Is Intel ready to challenge Samsung, TSMC?

Source:Elaine Huang

Pat Gelsinger introduced an ambitious IDM 2.0 strategy when he took over as Intel’s CEO in early 2021 aimed at vaulting past Samsung to become the world’s second-largest contract chipmaker by 2030. Is the company on track to achieve that?

Views

Is Intel ready to challenge Samsung, TSMC?

By Elaine Huangweb only

Sept. 19 at the San Jose McEnery Convention Center. It’s Intel Innovation Day, and the event opens with Intel CEO Pat Gelsinger running out on stage, doing a couple of push-ups under the bright lights, then addressing the crowd.

Gelsinger was clearly aware that he had to make a splash to put Intel back in the public eye during the company’s most important annual event.

First Integrated NPU in an AI Notebook

During Gelsinger’s presentation, where he laid out Intel’s chip roadmap, he revealed his trump card with Acer Group Chief Operating Officer Jerry Kao (高樹國)'s help.

They held up an Acer notebook on the stage to highlight the arrival of the latest “AI PC” and previewed its capabilities. With a single click that activated the notebook’s AI computing function, an astronaut pictured on the computer’s screen becomes a 3D figure within 3 seconds.

This special feature of the new notebook, expected to hit the market in December, is powered by Intel’s new Core Ultra processor, code-named Meteor Lake. It is equipped with Intel’s first integrated neural processing unit (NPU), a power-saving dynamo capable of running AI inferences that cuts computing times in half.

A reporter with HWZone, Israel’s leading technology and hardware media, told CommonWealth Magazine backstage that he came to the event with many pointed questions, such as why the performance of Intel’s chips was lagging so far behind that of the chips used in Apple’s MacBook M1.

“Intel people really hate hearing one name, and that’s ‘Apple,’” the reporter said. But he admitted that Intel had sold him on the Meteor Lake processor.

The Significance of Intel 4

The question Intel still has to answer is whether the Meteor Lake processor, the first to use Intel 4 process technology (similar to TSMC 4-nanometer or 5nm nodes) will go into mass production on schedule. The answer could be critical in determining whether Intel regains its past glory and catches up with or even surpasses TSMC in the battle for technology supremacy.

Gelsinger confidently declared in San Jose that the Intel 4 technology was ready to be mass produced.

Intel is using advanced EUV (extreme ultraviolet) lithography for the first time to produce Intel 4 wafers, and according to a report by technology consultant IC Knowledge, the Intel 4’s performance could surpass that of TSMC’s 5 nm process.

Intel 4 chips will also be the first under Intel’s IDM 2.0 strategy, wherein Intel’s product design and manufacturing divisions operate independently. In other words, the manufacturing division will in theory be competing for Intel’s design business with TSMC. How well this works will be closely watched.

Market intelligence provider Trendforce Corp. indicated that if the Intel 4 process does not go into volume production on schedule, Intel could rely on TSMC for more new Core Ultra chips, which could drive stronger growth for the Taiwanese chipmaker in 2024.

“The key to success of IDM 2.0 will be execution,” said an executive at a Taiwanese chip foundry.

In the past, Intel outsourced about 20% of its internal chip needs, but under IDM 2.0, its product design division can issue orders to any supplier it wants, without having to feed Intel’s own foundry.

Could that mean TSMC will get more orders from Intel?

When CommonWealth posed that question to Gelsinger, he sidestepped it, but acknowledged that “we were moving wafers out…and part of the reason we were moving was because we lost leadership.”

“[If] I have better wafers at Intel at a better cost structure, well of course I’ll use more of those, but as we’ve also said, we’re going to continue to use third-party foundries,” Gelsinger said. “TSMC in particular is a very, very important partner.”

Gelsinger described Intel’s relationship with TSMC as consisting of four elements. He said TSMC is a supplier to Intel, Intel is a supplier to TSMC, the two companies are joint investors in a business, and they are also competitors, with the Intel CEO and TSMC CEO C.C. Wei (魏哲家) both vying for the same foundry customers.

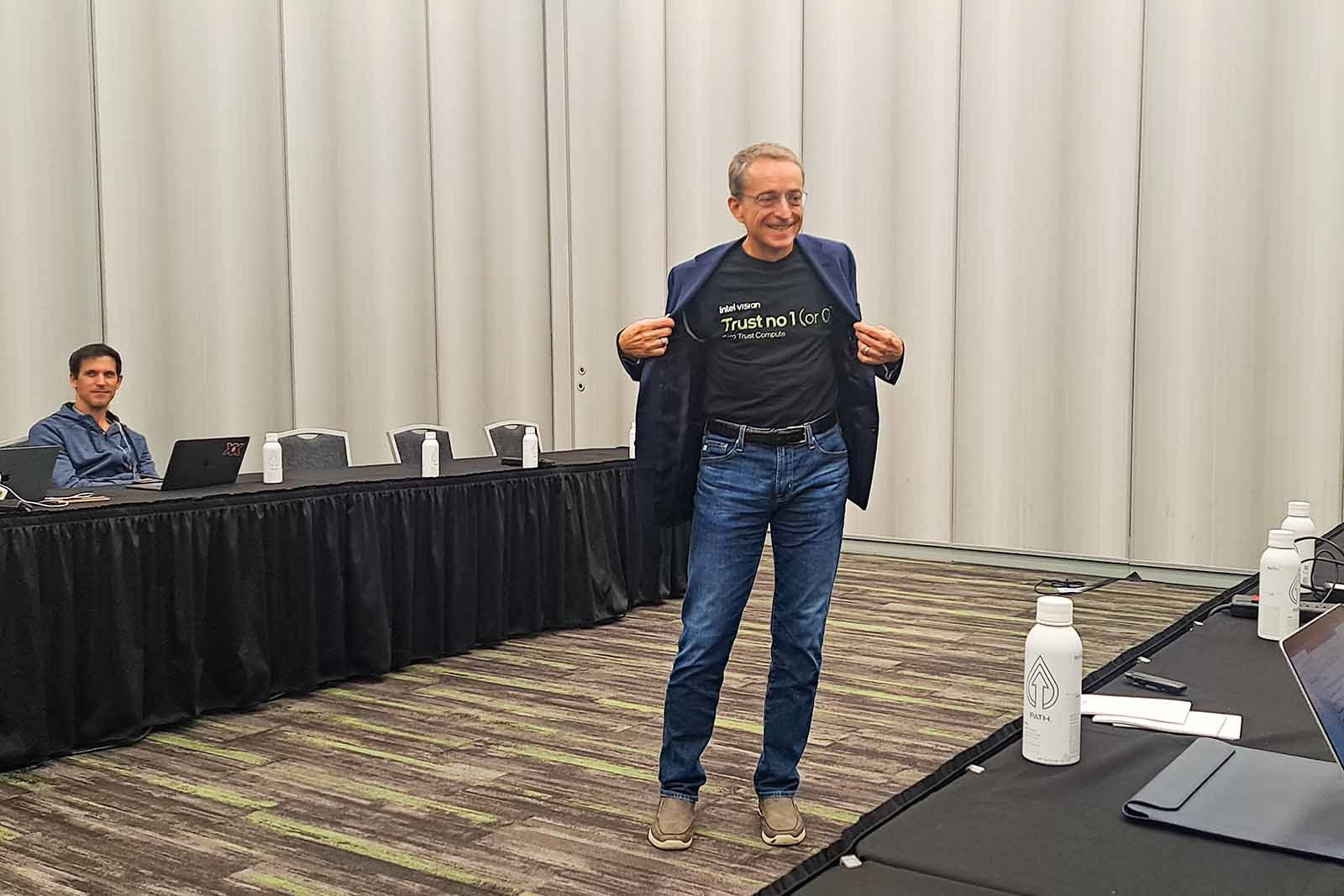

Pat Gelsinger at the press conference. (Photo: Elaine Huang)

Pat Gelsinger at the press conference. (Photo: Elaine Huang)

Redefining Intel’s Identity

In interviews with executives in the notebook supply chain, CommonWealth found that Intel will continue to rely on both TSMC and itself for components. In the volume production of Meteor Lake, for example, the graphics card will be manufactured by TSMC while the CPU will be made by Intel in house.

The hope is that the new structure will alleviate the bottlenecks of the past.

When Gelsinger took over in 2021, Intel’s design department had been repeatedly held back by delays in manufacturing, allowing AMD to gain a big edge in PC processors by using TSMC’s 7-nm process technology.

At the time, many analysts wondered whether Gelsinger, who had led 14 Intel microprocessor programs and played key roles in the Intel Core and Veon processor families, would jettison the manufacturing division and turn Intel into a fabless IC design company similar to AMD.

Instead, Gelsinger decided to separate the design and manufacturing divisions, hoping to forge a fabless semiconductor design house and contract chip manufacturing unit that work with each other.

Under that model, Intel is hoping that its manufacturing division will get orders from outside clients. Gelsinger’s goal is for Intel to supplant Samsung as the world’s second biggest contract chipmaker by 2030, while still outsourcing about 20 percent of its chip production.

At that time, Gelsinger proposed to Intel’s board an ambitious foundry strategy that most outsiders believed was nearly impossible: “five nodes in four years.” The goal was to complete the Intel 7, Intel 4, Intel 3, Intel 20A and Intel 18A processes within four years, catching up to and even surpassing TSMC’s 3-nm process.

Even Gelsinger acknowledged, however, that the pure-play foundry business, as contract chipmaking is known, is at its core a service business featuring a model that Intel was not familiar with.

So it was not surprising when the new Intel CEO announced the IDM 2.0 strategy that many analysts wondered whether the initiative was for real.

An executive, who had worked in Intel’s product department for over 20 years before returning to Taiwan to join a contract manufacturer, mentioned that based on his experience at Intel, he believed IDM 2.0 was genuine.

“It was its best option,” the executive said.

Previously, Intel’s products could only be manufactured in house, and only if the manufacturing division opted not to make an item would it be outsourced, the executive said. Under the new model, the product division will have a choice of suppliers.

“The design division has wanted to work with TSMC for a long time, but it had to stay in-house. Costs were high, and even if production was delayed, it could not assess its own company penalties for late delivery. It could only curse them out a bit,” said the source bluntly.

Halfway to the Goal

At Innovation Day, Gelsinger also showcased a wafer using the Intel 20A process, which is expected to debut as test chips in the customer computing market in 2024 under the name Arrow Lake. He said the process was doing well in the laboratory.

Intel 20A is the first process to use Intel’s PowerVia backside power delivery solution and new-generation RibbonFET gate-all-around (GAA) transistor architecture. The two technologies will also be part of the Intel 18A process, expected to go into production in the second half of 2024.

Backside power refers to routing power supply lines on the backside of a chip rather than the front side, reducing routing congestion. RibbonFET, the successor to the FinFET transistor, reduces current leakage and enables the same current in a smaller footprint, according to Intel.

When Gelsinger was asked how the “mission impossible” of five nodes in four years was progressing after two and a half years, he said, “The mission impossible journey, I’d say we’re halfway through the period. And I feel we’re halfway through the journey for it.”

Lucy Chen (陳逸萍), a senior vice president at computer contract manufacturer Inventec Corp., said, however, that Intel still had a ways to go.

“Intel is competitive in terms of technology and talent, but the development of diverse ODM/OEM services takes time to build up,” Chen said.

One example of taking a step toward that, Chen said, was Intel’s arrangement with Israel-based Tower Semiconductor Ltd. Intel had originally wanted to acquire Tower Semiconductor for US$5.4 billion to expand its foundry business. But after talks fell apart, a new model of collaboration was found, under which Intel produces wafers on a contract basis for the Israeli company.

The strategy has started to yield dividends. Faced with Nvidia’s sizable advantage in AI technology, Intel posted a loss in the first two quarters of 2023 but returned to profitability in the third quarter. Even though the gains were down year-over-year by 15 percent, they still exceeded expectations.

Intel company. (Photo: Elaine Huang)

Intel company. (Photo: Elaine Huang)

On the Road to Transformation

One Intel executive described Gelsinger with admiration in his eyes, comparing him to a missionary within the company full of strength. That was important, the executive said, because as America’s most representative semiconductor manufacturer, Intel has to make its transformation a success.

This might reflect the expectations thousands of Intel employees have for Gelsinger, but an objective look at the semiconductor landscape reveals the magnitude of the challenge facing the Intel CEO.

In this new AI era, Intel faces stiff competition from Nvidia and AMD, the recognized leaders in the AI domain. In the realm of contract chipmaking, Intel's primary challengers are TSMC and Samsung. Breaking through these headwinds will be difficult, but Gelsinger is trying to ensure that Intel’s people will maintain their fighting spirit.

Starting from his first day back at Intel in 2021, Gelsinger began overhauling Intel’s culture, hoping the company, which values engineers as its backbone, would refocus on solving engineering challenges.

As he said: “We night encourage each other for one minute and then we’re going to fixate on how we do better for 59 minutes.”

Have you read?

- TSMC founder Morris Chang: Taiwan is indispensable in global chip industry

- TSMC founder: “In the chip sector, globalization is dead.”

- TSMC's triumvirate of technologies leaves Intel and Samsung in dust

Translated by Luke Sabatier

Uploaded by Ian Huang