The Rundown: Google opens new hardware R&D base in Banqiao

Source:Google

A bi-weekly snapshot of Taiwan business news stories brought to you by CommonWealth and AmCham Taiwan’s Business Topics.

Views

The Rundown: Google opens new hardware R&D base in Banqiao

By CommonWealth/AmCham Taiwan’s Taiwan Business TOPICSweb only

Google opens new hardware R&D base in Banqiao

Google Taiwan announced the opening on January 27 of its new office complex in the Taipei Far Eastern Telecom Park (Tpark) in New Taipei City’s Banqiao District. The new 16-floor facility is Google’s largest hardware research and development center outside the United States.

The office includes a designated product exhibit for visitors to experience Google’s advanced artificial intelligence and hardware technologies. It uses an open, welcoming design, and features amenities such as gyms, massage rooms, a game room, medical and healthcare services, restaurants, and coffee shops for employees.

Google Taiwan also plans to introduce internship opportunities in the areas of manufacturing engineering, Google Cloud engineering, and project management. These positions will be open to students from 50 colleges and universities around Taiwan by the end of 2021.

Established in 2006, Google Taiwan is celebrating its 15th anniversary this year. Over the past five years, the number of employees has grown tenfold, vastly increasing the company’s presence in Taiwan. In order to meet its growth needs and fulfill its commitment to diversity, Google Taiwan will expand employment and internship opportunities, as well as host career events, specifically for women and minorities.

Hotai completes acquisition of iRent

Hotai Motors, the Taiwan distributor for Toyota and Lexus automobiles, announced on January 28 its acquisition of a majority stake in electric-vehicle rental company iRent for NT$360 million. The addition of iRent will add Toyota’s Mobility-as-a-Service (MaaS) to Hotai’s portfolio. Together with its existing “yoxi” (Your Taxi) platform, the acquisition will make Hotai Motors one of the leading ride-sharing service providers in Taiwan.

Hotai began investing in iRent, Taiwan’s largest automated car rental service, in 2014. After the acquisition is complete, iRent will provide car-sharing rather than car-rental services.

There are over 1.1 million registered cars and 580,000 members under iRent.

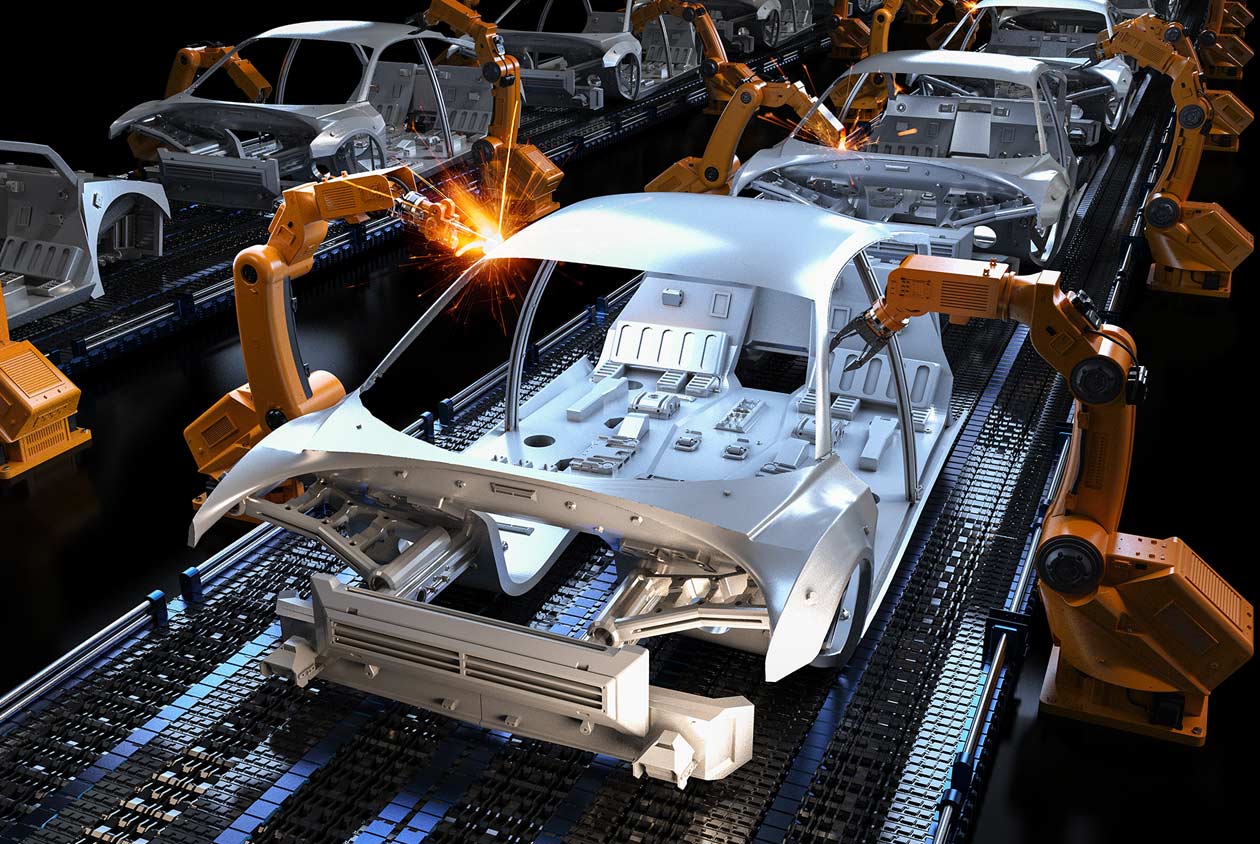

Semiconductor and automotive chips updates

The global supply shortage of automotive chips has forced German automakers Volkswagen and Audi to halt production, prompting the German Economics Minister to look to Taiwan for help. Taiwan’s Economics Minister Wang Mei-hua and leading chip manufacturers such as TSMC, UMC, and PSMC reached a consensus after a meeting to prioritize efforts addressing automotive chip shortages in hopes of minimizing the impact on the industry.

Wang explained that the current global shortage stemmed from last year’s drop in chip orders. At that time, Taiwanese chip manufacturers had cautioned their clients against cutting orders in view of the high demand for remote electronic devices spurred by the pandemic. The surging demand for electronic devices and 5G microchips is straining Taiwanese chip manufacturers’ assembly lines, leaving the automobile industry in crisis.

A report by TrendForce, a market intelligence provider, confirmed that the revitalized automobile market in 2021 is the cause of the current crisis. The report estimates that global car sales in 2021 will likely reach 84 million units, up from 77 million units in 2020. In addition, the growing trend of autonomous, smart, and electric cars will significantly boost demand for all kinds of semiconductor products.

In the past, the automotive semiconductor market relied mainly on integrated device manufacturers (IDM) and Fab-lite manufacturers such as NXP Semiconductors, Infineon Technologies, STMicro, Renesas, and Texas Instruments. Because automotive ICs require high-temperature and high-pressure operating environments as well as strict reliability and longevity requirements due to their long product lifecycles, their assembly lines are usually less flexible.

What comes next? Wang suggests that manufacturers first optimize their production capacity from 100% to 102% and 103% for automotive chip manufacturing. Secondly, due to the wafer shortage, supplies originally designated for other industries can be reallocated for automotive chip production. Finally, manufacturers should negotiate with their clients on adjusting delivery times for the automotive chips.

Have you read?

♦ Google Ups Investment in Taiwan, Highlights Risks

♦ Amidst Market Pessimism, Why Are Global Investors Bullish on TSMC?

♦ Taiwan’s Tesla Boom, and Looking for More

Translated by Jason Wu, AmCham Taiwan

Edited by Kwangyin Liu

Uploaded by Penny Chiang