Taiwanese meditech company behind half of all cataract surgeries worldwide

Source:Chien-Tong Wang

Every second cataract surgery around the world uses a delivery system for artificial lens injectors with a coating from Taiwanese medical device manufacturer ICARES Medicus Inc. How can an invisible coating be so crucial for large medical device makers?

Views

Taiwanese meditech company behind half of all cataract surgeries worldwide

By Ching Fang Wuweb only

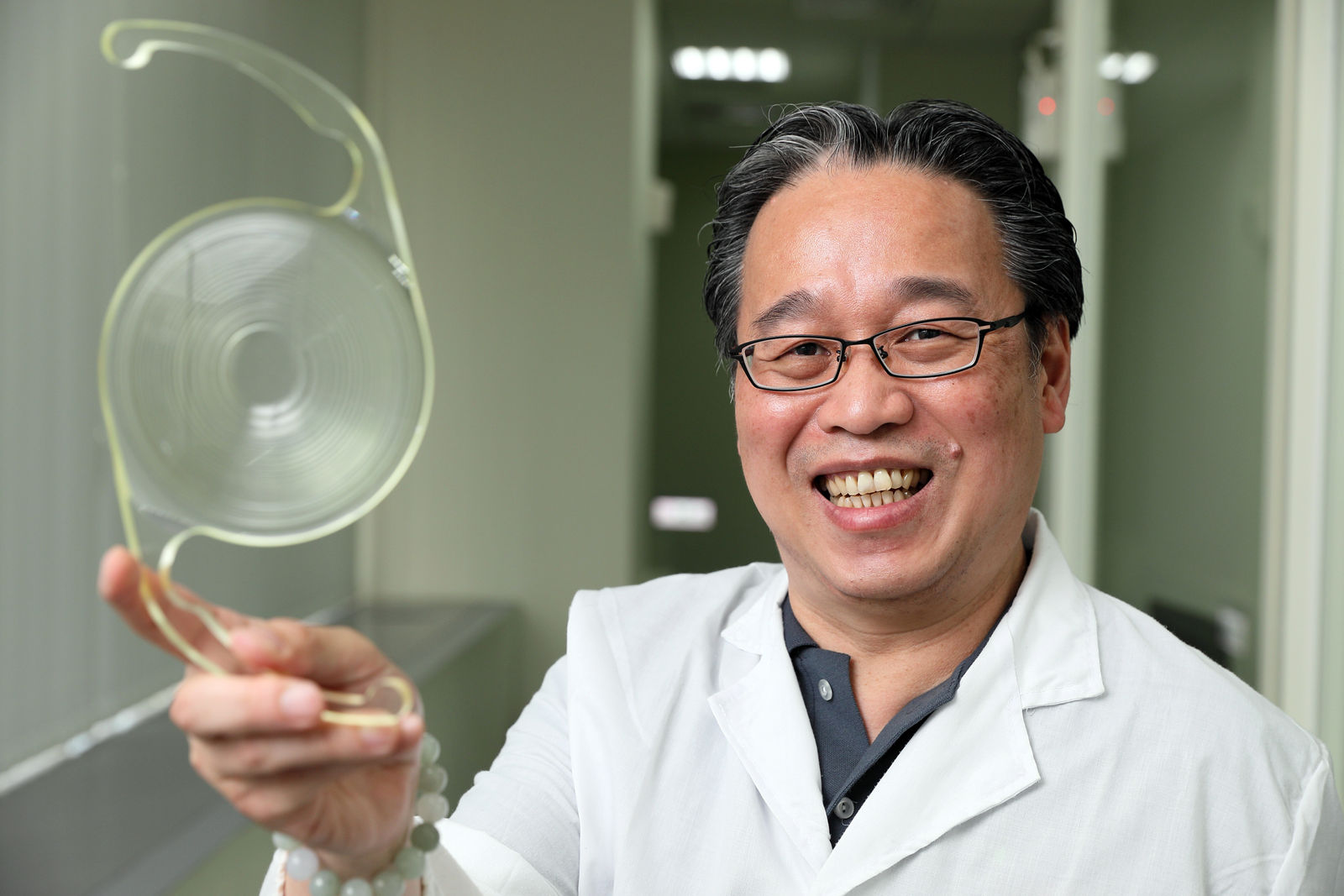

“The intraocular lens (IOL) is placed in this delivery cartridge,” explains ICARES President William Lee as he gestures holding a syringe-like device in his hand.

The surface of the plastic piece at the tip end of this medical device, which is smaller than a section of your little finger, has been treated with a coating that is invisible to the naked eye.

This surface treatment technology is the secret behind the success of this Taiwanese medical device manufacturer, whose annual revenue stands at less than NT$400 million. Half of all IOL injectors and cartridges used in cataract surgeries around the globe have been coated using ICARES technology.

Medical coatings are used for surfaces that come into direct contact with tissue during a surgical procedure on a patient. Such surface treatments serve to reduce friction, which helps lower the risk of discomfort, injury and infection.

Thanks to this coating technology, ICARES has established a dominant market position, which last year catapulted it into the CommonWealth Magazine list of the Top 100 fastest growing enterprises in Taiwan. Medical device companies hardly ever make it into that league. The company’s compound growth rate for the 2017-2019 period stood at 25.51 percent.

ICARES Medicus Inc. (ICARES)

- Founded: 2011

- Chairman: Loh Yi-houng

- President: William Lee

- Main fields of business: Surface treatment technologies for high-end medical devices, development and manufacturing of intraocular lens (IOL) delivery systems

- Revenue: NT$363 million in 2020

However, revenue took a hit in 2020 due to the pandemic-related lockdowns in Europe and the United States, the company’s major markets, which led to the postponement of non-essential surgeries, including cataract removals. As a result, revenue declined by 10 percent year-on-year in 2020. The situation is expected to improve as soon as the coronavirus pandemic is brought under control and hospital and clinic operations return to normal.

The ICARES founder team originally established AST Products Inc. in the U.S. city of Boston. It originally specialized in macromolecular coating technologies for plastic catheters. But in 1995, Alcon, the world’s largest ophthalmic company, came knocking, sparking AST to reorient its product portfolio.

Toward the industry’s gold standard

When an IOL is implanted in the eye, it is important to prevent the delivery cartridge from pulling or dragging eye tissue. Most medical device manufacturers therefore use an oily additive as a lubricant.

While this reduces friction, the oils still remain in the eye after surgery, causing inflammation, which has been a big headache for eye surgeons. Alcon therefore suggested that the AST technology could be used to treat the surface of IOL injectors as an alternative to the problematic oily additives.

“Coating is better than painting; it has different functions,” explains Lee. Coatings for ophthalmic devices must not only be very thin and biocompatible but also need to survive a five-year storage period without degrading or peeling. AST spent three arduous years perfecting its macromolecular formulation before Alcon gave its approval.

However, since the review procedure for medical devices is very strict, the bar remains high for competitors once a company has secured its position in the supply chain.

Alcon sells eight million IOL injectors worldwide per year. As a result, AST generated substantial revenue from license fees for its proprietary surface treatment technology and sales of macromolecular coating materials to Alcon for the past 23 years. “From then on, we were the gold standard in the industry,” says Lee.

Yet the AST team did not rest on their laurels after achieving gold standard status. Building on the cooperation with Alcon, the company ventured further into the ophthalmic materials industry, eyeing the business opportunities from the 26 million cataract procedures that are conducted around the globe each year.

Aiming to minimize cataract surgery complications from the handling of the cornea and side effects such as clouded vision, floaters and flashes of light with a suture-less procedure, AST set out to minimize the incision size needed to accommodate its IOL injectors.

In the beginning, they reduced the incision in the surface of the eye from 3.6mm to 2.2mm, and eventually to just 1.8mm. Some ophthalmic device manufacturers make preloaded delivery systems where the artificial lens is stored in a watery solution and hermetically sealed.

The smaller an incision is, the thinner the required coating. On top of that, the coating must be able to withstand five years of immersion in a watery solution without flaking or peeling. Such requirements put the technical development capabilities of medical coating manufacturers to the test.

Noticing that large multinational IOL manufacturers were changing their injector designs, AST developed a nano coating technology that not only delivers thin and permeable optical coatings but also remains stable in water without degrading.

Thanks to this novel technology, AST secured a market share of five million IOL injectors. Half of the injectors used worldwide per year are coated using AST’s surface treatment technology.

While medical coatings are an annually growing niche market, their growth potential is limited. Lee and AST founder Loh therefore early on brainstormed strategies to expand the company’s business beyond its core activities of coating material manufacturing and technology licensing.

In 2011, things fell into place when they got news in Boston that the Hsinchu Biomedical Science Park in Zhubei in northern Taiwan was soliciting investors.

AST squeezes out conventional competitors with advanced nano-coating

Reminding themselves that “Taiwan has plenty of optics talent and well-trained engineers,” Lee and Loh reckoned that, having been in the game for so many years, they needed to move on from being the supporting cast to playing a lead role. Given that they had gathered ample experience providing coatings to large transnationals for many years, why not manufacture entire sets of artificial lenses and injectors themselves?

So the AST team established ICARES in the Hsinchu Biomedical Science Park to focus on the development of new products.

Such a transformation from B2B technical licensing to marketing own-brand medical devices B2C is easier said than done. On the one hand, it means directly confronting the market, while on the other hand it amounts to challenging former customers as a supplier-turned-competitor.

At first glance, manufacturing coatings and producing IOLs appear to require two entirely different business strategies. But the ICARES management had a good reason to be confident that they had a chance to make it work.

Thanks to the licensing of its coating technologies, AST had gained ample expertise with artificial lenses over the years. “We must test whether the IOLs of different makers can be ejected [from the delivery cartridge or injector],” explains Lee. And on the sales and distribution side, they could build on their longtime cooperation with large players, which allowed them to gain access to optical device distribution channels quite smoothly. “Not doing it means giving up on yourself,” says Lee.

ICARES spent almost five years on development before the first own-brand IOL injectors hit the market. In 2019, they successfully entered the European and Taiwanese markets. Europe and Taiwan currently account for 15 percent of revenue, a share the company hopes to increase to 50 percent by 2025.

“In that sector, you wouldn’t find Taiwanese products in the past,” acknowledges ophthalmologist Hwang Yih-shiou. Hwang, chief of retina section at the Department of Ophthalmology at the Linkou and Taipei Branches of Chang Gung Memorial Hospital, is one of the eye doctors who were the first to use the nano-medical products. “The experience of some patients was not bad; the products don’t pale against foreign ones or are even better,” he asserts.

Hwang points out that although IOL injection is an old technique, the field presents many new opportunities.

The greatest business potential lies in the many different artificial lens designs that have been developed in recent years to meet different patient needs. “Meanwhile, it has even become possible to customize intraocular lenses to individual needs,” says Hwang. IOLs can not only be used to treat cataracts but also to correct extreme shortsightedness (myopia). And even the vision of patients who do not suffer from cataracts can be improved with the help of artificial lenses.

Taiwan’s medical device industry could draw a lesson from ICARES’ successful strategy – exploring new business opportunities while standing on the shoulders of a giant, and gradually evolving from an obscure sidekick to being the expert lead in the spotlight.

Have you read?

♦ Taiwan’s Health Tech success lies in Global South Collaboration

Translated by Susanne Ganz

Edited by TC Lin

Uploaded by Penny Chiang