Top 2000 CEO Survey

Plans for raises, new hiring, but worries over inflation

Source:Chien-Tong Wang

CommonWealth Magazine’s latest annual survey of Taiwan’s top executives found optimism over the global economy in 2022 and expectations of revenue growth, but also concerns that rising costs and prices will be a major challenge.

Views

Plans for raises, new hiring, but worries over inflation

By Pei-hua LuFrom CommonWealth Magazine (vol. 738 )

The COVID-19 pandemic has endured for two years and shows few signs of abating, but hopes remain that more widespread vaccination can offer some resistance to new waves of the coronavirus.

Taiwan’s top executives seem inclined to see the glass as half full. Nearly 70 percent of those who participated in the latest CommonWealth Magazine Top 2000 CEO Survey had an optimistic economic outlook for 2022, the first time in the last four annual surveys that more respondents were optimistic than pessimistic.

More of them are also anticipating strong revenue growth in 2022, with the percentage of executives foreseeing 11- to 20-percent sales growth in the coming year nine points higher than in last year’s survey.

In both the manufacturing and services sector, about 40 percent of respondents expected revenue growth of five percent or less, while 75 percent of tech executives and 58 percent of executives in the financial sector foresaw revenue growth of six percent or higher.

Fubon Group Chairman Daniel M. Tsai said in a public forum that, given the record retail sales on Black Friday in the United States and its low unemployment rate, the U.S. economy is on the road to recovery, which should bode well for Taiwan’s export-oriented economy.

High prices more of a threat than COVID-19

Concerns remain, however, for most of the executives surveyed, though they no longer see the COVID-19 pandemic as their biggest potential headache.

In last year’s survey, COVID-19 was cited as the biggest risk, but it fell to third in this year’s poll, replaced at the top by rising commodity prices. This is the first time rising commodity prices have taken the top spot in the more than 20 years since the CEO survey was first conducted in 1997. Only the CEOs of tech manufacturers disagreed, citing ongoing supply chain disruptions as their biggest concern.

Those disruptions are closely linked to the pandemic, and the spread of the Omicron variant of COVID-19 is only creating more uncertainty, leading Japan to close its doors to the world again and the United States to impose travel bans on certain countries.

(Source: Pei-Yin Hsieh)

(Source: Pei-Yin Hsieh)

Chris Hung (洪春暉), a senior industry consultant at the government-funded Market Intelligence & Consulting Institute, observed that companies can digitalize their operations and go online to strengthen their performance.

“But supply chains rely on ocean and air freight, and when the pandemic hit and places were put on lockdown, there was nothing companies could do,” he said.

Supply chain disruptions have pushed commodity prices higher, resulting in soaring costs for companies. The OECD has warned that high inflation has become the biggest threat to the global economy’s prospects, and U.S. Federal Reserve Chairman Jerome Powell recently ditched the word “transitory” in describing inflation.

The interaction between the pandemic, supply chain bottlenecks and rising prices has led to instability in companies’ operations.

To Taiwanese companies operating in China and other overseas markets, geopolitical factors have also contributed to rising costs.

Cathay United Bank chief economist Lin Chi-chao (林啟超) said the confrontation between China and the United States has turned “long” supply chains that cross continents into “short” or “broken” chains. As a result, the traditional production logic founded on low costs has disappeared, and Taiwanese companies manufacturing goods overseas are facing a new era of high costs.

Those manufacturers and exporters that are unable to pass on rising costs to their customers will inevitably see their gross margins erode.

But companies oriented toward domestic demand have had it even worse. Taiwan’s first major surge of COVID-19 in May of 2021 cost many people their jobs or reduced their incomes, blunting consumer spending, and vendors have been loath to raise prices for fear of further driving away consumers.

Bigger companies are better positioned to control costs, having the buying power to purchase commodities through futures markets, but small- and medium-sized enterprises (SMEs) have little recourse other than accepting higher costs for the materials and components they use.

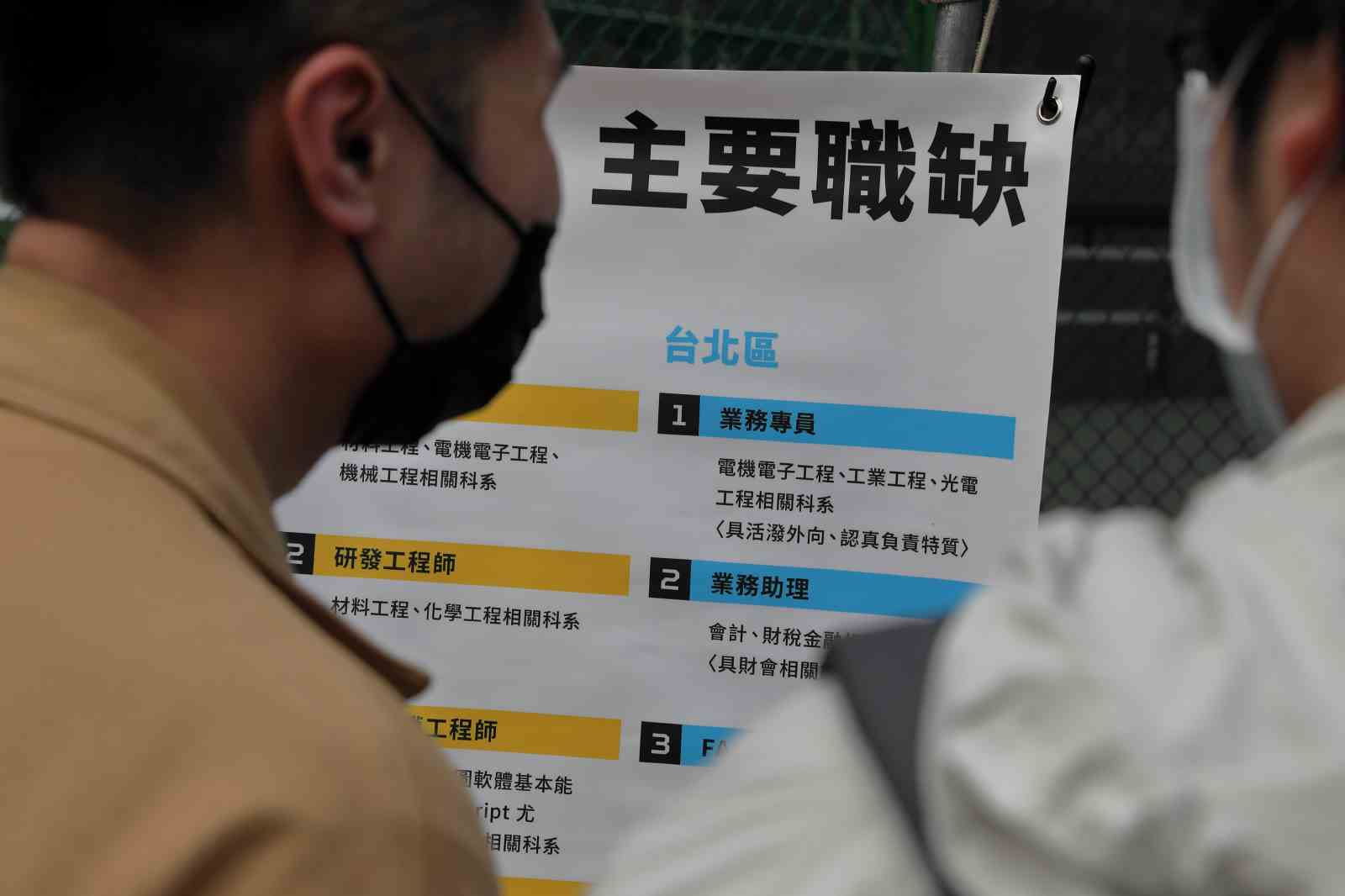

Investment, salaries, job openings all set to rise

Despite these inflationary pressures, top executives expect to invest more, raise pay levels and recruit more workers in Taiwan in 2022, according to the survey.

Most respondents anticipated pay raises of three percent or less, but the trend toward bigger increases in pay was noticeable. Nearly a quarter (24 percent) of respondents said they were willing to raise employee pay by four percent or more in the coming year, up 13.5 percentage points from the previous survey.

In terms of investment, nearly two of every five respondents (39.1 percent) said they would increase their investment in Taiwan by at least six percent in 2022, up nearly 12 percentage points from last year’s survey, and with more investment on the table, employers were also willing to recruit new workers.

By industry, the financial sector tended to have the most conservative outlook on hiring and pay raises, while the tech sector was the most aggressive, a finding that was not surprising to Cathay United Bank’s Hung. He said Chinese manufacturing activity was hurt by the U.S.-China trade war, especially in the semiconductor sector, as many orders shifted to Taiwan. Initially unable to meet this new demand, Taiwanese suppliers have scrambled to expand their capacity.

That has only been exacerbated by the global chip shortage that started in 2020, forcing vendors to invest even more aggressively in new factories and equipment. The world’s largest chipmaker, TSMC, has led the trend, but Powerchip Technology Corp., Winbond Electronics and Nanya Technology Corp. have also built new foundries.

The shortage of capacity has been matched by a lack of manpower. In its 2021 semiconductor white paper, manpower agency 104 Corporation said the recruitment gap in the semiconductor sector has hit a 6.5-year high, having grown by more than 40 percent from a year earlier. The shortage of engineers, it said, has even exceeded the shortage of packaging workers.

The manpower shortage means enterprises will have a harder time recruiting and retaining workers if they do not raise wages, said Tsai Lien-sheng (蔡練生), the secretary-general of Taiwan’s Chinese National Federation of Industries (CNFI). Further ramping up pressure on employers to boost wages, he said, were the 5.21 percent increase in the minimum wage and four percent increase in public employee and military pay set to kick in at the start of 2022.

(Source: Chien-Tong Wang)

(Source: Chien-Tong Wang)

Also casting a shadow over the investment craze are potential shortages of water and power.

When the executives were asked to identify the biggest business and economic challenges in Taiwan, relations with China again topped the list, though by a smaller margin than last year. The challenge cited by executives that made the biggest jump in this year’s survey was the energy supply.

Carbon taxes emerge as new challenge

Shortages of water and electricity have plagued Taiwan on and off for years, so why did the issue take on more urgency for executives this year?

“Everybody remembers the seriousness of the drought in early 2021 and the two major power outages on May 13 and May 17,” Tsai said.

Compounding the problem has been the increase in investment in Taiwan by overseas Taiwanese manufacturers, putting even more pressure on Taiwan’s already tight water and power supplies.

Beyond those shortages, which are domestic worries, the international trend toward carbon taxes has brought external pressures.

Tech manufacturers, old economy producers, and the financial sector all have to take climate transition issues seriously, and adjust their operations accordingly. Old economy companies are particularly under threat.

A forum on carbon neutrality organized by the CNFI earlier this year drew the participation of 300 companies in person and another 1,000 online “because the day when Europe starts imposing carbon taxes is approaching, and nobody knows what to do,” Tsai said.

He said the concerns of non-tech manufacturers exceed those in the tech sector because most of those manufacturers are SMEs. Unlike tech powerhouses with the ability to adapt to change, SMEs are barely familiar with basic concepts such as carbon neutrality and carbon footprints, and lack specialized talent in the field.

That lack of knowledge, along with growing calls by international brands to push for net-zero emissions by 2050, has given SMEs a sense of urgency.

“If the supply chain doesn’t cooperate, the big brands will have no way to meet the target no matter what they do. So suppliers that can’t meet the brands’ requirements will be eliminated from the supply chain,” Tsai said.

Investing in Europe, the US, and Southeast Asia

With companies investing more in Taiwan, there is less to invest elsewhere, and 62.5 percent of respondents said they have no plans to make new investments overseas.

The number of service-oriented enterprises investing in China has been on the decline since 2014, and was down to 7.4 percent expecting to invest there in 2022, in contrast to the increase in service companies entering the U.S. market. Gourmet Master Co. brand 85°C Bakery Café plans to continue adding stores there, and BaFang Dumpling expects to open its first outlet in California next year.

Old economy manufacturers were less likely to invest overseas, while more than 30 percent of financial institutions planned to increase their investment in Southeast Asia, with Europe also drawing interest.

More than 80% bearish on China

Overall, Tsai expressed belief that China is still in the mix. “Many Taiwanese companies in China are increasing their investment there after making money during the U.S.-China trade war and seeing China’s effective control of the pandemic,” he said.

But Hung felt the heyday for investing in China has passed. Though Taiwanese companies operating in China will not completely pull out because they want to continue to do business there, he said, their investment will likely be limited to upgrading their old plants or relocating rather than building new facilities. Many of them, he said, were looking to diversify their networks to outside of China.

“Taiwanese corporate investment in China has fallen from its peak, and there will never be the same frenzy to invest in China again,” Hung said.

In the survey, more than 80 percent of respondents were down on China’s investment environment, continuing a trend in which bears have outnumbered bulls every year since 2011.

The executives were more concerned about the high degree of political uncertainty in China and the effect it was having on Taiwanese companies there than they were on tensions in relations with China and soaring labor costs.

In 2021, China took control of large-scale internet platforms, promoted the concept of a common prosperity, and imposed dual controls on energy consumption. Though Taiwanese companies were not directly targeted by the measures, they have nonetheless felt pressure from those measures.

There was, however, another form of pressure emerging. In late November, Far Eastern Group companies operating in China were fined 474 million Chinese yuan (about US$74 million) for environmental, health and safety, and tax issues, according to China’s Taiwan Affairs Office. Hinting that perhaps there was more to the fines than just routine violations, the office said China would “absolutely not permit support for Taiwan independence,” sending chills through Taiwan’s business community there.

The world has changed. Facing disruptions in supply chains, soaring global commodity prices and worsening U.S.-China relations, Taiwanese companies will have to use their whole bag of tricks to find a way forward in this new environment.

About the survey

The survey is based on questionnaires sent by CommonWealth Magazine to the CEOs of Taiwan’s 1,350 biggest manufacturers, 650 biggest service sector enterprises, 100 biggest financial institutions and 16 financial holding companies.

The survey period was October 4, 2021 to November 1, 2021, and a total of 764 valid questionnaires were returned, a response rate of 36.11 percent.

Have you read?

♦ Why the Chinese Military Has Increased Activity Near Taiwan

♦ What does the Biden-Xi meeting portend for Taiwan?

Translated by Luke Sabatier

Edited by TC Lin

Uploaded by Penny Chiang