What is TSMC doing building a fab in the American desert?

Source:David Y.

Ambitions to manufacture in the United States have led TSMC to set up shop in America. This supply chain relocation poses various challenges, from cost to talent to management. Apart from satisfying U.S. demand, how can TSMC seek new opportunities?

Views

What is TSMC doing building a fab in the American desert?

By Hannah ChangFrom CommonWealth Magazine (vol. 740 )

(Read more: Servility no longer the way to save Taiwan TSMC: no more night shifts)

Michelle Chang, director of the Taiwanese Chambers of Commerce North America, took a distant photo of the Taiwan Semiconductor Corporation’s (TSMC) construction site in Arizona, adjoining a large 1,100-acre expanse of desert, and posted it to more than 10,000 members of an online group of Taiwanese business people in Arizona.

“Taiwan’s national guardian has come to America!” she proudly exclaimed.

While American companies were on their 2021 New Year’s holiday break, workers at TSMC’s Arizona plant site were busy at work, day and night.

CommonWealth’s special assignment photographer was on the scene in January to witness dozens of cranes at work on this desert plot, nearly the equivalent of 90 percent of the area of the Kaohsiung Science Park in Taiwan. At that time, four or five stories of buildings had begun to take shape.

(Source: David Y.)

(Source: David Y.)

Plans call for completion of a 5-nanometer advance process wafer fab in less than two years.

“TSMC supports the U.S. government’s CHIPS Act. In fact, it is key to TSMC’s investment in the United States,” relates TSMC Chairman Mark Liu.

TSMC will create 1,600 jobs at the facility, and recruit 250 American engineers. The plant will produce 20,000 5-nm advanced process wafers per month, giving a major boost to U.S. manufacturing.

TSMC technical director Tony Chen states plainly, “The Arizona facility will be a copy of the Taiwan wafer fab.”

100 American engineers undergo training in Taiwan

Inside TSMC, the Arizona facility has been dubbed “Fab 21”. As construction proceeded full speed ahead in the United States, TSMC sent over 100 American engineers to Taiwan, while at the same time Taiwanese engineers prepared to head to the U.S.

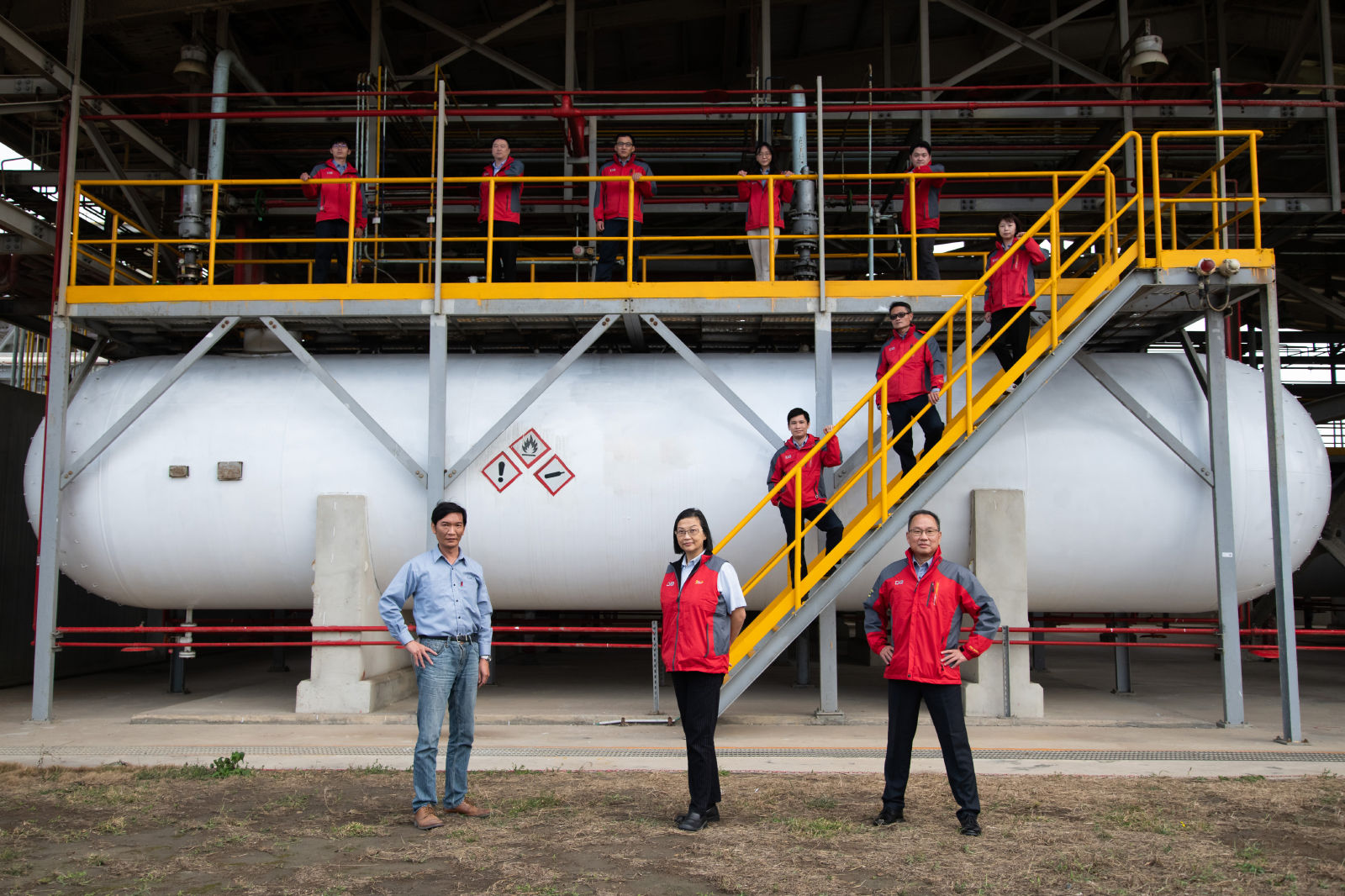

Last year, TSMC’s 15-B Fab at the Taichung Science Park hosted the training of over 15 engineers from the United States, covering six major systems including electric power, mechanics, water treatment, gasification, instrument control, and occupational safety and environmental protection. Training even included a bonus class on occupational accidents, during which engineers wore Virtual Reality (VR) headsets and resolved plant emergencies such as fires or chemical leaks.

Fan En-tzu, deputy director of plant operations development for TSMC, notes that plant operations are critical to wafer fab production, as any accidents can result in production stoppages and losses.

With assistance from VR technology, the orientation period for newly hired engineers can be reduced from six months to four.

American engineers are expected to undergo 12 to 18 months of training before returning to the Arizona plant.

At TSMC’s plant at the Tainan Science Park, by the second half of the year at the earliest, Taiwanese engineers slated to be transferred to the United States can be expected to grapple daily with the standard operating procedures (SOP) there.

(Source: David Y.)

(Source: David Y.)

“Our directive was to reproduce the 5-nm Tainan Science Park wafer fab in the United States,” revealed one anonymous engineer.

A group of engineers works assiduously day after day writing production and equipment maintenance SOP, producing exhaustively detailed charts and graphs of the Taiwan 5-nm plant production flow, and translating material into English to help the American engineers get everything right.

Great supply chain migration, land prices quadruple

“Everyone is working hard to overcome the poor overall environment, including labor and material shortages,” responded Lee Huei-wen, president of United Integrated Services (UIS), a major clean room provider for TSMC.

One supply chain insider revealed that equipment such as the specialized gas lines and exhaust systems for clean rooms use a modular approach consisting of “manufacture in Taiwan, transport of the entire plant, and assembly in the U.S.”

For instance, Chiu Ming-chien, chairman of Gudeng Precision, which supplies EUV mask packaging for TSMC, is preparing to set up an office in Arizona. “Clients worry that they won’t be able to find you when problems arise, so we’ll have to send staff to be located in the U.S. to service them.”

One staff member likened the big move to “baking bread”: semiconductor chemicals, materials, and specialty gas plants are all sent to the United States, where “the oven, flour, temperature, gases, molds, and various SOP for how you make the bread (wafer manufacturing), roasting (photolithography), spreading jam (film), and cutting, are all carried out in the same way.”

This is a completely new situation for Taiwanese vendors: moving from a low-cost country to a high-cost country, where cost planning, the language environment, assessment of the local regulatory environment, and operational strategy are completely different.

Former TSMC chief technology officer and the “Father of FinFET Semiconductors,” Chenming Calvin Hu, related in an interview that the three biggest challenges to Taiwanese vendors setting up manufacturing in the United States are “environment, talent, and cost.”

Specialty electronic gases (SEG) vendor, Taiwan Specialty Chemicals Corporation (TSCC), is preparing to lease land to build a warehouse around 15 minutes by car from TSMC’s Fab 21 facility in Arizona.

TSCC is an electronic chemicals supplier expanding to the U.S. in support of TSMC’s operations there. Other vendors purchasing or leasing land in Arizona industrial zones, including Mack Innovation Park and Casa Grande, include Kanto-PPC, the Chang Chun Group, the LCY Group, and Sunlit Fluo & Chemical.

TSCC says that it had intended to purchase land in Arizona. However, after a year of discussions and negotiations with local authorities and real estate agents, it was shocked to realize that the price of land in the immediate vicinity of the TSMC facility had quadrupled, rocketing from around US$3.5 per square foot to $18 since the announcement.

U.S. wages are also expensive. TSCC President Chang Hsiung-fei says that although the average starting salary for engineers in the United States is around US$43,000, it is impossible to find anyone for less than $60K.

(Source: Ming-Tang Huang)

(Source: Ming-Tang Huang)

Industry insiders also worry about a bottleneck in semiconductor talent recruitment. However, Calvin Hu, who teaches at the University of California, Berkeley, foresees a gradual turnaround in the U.S. semiconductor talent supply.

This is due to media coverage, which has focused the American public’s attention to the importance of semiconductors. Moreover, under the CHIP Act, the U.S. federal government will provide massive additional funding to encourage universities to train talent and strengthen related research, as evidenced by the ten-fold funding increase in 2021 over 2019. And although facilities cannot be updated to the absolute cutting edge, U.S. colleges and universities adjust recruitment quickly. Thus the introduction of more courses and projects can be expected.

Arizona State University, located 30 minutes by car from TSMC Fab 21, is taking an aggressive posture. Last July, the school introduced a certificate course in semiconductor manufacturing, and in August hired over 30 professors with expertise in manufacturing, mechanics, energy, and electronic chemicals.

“Because of strong historical roots and rapid expansion, Arizona is poised to be at the epicenter of the American semiconductor revolution,” the university’s college of engineering stated on its website, noting that companies such as TSMC, Intel, and Samsung could use more trained professionals.

“American teachers are very open to cooperating with TSMC,” offers Calvin Hu, noting that U.S. universities are hard at work trying to resolve the talent shortfall in the semiconductor field.

(Source: David Y.)

(Source: David Y.)

Willy Shih, Professor of Management Practice in Business Administration at Harvard University, focuses his research on supply management. Professor Shih offers encouragement, saying that over the mid- and long-term, Taiwanese vendors must adopt smart manufacturing, taking a page from Toyota.

Shih believes that TSMC suppliers looking to locate manufacturing to high-cost countries must employ AI and robotic learning to reduce costs, shrink scale, and raise productivity. Otherwise, he says they will find it difficult to turn a profit.

The clearest example of successful manufacturing in the United States by an Asian company is Toyota Motors, which made the move in the 1980s. Toyota was similarly forced at the time by circumstances to set up shop in the U.S., and ended up creating a Toyota miracle.

In his book The Toyota Way, Gary Convis, the first American CEO of Toyota, described the Toyota culture of “continuous improvement” and “respect for people” (workers), which successfully took root in the United States.

While Toyota’s first U.S.-based plant and its Kentucky plant are U.S. leaders, both were overseen behind the scenes by a “coordinator” dispatched from Japan, as “there was only one chance to establish the right culture” when setting up manufacturing operations in the United States.

“Continuous improvement” means precision manufacturing approaches such as increasing plant automation and accelerating workflow. At the same time, it means giving workers more creative, challenging missions to support clients and raise technical skills, explained Convis.

“Respecting people” was the key to helping Americans identify with company culture, understand its long-term ideals and be willing to devote themselves to these aims.

What made an impression on Willy Shih was that Toyota’s plant managers were all Americans. He relates that this group of managers actively helps the company think of ways to reduce costs, which is why guest workers are used extensively on the assembly line. “But only local workers understand the local legal environment, so they are able to respond to changes and reduce costs,” he says.

Apart from SOP, TSMC’s challenge is how to transplant the company’s mission and values to American soil. In late 2021, the position of “coordinator” appeared on the Careers section of TSMC’s website.

Positions currently being recruited for the TSMC Arizona fab include engineer, analytical chemist, as well as nearly 70 new positions including “global logistics management specialist” and “global supply chain specialist”.

In addition to satisfying U.S. demands, the most important thing for TSMC and its legion of allies is to find new opportunities amidst challenges; venturing into the American desert to dig up new clients and strike more of their own gold.

Have you read?

♦ Servility no longer the way to save Taiwan TSMC: no more night shifts

♦ Should Taiwan put its future in U.S. hands?

♦ Fukuyama: Taiwan doesn’t take its self-defense seriously enough

Translated by David Toman

Edited by TC Lin

Uploaded by Penny Chiang