A Decade of Low-key, Big Time Investment

Which Startups Do Hon Hai and MediaTek Ventures Favor?

Source:Chien-Tong Wang

How have the likes of “the world’s factory” i.e. Hon Hai Precision and major IC design house MediaTek, leveraged their corporate venture capital (CVC) teams to invest in their own futures? Can the deployment of their capital provide a glimpse into their strategic secrets?

Views

Which Startups Do Hon Hai and MediaTek Ventures Favor?

By Chiayi LinFrom CommonWealth Magazine (vol. 702 )

Hon Hai and MediaTek: One is a manufacturing plant for the entire world, and the other is the world’s integrated circuit (IC) design house. How do these two giants maintain their stature? One critical reason is external startup investment to help deploy the most forward-looking technology.

It could be said that corporate venture capital teams are like two advanced scouting squads dispatched by the two giants to probe the situation before the big troops move in.

CommonWealth combed through the two conglomerates’ financial reports, domestic and international media coverage, as well as global early-stage investment databases such as PitchBook, CrunchBase, and DealRoom. This data on startup investments by Hon Hai and MediaTek over the past near-decade helped paint a picture of their respective deployments.

Despite their reluctance to publicly discuss their venture capital deployments, both companies have been quite active in overseas corporate venture capital (CVC) efforts.

Low key at home, active abroad

Overseas startups account for over 80 percent of the Hon Hai Group’s investment mixture, the majority of which are in China. This includes numerous unicorns, such as DiDi, MoBike, Megvii, CloudMinds, Xiaopeng Motors (XMotors.ai), Contemporary Amperex Technology (CATL), and Suzhou Spitz Information Technology.

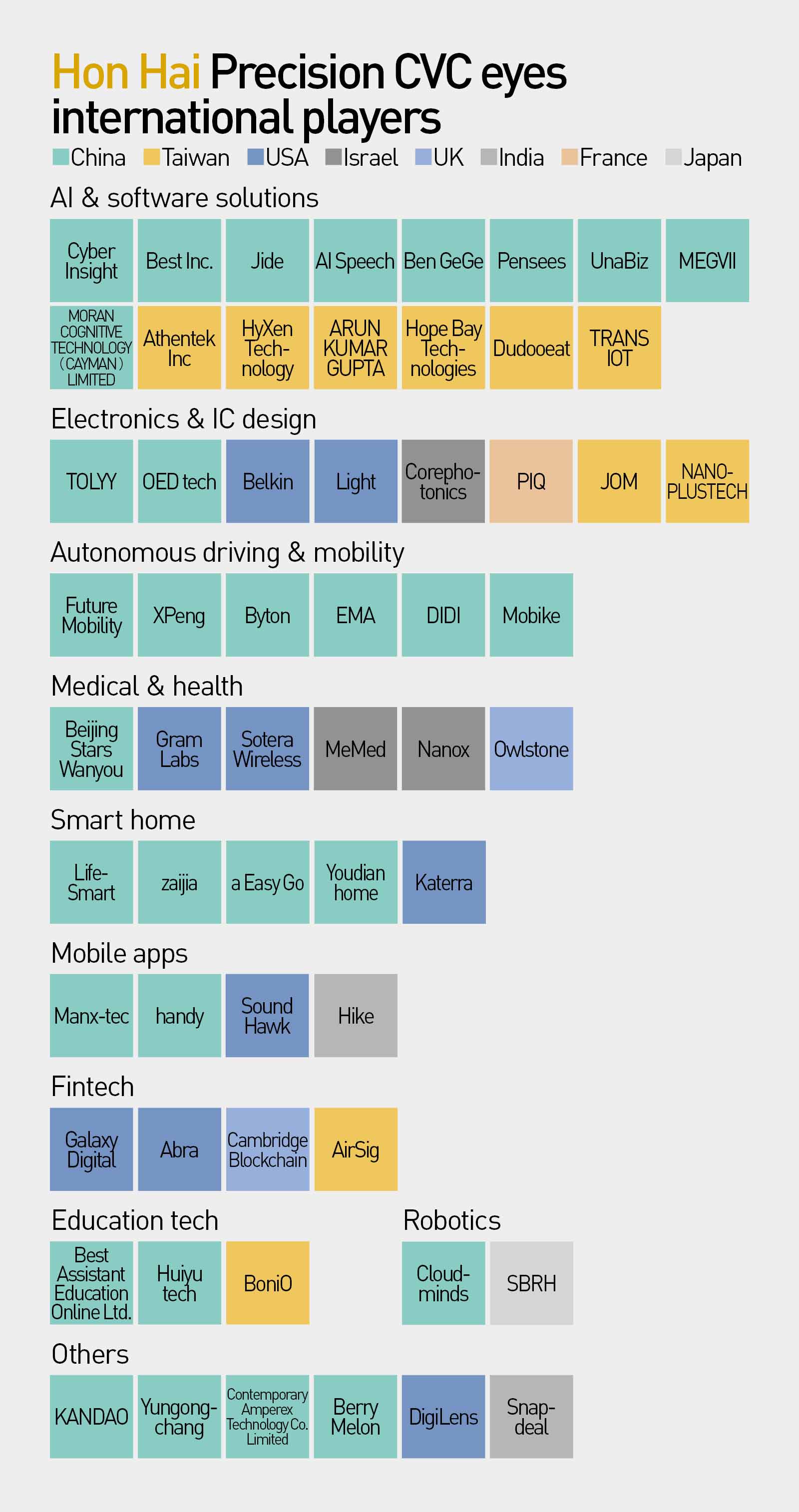

Leveraging its manufacturing interests around the globe, Hon Hai’s investments span numerous countries, including the United States, the United Kingdom, France, Japan, Israel, and India.

Industry insiders suggest that Hon Hai has invested very little in Taiwan primarily due to the company’s investment scope, as Taiwan has a limited number of investment properties. Additionally, Hon Hai seems more likely to directly establish startups in Taiwan, such as the Foxconn Health Technology Business Group.

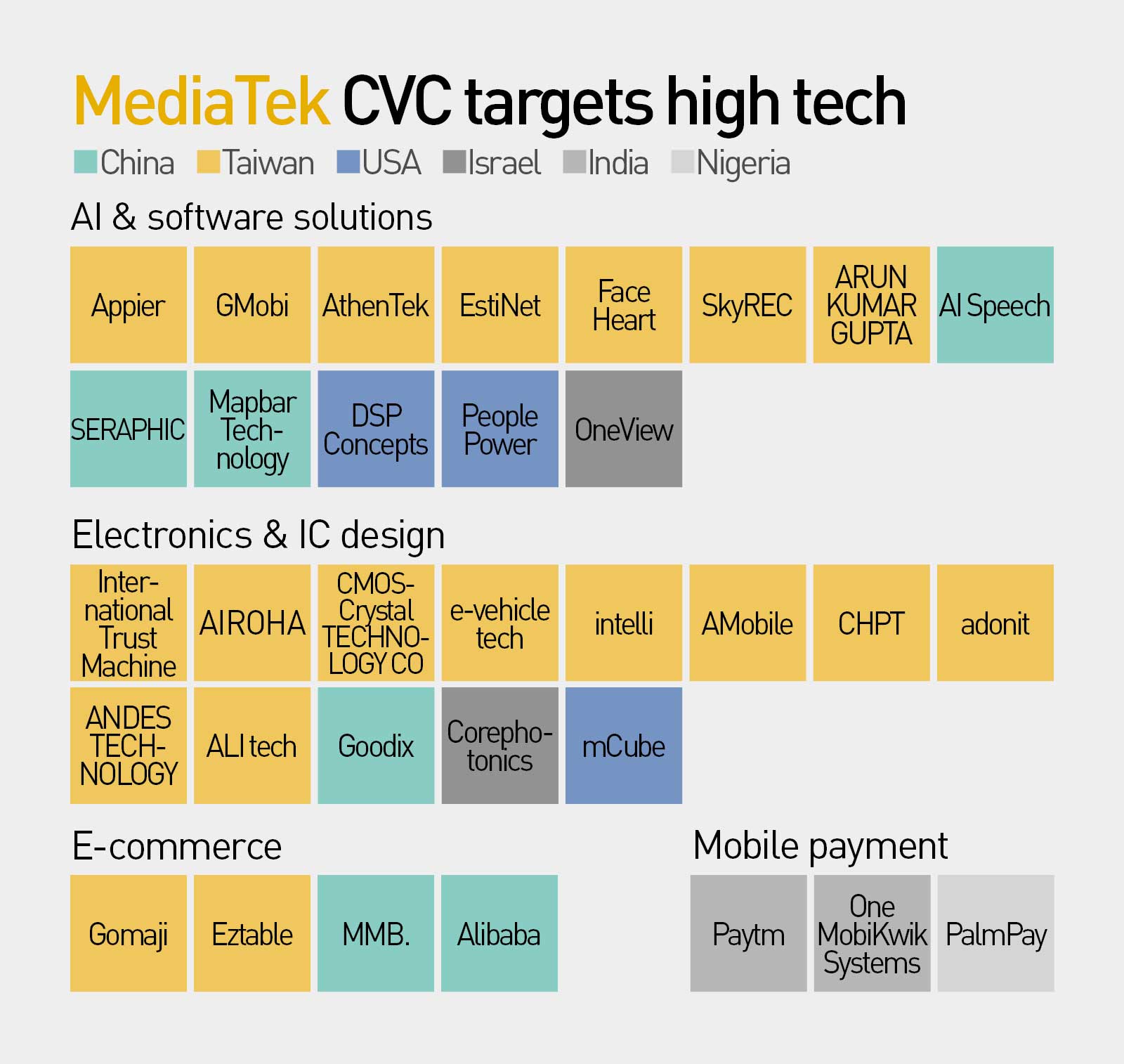

As for MediaTek, although overseas investments account for a smaller proportion than those of Hon Hai, they nevertheless approach 50%. From China to the U.S., Israel, India, and Nigeria, one can find records of MediaTek investment.

Industry insiders reveal that MediaTek poached quite a few members of its venture capital team from abroad. Possessing an international vision, from evaluation to due diligence, their approach is fairly American. And being willing to appraise at an international level value better equips them to take part in major venture capital projects abroad.

Hon Hai spends broadly, makes inroads far and wide

Concerning investment targets, with combined revenue exceeding NT$6 trillion, the Hon Hai Foxconn Group comprises 12 sub-groups from A to S, with at least several dozen strategic investment departments, subsidiaries, and single or externally jointly established venture capital investment funds under one umbrella. Together they make up a fairly complex system.

Different groups all engage in startup investment to aid the Hon Hai Group’s diversified transformation. From AI to autonomous vehicles, to educational technology, health and medicine, they have a hand in nearly every major technological trend.

Hon Hai has invested extensively in AI and software solutions startups on both sides of the strait, including continuous participation in B and C round funding for AI unicorn Megvii. In Taiwan, it has invested in Athentek, HyXen Technology, and MoMagic Data Intelligence.

Autonomous vehicles and electric vehicles are also priority targets for Hon Hai, whose related investments include Xiaopeng Motors and Future Mobility, as well as ride-hailing and bike-sharing companies like Didi and MoBike.

Hon Hai has also invested a considerable amount in blockchain technology, which was all the rage as recently as two years ago. These have come largely via subsidiary HCM Capital, which specializes in financial technology (fintech) investment, chiefly on properties in the U.S. and Europe, such as U.S.-based blockchain wallet startup Abra, and UK-based Cambridge Blockchain, a digital ID verification startup.

MediaTek zoned in on forward-looking technology

Compared to Hon Hai, MediaTek’s venture capital investment is relatively focused. The company’s investment properties over the years have largely been concentrated to penetrate the electronics and IC design, AI, and software sectors.

One Taiwanese senior VC industry insider says that MediaTek is already a world leader in IC design, with practically no counterparts ahead of it to take after. “It’s the kind of company that has to create its own market, so its sense of smell must be sharper than others,” he remarks.

Locking up startups with strategic value through early investment is the key to staying ahead. For instance, Andes Technology, a publicly listed IP core manufacturer, is Taiwan’s only company to successfully commercialize and possess the ability to penetrate the international market.

MediaTek was not only investing early in its development, but CEO Ming-kai Tsai has long concurrently been chairman of Andes Technology, a position he continues to hold to date. This is a rare case among MediaTek’s numerous reinvestment companies.

Thanks to its effort to explore forward-looking technology, MediaTek got in fairly early on the markets of many properties in its investment portfolio, even recruiting members of its entrepreneurial team out of college laboratories. For instance, National Chiao Tung University electrical engineering professor Bing-fei Wu’s FaceHeart Technology was only recently founded in 2018.

MediaTek leverages investment in startups to extend its feelers into other businesses. For example, both India and Africa are key markets for low- and mid-level smartphone chipsets. There would appear to be strategic significance behind MediaTek’s investments in both regions in mobile payment startups.

Many major Taiwanese electronics manufacturers that have had trouble transforming themselves have declined as a result. However, MediaTek has fallen behind and caught back up again in the IC design market several times, precisely because it is “constantly undergoing transformation” and constantly thinking about the state of the industry three, five, or even 10 years down the road. MediaTek not only uses its internal team to think about these issues, it also leverages startups around the world as its own R&D force.

Have you read?

♦ Drawing Strength from Misfortune

♦ Why Are Hong Kong Startups Setting Up Shop In Taiwan?

♦ Taiwan Top 50 Business Groups: 20 Years Later, Who’s In and Who’s Out?

Translated by David Thoman

Edited by TC Lin

Uploaded by Penny Chiang