Why are Taiwan bank employees taking to the streets ahead of mergers?

Source:Pei-Yin Hsieh

With financial mergers on the horizon, why are bank employees taking to the streets, carrying placards and holding up banners in protest? Why don’t these well-paid white-collar workers just jump ship and work for another bank? It’s because traditionally trained banking workers are no longer in demand as online banking and digital financial services spread.

Views

Why are Taiwan bank employees taking to the streets ahead of mergers?

By Pei-hua Luweb only

( Have you read: Why is Citibank exiting Taiwan and betting on China? )

Mr. Lu joined EnTie Commercial Bank five years after its founding in 1992, when Hungtai Construction was the parent company. In its beginning, the bank dazzled consumers with 13 percent interest on savings deposits. Subsequently, private equity fund Longreach took over, and in October this year, IBF Financial Holdings announced that it would buy EnTie Commercial Bank.

The buyout puts Lu, who is 50 years old, in a dilemma. Next year he will have accumulated a labor pension insurance seniority of 25 years, part of which was acquired before 2005 under the old labor pension system where pension accounts belonged to the employer. In order to claim these funds, Lu would have to apply for retirement. But he has a child in college and 15 years to go before reaching retirement age. He fears that should he leave EnTie Commercial Bank, finding a new job might not be easy.

Many EnTie employees are in a similar situation as Lu. The average age of EnTie staff is 42, and the ratio of lower-level employees with high seniority is high in comparison to other commercial banks. One out of four labor union members have accumulated some insurance seniority under the old labor pension system.

(Source: Chien-Ying Chiu)

(Source: Chien-Ying Chiu)

The EnTie case is only the tip of the iceberg amid the current merger wave in the financial sector. Citibank has announced that it will exit consumer banking operations in Taiwan and 12 other countries.

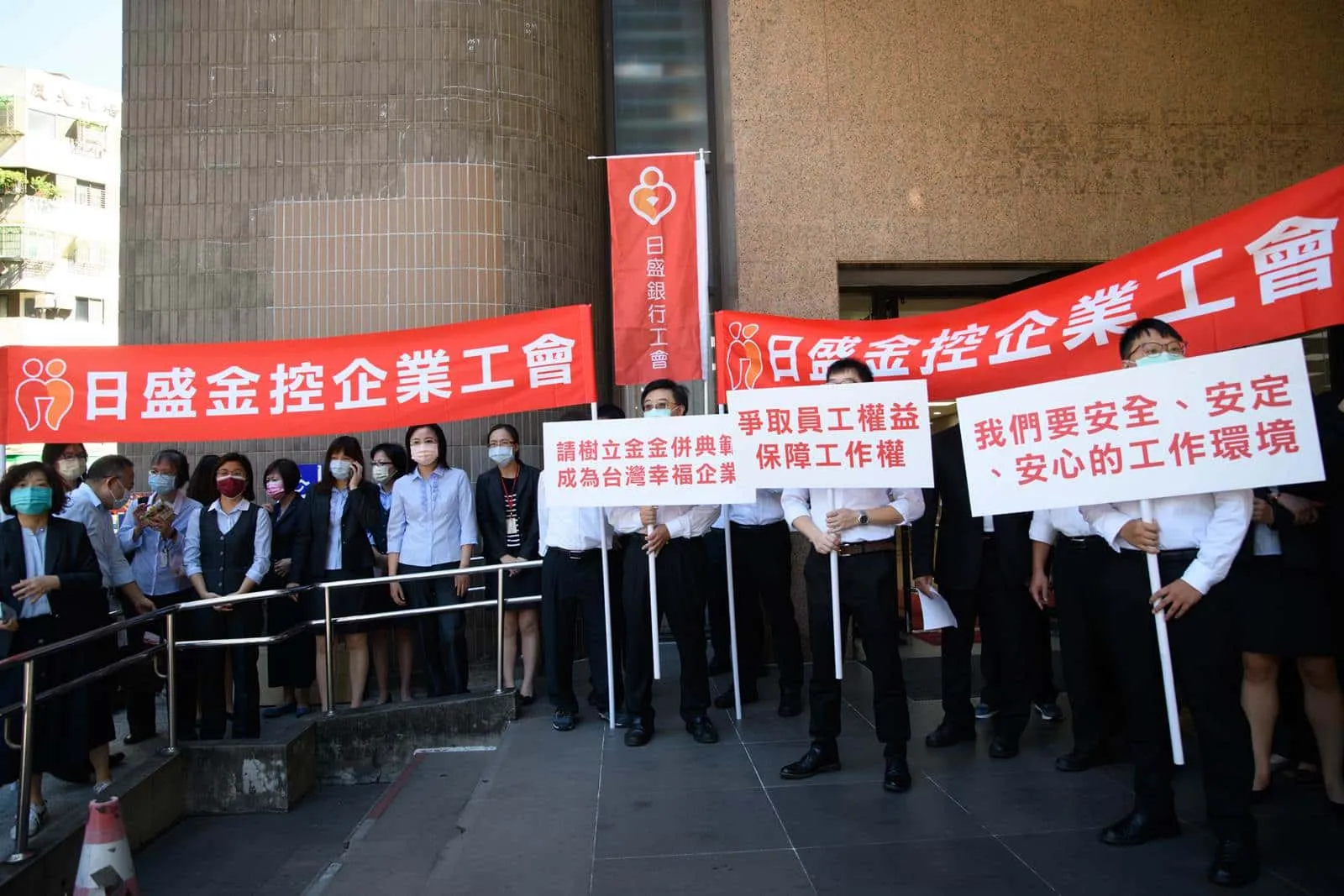

In late August, Jih Sun Financial Holding held a special shareholder meeting, electing a new board that approved the merger with Fubon Financial Holding. The merged entity will have more assets and more employees. Yet, due to the ongoing consolidation in the banking sector, an estimated 8,000 jobs are at stake this time.

“Although the number of cases is not at a record high, it is the highest number in terms of affected people this time,” explains Hang Shr-shian, general secretary of the Taiwan Federation of Financial Unions (TFFU).

With an average monthly salary of NT$94,473, according to government statistics, the financial sector is the best-paying industry in Taiwan. Yet, as well-paid bank employees now see their once stable jobs at risk, they are beginning to organize to assert their rights.

While EnTie bank has had a labor union for many years, Citibank and Jih Sun International Bank founded labor unions only this year, with 80 to 90 percent of their staff becoming members. Jih Sun’s union boasts even vice presidents among its ranks, which underlines just how strong the sense of crisis is.

Fubon Financial Holding and IBF Financial Holdings have both pledged to retain all employees after the merger. And Paulus Mok, chairman of Citibank Taiwan, keeps emphasizing that the protection of employee rights is a priority during the sale of the consumer banking arm. So why do their employees not trust these assurances?

(Source: CommonWealth Magazine)

(Source: CommonWealth Magazine)

It is not just the fear of imminent job cuts, but other concerns differing from employer to employer that also come into play.

A veteran employee of Jih Sun International Bank who did not want to be identified provided some insights into what causes many a sleepless night. The branches of Taipei Fubon Bank focus on wealth management. Consequently, their branch managers have a background in financial management, whereas the branch managers of Jih Sun International Bank are business management graduates who are adept at consumer lending such as mortgages and loans. The latter worry that they will not get important positions after the merger.

Likewise, the supervisors of the savings and remittance business at Jih Sun bank branches fear that their posts will be scrapped should the branch network be consolidated, and that they won’t be able to adjust to the way business is done at Fubon. Even the lending and wealth management pros are concerned because the two banks’ credit risk management and product strategy differ, so they might not be able to keep up their original performance.

“It is not about how good or bad Fubon is, but how different the two systems are, that’s what rattles us,” says the bank employee.

(Source: Pei-Yin Hsieh)

(Source: Pei-Yin Hsieh)

The TFFU, which used to stage strikes and street protests in the past, is now taking the lead in helping the labor unions make their case with the competent authorities. They assist them in negotiating collective bargaining agreements with Jih Sun and Fubon financial holdings, and deal with the press on behalf of the Citibank labor union.

Hang has witnessed the development of labor rights in the banking industry since the Asian financial crisis in 1998 through the first domestic merger wave in 2004. He admits that bank employees were reluctant to take their employers to court even if it was only to secure the most basic labor rights. Meanwhile, however, the Business Mergers and Acquisition Act and the Financial Institutions Merger Act have been adopted, clearly stipulating the rights and obligations of labor and management, and strengthening the employees’ position.

Article 12 of the Financial Institutions Merger Act, for instance, requires a financial institution contemplating a merger to submit an employee settlement scheme along with the merger application.

“This is not the management’s version; it must be negotiated with the labor union beforehand or a labor-management meeting must be convened,” Hang points out. Among the three merger projects, Fubon Financial Holding has been moving forward the fastest.

The sense of crisis among banking personnel is not only caused by the specter of labor rights violations. Many also fear they won’t be able to keep pace with the rapidly changing business environment as the sector increasingly goes digital.

In the current low-interest environment, banks are more and more reliant on transaction fees to make money. Employees across the board are expected to market products so that even tellers push credit cards. The financial holdings hand cross-selling over to bank employees to boost business. For employees who are not good at sales, this is a taxing situation. Due to the accelerating pace of digitalization in the financial sector, bank branches are losing their significance. Job openings for traditional bank workers are increasingly rare as banks prefer to hire non-traditional talent with more diverse backgrounds.

“The savings banks all face the demise of bank branches; this is even more the case for merged banks. If the banking workforce does not transform, they won’t be competitive,” notes banker-turned-lawmaker William Tseng, hitting the nail on the head.

Mr. Lu has worked in the back office at EnTie bank for 24 years without ever having to sell funds or insurance products. “We are the ones who are being merged, so you can be sure that we will be the ones to be fired first. Moreover, I have no sales experience. Should I fail to generate sales, I’m afraid I would have no choice but to leave,” he says in describing his conundrum.

The fast development of digital financial services has led to the marginalization of smaller banks. Digital transformation requires massive investment as core systems must be replaced, interfaces for direct customer contact developed, SOPs improved, and multidisciplinary talent recruited. Against this backdrop, banks are the more competitive the more resources they have.

(Source: Pei-Yin Hsieh)

(Source: Pei-Yin Hsieh)

Spirits are low even at EnTie and Jih Sun banks, which are being merged and not sold. Since their previous majority shareholders were private equity funds looking for short-term profits, the banks’ digital transformation lags behind their industry peers. The upcoming mergers into financial holding companies might bring the financial resources and development vision that is necessary to boost the banks’ competitiveness, which in return would help secure banking jobs.

From a zero-sum game to win-win situation for labor and management

While negotiations between labor and management are still in progress, the Jih Sun and En-Tie labor unions take the settlement reached in the merger of Ta Chong Bank with Yuanta Commercial Bank, which became effective in January of 2018, as their bottom line. This would mean that employees who are made redundant will be compensated with retirement and severance payments above the minimum set in the Labor Standards Act. Moreover, employees will be entitled to these preferential severance or retirement packages if they quit within three years after the merger.

“Presently, labor and management both have their own agenda. The labor union thinks that if they don’t compromise, the merger will fall through. Since this is not necessarily the case, labor must not be overly confident,” says an individual involved in the negotiations.

So far, none of the three proposed mergers have gotten the green light from the Financial Supervisory Commission. Fubon Financial Holding, however, has already acquired a majority stake in Jih Sun Financial Holding, and gained majority control of its board. Citibank was slated to pick a buyer in late October, but the widening labor dispute has thrown a spanner into the bidding process. The board of IBF Financial Holding has approved the planned merger with EnTie Commercial Bank, but since opinions among the large shareholders are divided, an extraordinary shareholders meeting in early December could change the scenario.

The chairman of a bank who requested anonymity points out that labor disputes have the potential to derail merger processes. “The stronger labor unions get, the less likely it is that the competent authorities can muster the courage to touch [a merger]. Also, since labor disputes are bad for the reputation, the commercial environment is not favorable to mergers,” says the banker.

The idea is that financial mergers create economies of scale and boost operational efficiency, making Taiwanese banks more competitive and fit for regional if not global expansion. But doubts are also being voiced that the creation of large financial holdings actually benefits the consumer and society. Fraudulent or questionable practices in wealth management and insurance policy solicitation have repeatedly highlighted the complacency and lax controls at financial holdings that ultimately sacrifice customer interests.

There is no black-and-white solution to the tug of war between fair labor practices and business synergies. But corporations, employees, and even society at large will have to live with the eventual outcome.

Have you read?

♦ Why is Citibank exiting Taiwan and betting on China?

♦ Online banking takes shape in Taiwan

Translated by Susanne Ganz

Edited by TC Lin

Uploaded by Penny Chiang