

At a legislative hearing on March 31, Economics Vice Minister Tseng Wen-sheng (曾文生) said Taipower proposed a solution following the March 3 blackout to make the grid more resilient, to be completed within 10 years, and then stressed that the MOEA was preparing a NT$100 billion plan to achieve the goal.

(Source: Pei-Yin Hsieh)

(Source: Pei-Yin Hsieh)

“Companies are already sensing a change,” Hsu said, explaining that Taipower may try to tighten its management of energy resources.

Taipower traditionally has maintained an operating electricity reserve margin of 12 percent, an ample cushion capable of meeting different contingencies. But that, Hsu said, has been like factories “that used to accumulate a lot of inventory, which was a type of waste. Now the focus should be on responding in real time and making the most effective use of resources because building big new power plants is almost an impossibility.”

Many manufacturers are willing to adjust their production models and be involved in a “demand response” system, Hsu said, referring to the reduction of demand by big power consumers to reduce peak demand and avoid emergencies.

“Some of them have already started, but Taipower should do it more comprehensively and educate more companies about it,” Hsu said.

Yet that may not go far to allay the fears of companies in industrial parks or those interested in investing.

Hander Chang (張致遠), secretary-general of the Allied Association for Science Park Industries, said a foreign company that manufactures in many countries called and told him that based on its annual assessment of the global industrial chain, “it believed that Taiwan’s biggest problem was the supply of water and electricity, and that those issues would definitely affect their willingness to invest here in the future.”

Regardless how much companies try to do on their own, the government is still ultimately responsible for ensuring that core industrial sectors such as the steel, petrochemical, and textile industries do not have to worry every day about potential power disruptions.

Electricity is a critical part of an economy’s infrastructure, and individual companies cannot be expected to solve the power grid problems on their own, much less deal with the unequal treatment of non-tech companies that has them feeling like second-class citizens.

Have you read?

♦ Blackout exposes Taiwan electrical grid’s major vulnerabilities

♦ Does Taiwan Have Enough Power for TSMC?

♦ Is Taiwan headed towards an energy crisis in 2023?

Translated by Luke Sabatier

Uploaded by Penny Chiang