Chinese Tourists in Taiwan

Spending Big, but to Whose Benefit?

Source:CW

Chinese tourists were expected to give Taiwan an economic shot in the arm after they began flooding in four years ago. But the results have been mixed, with only a few beneficiaries.

Views

Spending Big, but to Whose Benefit?

By Rebecca LinFrom CommonWealth Magazine (vol. 509 )

It's nighttime in Kaohsiung. At the traditional Liouhe Night Market, lit brightly by magnesium bulbs, the aromas of fried squid and eel noodles blend with a cacophony of human voices, Chinese renminbi trading hands at a brisk pace.

At the end of the night market, a white banner unfurled by Falun Gong devotees flutters in the air. Moving away from the market, there are at least 20 hotels and inns, one more eye-catching and stylish than the next, that generally cater to Chinese tour groups.

China has become the biggest source of tourists in Kaohsiung and in Taiwan. A total of 930,000 Chinese nationals stayed at least one night in the southern port city in the first eight months of 2012, accounting for 67.5 percent of all foreign tourists who enjoyed the city, up from 50.9 percent last year.

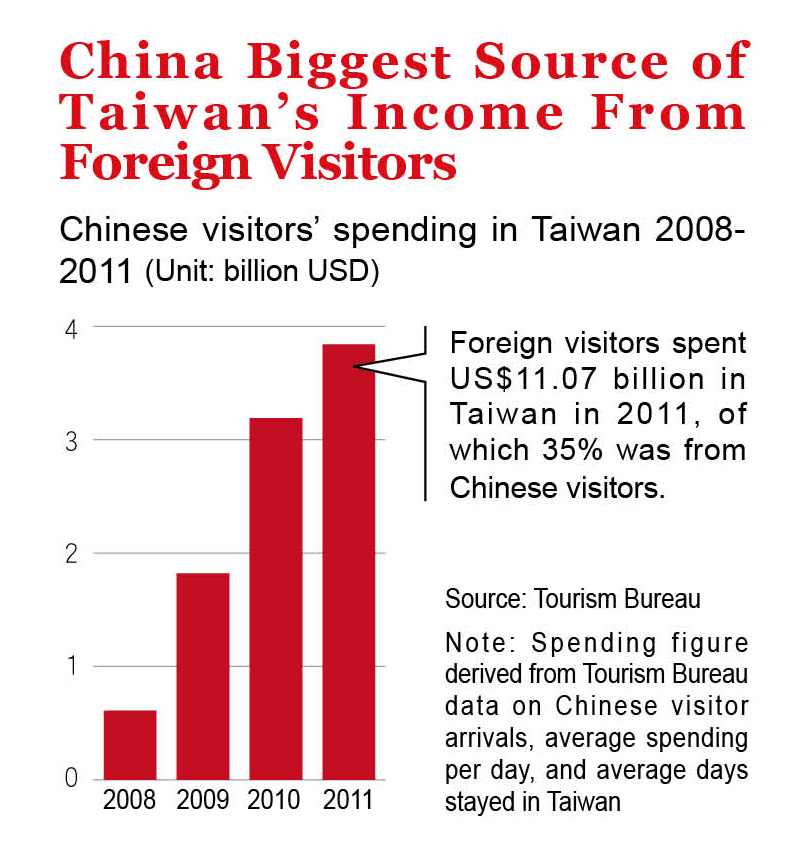

In fact, Chinese visitors are the biggest source of foreign exchange earnings in Taiwan's tourism sector. Of the US$11.07 billion spent by foreign visitors in 2011, US$3.84 billion, or 35 percent, came out of the pockets of Chinese nationals. (See Table)

"After Taiwan opened up to Chinese tourists, they quickly became Kaohsiung's biggest group of international visitors," says Hsu Chuan-sheng, the director-general of the city's Tourism Bureau. As he rushed back to his office from a city council meeting, Hsu pulled out a pile of documents from his cloth bag, showing that the Japanese, traditionally Taiwan's biggest source of visitors before the Chinese influx, are not that familiar with the southern metropolis. In contrast, out of every 10 Chinese visitors to Taiwan, roughly six make it to Kaohsiung.

Who Is Cashing In on Chinese Tourists?

But who is really cashing in on this new source of "wealth" in the city?

"Chinese tourist numbers are not being driven by the logic of a free market," is the refrain of many tourism officials. Since Taiwan's opening to Chinese tourists in mid-2008, the Chinese government's restrictions on traveler numbers and where they come from have been clear to everybody in the industry, and Hong Kong investors have supported the controlled invasion into Taiwan's market.

In fact, Kaohsiung officials and industry insiders are clearly aware that the large Chinese visitor numbers are just one aspect of the Chinese government's policy of "benefiting Taiwan," which is focused on the southern part of the island, the bastion of pro-independence sentiment.

"I have a hard time imagining what kind of an impact it would have if one day Chinese visitor numbers fell by half or suddenly disappeared," worries Democratic Progressive Party legislator Chao Tien-lin, a Kaohsiung native who represents one of the municipality's nine electoral districts.

Chao's concern is not unfounded. In 2009, two events drew China's ire, causing a sudden drop in visitor numbers. At the end of August, the Dalai Lama visited southern Taiwan to offer his blessings after the area was ravaged by Typhoon Morakot three weeks earlier. The Kaohsiung Film Festival then announced it would screen "The 10 Conditions of Love," a documentary about exiled Uighur Muslim leader Rebiya Kadeer, at the event in October. There were even moves afoot to invite Kadeer, seen by Beijing as a terrorist, to the festival.

During that time, occupancy rates at Kaohsiung hotels shrank from 60 percent to about 30 percent, and reservations for 2,780 rooms were canceled. Department stores and restaurants also saw sales plunge.

"That's something from the past we really don't want to revisit," says Frank Lin, the convener of the Southern Taiwan Tourism Industry Alliance, of that difficult time for the sector. He remembers doing interviews with China Central Television (CCTV) in which he publicly opposed the festival's showing of the documentary and leading a delegation of 78 industry leaders to Hangzhou and Ningbo, in an apparent attempt to show Kaohsiung's good will toward China.

"There were people on the Internet launching a boycott of the Kingship Hotel and there were those who accused me of being a chameleon who was changing his color to red for a meager profit," says an indignant Lin, the chairman of the Kingship Hotel Kaohsiung who served as an adviser to the Cabinet while the DPP, which is much less amenable to ties with China, was in power.

"In southern Taiwan, there are 48,000 people whose lives depend on the tourism industry. What would you want us to do?"

The Kaohsiung City Council was also up in arms over the film festival's plans. Under pressure from Kuomintang councilors, the council struck out the festival's funding from the Kaohsiung Information Office's budget and passed a resolution to abolish the office the following year in June.

"The economic benefit that the mainland gave to Taiwan evidently came with thorns," says Chao of the 2009 tumult.

Few Sectors Benefit

The eagerly anticipated Chinese tourists gradually returned, but China's controlling hand remained as strong as ever, essentially handpicking those who would benefit from the tourist trade most and, in particular, those who could cultivate a tight network of contacts across the Taiwan Strait.

Ma Yi-lung, who stepped down as president of the Kaohsiung Association of Travel Agents in early October, says candidly that only a small number of businesses in every segment of the tourism industry –from hotels and tour buses to specially designated restaurants and stores – are making money from the influx of Chinese tourists.

One of those businesses used to be Chin Hsi Travel Service Co.

Outside of the company's office stands a life-size image of Taiwanese opera star Lin Mei-chao urging visitors to tour Taiwan. But as Chin Hsi Travel Service chairman Chiang Chi-hsing turns out the lights in his office as he leaves for the night, he says in a hoarse voice, "I want to gradually pull out of the Chinese tourist market."

Two years ago, Chin Hsi was one of five Taiwanese travel agencies handling the most Chinese tour groups, according to a ranking by Taiwan's national Tourism Bureau. At the time, Chiang's company regularly served over 100 tour groups per month, but that number has now fallen below 10, Chiang's dream having become a nightmare.

"My professional expertise could not overcome cutthroat pricing competition," he laments.

To get a bigger share of the market, Taiwanese travel agencies lowered the amount they charged Chinese agencies per visitor from between US$60 and US$65 per day (Taiwan's government set the minimum at US$60) to about US$24, and in some cases they decided not to charge anything.

That meant that of the NT$25,000 Chinese tourists typically pay for package tours in Taiwan, most of the profit was going to travel agencies in China. Local travel agencies needed to find other ways to make money, and the result was squeezing in as many stops as possible into Chinese tour groups' itineraries.

"They aren't brought back to their hotels until 9 or 10 at night," Ma says, shaking his head with a sigh. The strategy, he explains, is to force Chinese visitors to spend their money at designated stores to guarantee travel businesses hefty commissions.

Islandwide Chain of Opportunities

On all Chinese package tours to China, the island is carved up into six "special product areas" – Taipei (pineapple cakes and watches), Alishan (tea leaves), Sun Moon Lake (Antrodia camphorata, a medicinal fungus), Kaohsiung (diamonds), Taidong (coral products) and Hualian (jade and marble).

"Even pineapple cakes and tea leaves have to be bought in pre-designated stores. You can't let the tourists buy it from a store of their choice," says one industry insider.

This behind-the-scenes control of the profits extends to travel agencies. Of the 400 companies authorized to handle Chinese tour groups, 50 generally do much of the business, and, of those, 15 are Hong Kong travel agencies. "And there are probably more because in some companies, Taiwanese act as front men for people from Hong Kong," the insider says.

In fact, many of these Hong Kong-invested travel agencies – which advertise "no tour fees" and use cutthroat pricing in China to capture market share – make their money from a series of shopping venues in Taiwan that are linked together in an exclusive network.

Why fight for the privilege of doing a business that on the surface seems to lose money? "Because behind the scenes they're getting fed by the 'shopping stations,' which are supporting them," admits one vendor in the shopping network.

This is the tourism industry's golden rule for success: "When the people flow in, so does the money."

One of the stores riding the Chinese tourist wave is the stylish Zeta Jewelry in Kaohsiung on Zhongzheng Rd., where tour buses carrying groups from all over China are already parked at 7:30 a.m. To ease the constant traffic snarls on this important Kaoshiung thoroughfare created by the swarms of buses that arrive throughout the day, the Love River Ferry now starts its operations at 9 a.m. rather than 4 p.m.

One group after another from the more than 1 million Chinese visitors who arrive in Taiwan every year travel to Kaohsiung to buy diamond jewelry, turning Kaohsiung into something of a "diamond shopping Mecca."

Hong Kong Investors Getting the Biggest Piece of the Pie

The problem is that of the five main diamond vendors in Kaohsiung that welcome Chinese tour groups, three are owned by Hong Kong investors: Zeta Jewelry, Ou Ya Jewelry, and Lin Hong Jewelry.

"These three stores have an 80 percent share of the market. The rest is all that's left to be divided among Taiwanese diamond vendors and suppliers," reveals one diamond dealer familiar with market trends who describes the situation as anything but fair market competition.

In fact, Zeta, Ou Ya and Lin Hong are the most prominent faces in three different self-enclosed networks of tourist shops. All the stores on which the Chinese visitors descend throughout their tour, selling everything from jewelry and watches to souvenirs and coral, are in the hands of Hong Kong investors or their partners. Hotels and restaurants are now even gradually moving in that direction.

Zeta and Ou Ya are both expanding to Taidong, where they will open coral product shops at the end of the year. The Lin Hong Group has already opened a store called Donglin Coral in Taidong that caters almost exclusively to Chinese tour groups.

According to Taiwan's Tourism Bureau, the 1.78 million visitors from China who arrived in Taiwan during the first nine months of this year generated more than NT$120 billion in revenues.

"But Hong Kong investors took away at least 40 percent of that, making them the biggest winners. Of the remaining 60 percent, among how many people is it being divided?" says one frustrated travel industry veteran.

The only Taiwanese businesses that have an edge among Chinese visitors are in the Taidong coral market and the Hualian jade market. For coral products, for example, Taidong's Chii Lih Coral and Lucoral and Lupearl Corp. control 80 percent of the market.

Hong Kong companies have an edge in the industry because of their extensive networks of business relationships in China, developed since hoards of Chinese tourists began flooding into the former British colony after it was handed over to China in 1997. To cope with the tourist influx, Hong Kong travel agencies and retailers quickly engaged with Chinese tour operators and built tight cooperative relationships.

One Taiwanese industry insider says it cannot be denied that Hong Kong companies have been in the game a long time and have a wealth of sales experience.

"In terms of management, Taiwan does not have priorities. It has even completely opened the hotel and hospitality industry to outside investment. Outsiders can come. We shouldn't be afraid. But the key is how to manage them," says Tsai Chin-shu, chairman of the Commerce Industry & Culture Interchange Association, rattling off the names of a few hotels that already carry the shadow of Chinese capital.

Perhaps the opportunity for Taiwanese companies to gain a clear advantage in the sector has passed, and they are now left to face an oncoming competitive war. The relative strengths and weaknesses of different competitors have grown increasingly clear, but one shopping chain vendor is not discouraged.

"This is a marathon, so we need to concentrate more on the quality of our own products," he says.

That may ultimately be Taiwan's real advantage.

Translated from the Chinese by Luke Sabatier