Top 2000 Survey: Manufacturing

Identifying Trends, Seizing Niches

Source:CW

In 2013, Taiwanese manufacturers saw their sales fall but their profits rise. Was that a warning or good news? What are the secrets to coping with mounting external challenges?

Views

Identifying Trends, Seizing Niches

By Yuan ChouFrom CommonWealth Magazine (vol. 547 )

Taiwan's top 1,350 manufacturers still continued to feel their way through a low-visibility environment in 2013 but made out better than some might have expected.

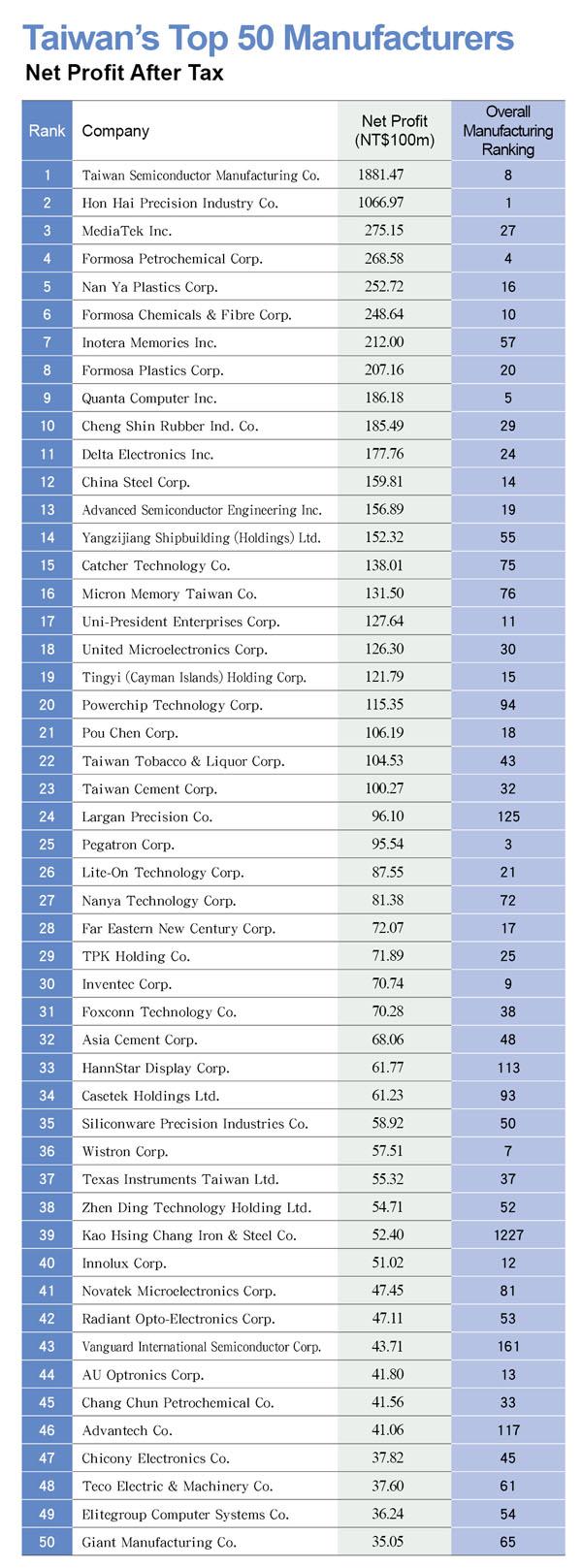

Though their combined revenues fell 0.35 percent year-on-year to NT$26.75 trillion, total net income soared 83.54 percent to NT$1.08 trillion, and their average profit margin nearly doubled, from 2.19 percent in 2012 to 4.04 percent last year.

But they face huge challenges both overseas and at home. Externally, two of the BRIC countries – China and India – are growing at slower paces than in the past, and labor and energy costs are on the upswing, prompting doubts over the prospects for Asian exports and whether they will be able to take advantage of improving economies in the West.

Internally, recent student-led protests in opposition to Taiwan's trade-in-services pact with China indicated that the difficulties Taiwanese industries are facing in maintaining their competitive advantages in an era of globalized trade have become an issue of national importance.

Identifying Trends, Making the First Move

The Taiwan stock exchange's biggest headline recently was made by smartphone camera lens maker Largan Precision Co. The company set a new record for the highest priced shares in the market's history when its share price closed at NT$2,000 on May 6.

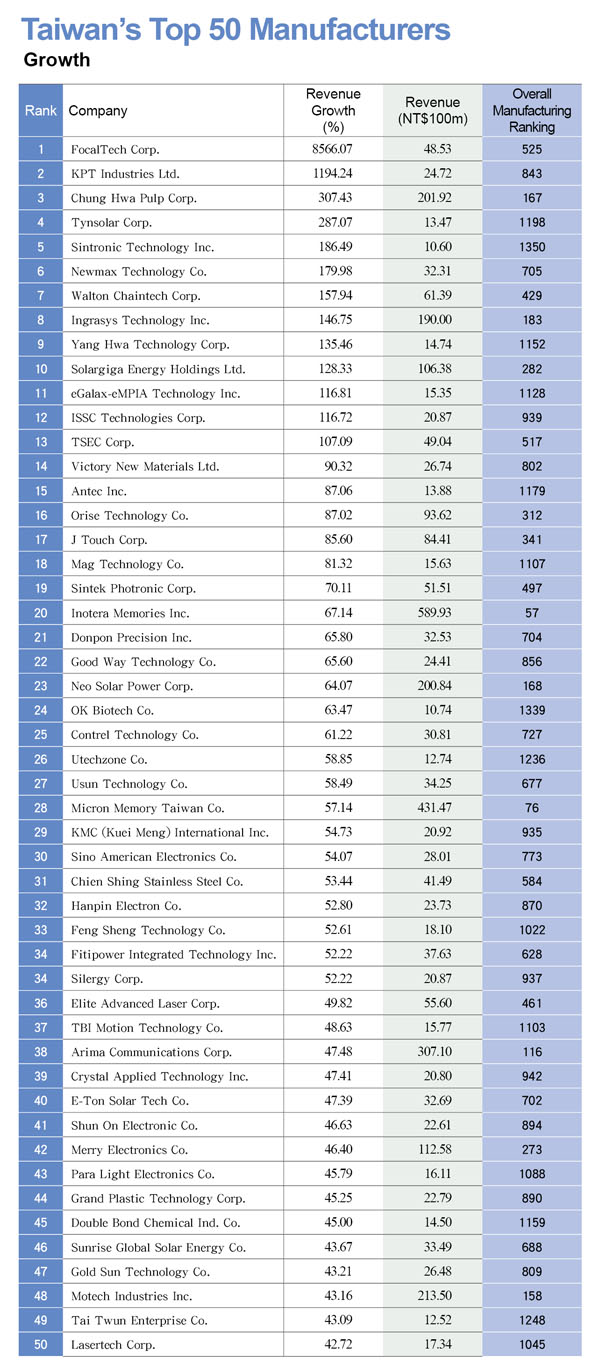

Largan, which produces a camera lens protected by sapphire crystal for Apple's iPhone 5, saw its sales rise 36.67 percent in 2013, catapulting it to 125th in the rankings of Taiwan's biggest manufacturers (by sales) from 170th a year earlier. Its profit margin was 35.03 percent.

Largan's secret of success is that 27 years ago, before the first smartphone was even invented, it saw the trend toward lenses that were lighter, thinner and smaller.

Examples of successful companies having the foresight to identify a trend early and master the technology – as was the case with Largan – abound in every industry, and even in the midst of economic doldrums, they generally continue to perform well.

Hermes Microvision Inc., which trades on Taiwan's over-the-counter market and has the second highest share price in the country's equity markets, has followed such a path. Hermes Microvision's founder and CEO Jack Y. Jau noticed in the 1990s that semiconductors were getting progressively smaller, creating problems for the optical devices that were used at the time to check wafers for defects. Jau decided to develop more advanced electronic beam inspection systems, which have now become indispensable to the industry.

Headset and amplifier manufacturer Merry Electronics Co., which soared in the rankings from 365th in 2012 to 273rd last year, has always focused on investing in R&D and talent. The 70-year-old founder and chairman of the nearly four-decades-old company, Leo Liao, demonstrated that commitment when he opened an acoustic materials laboratory at Dayeh University at the end of April.

"Developing a business depends on more than just identifying trends; it also has to be supported by the prowess of R&D," he says, explaining the secret of a sustainable operation.

Even in industries with poor outlooks, companies can find fertile ground by mastering technologies and enhancing their competitiveness in specific niches.

Giga Solar Materials Corp. is one such company. The fourth company founded by former Gigastorage Corp. chairman Chen Chi-jen, Giga Solar specializes in manufacturing the solar cell conductive paste that collects electricity generated by solar cells and transmits it to a system. Its ranking among Taiwan's top manufacturers rose to 526th in 2013 from 679th in 2012.

When the solar industry was just taking off in 2003, Chen realized that the solar cell sector had a relatively low entry threshold – a production line cost only NT$500 million – and would sooner or later fall prey to oversupply and vicious cost competition.

He decided to move further upstream in the supply chain and produce the key component needed to make solar cells, turning flourishing solar cell manufacturers into customers. After five years of R&D, Giga Solar was producing conductive pastes as cost-effective as those made by major international players. Today, it may only have about a quarter of the sales of major solar cell makers, but its profit margin of 12.76 percent is roughly 10 times that of its customers.

All Industries Have Their 'Largan'

Onano Industrial Corp., ranked 963rd, has positioned itself in between small LCD module vendors and larger TFT-LCD panel suppliers, thinning glass substrates for small and medium-sized displays.

Back when regular feature phones were in vogue, company founder and chairman Jerry Huang anticipated the trend toward ever thinner and lighter portable devices. He believed that the traditional grinding process used to thin down glass panels would eventually encounter limitations.

"We bet that it would definitely face problems," Huang says.

Starting from scratch, Huang spent three years developing a chemical etching technology that could reduce the thickness of glass by 60 percent and staked out ground in the supply chain to offer the service before anybody else. As flat panel factories needed glass thinned, they decided there was no longer any reason to invest in new equipment, instead contracting Onano to do the work. The company had after-tax net income of NT$378 million in 2013 on revenues of NT$2.01 billion, earning half of its paid-in capital.

Taiwan does not have any one "hot" industry, but in almost every industry there can be found enterprises that have established themselves in a niche market with a high entry threshold, where they maintain an unassailable position.

Anticipating trends, mastering technology, developing innovative services, products and business models, elevating the threshold of competition – these are the specialties of companies such as Largan that are changing the face of the manufacturing sector in Taiwan.

Translated from the Chinese by Luke Sabatier