Thailand's electric shift: The rise of Chinese EVs threatening Japan's legacy

Source:Chien-Tong Wang

In Thailand, Japanese car manufacturers dominate 90% of the automobile production, but China leads with 80% of the electric vehicle market, highlighting Japan's slower progress in this area. If you order an Uber 6 times, 4 times you will get an electric car.

Views

Thailand's electric shift: The rise of Chinese EVs threatening Japan's legacy

By Kwangyin LiuFrom CommonWealth Magazine (vol. 783 )

At Bangkok's tourist attraction, the Golden Mountain Temple, under the shimmering golden pagoda, a pink car silently drives past a group of young monks in orange robes.

47-year-old Paweena is the accounting head of the Thai branch of a U.S. retail company. She has a youthful spirit. "I bought it just for this color. No other brands have it," she says with excitement.

This compact electric car, the "Neta V", is produced by Hozon Auto from China’s Zhejiang Province. When it was launched in Thailand last September, it caused a sensation due to its competitive price. After the Thai government's EV subsidy, it costs less than 500,000 Baht (equivalent to US$13,700). This model was the second best-selling EV in Thailand in the first half of 2023, only behind BYD.

Paweena, who owns several properties, believes that to tackle Bangkok's pollution, switching to electric vehicles is the solution. "Electric cars are the future," she says. She also has a Toyota SUV, which she plans to replace with an electric car.

In Bangkok, more and more people share her sentiment. During a week in Bangkok, CommonWealth journalists found that all recent EV buyers they spoke to had chosen Chinese brands, ranging from the US$46,000 Great Wall Haval to the affordable Neta.

Known as the "Detroit of the East", Thailand is the tenth-largest car producer in the world, with Japanese car manufacturers accounting for 90% of the total output. On the roads, Japanese brands like Toyota and Honda dominate.

However, as the industry shifts from gasoline to electric, the leader might soon change.

Electric vehicles are everywhere in Bangkok. MIH Alliance procurement manager, Annie Huang, took Uber six times during her trip to Bangkok in May; four of the rides were electric cars.

This year, Chinese brands are expected to hold an 80% market share of electric vehicles in Thailand. Last year, about 20,000 electric vehicles were sold in Thailand, with the top three best-sellers coming from China's Great Wall and SAIC. The top seller this year is BYD. Japanese brands do not even make the top ten.

Yet Thailand is not content with just importing vehicles; it wants to manufacture them locally. The automotive supply chain contributes over 10% of Thailand's GDP, providing jobs to half a million people.

Chinese auto companies like BYD, Changan, Hozon, and SAIC have all announced plans to invest in electric vehicle production lines in Thailand, aiming to produce up to 300,000 vehicles per year, a sixth of Thailand's current annual output.

Great Wall Motor's two-story, bright and spacious electric-vehicle showroom in the Iconsiam shopping mall. (Source: Chien-Tong Wang)

Great Wall Motor's two-story, bright and spacious electric-vehicle showroom in the Iconsiam shopping mall. (Source: Chien-Tong Wang)

The main reason is policy guidance. Krisda Utamote, the chairman of the Electric Vehicle Association of Thailand (EVAT), pointed out that the government provides a subsidy of up to 150,000 Baht per vehicle. The higher the local production ratio, the more subsidies are given, which will continue until at least 2025.

There are over two thousand companies in Thailand's gasoline vehicle supply chain. "Faced with the EV revolution, we need to prepare our supply chain for the future," Krisda emphasizes.

A decade ago, China's Belt and Road Initiative focused on infrastructure development. Today, the initiative has shifted to batteries and electric vehicles.

"Now, with Chinese EV companies setting up factories in Thailand, it's like the Japanese car invasion of the U.S. 20 years ago," says Jack Cheng, CEO of Taiwan’s MIH Open EV Alliance. He believes that Chinese EV brands will eventually outpace their competitors, and Thailand will be their first stronghold.

Evidently, a significant shift in Thailand's auto industry has already begun.

One of the main battlegrounds is an hour's drive north of Bangkok, in an industrial zone in Ayutthaya.

From Japanese and American clients to Chinese EVs

Workers wearing safety goggles are operating laser cutting machines, preparing aluminum frames for the Vietnamese EV startup, VinFast.

Several giant die-casting machines are producing pickup frame parts for Ford.

This is Aapico, Thailand's leading auto parts listed company, with an annual turnover exceeding 28 billion Baht. No one would dare challenge their claim to being number one in Thailand.

Attar Feng, originally from Hsinchu, Taiwan, is the only Taiwanese in the group. He has been in the automotive electronics industry for over 20 years and has been in Thailand for the past five, serving as the general manager of one of the group's automotive electronics companies. A few months ago, he met with Jack Cheng to discuss collaboration opportunities.

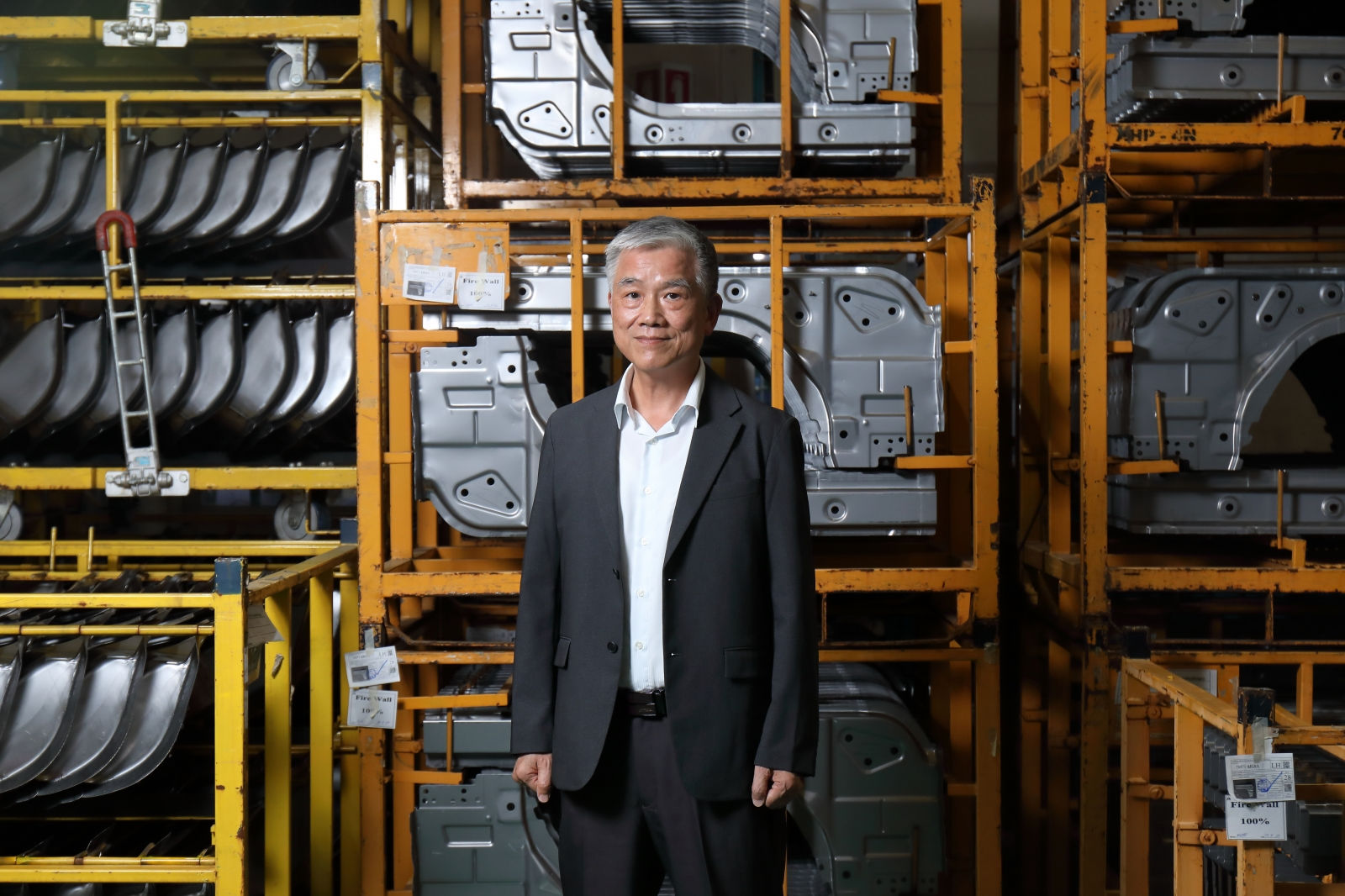

Attar Feng. (Source: Chien-Tong Wang)

Attar Feng. (Source: Chien-Tong Wang)

Because, to build cars in Thailand, one would most likely need to do business with them.

Aapico specializes in frames, the skeletal structure that supports all parts and mechanics in a car. 40% of their business comes from the Japanese brand Isuzu, but American brands like Ford, Dana, and Japanese brands Toyota and Nissan are also crucial clients.

Their current customer base, mainly Japanese and American brands, might soon see a major reshuffle as Chinese clients are flooding in.

Every Chinese EV company setting up a factory in Thailand has approached Aapico.

Feng revealed that they are in the final stages of collaboration talks with BYD. Other potential clients include Great Wall, SAIC MG, Changan, Neta, and Foxconn's Horizon+.

Most of Aapico's parts are interchangeable between gasoline and electric cars. They can produce thousands of products, from frames and chassis to internal plastic fittings, with the only difference being the lighter materials for EVs.

They even bought a BYD electric car a few years ago to dissect and found that they could produce 90% of the parts.

However, what about Japanese companies? Aren't they planning for electric vehicles? Feng just shrugged and shook his head.

Japanese automakers' dominance fading

Even the Japanese are concerned about their companies falling behind in the EV race.

"The Japanese auto industry is facing significant challenges," says Yoshinori Kameyama, the general manager of a Japanese trading company who has been stationed in Thailand for seven years, expressing his concerns.

Something recently shook his confidence in Japanese car companies’ future.

"A senior executive friend from a Japanese company recently bought a hybrid car from Great Wall Motors. I was shocked," says Kameyama. This friend was a devoted Toyota user. The fact that he chose a Chinese brand indicates the changing winds.

As gasoline cars remain profitable, turning such a large ship is no easy task.

Jack Cheng points out that Toyota's profit this year exceeded one trillion Yen, almost doubling from the previous quarter. High profits from internal combustion engine cars mean that the transition to electric vehicles will continue to stall, making it harder in the future.

That's why he believes China will overtake Japan in the EV race in Southeast Asia.

And Thailand is already prepared to ally with the strongest.

China's ambition to dominate the developing markets

"Thailand's ambition is to maintain its status as a major car-producing hub," says Syetarn Hansakul, a Senior Analyst at The Economist Intelligence Unit. "The strategy is to follow global automotive trends. Whether it's Japanese or Chinese companies leading the game, we need to collaborate."

(Source: Chien-Tong Wang)

China currently produces 10 million electric vehicles a year, but the production capacity is at least three times this number.

"Markets outside the U.S. will see significant changes," Cheng says. "Consumers will vote with their money."

He is referring to consumers mainly from developing countries, including Southeast Asia, Eastern Europe, and North Africa. These populations account for 75% of the world and are three times the population of developed economies.

"I believe that Japanese automakers are following in the footsteps of Nokia from years ago," says Veena, a senior Thai journalist. When she asked her friends working in Japanese car companies, "Why aren't you producing electric cars?" they couldn't answer. What surprised her even more was that they weren't even worried.

"I can already see that they will be replaced," says Veena.

A silent war is taking shape.

What's happening in Thailand right now may happen in Europe in the next 20 years, dethroning proud century-old auto giants.

Just like the moral of the tortoise and the hare: Even if the hare starts faster, if it becomes complacent, the tortoise will eventually overtake it.

Have you read?

Uploded by Ian Huang