Meet the 1000 ‘hidden champions’ behind Taiwan's car-making dream

Source:CommonWealth Magazine

From hardware providers to software companies, 1000 Taiwanese ‘hidden champions’ have rallied under the banner of electric vehicles. The majority of these companies are new to the automotive field. The way we travel is being revolutionized. What has placed Taiwan at the forefront of this bold new wave?

Views

Meet the 1000 ‘hidden champions’ behind Taiwan's car-making dream

By Kuo-chen Lu, Ching Fang WuFrom CommonWealth Magazine (vol. 718 )

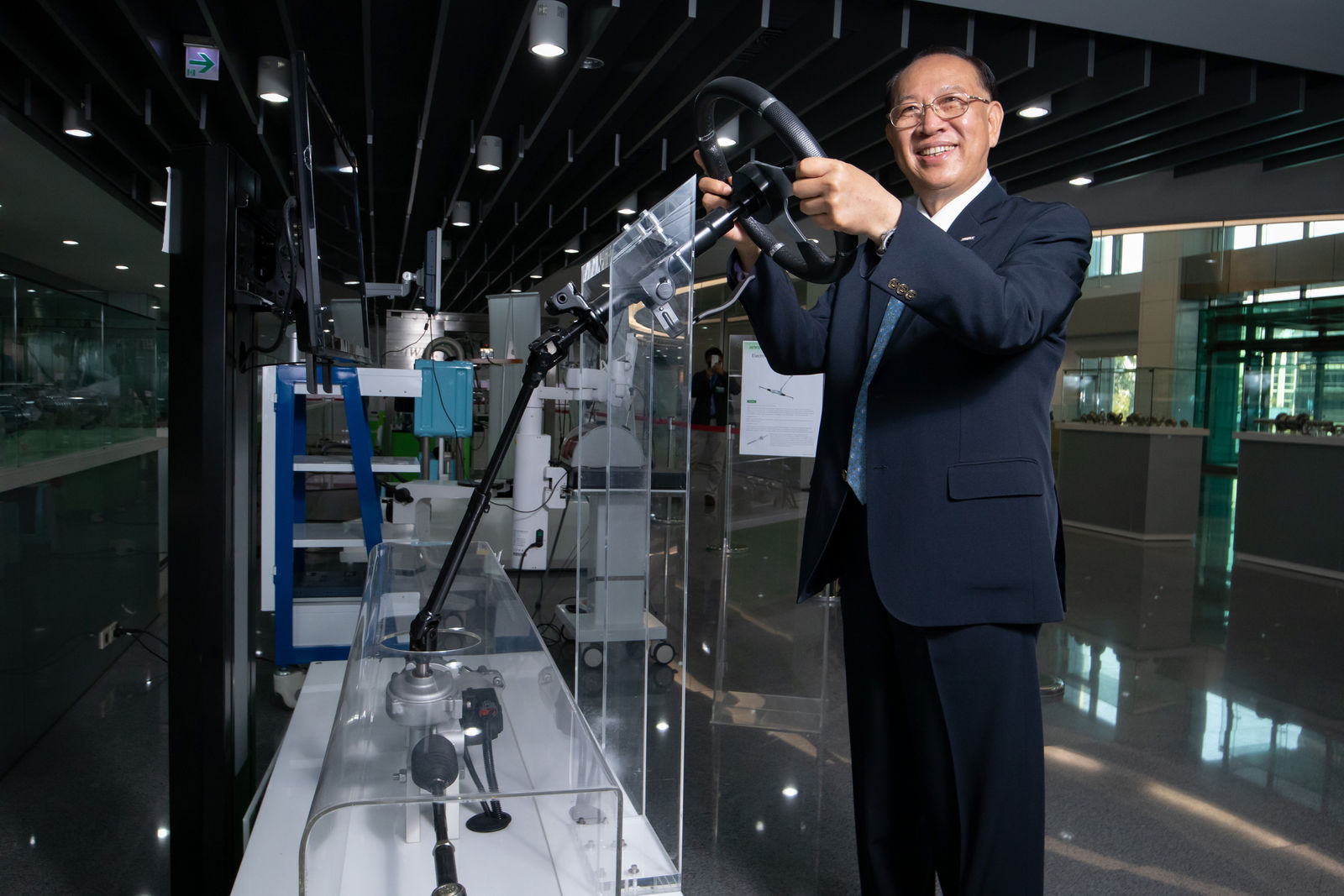

Taichung-based Hiwin Corporation has received an impressive order for 500,000 electric vehicles from a European automaker customer. Hiwin Founder Eric Chuo (卓永財) grasps a steering wheel connected to ball screws in his hands as he excitedly explains how the mechanism works.

The European automotive client has not only placed an order for 500,000 electric vehicles in one fell swoop, they also pledged to increase the order to two million by 2024.

A European auto brand can place an order five times the size of Taiwan’s entire auto sector. With the orders coming in hard and fast, Taiwanese suppliers need to scramble to ramp up production.

The nearly 1000 hidden champions in Taiwan have become the number one choice for global auto brands seeking to outsource their production. When one talks about electric vehicles and self-driving cars, who would have thought those technological marvels could be reliant upon Hiwin’s humble ball screws?

That is not to mention lidar technology, which is used in cruise missiles; high frequency, high resistance third-generation semiconductor materials, which are used in telecom satellites; and special petrochemical materials.

The unexpected rise of the electric vehicle market has rallied Taiwan’s hidden champions and spurred them to make new investments across the country.

Most of them are not conventional auto component providers, but they have quietly devoted years of research and development just so they could be ready for this day--the day when Taiwan’s dream of becoming the kingdom of carmakers can be realized. They may not have their own brands, but they can produce every part of the car, from top to bottom, from software to hardware.

Taiwan’s technological know-how is more than capable of holding its own against Germany and Japan. The development of electric vehicles not only displaces the internal combustion engine; the mechanical steering system also has to be digitized, and the new alternative must be precise and energy-efficient.

Hiwin Chairman Chuo said, “Once the automobile’s traditional internal combustion engine has been replaced by something that runs on electricity, the steering system must also be changed from a traditional hydraulic system to a digital control system; it’s the only way to be both precise and power-efficient. Because of this, ball screws are used to produce an ‘R-Type’ steering system.”

Ultra-precise steering system: Hiwin Corporation

The razor-thin 18-micrometer margin of error

The maximum margin of error allowed in a German steering system is within 23-micrometers. The Japanese system lags behind a bit and can only do 50 micrometers. Taiwan’s Hiwin has surpassed them both and narrowed it down to 18 micrometers, which is thinner than a strand of hair. Hiwin developed this technology in a lab in Stuttgart, Germany, and they’ve been refining their technique for over 20 years.

(Source: CommonWealth Magazine)

Hiwin made it a point to enter the market from the top of the pyramid. Chuo explains: If you want to enter the semiconductor foundry supply chain, you must first make it big in Silicon Valley, because that is the shortest way to approach TSMC. In the same vein, Hiwin has been able to secure deals in Europe precisely because it invested in the German market over a long period of time.

To fulfill Taiwan’s dream as the kingmaker of outsourced automobile brands, Taiwanese companies also need to satisfy the consumer’s need for a car that goes farther and faster. The secret is in the special petrochemical materials used in lithium batteries. With an annual revenue of NT$40 billion, Eternal Materials Co. is the world’s largest producer of dry film solder mask, a type of printed circuit board material. Out of its workforce of 4,000 employees worldwide, 2,000 are in Taiwan, and 600 are in research and development.

Extending battery life: Eternal Materials

Achieving twice the range without a hiccup

In 2017, Eternal Materials established an energy storage materials project team. They devoted themselves to the study of lithium batteries and other energy storage materials. However, Eternal knew better than to try and upset the established lithium battery market. Instead, it concentrated on next-generation technologies.

(Source: CommonWealth Magazine)

Mao Hui-kuan, CEO of Eternal Materials, says the lithium battery additives developed by his company can extend the range of electric vehicles from 300 to 500 or even 600 kilometers without a problem.

Says Tai Ming-te, director of Eternal’s R&D department, “Eternal has developed electrolyte additives for lithium batteries that can remove moisture and prevent the battery from bloating; in effect, it extends the battery’s lifespan.”

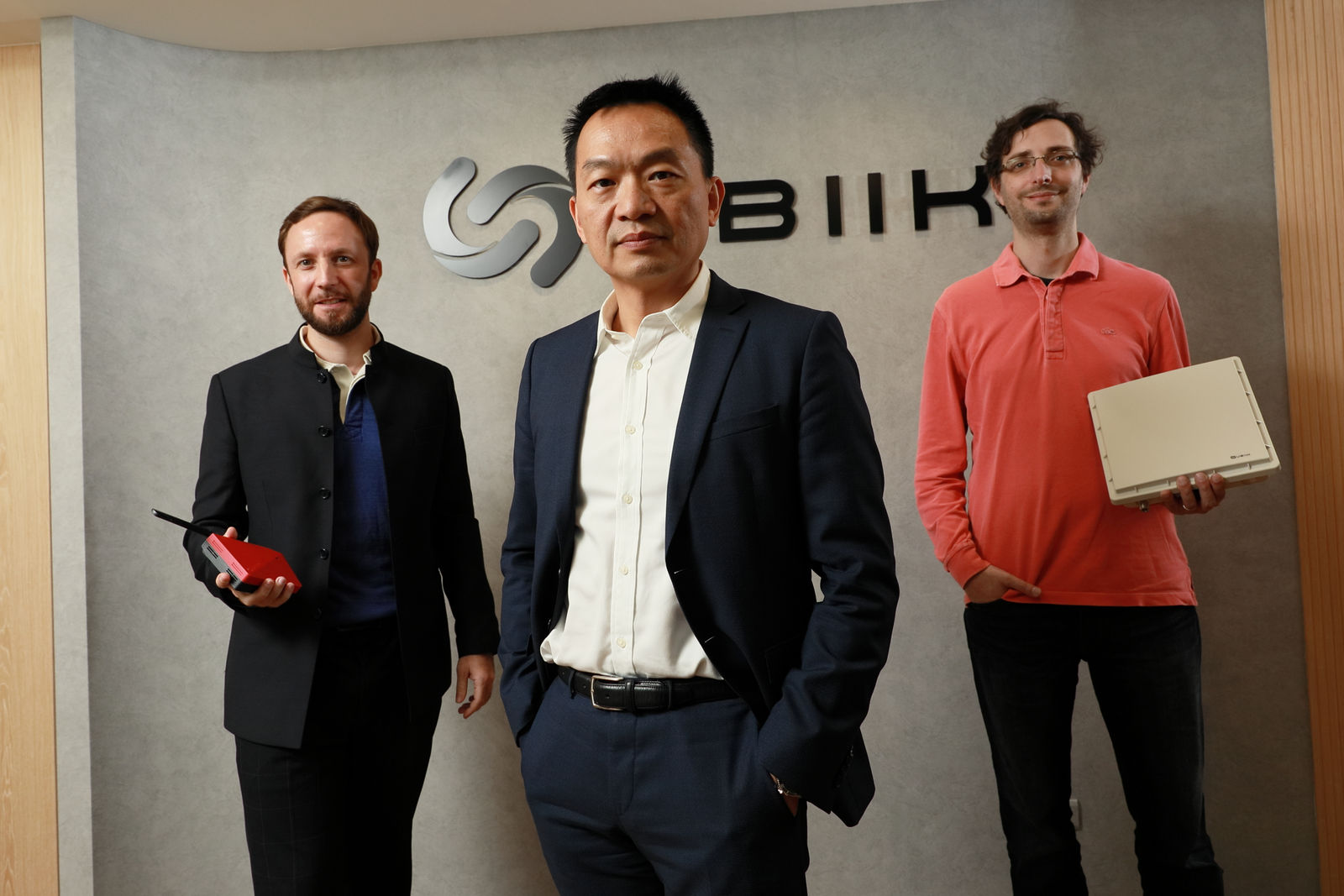

Besides German car manufacturers, selling to Japan also proves that Taiwan has what it takes to become the kingdom of OEM and ODM carmakers. As the demand for recharging grows, Ubiik, Taiwan’s largest provider of smart electric meters, sees an increasing opportunity for maintaining the balance of the electric grid.

Smart meters: Ubiik

Two-way transmissions from underground basements to the cloud

Ubiik has been around for less than five years, but it possesses proprietary telecommunications technology developed in conjunction with British Internet-of-Things standards organization Weightless. For three consecutive years, it has been awarded contracts for smart meters from Taipower. The sum of the bids is over NT$1.2 billion.

Winning the contracts from Taipower was an important milestone. Last year, Ubiik delivered 20 electric meters to California to test the monitoring system for charging stations. A supplementary system that ensures smart power usage is something electric cars can’t do without.

Tien-haw Peng, CEO and founder of Ubiik, says: “The electricity generated by offshore wind turbines in the Taiwan Strait during the night will be wasted if it’s not used. Fortunately, the power can be stored in electric vehicles.”

How to find the best time to recharge? To use the test in California as an example, the area they experimented in was as big as six basketball courts. Wi-Fi no longer sufficed in such conditions, and 5G communications would have taken too much power.

(Source: CommonWealth Magazine)

Ubiik’s technology allows signals to be transmitted smoothly in both directions, from the flat ground or from inside an underground basement to the cloud, and vice versa. In this way, charging stations will be able to connect to each other and get a clearer picture of the situation. Two years ago, one of Japan’s top three telecom companies came to discuss working with Ubiik. This proves the importance of this hidden champion.

There is another software company on our list that used to work with the Taiwanese luxury car brand Luxgen back in the day. It learned from the experience, and now it has forged its own path towards success.

AI-empowered auto parking: oToBrite

Let the car be its own valet

Two years ago, China’s XPeng Motors launched its first car, the G3. The secretive “black box” technology that allowed the car to park itself took the Chinese market by storm. The key technology behind this automated valet parking system was invented by the Taiwanese company oToBrite.

(Source: CommonWealth Magazine)

oToBrite came from the Taiwanese automaker, Yulon Group. In 2009, Yulon’s Luxgen was the first car in the world to offer an onboard system with a 360-degree view of its surroundings, thanks to seven separate cameras on the vehicle.

“At the time, most cars did not have even one camera,” says Roy Wu, CEO of oToBrite. Even the models launched by Japanese automaker Nissan a year earlier featured only four cameras.

oToBrite continued to keep a low profile as it forged ahead for a decade. They combined cameras with AI to create a visual recognition system. Even without the guidance of human eyes, the cars could understand their surroundings and park themselves. XPeng came knocking to learn about this amazing technology. They combined their own proprietary ultrasonic tech with oToBrite’s visual recognition AI system in order to develop even more precise auto-parking technology.

Wu put it this way: A small and crowded country with few parking spaces would naturally have to develop an auto valet system empowered by visual recognition technology. With the rise of Tesla, smartphone software has paved the way for models with high added value; this trend can be expected to be replicated for all electric vehicles. He goes a step further with his example: Tesla’s “full self-driving” system has continued to advance, and its price has continued to go up. In two years, the price of their system has gone from US$5,000 to US$10,000.

This means smart car systems will have more and more applications loaded into them. XPeng makes up over half of oToBrite’s revenue; it sold over 27,000 cars last year.

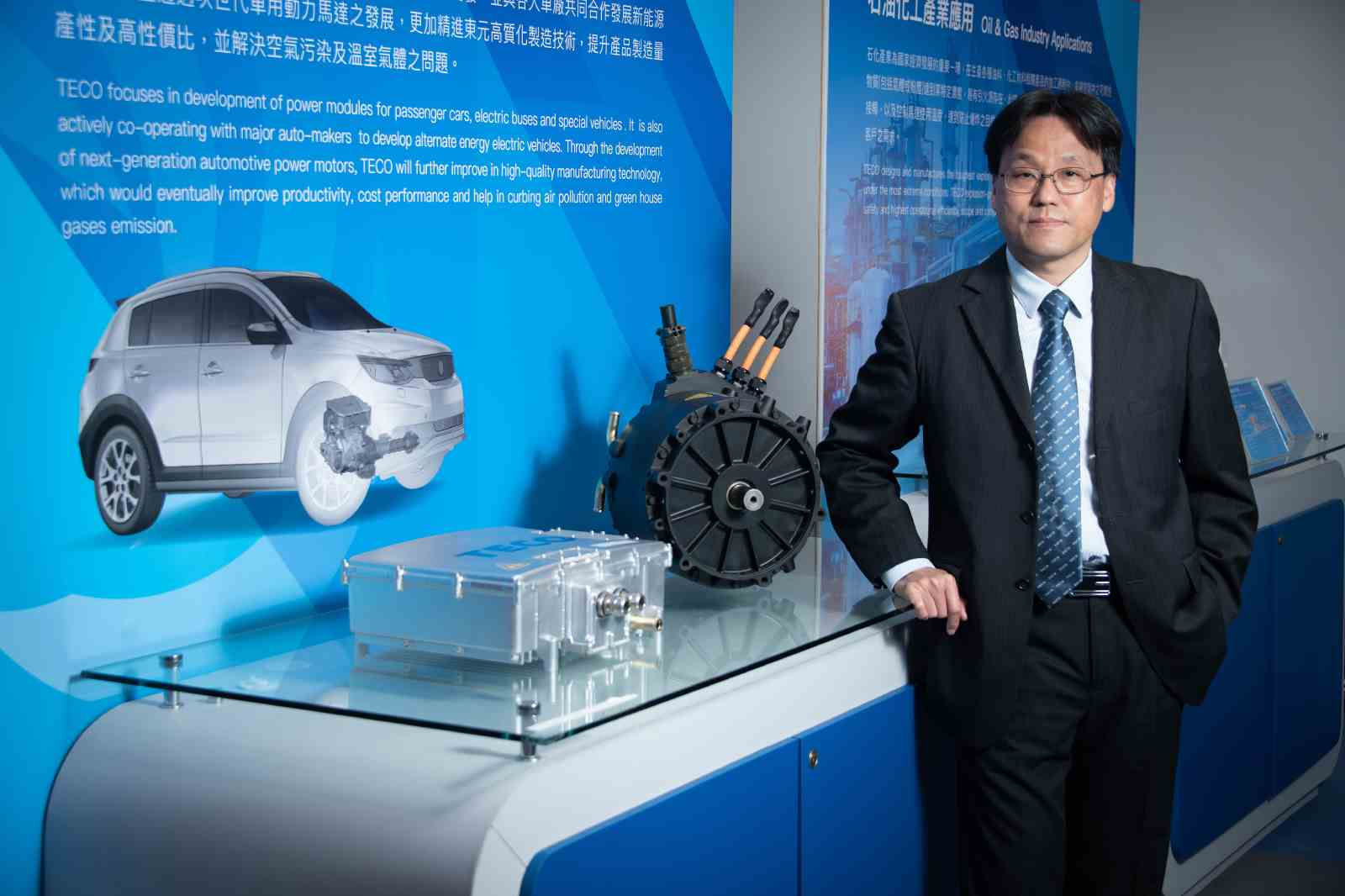

Electric Motors: TECO

Electric bus technology designed and built in Taiwan

It is not only American and European auto brands who have come to Taiwan in search of suppliers. Customers from India and Turkey have also found their way to the doorsteps of TECO, a company that produces motors for electric buses.

Just with their motors alone, TECO rakes in a revenue of over NT$20 billion a year. From power generators to nuclear power plants to elevators in the Burj Khalifa, TECO motors are everywhere. It is the fifth-largest producer of industrial motors in the world.

Because it has made motors for six decades, TECO got into the electric car motor business fairly early. At the time, Tesla still had a manufacturing base in Taiwan. Tesla’s motor engineer used to work in the motor branch of the U.S. manufacturing company, Westinghouse Electric Corporation. Since the department was later acquired by TECO, the engineer knew all about TECO’s technology, and was glad to make introductions. Tesla thought very highly of TECO. Unfortunately, the Obama administration wanted Tesla to return to the United States, so the deal was called off.

(Source: CommonWealth Magazine)

But TECO did not give up so easily. According to Kao Fei-yuan, the assistant vice president in charge of the green-energy electric machinery production and research division, in addition to the heavy electric equipment division at TECO, they began working on electric mail trucks with Taiwan’s Industrial Technology Research Institute in 2010.

In 2017, TECO also began working with the Finnish start-up Visedo. Visedo had the design capabilities, but lacked the means to manufacture. They did not trust Chinese vendors, who were notorious for stealing intellectual property, so they came to TECO.

From electric buses in Europe to freight haulers in Singaporean harbors to electric ferries in Thailand--all in all, TECO has built over 300 electric motors for Visedo.

Luxgen’s electric SUV for the Chinese market also ran on electric motors made by TECO. In 2018, Taipei City also approached TECO with their electric buses. Their purchase of TECO’s electric motors paved the way for Indian and Turkish companies, who also wanted TECO to provide for their projects.

Hidden champions are around every corner. Even beach buggy and motorcycle producers can grab a share of the emerging market. Aeon Motor started off making plastic shells for motorcycles before manufacturing their own bikes; they’ve been in the business for over 20 years. Now, as the market shifts towards electric vehicles, they are eager to embrace the trend.

Special customized vehicles: Aeon Motor

Electric trikes for commuters and couriers

Aeon Chairman Chung Chieh-lin admits it was quite the dilemma for him five years ago. “It meant more than a decade of effort spent on petroleum engines was likely going to waste. But government policies around the world showed us the future was in electric vehicles, so we followed suit.” Aeon shifted gears and joined Gogoro’s PBGN (Powered by Gogoro Network) alliance.

(Source: CommonWealth Magazine)

Aeon CEO Tony Lin explains that, in the upcoming era of autonomous vehicles, self-driving cars must find a way to talk with motorcycles. Since Taiwan has more than 10 million motorcycles and scooters on the road, failure to communicate between cars and motorcycles will become a problem for truly driverless cars.

A new generation of electric vehicles may spell trouble for traditional auto component makers. Chen Chin-chao, President of TYC Brother Industrial Co., imagines the worst-case scenario: “If cars can find and navigate traffic with lidar technology, will anyone still need headlights on their cars?”

Smart Headlights: TYC

Smart lights turn a car into a mobile theater

TYC has initiated its medium- to long-term strategy. But in the short term, it is making smart headlights.

In the past, headlights were required by law to be properly illuminating. In the future, they may be allowed to automatically adjust to fit the environment. For example, when the driver makes a turn, the headlights can swerve to light the way and ensure safety. Or, if the car detects an animal along the road, the lights may avoid pointing directly at the animal, since that may cause the animal to panic and create a dangerous situation.

(Source: CommonWealth Magazine)

What’s more, it must be considered that as autonomous vehicles and smart tech become more complicated, automakers will possess more irreplaceable know-how, which will give them more leverage over their vendors.

Because of this, suppliers must maintain a close relationship with the automakers, and they must acquire more patented technology. Chen notes that TYC holds 238 patents in Taiwan, the US, the European Union, and Japan.

Even more importantly, the suppliers must dare to dream. Traditional auto brands are all about standards and verifications. But nowadays, the first thing an electric car start-up asks a supplier is:

What do you imagine the future will look like? What role do you see a car’s headlights playing in the future?

TYC has invested in new electromagnetic labs, and optical labs that can simulate situations on the road. Future cars will come loaded with electronics, so it’s important to prevent electromagnetic waves from interfering with each other.

Taiwan must dare to dream. If Taiwan becomes a kingdom of carmakers, it will mean the world will need Taiwan more.

This year, due to the trade war between China and the U.S., the supply chain has become more complete than ever before. The 1000 hidden champions in Taiwan have gathered for the big race, waiting for the chance to put the pedal to the metal.

Have you read?

♦ Taiwan’s Tesla Boom, and Looking for More

♦ How a Stapler Manufacturer Ended Up Creating Recharging Solutions for Tesla

Translated by Jack Chou

Edited by TC Lin

Uploaded by Penny Chiang