Why does this Taiwan Hotel CEO Expand under COVID-19?

Source:Ming-Tang Huang

As the virus rages on, small- and medium-sized hotels are hoping to sell their businesses to survive. Wu Bing-ting, founder of the Chase Walker Hostel, Taiwan’s first “self-service hotel”, has gone on a buying spree looking for bargains. What makes him see this as the opportunity of the century?

Views

Why does this Taiwan Hotel CEO Expand under COVID-19?

By Yi-chih Wangweb only

In the over nine months since the novel coronavirus outbreak began, 16 hotels have suspended operations and 17 have shut down permanently in Taipei alone. Under this rash of sales, as others are leaving the industry, a new hotel brand is boldly stepping in to buy up properties.

The Dun-Qian Intelligent Hotel Management Company is one of those buyers. This past September, Dun-Qian founder and CEO Wu Bing-ting took over the operation of the Hotel MEZI near the Taipei 228 Peace Memorial Park, previously run by the Day Light Hotel Group.

During an interview with CommonWealth, the 38-year-old Wu, who got his start with investments and rental suites, would not disclose the purchase price. Five years ago, the Chase Walker Hostel, a Dun-Qian property, opened in Taichung’s Fengjia commercial zone with the novel appeal of being Taiwan’s first staffless hotel, in which guests do not encounter any staff from check in to check out.

Going forward, hotel properties acquired by the Dun-Qian group will carry the banner of the CHECK inn hotels founded by Bart Tund Day, the eldest son of Wowprime Corp. founder Steve Day.

In July, Wu invested in CHECK inn, a trendy hotel in the heart of Taipei, adding to his brand portfolio.

It might be hard to imagine, but Wu’s connection with CHECK inn grew out of imitation. Back when he was planning his staffless Chase Walker Hostel in Taichung, he sincerely appreciated CHECK inn’s American industrial style. In fact, he liked it so much that he engaged a designer to copy CHECK inn’s room appointments and decor.

Early this year, in the effort to reduce the cost of front desk staffing, Bart Tung Day adapted Dun-Qian’s automated check-in system. This ended up bringing the two together.

At a time when the CHECK inn was ravaged by the pandemic, with an occupancy rate down to just 10 percent, Wu Bing-ting and Bart Tung Day decided to move ahead with a strategic alliance, exchanging shares in each other’s operations. As a result, Dun-Qian now holds a 49-percent stake in CHECK inn.

Wu decided to seize the moment of massive hotel industry reshuffling to conduct rapid expansion. “This is the worst situation for the hotel industry, as well as a rare opportunity. Pandemics come and go, and heroes are forged out of trying times,” he observes, noting that he is currently in negotiations over three or four more properties.

Wu Bing-ting’s staffless hotels envisioned the future operational model for small- and medium-sized hotels.

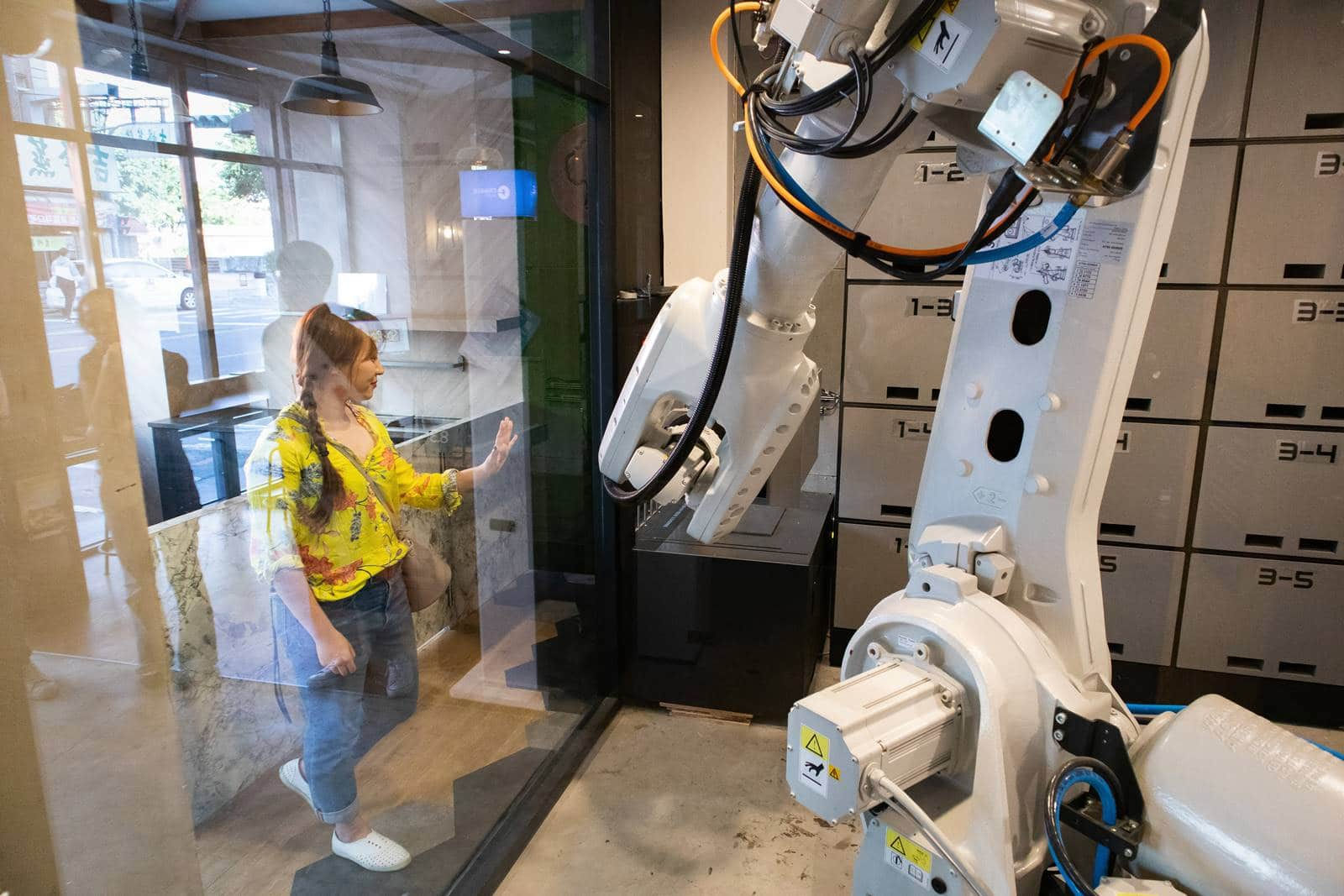

There is no front desk at the Chase Walker Hostel in the Fengjia commercial district. Instead, there is a panoramic surveillance camera overhead, along with two check-in panels, a room service robot, and a giant robotic arm inside a glass enclosure that delivers luggage to the guestrooms.

The Chase hotel retains only three service staff to cover all 63 guestrooms. Meal delivery is handled by robots, and in the event of issues with checking in or out, remote engineers are standing by to provide guidance. If that is still not enough, someone can appear in three to five minutes. The 70-percent savings on manpower help keep room prices as low as NT$800 per night. And while the rooms are small, they offer privacy unobtainable at a hostel at a comparable rate.

This was Wu’s strategy from the time that he got into the hotel business. He used technology to forge a disruptive cost structure and establish new ground rules.

Wu Bing-ting admits that early on it was difficult to find acceptance for staffless hotels, resulting in occupancy rates of just 20 to 30 percent and countless negative online reviews. However, the convenient location and low room rates drove occupancy rates, and Chase Walker broke even in its second year. Last year the average occupancy rate was 90 percent, even maintaining a rate of 60 percent during the pandemic.

Buying low to get in place

Wu is not the only upcoming Taiwanese hotel chain maverick picking up new properties on the cheap during the pandemic. Quite a few hotels that either halted or closed up business have quietly hung up new signs and reopened. For instance, the Capitol Hotel Nanjing Road branch became the Hej Taipei Arena Hotel, and the Green World Hotel Songjiang hung up the banner of the Hub Hotel.

The calculation that these upstart domestic hotel chain operators share in common includes low cost of entry, occupying a good location, and expanding market share.

Andy Huang, director and Head of Research and Consultancy at market research firm REpro Knight Frank, offers that previously it was difficult to find entire buildings in urban areas, and that old commercial offices, hotels, or free-standing homes with inexpensive rents have largely undergone tear-downs or renovations. Properties in the prime battleground for discount hotels - around Taipei Main Station, Ximending, and the Zhongshan District of Taipei - are as rare as hen’s teeth.

These days it is possible to take advantage of the slowing of the pandemic in Taiwan to expand operations to occupy popular locations with little effort, keeping the existing amenities and facilities without spending a lot of money on remodeling.

This year is not the first time there has been a wave of small- and medium-sized hotel sales. “It actually began three years ago,” relates David Tien, managing director of PwC Realty Taiwan.

When the flow of travelers from across the strait stopped three years ago, hotels in central Taiwan specializing in serving PRC customers were the first to offer their properties for sale at reduced prices. Last year another 50 or 60 three- and four-star hotels were sold, and only inexpensive backpacker hostels popular with Southeast Asian travelers maintained business at the same level.

Proprietors pivoting to containment hotels, ‘just breaking even’

Early this year as the pandemic struck and Taiwan shut its borders, business hotels and backpacker hostels alike dropped like flies. Meanwhile, by mid-year, low-cost hotels that were unable to find buyers transitioned to become pandemic containment hotels. “We haven’t lost money, but we also haven’t made money,” admits one low-cost hotel operator.

As for those operators not interested in pivoting to become containment hotels, with no signs of the revival of the travel industry in sight, they have little recourse but to try and sell off their businesses for cash. “Last year, hotel operators putting businesses on the market were looking to turn a profit, but this year they just want to get rid of stuff,” relates an agent specializing in buying and selling hotels, as hotel operators that are staying open at this time are losing more money than those that have temporarily halted operations.

However, unless their pockets are deep enough, hotel operators seeking expansion during the pandemic face the prospect of paying rent as soon as the deal goes through. Moreover, forecasts for a travel industry recovery keep getting pushed back, even as far as 2024.

The greatest challenge to those entering the market during times of crisis will be enduring by pivoting or sticking it out by expanding domestic operations. Those that make it through will ultimately have a chance to become the biggest winners.

Have you read?

♦ How Century-old Tatung Fell Apart

♦ Kytu Lin’s road to build Taiwan’s most popular social network

♦ TSMC Recovered Firefly Population in Plant Zone

Translated by David Thoman

Edited by TC Lin

Uploaded by Penny Chiang