Leading the race, Delta builds the heart of electric cars

Source:CommonWealth Magazine

Europe’s top EV companies all buy from Taiwan’s Delta, because it was the first to develop the “four-in-one” heart of the electric car. Delta’s next step will be hardware and software integration, which will prove once and for all that this is more than your run-of-the-mill electronics company.

Views

Leading the race, Delta builds the heart of electric cars

By Kwangyin LiuFrom CommonWealth Magazine (vol. 733 )

The year is 2005. The first second-generation Prius, which is Toyota’s hybrid electric car to come to Taiwan, is imported all the way from the United States by Delta Electronics founder Bruce C.H. Cheng.

Back in the eighties, Cheng visited automobile factories in the U.S. to observe the development of electric vehicles. He was looking for an opportunity for Delta. Cheng, who approaches carbon reduction with an almost religious fervor, was convinced that Delta would have a role to play in the world of alternative fuel vehicles.

Much has changed in forty years. “We jokingly call this place the ‘Pingzhen Night Market’,” says Liu Cheng-wen, Director of the Traction Inverter Business Unit at Delta, with a smile. “We keep working even after our neighbors in the industrial zone close shop for the night.”

Delta’s research and development center in Pingzhen is like the proverbial empire on which the sun never sets. There are meetings with the plant in Thailand in the morning; discussions with Italian customers and the German team in the afternoon; a marathon of calls with American clients late into the night.

(Source: Ming-Tang Huang)

(Source: Ming-Tang Huang)

The work must go on, because Delta’s clients encompass the world’s top ten auto brands, whether they make EVs or conventional cars: Tesla, Mercedes-Benz, Volkswagen, BMW, and General Motors, to name just a few.

Top-tier American and European automakers all buy from Delta

Investor representatives estimate that automobile products will make up nearly 9% of Delta’s annual revenue this year—close to NT$30 billion. Delta is peerless in the market, and in a couple of years, that number is expected to double.

Just recently, Delta CEO Ping Cheng estimated that the EV drivetrain market could approach US$33 billion within a decade. Delta aims to control at least a tenth of the market—nearly NT$100 billion.

It will be a long journey, and although Delta took the first step before anyone else, the way will not be easy. “Back in the day, when we first began visiting foreign customers, they thought we represented the American airline,” recalls James Tang, VP and General Manager of the Electric Vehicle Solutions Business Group (EVSBG) at Delta.

(Source:

Ming-Tang Huang)

(Source:

Ming-Tang Huang)

In time, Delta’s efforts affected even U.S. President Joe Biden.

This August, Biden signed an executive order setting a new target to make half of all new vehicles sold in 2030 electric. However, when the team at Delta watched the press conference, their eyes were not on the President. They looked at those standing behind Biden: representatives from EV brands such as Ford, GM, and Stellantis—all Delta’s customers.

The funny thing is, Delta’s EV journey began with the cigarette lighter receptacles installed inside older automobiles.

Liu Cheng-wen has been with Delta for 17 years. He got his start in consumer electronics. The first automotive electronics products he oversaw were power convertors that converted 12 volts to 110 volts for cigarette lighter receptacles.

Delta found a place in Ford’s supply chain. It was just in time for the rise of electric vehicles. Since 2008, Delta has been able to devote its 40 years of experience making power supplies to the production of power management components for Tesla and GM.

However, power management components are standardized products that have little added value. To become a key partner for major automakers, Delta set a goal for themselves to earn a place in the heart of electric vehicles.

Ahead of the curve: Producing the “four-in-one” EV heart

Delta has decades of experience in industrial automation. It is no stranger to motors and motor drivers. But it was still a major hurdle to improve precision and stability to the point where Delta could sell its products to automakers.

Delta bested multiple top-tier, long-time European providers by creating the first integrated, hybrid EV “heart”. The key to its success was the adaptivity of the electronics industry. Delta was also willing to start from a lower tier so it could gain insight into the clients’ needs through interactions with automakers.

Let’s take a step back and use the food industry as a comparison. Third-tier vendors are like farmers in the field; second-tier vendors are hawkers who have cleaned up the produce a bit; top-tier vendors are food processing giants. The higher you climb, the more added value and technical expertise you are expected to bring to the table. The position also puts you closer to the automakers. Top-tier vendors around the world have always been famous old brands such as Bosch, Siemens, ZF Group, Denso, LG, etc.

This was a new challenge for Delta. “We’ve never faced off against them,” says Tang. What’s more, these old brands generate a lot of value by selling to conventional petrol engine automobile makers. They could not stand to lose.

How to beat them despite the odds? The secret: “We chose the hardest task for ourselves.”

2018 was an important year. Fiat Chrysler Automobiles (FCA), which was the world’s seventh largest automaker at the time, before it merged with PSA Peugeot Citroën to form Stellantis, was working on a new EV model. It asked its supply chain for four products: a motor controller, on-board charger, DC-to-DC converter, and an on-board fast-charging controller.

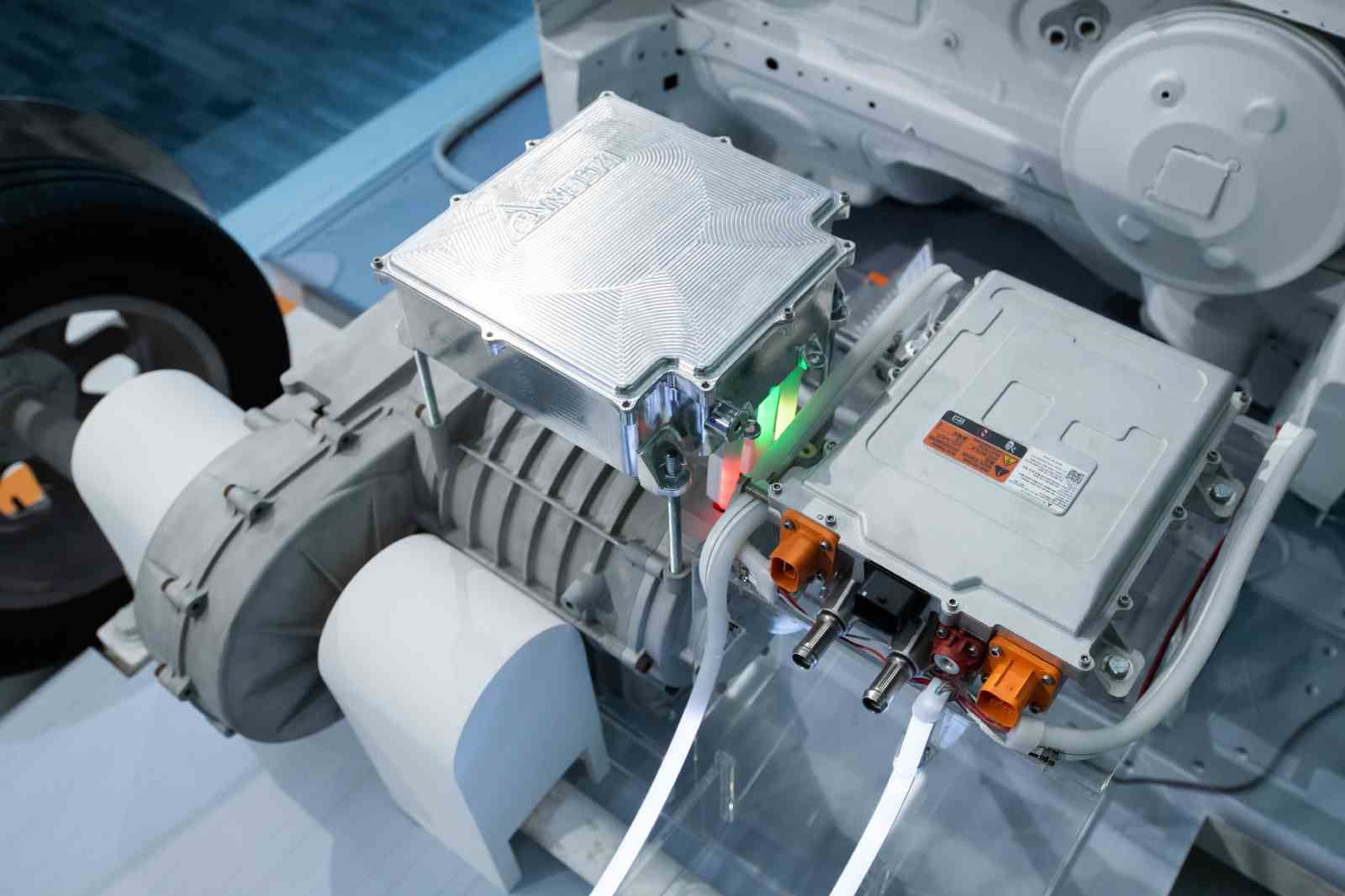

Delta’s solution was bold and unconventional. It combined the four separate products into one.

To marry components from the two disparate fields of “drive” and “electric” was a bold new experiment, for automakers and Delta alike.

To make the “four-in-one” heart of the electric vehicle was not only hard in terms of design; it also presented an unprecedented technical challenge for production and testing.

“Imagine four blocks in different shapes—how could you possibly combine them into one?” Wei-te Su, a senior research and development manager who has a PhD in electrical engineering from National Tsing Hua University, is the head of R&D at Delta’s Traction Inverter Business Unit. He explains that not only must the four components be pieced together, but they also had to share the same cooling channel, and the four connectors had to be merged into one. There was no room for error.

(Source:

Ming-Tang Huang)

(Source:

Ming-Tang Huang)

This high level of difficulty meant nearly three years of development and testing for the brand-new four-in-one product. It took thrice as much engineering resources and manpower as the average product.

Why undertake such an overwhelmingly difficult project?

“We did it because it was hard. If we made the parts separately, we’d be no different from anyone else,” explains Tang. If Delta just made the components, it wouldn’t stand a chance against the century-old established brands.

Currently, Delta is the first vendor in the world to mass-produce the four-in-one product.

The integration of all four components reduces the total mass and volume by as much as thirty percent. It also lowers the cost. For this invention, Delta was awarded the “Powertrain Supplier of the Year” by FCA in 2019.

Tang reveals that Delta is in talks to provide for the development of next-generation electric vehicles. If Delta snags the order, it will bring in tens of billions of US dollars in revenue. Needless to say, competition is fierce.

Investing in the acceleration of globalization

What is Delta’s next step? Not only must its hand be steady, its wits must be sharp as well. That means a lot of investment in advanced technologies.

Besides putting NT$1 billion in the EV testing lab at Pingzhen, Delta also spent US$2 million to construct a lab in Detroit more than a decade ago. The lab is staffed with over 50 R&D personnel.

Globalization is the natural next step. Delta’s powertrain products are currently produced in Thailand and China. However, because clients want their orders to be filled as soon as possible, Tang says that as early as next year, and no later than 2024, Delta will start manufacturing in Europe and the U.S.

“Delta has its finger on the pulse of local markets,” says Volker Heistermann, co-founder of the EV innovation platform Mosaic Venture Lab. Delta’s German team is staffed by local R&D personnel; this has helped Delta expand its network in the auto industry.

Heistermann also points out that Delta is popular with big automakers and has ascended to top-tier status because it has always kept its eye on the ball. For more than a decade, Delta has not shied away from investing in the necessary research and development, even if the effort sometimes resulted in a net loss.

Delta’s newest challenge is the lack of software experts.

“This is a major hurdle,” admits Tang. Automakers have an exceptionally high demand for software solutions.

(Source:

Ming-Tang Huang)

(Source:

Ming-Tang Huang)

Software experts sorely needed to help Delta level up

He goes on to say that Delta is currently in talks with a European automaker to jointly develop a product that combines the on-board charger with the DC-to-DC converter. The client has added a lot of software related to vehicle control. Because this requires the integration of functions that were originally spread across different ECUs, Delta had no choice but to hire a third-party software provider to help with development.

What happens if Delta cannot acquire software know-how? “We will always be just another OEM and ODM provider, waiting for our clients to tell us their requirements,” says Su.

As the electric cars of the future become more intelligent, the software also grows more complex. Delta’s next order, for a next-generation American EV model, came with a hardware and software specification manual that’s over 400 pages long. That’s four times the length of the average manual.

“We are in competition with software companies when it comes to attracting talent,” says Tang. In the past, software experts mostly went to work for wafer and IC design companies. Tang wants them to come to Delta: “We are more than your average electronics company!”

Have you read?

♦ How Century-old Tatung Fell Apart

♦ Kytu Lin’s road to build Taiwan’s most popular social network

Translated by Jack Chou

Edited by TC Lin

Uploaded by Jane Chen