The ‘Prosperous 100’ leading Taiwan’s semiconductor industry into a decade of success

Source:Ming-Tang Huang

A cluster of Taiwanese semiconductor companies covering a wide range of sectors from IC design to conventional manufacturing are enjoying a meteoric rise. Led by TSMC, this dream team of semiconductor leaders will reshape the game as they outperform their American and Japanese peers.

Views

The ‘Prosperous 100’ leading Taiwan’s semiconductor industry into a decade of success

By Hannah Chang, Chen-kang KangFrom CommonWealth Magazine (vol. 748 )

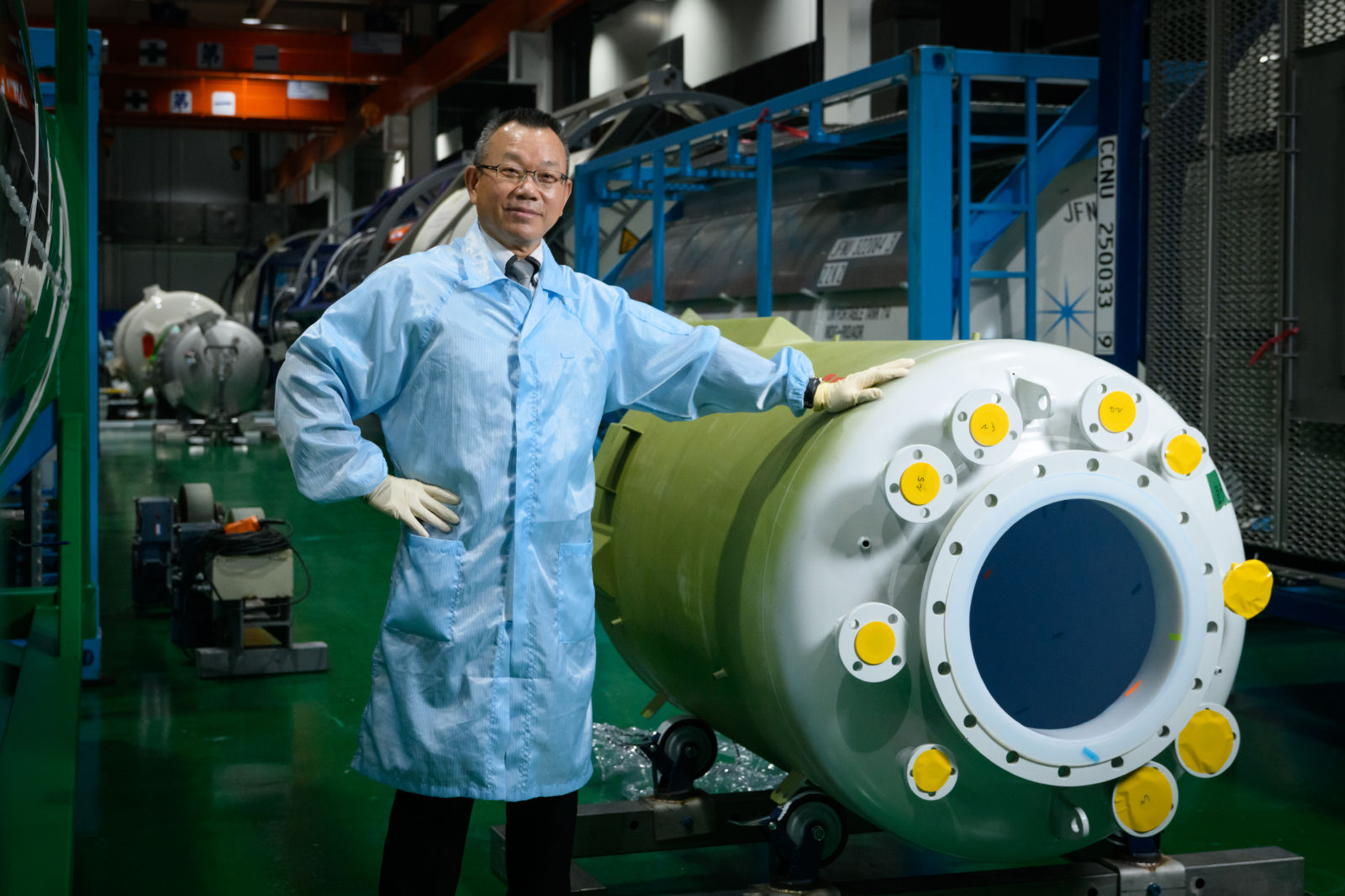

The fresh breeze smells faintly of orchids despite the vicinity of a chemical plant on the coast of Kaohsiung. Jan Yen Sun (孫靜源), the 83-year-old founder and chairman of Shiny Chemical Industrial Co., steps in front of a storage vat.

“There’s no smell, right?” He asks. The tank truck nearby is filled with chemical solvents and cleaning solutions used in the semiconductor industry.

Inside the Changhua Coastal Industrial Park, Shiny produces the liquid chemicals used for etching in the semiconductor manufacturing process—the most advanced fabrication technique on the planet.

Shiny is the first Taiwanese provider to supply etchant for advanced semiconductor manufacturing. Shiny was established in the 1970s, when the founders purchased technology from a Japanese provider to produce urea glue.

As Taiwan’s industrial landscape transformed, so did Shiny. It went from making adhesives for plywood to producing electronic-grade solvent. This allowed Shiny to hitch onto the electronics industry bandwagon; many years later, it has secured a spot in TSMC’s supply chain. Shiny now competes directly with Japanese vendors.

(Source: Ming-Tang Huang)

(Source: Ming-Tang Huang)

Last year, Shiny made a record-breaking NT$11.1 billion, and its net profit margin increased 40% to reach NT$1.617 billion. TSMC has become Shiny’s biggest customer and makes up 20% of its revenue. Shiny’s market value has surpassed NT$40 billion.

The global economy is in a strange state. Inflation and interest hikes have tanked the stock market. But as the saying goes, the night is darkest just before the dawn.

At this moment in history, a new class of Taiwanese manufacturers—exemplified by Shiny—is making its highly anticipated bid for dominance.

Taiwan overtakes Japan and the US, sails into new decade of prosperity

The oligopoly enjoyed by American and Japanese providers is being gradually eroded by Taiwanese companies, whose revenues and profit margins have hit record numbers.

These are manufacturers that make petrochemicals, materials, and equipment. Besides Shiny, there is Allied Supreme Corporation (ASC), which makes tank trucks; WahLee Industrial Corp., which imports solvents; Taiwan Speciality Chemicals Corporation (TSCC), which specializes in electronic-grade gasses; Solar Applied Materials, which produces “sputtering target” materials. There are also the EUV pod manufacturer Gudeng, the silicon wafer supplier GlobalWafers, and the petrochemical giants LCY Chemical Corp., and the Chang Chun Group.

An unprecedented sea change is sweeping over Taiwan’s manufacturing sector. TSMC has always been a world-class semiconductor powerhouse, but until recent years it has not triggered the growth of its peripheral industries.

TSMC is now one of the world’s ten most valuable companies. Its annual expenditure is in the hundreds of billions. This is causing quantitative and qualitative changes to Taiwan’s chemical materials and equipment supply chains.

As the world’s largest semiconductor company, TSMC is like a flagship leading a massive fleet of smaller vessels. What’s more, the fleet is growing continuously.

Mark Liu (劉德音), chairman of TSMC, once predicted that the value of the global semiconductor industry will increase exponentially from 2020 to 2030, to surpass US$1 trillion.

(Source: Ming-Tang Huang)

(Source: Ming-Tang Huang)

The semiconductor industry is looking at a decade of prosperity. CommonWealth has selected 100 illustrative success stories from the “CommonWealth Magazine Top 2000 Survey” to present this list of the “Prosperous 100”.

They include familiar champions of Taiwan’s semiconductor industry, including UMC, Macronix, and Winbond.

There is also a group of companies that belong to more conventional sectors. After securing orders from TSMC, every one of them has been completely transformed.

GlobalWafers is TSMC’s biggest domestic supplier. Doris Hsu (徐秀蘭), chairwoman of GlobalWafers and Sino-American Silicon Products Inc. (SAS), says that ever since TSMC became number one in the world, it has initiated the rapid growth of Taiwan’s semiconductor ecosystem. This not only covers the companies that make chemicals, materials, and equipment; it also relates to the field of IC design.

(Source: Chien-Ying Chiu)

(Source: Chien-Ying Chiu)

In the “CommonWealth Magazine Top 2000 Survey”, the IC design industry showed an increase in revenue of 48%. Its net profit margin shot up by 150%.

MediaTek takes the lead over Qualcomm

Hsu points out that despite the global chip shortage, Taiwanese IC design companies can find subcontractors and materials within the country. This is an incredible advantage available only in Taiwan.

Last year, the paradigm shift that occurred among the world’s top ten IC design companies was the rise of Taiwanese brands. TrendForce’s 2021 survey of the world’s ten biggest IC design companies (in terms of revenue) for the first time included four Taiwanese companies. MediaTek came in at number four; Novatek at number six; Realtek at number eight, and Himax at number ten.

The Nikkei reports that one of the major reasons why Taiwan’s semiconductor industry has experienced a meteoric rise is due to its “proximity to TSMC”. “TSMC and UMC have prioritized the Taiwanese design companies they already had close ties with, giving them an additional boost…This is particularly clear in smartphone chips, where MediaTek, which has deep connections with TSMC, has surpassed Qualcomm to take the lead in the global market.”

Localization benefits not only IC design, but also conventional industries

How is it possible that, in just a few short years, these conventional industries have churned out electronic components on par with the best American and Japanese vendors?

A veteran of the petrochemical industry has described the process as “eye-opening”.

To use Shiny as an example, TSMC’s research and development personnel have actively worked with Shiny’s petrochemical experts to help them pinpoint the source of impurities, fiddle with the parameters, and improve the yield rate.

At the Changhua Coastal Industrial Park, the finished chemical products are loaded onto fleets of tank trucks. The entire plant is packed full of over a hundred tank trucks, with deliveries slated for TSMC, Intel, Shiny, LCY Chemical Corp., the Chang Chun Group, and Sunlit Fluo & Chemical Co.

(Source: Pei-Ying Hsieh)

(Source: Pei-Ying Hsieh)

Chia-Sheng Hou (侯嘉生), Chairman of Allied Supreme Corp., reveals that TSMC used to buy from the Japanese provider Valqua. In recent years, TSMC has expanded its orders from ASC. TSMC has even outsourced the construction of its high-purity chemical supply pipelines to ASC. This boosted ASC’s revenue and profit margins to new heights last year, and its net profit margin grew by 80% year-over-year.

Solar Applied Materials recycles leftover waste from the production process for TSMC, and then converts it to raw materials—which it uses to manufacture “sputtering target” materials, which can be used on the assembly lines again. This has elevated the company to the position of the first Taiwanese supplier to produce target materials for the early-stage production process of high-end semiconductors.

(Source: Pei-Ying Hsieh)

(Source: Pei-Ying Hsieh)

Income from the electronics and semiconductor sectors made up 27% of Solar Applied Materials’ revenue last year, which was over NT$30 billion. Its net profit margin grew by close to 50%.

A high-level executive with Qualcomm’s R&D team says, “In the future, it is an inevitable trend that the global semiconductor industry will shift its focus closer to Taiwan.”

The common denominator of all of these success stories is this: They all benefited from the guidance of TSMC.

Why has TSMC become more proactive in its nurturing of Taiwanese suppliers in recent years?

Advantage number one: Handpicked by TSMC to fight back against Samsung’s infringements

According to TSMC’s public statement, it based its decision on CSR (corporate social responsibility), as well as its effort to increase local purchasing.

(Source: Pei-Ying Hsieh)

(Source: Pei-Ying Hsieh)

But TSMC’s suppliers agree that there is another major factor: TSMC’s rival, Samsung. Industry experts explain that some years ago, a number of foreign companies that worked with TSMC on its advanced manufacturing process wound up opening offices in Korea. TSMC is worried that its tech know-how is being leaked.

Wei-Wang Chen (陳偉望), Chairman of the Taiwan Chemical Industry Association, says that because international companies sell around the globe, Taiwanese companies had to face an uncomfortable realization: “Somehow, by the time we activated our assembly lines, Samsung and our American and Japanese competitors had already gotten hold of our technology.”

Due to this, TSMC would rather support local suppliers and forge an exclusive supply chain of its own.

The chairman of a materials vendor attests that, ever since the company began providing materials for TSMC’s groundbreaking 3nm process, TSMC has asked the company to sign an agreement “not to work with Samsung for a period of time”.

“This is the benefit of localization,” says the chairman; American vendors would never have signed such an agreement.

(Source: Pei-Ying Hsieh)

(Source: Pei-Ying Hsieh)

In order to tighten its grip on its technology, beginning last August, TSMC elected six specific local providers to help it better protect its trade secrets. Solar Applied Materials was one of them.

Advantage number two: The weakening global supply chain and the geopolitical threat

A former senior executive at TSMC’s R&D department reveals that in the past, the idea of cultivating a local supply chain was unheard of. The recent drastic shift in policy is probably a reflection of “risk management decisions in the face of geopolitical crises”.

GlobalWafers Chairwoman Doris Hsu also feels that the pandemic and the trade war have helped to reinforce TSMC’s commitment to localization. TSMC wants to keep its suppliers close. Because of this, GlobalWafers has ramped up its wafer production. Taiwan Speciality Chemicals Corporation, which is also part of Sino-American Silicon Products Inc., has worked closely with the TSMC task force to improve its operations and turn a profit. It recently landed a long-term contract with another client.

Because of this, Apple’s latest iPhone 13, which runs on TSMC’s 5nm chips, can be seen as an impressive demonstration of Taiwanese tech. There are silicon wafers provided by GlobalWafers and thin films made of disilane gasses provided by TSCC. In the future, Solar Applied Materials’ copper manganese alloy target materials may be used in the thin film sputtering production process.

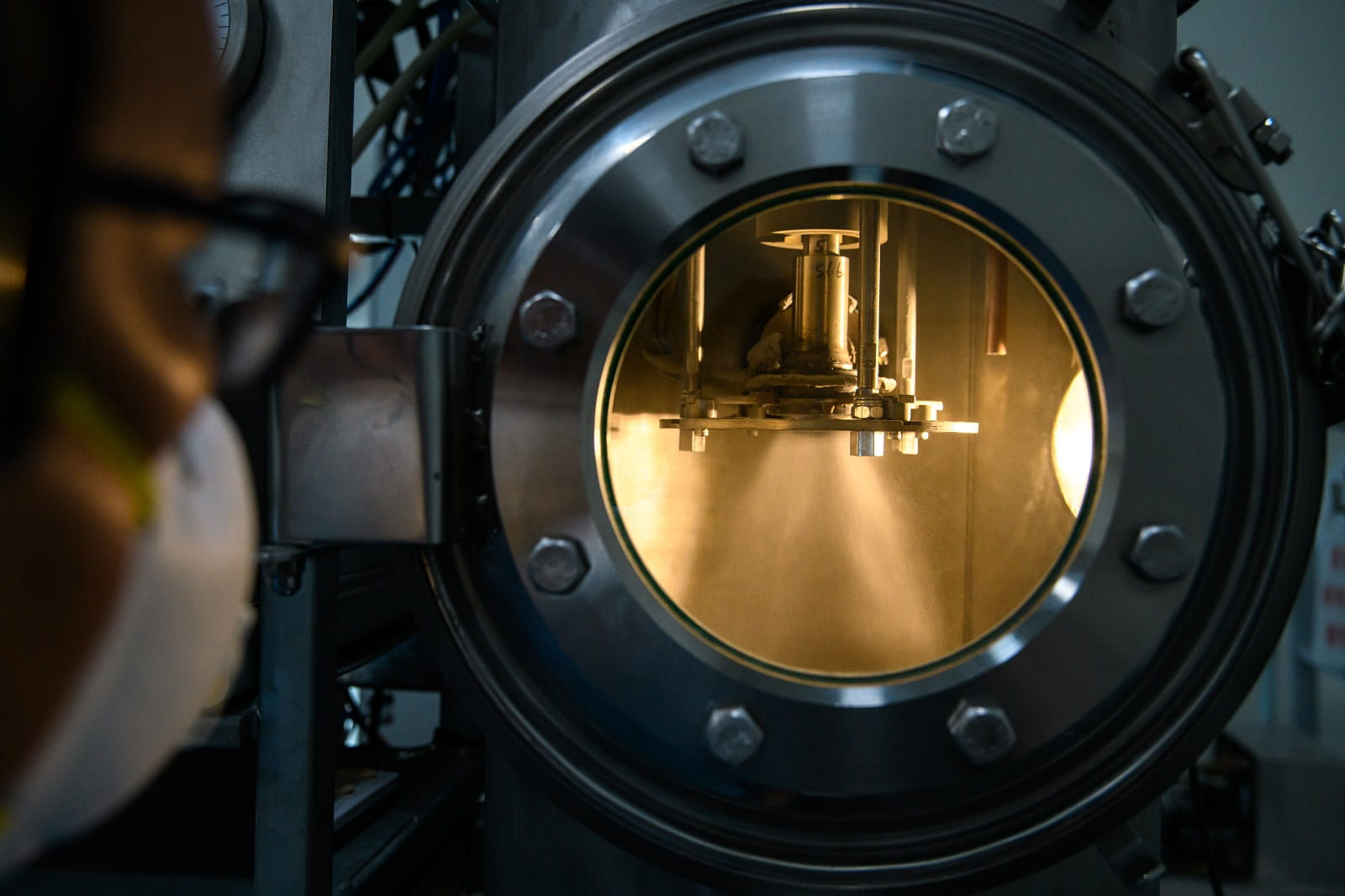

Inside TSMC’s own foundries, the extreme ultraviolet lithography fabrication process uses EUV pods manufactured by Gudeng, tetramethylammonium hydroxide developer made by Chang Chun, and etchant provided by Shiny. The process also uses electronic-grade isopropyl alcohol (EIPA) made by LCY Chemical Corp., sulfuric acid made by Quanta Storage Inc., and hydrofluoric acid made by Sunlit Fluo & Chemical Co.

TSMC used to buy all of this from American and Japanese suppliers.

In 2016, Shiny’s etchant was used in TSMC’s sub-7nm fabrication processes for the first time. This used to be the domain of the German manufacturer BASF and Japan’s Kanto Chemical.

In order to sell to TSMC, Shiny invested 250 million dollars to purchase 151 sets of testing instruments. Eight of them are inductively coupled plasma-mass spectrometry (ICP-MS) devices—the same as TSMC uses. In 2022 and 2023, Shiny plans to spend another 80 million dollars to buy new instruments that can detect trace amounts of particles and impurities.

Optimized waste management creates circular economy for recycled materials

These Taiwanese partners are not only supplying materials to TSMC, they also help to take charge of waste management.

TSMC plans to open its first zero-waste manufacturing center in Taichung next year. The eco-friendly production process will be replicated at other sites. By utilizing advanced recycling techniques, waste material from the production process can be refined until it reaches electronic-grade, at which point it can be reused in the foundries.

LCY Chemical Corp. is also building new EIPA lines; its aim is to double the production capacity within three years. LCY benefits from its proprietary "double cycle" process. The first cycle separates and filters waste fluids left over from fabrication, and then reprocesses it to create EIPA of the same purity, which can be used by the customer. The second cycle extracts water, which makes up 90% of the waste fluids, and then cleans it of foreign substances and contaminants, so that the water can be reused in the semiconductor manufacturing process.

“Every year, over a thousand metric tons of waste fluids are delivered to LCY for processing. We turn that into new EIPA for our customers,” says Vincent Liu (劉文龍), CEO of LCY Chemical Corp. LCY is ready to set up shop in new locales around the world, wherever their customers choose to build their factories. It has set aside US$100 million to build new EIPA production lines and R&D centers in Arizona, USA.

As the wind of prosperity rises, countless Taiwanese companies are ready to set sail alongside TSMC. This is a test of their management skills and adaptability; but for those who pass the test, the rewards will be well worth the investment.

Have you read?

♦ Evergreen Marine profits jump 9-fold as era of mega vessels dawns

♦ Does Taiwan Have Enough Power for TSMC?

♦ 2021 Top 2000 Survey: Resilience in the face of adversity

Translated by Jack Chou

Edited by TC Lin

Uploaded by Penny Chiang