How Johnson became Japan’s massage chair champion

Source:Chien-Tong Wang

Fujiiryoki is a dominant massage chair brand with over a 50-percent share of the Japanese market, whose boss behind the brand is Johnson Health Technology, a Taiwanese company based in Taichung. What’s the story behind Johnson and its successful acquisition of a Japanese company?

Views

How Johnson became Japan’s massage chair champion

By Chiayi Linweb only

Japanese massage chairs enjoy great popularity with consumers. Yet two years ago, Japanese massage chair market leader Fujiiryoki became a “Taiwanese” company.

In 2020, Taiwanese exercise and fitness company Johnson Health Tech made a low-key investment of 6.241 billion Japanese yen in Fujiiryoki, acquiring a 60-percent majority share in the company. Within a year, it managed to raise profitability by 40 percent, and plans are underway to take the company public in Japan in 2025, establishing a rare record for a Taiwanese corporation’s acquisition of a famous Japanese brand.

“Johnson was interested in getting into the massage chair business more than a decade ago, and Fujiiryoki became the third key to the Johnson Group’s transformation,” explains company CEO Jason Lo. With the acquisition of Fujiiryoki, Johnson Health Tech was finally able to grow a third “leg” in addition to commercial and home fitness, giving the group the opportunity to increase revenues by an average of NT$10 billion per year over the next three years.

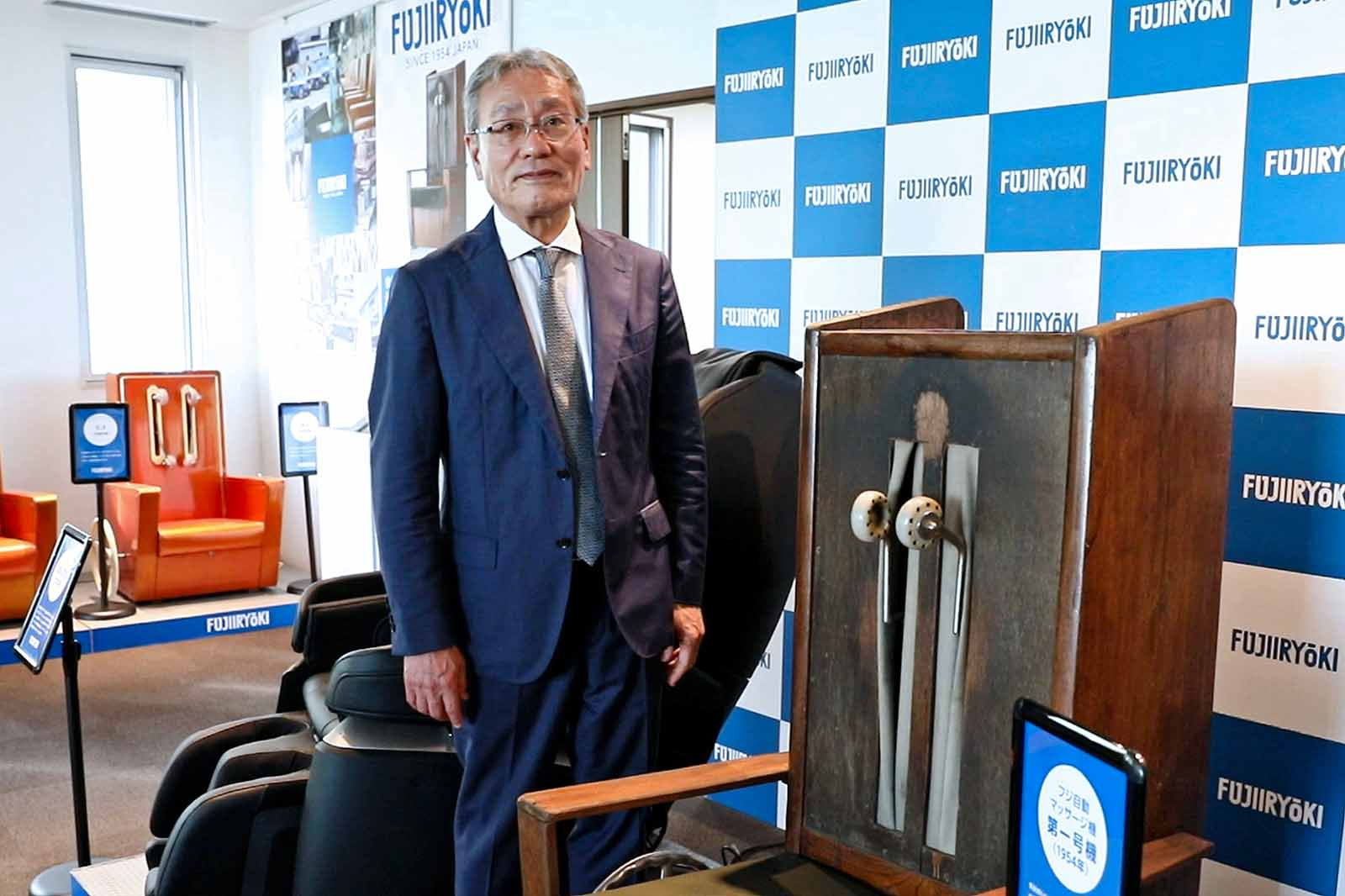

The secret weapon behind the successful acquisition was current company chairman and CEO Seiji Yasunaga, known as “the electronics store grandpa”.

Fujiiryoki’s manufacturing base is located in Taishi, around a one-hour drive southeast of Osaka, Japan. With its rolling hills dotted by grape trellises, locals call it “Japan’s Tuscany”.

(Source: Chien-Tong Wang)

(Source: Chien-Tong Wang)

In late June our CommonWealth team paid a visit to the Fujiiryoki factory, where upon entering the lobby we came across an entire row of vintage massage chairs.

In the middle stood a very old massage chair made of wood. The massage beads on the back were directly exposed, with a round wheel on the side.

This was the very first mass-production massage chair, produced in Osaka in 1954 by Fujiiryoki founder Nobuo Fujimoto.

“This wheel was a steering wheel taken from the trash,” explains 70-year-old Seiji Yasunaga. Nobuo Fujimoto, who had been making a living selling cleaning supplies at public baths, started by collecting wood and other materials from garbage piles, such as softball bats and chains. He tested the massage chairs he was developing over and over again.

Seiji Yasunaga is a high-level Japanese executive groomed by Johnson over the years since Johnson established a Japanese subsidiary in 2004, as well as a key figure in helping Johnson consolidate its Fujiiryoki ownership in the past two years.

A veteran of 32 years at Toshiba, Seiji Yasunaga retired after long stints in Germany and Spain. He joined Johnson Health Japan in 2008, overseeing the company’s fitness equipment operations.

Jason Lo relates that Yasunaga retired in his early fifties after serving for many years in overseas positions, making him a rare Japanese professional with international management experience.

However, due to his 30-odd year background in electronics products, it took some time for Yasunaga to gain acceptance among Johnson employees in Japan. Many people criticized him as “the electronics store grandpa” and claimed that he did not understand the fitness world.

(Source: Chien-Tong Wang)

(Source: Chien-Tong Wang)

After being assigned to Fujiiryoki, Yasunaga immediately noticed that after undergoing the change of company management, internal staff seemed to feel disillusioned about the company’s future. This prompted him to unequivocally state that Johnson’s acquisition was not about selling and re-selling the company, and that investment in the company would actually increase.

“Johnson Health sees Fujiiryoki as a long-term development enterprise. And this is the key to successful operations,” asserted Yasunaga.

“The secret to acquiring a Japanese enterprise is finding Japanese professionals with overseas work experience,” says Alex Wu, director of Johnson’s massage chair division.

This is because, becoming immersed in overseas living and working environments can change one’s thinking and concepts. Yet still being able to understand Japanese thinking allows such people to act as bridges between the local team and the parent company.

After Johnson formally took over the operation of Fujiiryoki in 2020, Yasunaga became director, while Wu headed up product development and overseas sales.

Combining the strengths of Johnson’s existing overseas manufacturing and global marketing and sales network, in 2021, the first full year under Johnson ownership, Fujiiryoki’s cost structure was greatly improved, and year-on-year operating profitability exceeded 40 percent.

Looking at figures from both market research company GFK Japan and Johnson’s own statistics, the number of therapeutic massage chairs sold by Fujiiryoki over the past three years continued to make up over 50 percent of total sales at big box stores across Japan.

(Source: Chien-Tong Wang)

(Source: Chien-Tong Wang)

Acquisition mindset: Establishing trust

Johnson’s successful acquisition of a Japanese brand is a story of intrepid determination amid multiple setbacks over the course of nearly a decade.

Jason Lo reveals that over a decade ago, after entering the massage chair field in 2006, Johnson had the idea of acquiring an existing brand. At the time, Fujiiryoki’s founding family had already long gotten out of company operations, and it was bought by a quasi-official Japanese venture capital firm and restructured.

In 2014, Fujiiryoki was made available for sale, and although Johnson was aggressive with the highest bid, it did not win out. The justification given was merely that Johnson “is not a Japanese company.”

Undaunted at losing the bid, Johnson sought out a subsidiary of the Asahi Group, which won the bid, to negotiate Fujiiryoki licensing and representation for Taiwan. Having succeeded, Johnson thrust itself into operations, increasing the number of Fujiiryoki massage shares sold in Taiwan by 40 percent in the first year, and doubling sales in three years.

In the meantime, the Asahi Group Holdings subsidiary that originally won the bid for Fujiiryoki, whose core business is metal recycling and which was not adept at running a consumer brand, saw no revenue growth. This led the company to come directly to Johnson and propose that it take over its holdings in Fujiiryoki.

“We had lost back then because we weren’t a Japanese company,” recalls Jason Lo. “But we learned how important trust is in Japan.”

Have you read?

♦ Despite Pandemic, Johnson Eyes Global Fitness Equipment Leadership

♦ How GlobalWafers got ready for merger failure

♦ As Peloton loses steam, Taiwan suppliers drown in inventory

Translated by David Toman

Edited by TC Lin

Uploaded by Penny Chiang