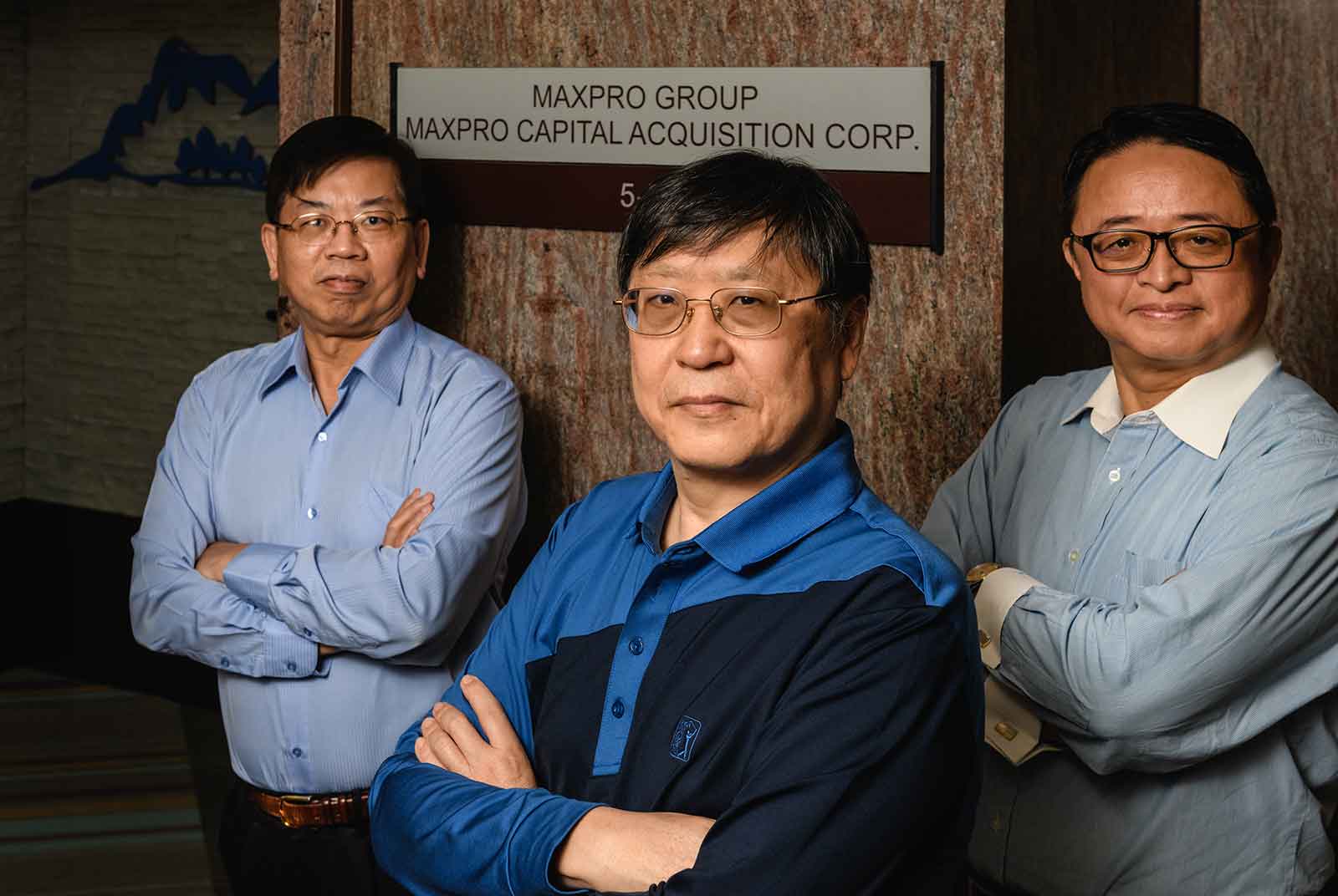

Exclusive: The team behind Taiwan’s first SPAC maker

Source:Pei-Yin Hsieh

During the second half of 2021, there was a trend among Taiwan’s unlisted companies to file for IPO on the Nasdaq in the form of a SPAC. How did the shell company MCA become the first Taiwanese SPAC to go public on the Nasdaq? Who makes up this mysterious team?

Views

Exclusive: The team behind Taiwan’s first SPAC maker

By Chiayi Linweb only

Maxpro Capital Acquisition Corp. (MCA) is a biotech startup founded in October 2021. It is the first American SPAC (special purpose acquisition company) listed on the Nasdaq that has its headquarters in Taiwan. It plans to acquire promising biotech and pharmaceutical companies in Asia, Europe, and the United States before this October.

Ever since Taiwan’s biggest unicorn startup, the electric scooter manufacturer Gogoro, announced that it would seek to go public on the Nasdaq via a SPAC deal, at least five other companies have announced their intention to follow suit.

| Category | Company Name | Stock Symbol | Acquisition & IPO Date | Funds Raised | Est. Value After Merger | Industry | Status |

|---|---|---|---|---|---|---|---|

| Acquirer | Maxpro | JMACU | 2022Q4 (est.) | 2.49 B | (TBD) | Biotech | Negotiating |

| Acquiree | Gogoro | GGR | 2022Q1 (est.) | 152 B (est.) | 650.5 B | Electric vehicles | Initiated Acquisition |

| Acquiree | Gorilla Technology Group | GRRR | 2022Q1 (est.) | 46.7 B (est.) | 195.7 B | Artificial intelligence | Initiated Acquisition |

| Acquiree | Roo Hsing Co. subsidiary | (TBD) | (TBD) | (TBD) | (TBD) | Textile | Internal evaluation |

| Acquiree | Belite subsidiary | (TBD) | (TBD) | (TBD) | (TBD) | Biotech | Internal evaluation |

| Note: 1. Includes capital increase of US$250 million (NT$6.92 billion) through private equities. | |||||||

“What the Americans call a SPAC is not a reverse takeover; rather, you form the shell corporation with the express intention of filing for an IPO,” explains Chia-heng Seetoo, Executive Director at Innovatus Law. A SPAC cannot declare its acquisition goals at the outset; true to its byname, it is a “blank check company” created by its management team from nothing to form the basis of an acquisition.

MCA is the first Taiwanese SPAC to go public in the U.S. It signifies that if Taiwanese companies want to be listed on the Nasdaq via a SPAC deal, they are no longer limited to the role of a passive acquiree. Instead, they can create their own shell corporation and take on the role of the acquirer—by becoming a listed SPAC.

How did MCA become Taiwan’s first SPAC? Its management team is made up of senior traders with backgrounds in biotech, investment banking, and accounting—a real A-Team of industry veterans.

MCA founder Alex Chen (陳奕魁) began his career at Central Investment Holdings (中央投資公司). He once made investments in Tanox, a successful Texan biopharmaceutical company founded by Taiwanese American scientists Tang Nanshan and Tse Wen Chang. In 2013, he founded an investment firm called Maxpro Ventures (創億資本). His capital came from the second-generation owners of successful companies in Taiwan’s traditional industries, as well as the owners of listed companies in the electronics industry.

According to Moses Chen (陳鴻榮), who joined Maxpro Ventures as a Managing Partner in 2018, and is now CEO of MCA, Maxpro currently manages capital amounting to US$100-200 million. It adopts the evergreen funding model, which means the business is allowed to renew its debt periodically, and a revolving credit arrangement is used to renew the debt financing, rather than having it reach maturity.

The most famous member of the management team is Ronald Song (宋雲峰), who came on board just last year. Song has worked at Goldman Sachs; he has also served as Chief Investment Officer at Chung Hwa Telecom Corp. and Managing Director at LeadSun Investment Company Ltd., among other positions. In 1997, when Goldman Sachs facilitated TSMC’s first NYSE ADR listing, Song was part of the team that made it possible.

Gao Wei Chuan (高渭川) is a famous Taiwanese accountant. He served as Managing Director of KPMG in Taiwan before retiring at the beginning of 2021. He has an accounting license in the state of New York. Last year, when electric motor company TECO was beset by an internal power struggle, Gao was listed as a potential candidate for member of the board.

MCA CEO Moses Chen has a background in biotech. He has worked as the Senior Principal Scientist in Celgene, the American pharmaceutical giant that makes cancer and immunology drugs. Since returning to Taiwan in 2013, he has worked as the Acting COO of SyneuRx International Inc. and the VP of Pharmacology at Meridigen.

According to Chen, he learned about SPACs from friends on Wall Street back in 2020. At the beginning of last year, after Gao retired from KPMG and became a consultant for MCA, he brought Song, his old friend from Jianguo High School, on board, and the whole thing started from there.

These industry veterans are giving it their all because they expect to quadruple their investment after the successful IPO.

According to the rules laid out for SPACs, compensation for the management team in the shell corporation that initiates the process comes entirely from equities after the successful acquisition. Before the IPO, the initiators usually purchased shares at an extremely low price. Altogether, they could usually get around 20% of the shares of the entire company, after it had completed the acquisition and gone public.

At that time, one share of investment would likely return four times the original value. In other words: “If you invested 2.5 dollars, you would probably get 10 dollars in return,” explains Gao.

However, the biggest risk is that a SPAC must burn money to build the shell. If it all comes to nothing, the management team gets zilch.

MCA estimates that, if you account for all the administrative, accounting, and legal fees, the total cost comes down to around US$6 million. If the deal goes through, the investment will return as stock options. If not, it’s money and time down the drain.

MCA’s next big task is negotiating the acquisition.

In its prospectus, MCA announced its plan to complete the merger a year after going public, or within 18 months at the latest. In other words, they have until October of 2022.

According to its press release, after the IPO, it will target “biotech and pharmaceutical companies worth between US$200 million and 2 billion in Asia, Europe, and the United States as a priority.”

Outside sources speculate that MCA will prioritize companies that Maxpro Ventures invested in, including ACT Genomics (行動基因生技), the Polaris Group (北極星製藥), and Eden Biologics (伊甸生醫).

MCA’s response has been reserved, saying only that they are conducting negotiations.

Gao explains that the technology, the pipeline, the management team, whether the evaluation method is reasonable, whether the accounting quality is up to American standards—all are points to consider.

The most crucial point is the scale of the evaluation.

Around mid-2021, the U.S. Securities and Exchange Commission (SEC) determined that the SPAC market was overheating, and more restrictive measures were put into place. This shrunk the value of many biotech stocks.

Because of this, smaller Taiwanese biotech companies had a hard time clearing the capital threshold in the American market.

MCA currently has around US$100 million to its name. That means its potential acquirees fall in the range of US$300-500 million in value. There are not many unlisted biotech companies in Taiwan of this caliber.

Moses Chen reveals that MCA is in talks with 20 or 30 biotech companies. In addition to Taiwanese entities,top-tier American and European companies have also approached them. MCA will work on narrowing the list down to just two or three candidates. This will be finalized around February or March.

Taiwanese companies rushing to the US: An opportunity or a crisis?

However, when all is said and done, it remains a fact that while Taiwanese companies are flying high on the SPAC wave, the fad is already waning in the U.S.

Taiwanese companies still rushing to get listed in the States face two lurking threats.

First, the SPAC is nothing new. In 2020, a multitude of factors, including hot money and the mounting pandemic, served as the springboard for the wave of SPACs.

According to statistics published by White & Case, an American law firm, 245 SPACs went public in 2020, making up 32.8% of all the companies that filed for an IPO that year. In the first three quarters of 2021, the number of new SPACs ballooned to 444—59.4% of all newly listed companies.

But in the third quarter of last year, the number of De-SPAC transactions (that is, a SPAC that successfully completed a merger) dropped down to 44, from 84 in the first quarter. This was because the SEC took measures to rein in the overheating SPAC market.

The second threat is the worry that the Federal Reserve System will raise interests. Among the first hit will be the American companies that have filed for an IPO since last year. These are the main backers behind many SPACs.

“From the perspective of an acquirer, now is the time to invest in biotech,” says Chen. If American biotech companies are in a slump, that means their estimated value would be in a more reasonable range. Which is to say, this is exactly the right time for an investor to enter the market and snatch up great bargains.

For Taiwanese companies that may be late to the SPAC market, time is their greatest asset—and their greatest reason for concern.

Have you read?

♦ The top Taiwanese App company you never heard of

♦ Grabbing the first metaverse generation! Barry Lam: Two platforms to dominate virtual space

♦ What is TSMC doing building a fab in the American desert?

Translated by Jack Chou

Edited by TC Lin

Uploaded by Penny Chiang