China under lockdown: The global supply chain crisis

Source:Getty Images

Eighty-seven of China’s 100 major cities are under some form of lockdown. Shanghai has been under a strict lockdown for over a month. With logistics stymied and supply chains in every sector affected, how will Taiwan pull through? As China pursues its zero-COVID policy, how will the global economy regain its footing?

Views

China under lockdown: The global supply chain crisis

By Elaine HuangFrom CommonWealth Magazine (vol. 747 )

Remember Tom Hanks from the 2004 movie, The Terminal? Meet Mr. Cheng, the 59-year-old who has been stuck in a warehouse in Shanghai’s Pudong Airport for a month.

Scene one: Pudong Airport, Shanghai

Cheng manages the import warehouse in Shanghai for Dimerco, the Taiwanese freight forwarder and logistics leader. On April 1st, after the lockdown had begun, he packed a blanket and a week’s worth of clothing, met up with four other core members of the staff, and moved into the customs warehouse in Pudong Airport. He has been living there for a month now, getting by on the food his colleagues bring for him.

Shanghai’s Pudong Airport is China’s biggest entryway for air freight. Despite the lockdown, EVA Air and China Airlines still each land a flight every day. The shipments cover goods that Dimerco is moving for its customers, including key electronic components like IC chips, semiconductors, and auto parts, all of which must be delivered to the electronics and auto industries that thrive in eastern China.

After the lockdown was put into effect, it became next to impossible to find truck drivers. A few dozen deliveries a day was as good as it got. But the shipments kept coming in, filling the warehouses. Dimerco ended up renting a thousand square meters of space from China Eastern Airlines to provide emergency storage.

(Source: Dimerco Express Corporation)

(Source: Dimerco Express Corporation)

Ten million iPhones left unassembled

The supply chain on China’s eastern seaboard has come to a standstill. Finished products cannot be exported; key components are stuck in import warehouses. The flow of goods has slowed to a drip.

If the lockdown continues into May, the chain will be broken.

CommonWealth has pulled the numbers from the Market Observation Post System. 238 publicly traded Taiwanese companies have been impacted by the lockdowns in Shanghai and Suzhou. Even though the key indicators of Taiwanese business in China—such as Quanta, Wistron, and Unimicron—have gradually restarted operations by adopting what is called “closed-loop production”, they still suffer from a lack of staffing and supplies.

According to the Oxford COVID-19 Government Response Tracker (OxCGRT), China has never completely lifted its lockdown restrictions in the past two years. Even so, the current level of restrictions matches that of Wuhan two years ago.

Taiwan’s top-five electronics leaders: Quanta, Compal, Wistron, Inventec, Pegatron; Apple supplier Foxconn; and display, PCB, heat dissipator, chassis, mechanical equipment vendors higher up the supply chain—just about everyone has some capacity tied up in the affected areas. Over 20% of the world’s 200 million laptops are manufactured in eastern China’s consumer electronics supply chain. Big brands from MacBook to Dell are all feeling the squeeze.

The lockdown in Shanghai (Source: Reuters)

The lockdown in Shanghai (Source: Reuters)

Protek (Shanghai) Limited is Pegatron’s iPhone assembly plant in China. Pegaglobe (Kunshan) Co. is its auxiliary factory. Han Wen-yao (韓文堯), senior analyst at Isaiah Research, says: “If the lockdown in Shanghai continues, and if Apple cannot successfully transfer the orders owing to logistics issues, the production of six to ten million iPhones may be affected.”

A senior manager at a laptop company who is a long-time resident of Shanghai says that, even though both the Shanghai and Kunshan city governments have announced the lists of companies that are permitted to resume production in mid-April, due to the lack of components and workers, the entire supply chain can be best described as a stroke victim: “The brain wants to work, but the limbs are unresponsive.”

Scene two: The roads to Kunshan

Right now, nothing is less responsive than this key resource: trucks and drivers.

According to Chinese IoT tech company G7 Connect, less than 20% of the trucks in Shanghai have been working since the lockdown began. “It’s a melee to see who can secure truck drivers,” a senior manager at a laptop supply chain provider says helplessly.

(Source: Reuters)

(Source: Reuters)

Why are drivers in such high demand?

Since the lockdown began, truck drivers who wish to work have been required to carry “two tests and one pass”, to be renewed every 48 hours. The two tests are the nucleic acid amplification test (NAAT) and the health check-up; the one pass is a work permit. What’s more, after every trip outside of Shanghai, the driver is required to be quarantined for 14 hours.

The senior manager reveals that Beijing now requires every city to individually enforce the zero-COVID policy. That means a driver delivering from Shanghai to Suzhou would have to retake the NAAT, since one municipality does not recognize a test done in another municipality.

The way from Shanghai to Kunshan used to take merely three hours; it’s now a 48-hour trip. Delivering from Shanghai to Kunshan can cost as much as US$15,000. That is comparable to air freight.

To alleviate the situation, the Chinese government has introduced a permit for freight trucks delivering key items. By limiting one vehicle to one pass and one route, China hopes to unify the work permits being used across the country, which will make deliveries more efficient and stabilize the supply chain. It remains to be seen if the results will live up to the promise.

Scene three: Airports across southern China

Due to the restrictions, it is now pricier for Taiwanese companies to deliver to Zhengzhou than to Europe.

The problem is, since Shanghai and Suzhou are under lockdown, truck drivers are the only ones who can penetrate the blockade and deliver life-saving supplies.

A Taiwanese businessperson delivering chips to Shanghai reveals to CommonWealth that components that were meant to go through Pudong Airport into Shanghai and Suzhou are now being routed through airports in Xiamen or Guangzhou, and then delivered over land or water. “It takes an extra three or four days, but our clients can accept it.”

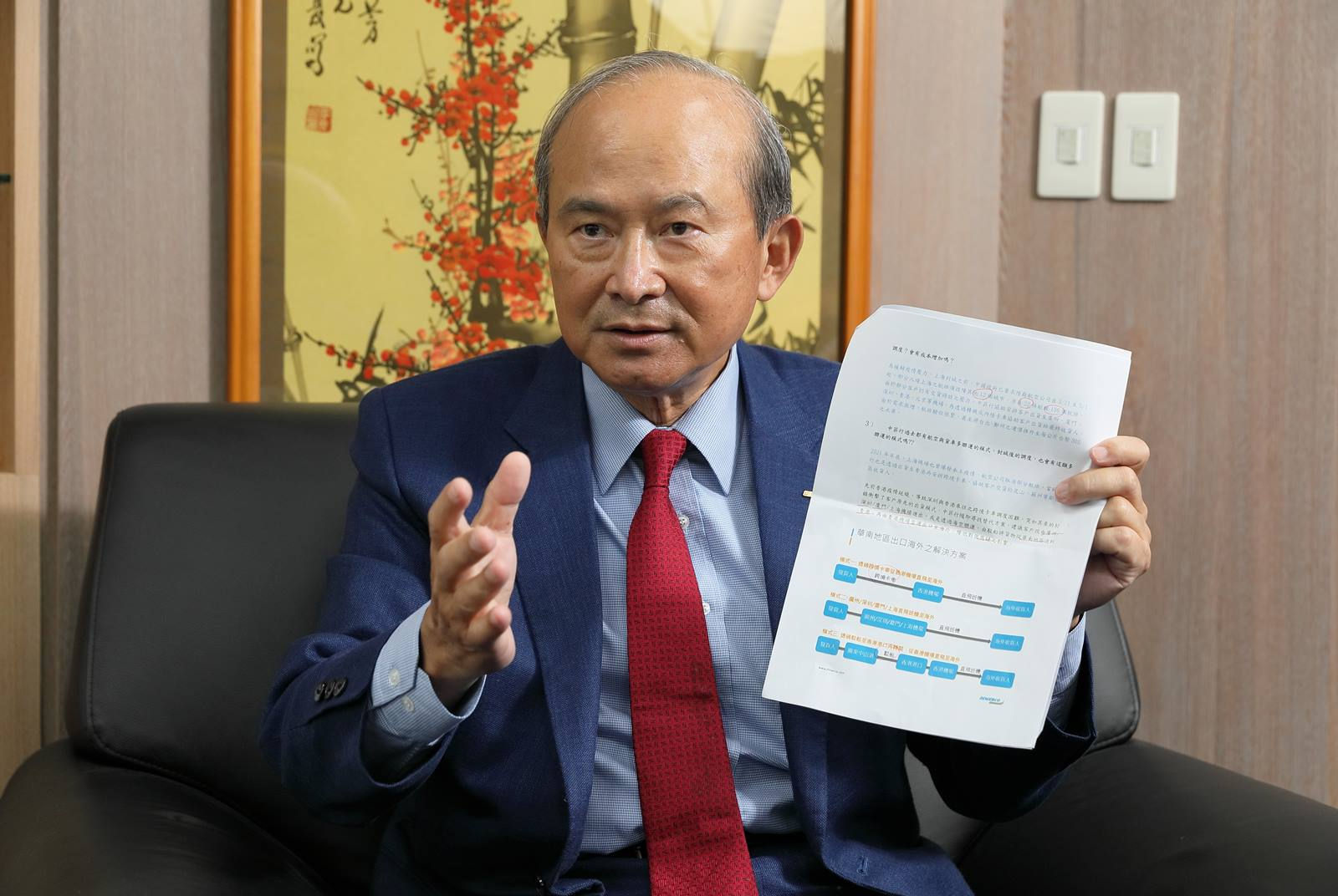

These urgent deliveries have “filled the warehouses of southern Chinese airports to the brim,” says Chiou Jiun-rung (邱鈞榮), President of Dimerco. The Chinese market makes up 48% of Dimerco’s overall revenue.

Chiou Jiun-rung (Source: Chien-Tong Wang)

Chiou Jiun-rung (Source: Chien-Tong Wang)

In mid-April, Guangzhou’s Baiyun Airport announced that its warehouses had reached maximum capacity and that it was suspending acceptance of new deliveries. On April 26th, SF Airlines announced to its freight deliveries that, due to the influx of shipments in Shenzhen, a load limitation would be imposed on flights until April 30th. “Everything besides chips and wafers have been superseded by more important deliveries.”

“It is unheard of to have limitations placed on shipments,” says Chiou.

Even in Zhengzhou, a major hub of iPhone assembly, the airport warehouses are filled to the brim. This is reflected in the delivery fees. It now costs six times more to ship from Taipei to Zhengzhou; a kilogram of goods can cost up to NT$400. “It only costs NT$200 to ship from Taipei to Europe, even though a flight to Europe takes 13 hours and a flight to Zhengzhou only takes four hours,” says Chiou.

The lockdown is different this time. “Even if you could get your hands on components, it would do you no good, because you never know at which point of the delivery you will encounter issues,” says a senior manager at a contract manufacturer. Because many suppliers were burned by the shortage of supplies in the last two years, a majority of them have broken their “zero inventory” rule and stocked up on 3 to 6 months’ worth of supplies.

Supply chain fragmentation

Not long ago, the Chinese cities of Shijiazhuang, Xi'an, Shenyang, Shenzhen, and Dongguan were also under lockdown. Why is it more serious this time?

The Lockdown in Shijiazhuang last year impacted thousands of people (Source: Reuters)

The Lockdown in Shijiazhuang last year impacted thousands of people (Source: Reuters)

It is because of this: “Shanghai and Kunshan are important cities. One is the gateway to eastern China, and another is a manufacturing stronghold. The repercussions are enormous,” says Synergy Intelligent Logistics CEO Lin Hsien-Chun (林憲群).

Many experts predict that, in the face of unexpected black swan events, the fragmentation of the supply chain, which started during the China-U.S. trade war but slowed due to the pandemic, may be poised to make a comeback.

“Everyone is worried about production halting, and so they stock up on components, with the hope of winning their customers’ trust and securing orders when work resumes. But every additional production site means more inventory and costs for everyone involved. There is no room for smaller-scale manufacturers,” says Yung-jen Chen (陳泳仁), Spokesman for bicycle chain manufacturing giant KMC.

When KMC’s production site in Taicang, Suzhou, which provides for the Kunshan plants of Taiwanese bicycle brands Giant and Merida, had to shutter its doors due to the lockdown, KMC shipped from its plants in Tianjin and Shenzhen to pick up the slack. The site in Suzhou has since been approved to resume production.

In addition to fragmenting the supply chain all over China, the same thing is happening across international borders.

In April, it was reported that Giant’s plant in Vietnam would open by the end of this year. A manager in the bicycle component industry states that it is inevitable that the production lines will move farther south.

Matthew F.C. Miau (苗豐強), the newly appointed Chairman of the Chinese National Federation of Industries, says that a costly supply chain has become an enterprise’s greatest liability. Because of geopolitical issues, companies are bound to invest in supply chain fragmentation, which will push costs up. Consumers will end up footing the bill, and so price inflation across the globe might become inevitable.

Lin Hsien-Chun, president of SYN Logistics (Source: Chien-Tong Wang)

Lin Hsien-Chun, president of SYN Logistics (Source: Chien-Tong Wang)

Lin Hsien-Chun says that in the past two years, when people have spoken about a shortage of components or the need to secure suppliers, what they were really talking about was the need for transparent communication. The biggest challenge for the logistics sector moving forward is facilitating communication between different stages of production and sharing data with the customer, so information on the supply chain may become less opaque.

Fragmented and transparent: this is the medium-term and long-term way to move forward for the high-cost supply chains of the future.

Experts are saying that Shanghai will come out of lockdown beginning in mid-May. Once work resumes, the scramble for workers, drivers, and storage space will become even more frenetic. “It’ll take at least a month before things regain some semblance of normalcy,” predicts TrendForce analyst Chen Wei-sheng (陳惟聖).

Have you read?

- What price has Shanghai paid for China’s zero-COVID policy?

- Why are Chinese companies in Taiwan being raided?

- Should Taiwan put its future in U.S. hands?

Translated by

Jack Chou

Edited by TC Lin

Uploaded by Ian Huang