How a Flour Mill from Tainan Became the World's 12th Largest Food Conglomerate

Source:Ming-Tang Huang

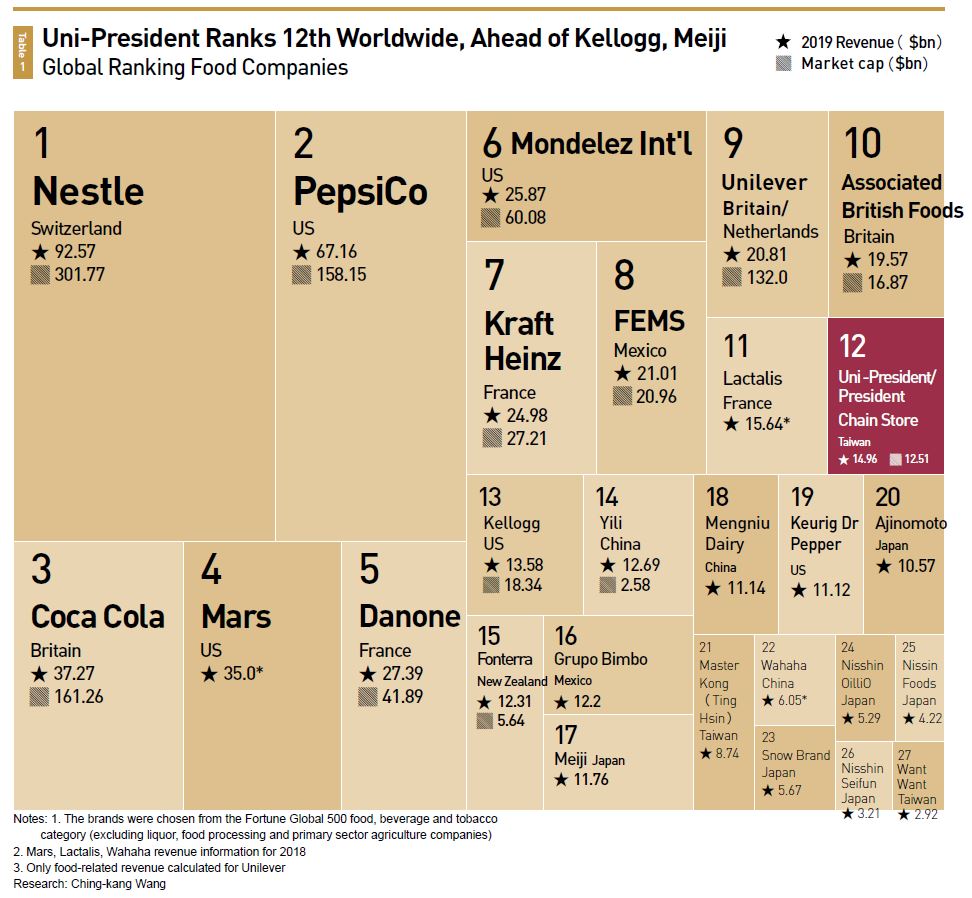

Within half a century, Uni-President Enterprises Corporation, which started out as a humble flour factory in the southern Taiwanese city of Tainan, grew into the world’s 12th largest food conglomerate. Many of its subsidiaries are the largest companies in their respective sectors in Taiwan, if not in Asia. The conglomerate’s business covers entire supply chains in a wide range of industries. How did Uni-President brands come to dominate the lives of Taiwanese consumers, beating transnational food giants such as the U.S.-based Kellogg Co. and Japan’s Meiji Holdings Co. Ltd.?

Views

How a Flour Mill from Tainan Became the World's 12th Largest Food Conglomerate

By Yi-chih WangFrom CommonWealth Magazine (vol. 698 )

It is virtually impossible for Taiwanese consumers to get around Uni-President brands and services. From breakfast at popular coffee chain Starbucks to the soybean oil you use for preparing dinner, it all comes from Uni-President. When leaving the house, you will inevitably pass a 7-Eleven convenience store - there’s one on virtually every street corner - and Cosmed drugstores are almost as ubiquitous – they too belong to the conglomerate. Even if you don’t leave the house to shop, let’s say you order a book online from www.books.com.tw that is delivered to your doorstep by T-cat express delivery – Uni-President is behind that as well. Estimates are that the conglomerates serve consumers 15 million times per day.

Taiwan’s largest food manufacturer and retailer began half a century ago as a flour factory. Last year, the conglomerate generated NT$440 billion in revenue, beating arch rival Meiji from Japan to become the largest food empire in Asia, and surpassing American cereal giant Kellogg to make it to rank 12 of the world’s largest food groups.

“This is owed to our emphasis on ‘stability’, which created the conditions that allowed us to be so fortunate,” notes Uni-President Chairman Alex Lo in describing the key to the company’s success.

Lo, who is the boss of around 100,000 employees on both sides of the Taiwan Strait, has been pushing ahead with the conglomerate’s internationalization. Lo, husband of Kao Shiu-ling, the only daughter of the late Uni-President founder Kao Ching-yuan, joined the company 35 years ago, starting out as a section chief in the overseas department. Seven years ago, Lo took over as chairman from his father-in-law.

Steady Management the Secret to the Group's Longevity

Lo, who usually keeps a low profile, personally answered questions from CommonWealth Magazine, mentioning “stability” or “steady management” twelve times in his written response.

Group Chairman Alex Lo (Photo by Ming-tang Huang)

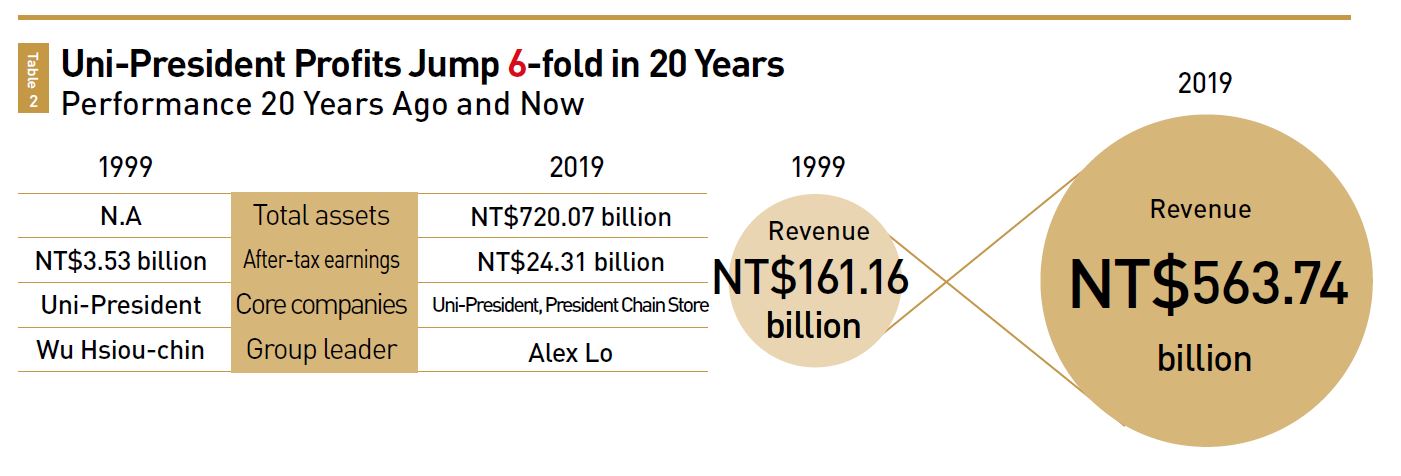

Thanks to scrupulously abiding by the principle of steady management, Uni-President’s market capitalization continued to grow, jumping 7.6-fold in 15 years and becoming the only food company to make it into CommonWealth Magazine’s Taiwan Top 50 Business Groups.

“To put it bluntly, Uni-President has not been beaten by global economic turmoils because it has a solid base,” says Lo. Uni-President has sufficient conditions to hold out while waiting for the situation to change to its advantage, banking on the resources that group founder Kao and countless loyal employees have accumulated over the past 50 years.

Diversification Across Entire Industry Chains

Many Uni-President Group companies are the largest in their industry. President Chain Store Corporation (PCSC) is Taiwan’s largest retail channel, TTET Union Corporation is the island’s biggest cooking oil refinery, Ton Yi Industrial Corporation, which specializes in beverage packaging materials, is Taiwan’s largest tinplate producer, and Scinopharm Taiwan Ltd. is the world’s largest supplier of active pharmaceutical ingredients for cancer treatments. Then there is Tait Marketing and Distribution Co. Ltd., which distributes products from foreign brands in Taiwan. The group covers a broad array of industries, including upstream, midstream and downstream products.

These are the fruits of the diversification strategy of founder Kao, efforts that have also played a crucial role in generating rapid growth and building momentum for internationalization.

In 1999, the Uni-President Group spanned 17 industries and owned or had equity interests in almost 400 subsidiaries. “We had so many subsidiaries then that we only knew we belonged to the same conglomerate after exchanging business cards,” recalls one retired former Uni-President executive.

Unwise Investments Turn Subsidiaries into Millstone

From the outside, Uni-President looked fabulous, but behind the Group’s impressive annual revenue of more than NT$160 billion lurked meager real profits of just NT$1 billion and a stock price below the NT$10 per-stock face value.

In 1982, Springfield Lai, then head of accounting firm PwC Taiwan, recommended that Kao streamline the portfolio by closing underperforming companies, but Kao, who put harmony above all, found it difficult to act on Lai’s advice.

Lo, however, subscribes to a different management philosophy. Having been dispatched to the U.S.-based cookie manufacturer President Baking Co. and having earned a master’s degree in business administration from the University of California, Los Angeles (UCLA), Lo espouses American management ideas.

For Lo, profits take priority. If targets are not met within a year, he immediately replaces those responsible, irrespective of personal feelings, because he wants Uni-President staff to feel the pressure.

When Lo took over as Uni-President general manager in 2007, he clearly knew that the company urgently needed to transform and move towards an international management style. But he opted to consolidate the Group’s main business first to bolster its strength.

Transition to the Second Generation, Streamlining for Higher Profits

If we call Kao’s leadership style management by addition, Lo stands for management by subtraction.

Lo carefully studied the financial status of the 400 companies in which the Group had invested and gradually divested equity interests in more than 100 companies outside the food and distribution sector such as Grand Commercial Bank and display maker TPO Displays.

He set the gross margin at an average of 30 percent, meaning that products falling below that mark were phased out. Since Lo took over, he has slashed the Group’s line-up from 6,400 products to less than a tenth of that. At the same time, the gross profit margin rose from 23.32 percent in 2000 to 34.37% last year.

Aiming to warn employees against developing bad products, he emulated the flavor graveyard of American ice cream brand Ben & Jerry’s by setting up a “brand graveyard” on the company website where unsuccessful products are relegated. Supervisors are required to regularly “send flowers” to the deceased items to mourn the premature death of these products.

Group founder Kao Ching-yuan (center) handed the position of president to Lin Chang-sheng (left). When Lin turned sixty, he handed the baton to Lin Lung-yi (right). (CommonWealth Magazine archive photo)

Group founder Kao Ching-yuan (center) handed the position of president to Lin Chang-sheng (left). When Lin turned sixty, he handed the baton to Lin Lung-yi (right). (CommonWealth Magazine archive photo)

Safety First to Guarantee Steady Management

As Taiwan’s largest food manufacturer and retailer, Uni-President cannot take any risks when it comes to safety. A minor mistake could bring down even the largest company.

“My greatest concerns are food safety, industrial safety and environmental safety. If we do a good job in these three areas, then Uni-President won’t run into excessive trouble,” Lo reminds his staff every day.

Lo also commands great trust among foreign investors. He travels to Hong Kong and Singapore every year to attend institutional investor conferences, and meets one-on-one with the managers of large investment funds. “In Taiwan, very few CEOs can do this, much less those from conventional industries,” notes the vice president of a foreign institutional investor.

Before Lo became vice president, foreign investors held a stake of less than 10 percent in Uni-President. Today, that figure stands over 50 percent, reflecting the Group’s continuous internationalization, which necessitates even steadier management and profits.

For a company from an island nation, internationalization and diversification are equally important.

Tackling China, Japan and South Korea as a Transnational Enterprise

Two years after Lo became vice president, Kao sent him to China as vice president of the Group’s China business to streamline operations there. In 2008, he launched the “Phoenix Plan” in China in a bid to make the languishing, loss-making instant noodle business rise from the ashes.

He observed that generating sales was easy in China’s huge market, but turning a profit was a completely different story. Why not then go for the high-end market instead? He gradually began to offer Uni-President’s Lao Tan (”Old Jar”) Pickled Cabbage and Beef Flavored Noodles, an instant cup noodle product originally sold only in Sichuan Province, in other parts of China. The product proved a nationwide success, with Uni-President instant noodles grabbing a record high market share of 16.8 percent in China, up from less than 10 percent.

Riding this wave of success, Uni-President launched more brands targeting high-end consumers in China. Consequently, the China business generated earnings worth 835 million RMB in 2015, doubling its profit.

After consolidating the China business, Lo felt it was time to zero in on Asian markets outside of China. He envisaged a “Great Asian distribution platform” spanning a wide area from Japan and South Korea in northeast Asia to southeastern Indonesia.

In a first step, Uni-President acquired South Korean food Woongjin Foods Co. Ltd. for NT$7 billion in late 2018, bidding out two rival bidders. This was no easy feat for the cost-conscious Group, given that it had little experience with international bidding and was beholden to a conservative business style.

Lo has successfully turned a home-grown, domestic-oriented business group into a multinational conglomerate that keeps growing by acquiring other food brands abroad.

One of the biggest concerns that Lo faces in his endeavor is finding suitable talent.

One Uni-President veteran reveals that Lo has been trying to poach international talent, but most of these candidates throw in the towel quickly because they find it difficult to adjust to the conservative Uni-President corporate culture.

“The question is how to give them a stage where they can hone their skills while allowing for failure. There must be more to it than people just obediently doing what they are told,” the company insider says.

The other challenge is presented by PCSC, the Group’s golden goose, which contributes almost half of its revenue.

For six years in a row, the convenience store operator is the only Taiwanese company to have made it into the Top 250 Global Powers of Retailing report by Deloitte Touche Tohmatsu Limited. But according to the 2020 report, PCSC’s composite compound annual growth rate for FY2013-2018 stood at 4.5 percent, lagging behind the 4.9 percent average for the global top ten.

Looking back at the eight years since Lo took the helm at Uni-President, profits reached a new high on the back of a shift in the management strategy to a single-minded focus on performance. But given that the Group is lagging behind in terms of digital and omni-channel transformation, doubts are emerging about whether it has sufficient innovative potential.

“From the top to the bottom, everyone is scared of making a mistake; they don’t dare to experiment,” says a former Uni-President executive in analyzing the underlying problem.

As for future development, Lo and his wife Kao Shiu-ling, who heads the Group’s five beauty and wellness businesses, are aware of the importance of branding. They have begun to shift the Group’s focus toward the lifestyle industry.

Lo’s rationale is that where there are people, there is lifestyle. Matching their needs and aspirations, people pursue different things in life, thus lifestyle diversity makes for an endless market.

Have you read?

♦ How Douglas Hsu Commands 10 Business Divisions and 200 Companies

♦ Taiwan Top 50 Business Groups: 20 Years Later, Who’s In and Who’s Out?

♦ Taiwan’s Top 50 Performers: IC Design Leads the Pack Thanks to China’s 5G Potential

Translated by Susanne Ganz

Edited by TC Lin

Uploaded by Judy Lu