Why is Foxconn building "AI factories" with Nvidia?

Source:Pei-Yin Hsieh

Nvidia founder Jensen Huang was the special guest at Foxconn's 2023 Tech Day. He announced that the two tech giants were joining forces to build "AI factories". What does that mean?

Views

Why is Foxconn building "AI factories" with Nvidia?

By Meng-hsuan Yangweb only

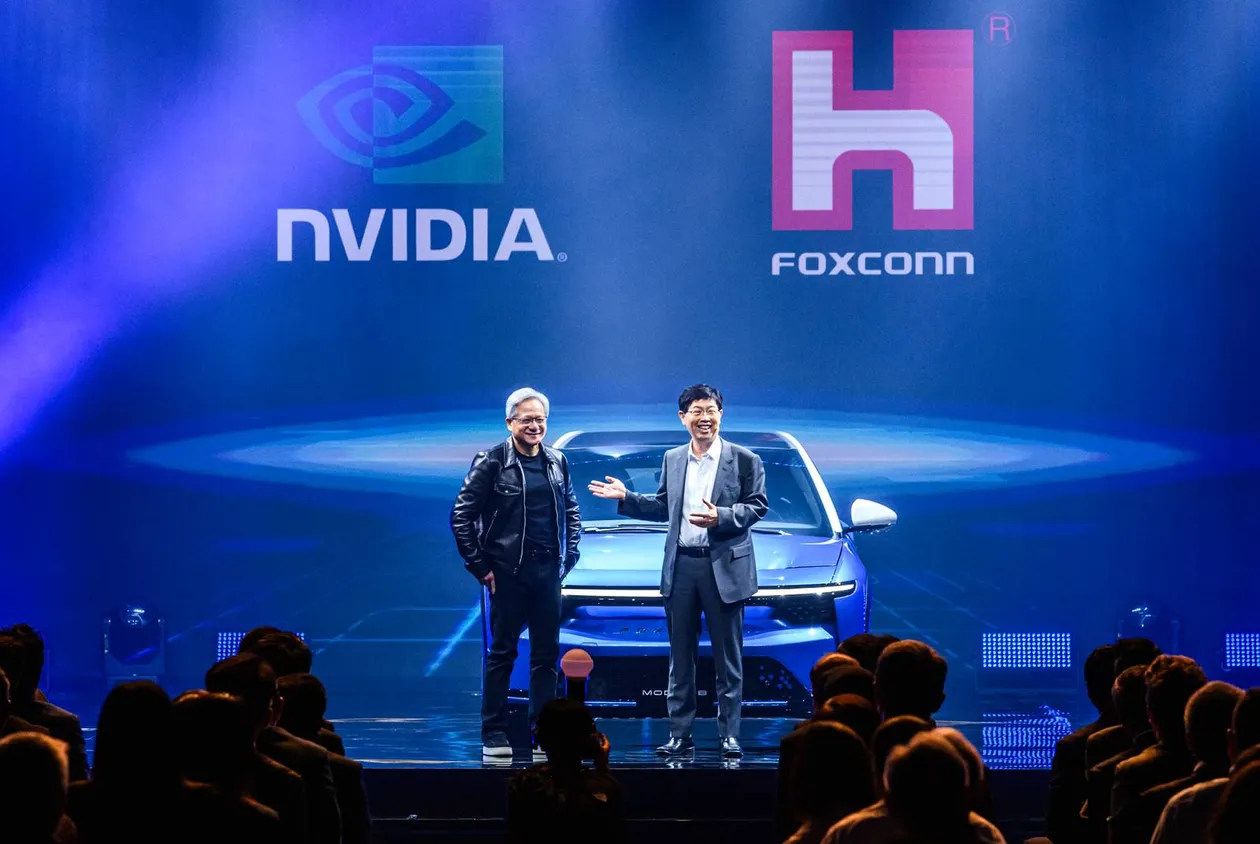

During the Hon Hai Technology Group (Foxconn) Tech Day on Oct. 18th, Foxconn Chairman Young Liu (劉揚偉) and Nvidia founder and CEO Jensen Huang (黃仁勳) made a grand entrance by driving on-stage in a Model B electric vehicle.

The highlight came when Huang projected his hand-drawn sketch of his vision of an "AI factory" on the big screen. He explained that Nvidia's partnership with Foxconn has progressed from providing AI servers to designing AI solutions powered by Nvidia's cutting-edge GH200 AI chip.

Jensen Huang and Young Liu, CEO of Nvidia and Foxconn Chairman. (Source: Pei-Yin Hsieh)

Jensen Huang and Young Liu, CEO of Nvidia and Foxconn Chairman. (Source: Pei-Yin Hsieh)

What is an "AI factory"?

The concept of an "AI factory" may sound similar to smart factories and Industry 4.0, but it's actually something completely different.

An AI factory doesn't build things with AI. Instead, it manufactures AI solutions and other "smart" products.

According to Nvidia, the AI factory is an Nvidia GPU computing infrastructure specially built for processing, refining, and transforming vast amounts of data into valuable AI models.

On the piece of notepaper displayed by Huang, there's an electric vehicle on one side with AI at the wheel, which can navigate the roads and interact with humans on its own; and on the other side, there's an AI factory that receives a continuous stream of data from the electric car, which it uses to develop a plethora of new software that's more suited to the electric vehicle's needs.

"An AI factory ingests information and produces intelligence," says Huang excitedly. This is a whole new method to design software—by using supercomputers to design software in ways that humans can't.

Liu adds that an electric vehicle is outfitted with many sensors that collect data and convert it to tokens. The AI factory processes the tokens and produces better software, AI models, and solutions that will make electric cars more intelligent.

(Source: Pei-Yin Hsieh)

(Source: Pei-Yin Hsieh)

Creating the optimized AI loop

This is how the two tech companies are cooperating: Foxconn builds the electric cars, which are then outfitted with Nvidia's autonomous mobile robot platforms. The platforms collect and transmit data to the AI factories, completing a continuous, virtuous loop.

"This is the factory model of the future. There are smart factories that produce cars, and there will be smart factories that can build AI. The two kinds of factories will complement one another and continue to create value," says Huang with enthusiasm.

The AI factory model will not only be for electric cars. Foxconn plans to implement this in smart cities and smart manufacturing. In this way, Foxconn will no longer be only making hardware for its clients, but also providing hardware and software solutions.

"The AI factory can extend to every industry. In the future, AI may generate press releases for your company, optimize SOP on the back end, and more," explains Liu during the press conference.

The supercomputing power necessary for these AI factories to function comes from the supercomputer product that Huang announced during Computex this year. The Nvidia DGX GH200 is a computing platform outfitted with 256 Nvidia Grace Hopper Superchips.

Huang elaborates that an AI factory may have multiple supercomputers of this caliber.

In addition to the DGX GH200 supercomputer, there are other products based on the GH200 that's entered trial production. Mass production is slated for early next year. Clients that have already placed orders include Dell and Hewlett Packard, which will mainly use the servers to train enterprise-grade AI models.

However, a senior analyst focused on downstream hardware products tells CommonWealth Magazine that most Taiwanese server contract manufacturers have adopted a "wait-and-see" attitude regarding the GH200. "Jensen is passionate and he wants to sell to enterprises, but his products are very expensive," the analyst says. At the end of the day, the price tag is still a major barrier to entry.

(Source: Pei-Yin Hsieh)

(Source: Pei-Yin Hsieh)

Foxconn AI servers dominate the entire value chain

Even so, the fact that Foxconn invited Huang to speak at their Tech Day shows how closely the two tech giants are working together. One of the products on display at the event was the HGX-1 AI server powered by P100 GPU, built by Foxconn, Nvidia, and Microsoft in 2017. Foxconn and Wistron are the only two Taiwanese systems providers that are listed on Nvidia's official vendors list.

In terms of their scope of cooperation, Foxconn one-ups Wistron by participating in nearly every part of the AI server value chain, from upstream to downstream.

During the investor conference in August, Liu explained that Foxconn makes every part of the server, from the GPU module to the baseboard, from the motherboard to the entire server rack. "We are the only provider that makes every part of the AI server."

"The profit margin of chip modules is over 10%," observes an analyst focusing on downstream hardware systems, who works for a major Taiwanese securities firm.

As soon as Nvidia's GPU chips for AI servers have been packaged by TSMC with its new CoWoS technology, they are sent to Foxconn Industrial Internet (Fii). Its entire production capacity is devoted to manufacturing Nvidia's GPU modules.

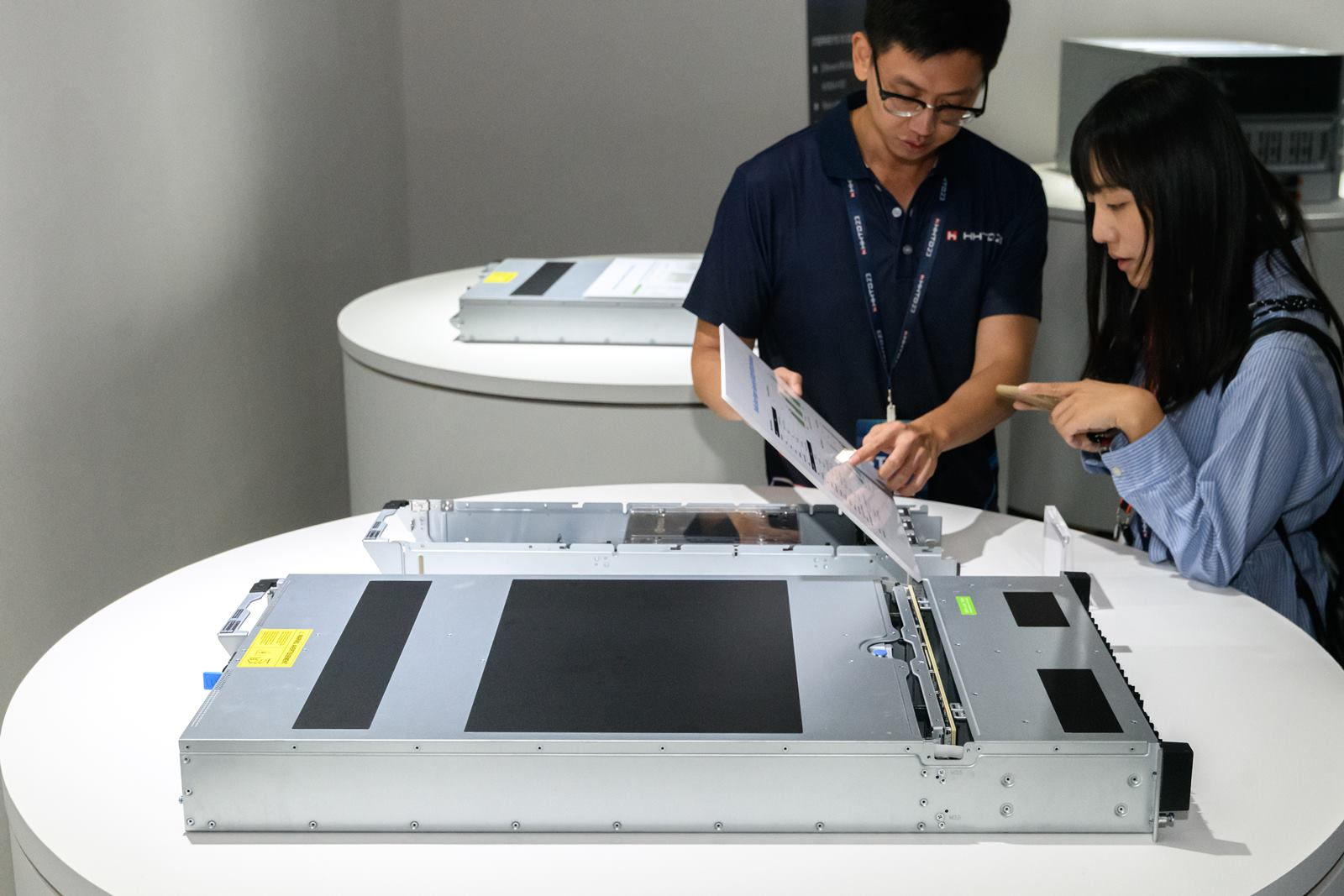

GH200 of Nvidia. (Source: Pei-Yin Hsieh)

GH200 of Nvidia. (Source: Pei-Yin Hsieh)

In the past, Wistron controlled a lion's share of the GPU baseboard assembly market. Fii has made a lot of headway, however. It also does contract work for motherboards, systems, and entire servers.

Foxconn is the AI server market leader

"It makes business sense for chip modules to be assembled at the same company that puts together the baseboards, since the two can be shipped together," says the analyst who specializes in downstream hardware products.

In its October report, Morgan Stanley forecasted that Foxconn will control 24% of the AI server market in 2023, surpassing Quanta Computer's share of 22% to become number one in the world.

From AI servers to AI factories, Foxconn and Nvidia are jointly leading the computing revolution in the era of generative AI.

Have you read?

- How Taiwan’s Andes Technology makes Facebook’s AI chips

- OpenAI founder Sam Altman: Nuclear fusion could meet Taiwan’s clean energy needs

- AI medical records assistant Copilot

Translated by Jack Chou

Uploaded by Ian Huang