The screw triggering a battle worth NT$200 billion

Source:Ming-Tang Huang

The EU carbon tariff will have a significant impact on Taiwan's small and medium-sized enterprises. According to a survey by CommonWealth Magazine, 80% of SMEs feel pressure to reduce carbon emissions, but less than 20% have concrete plans. We visited the sites of the screw industry in southern Taiwan to understand how SMEs are catching up with emission reduction goals.

Views

The screw triggering a battle worth NT$200 billion

By Kaiyuan TengFrom CommonWealth Magazine (vol. 777 )

This butterfly effect that unfolded on the Atlantic coast affected the screw communities in southern Taiwan. On December 12th last year, after ten hours of negotiations, Pascal Canfin, Chairman of the European Parliament's Committee on the Environment, Public Health and Food Safety, announced at a press conference at the headquarters of the European Parliament that the EU carbon tariff would be implemented. The EU carbon tariff, also known as the Carbon Border Adjustment Mechanism (CBAM), will impose taxes on industries with high carbon emissions such as steel, cement, aluminum, and fertilizers.

The European Union's carbon tariff is on its way, and the steel industry, which has a high carbon footprint, is the first to bear the brunt. (Source: Ming-Tang Huang)

The European Union's carbon tariff is on its way, and the steel industry, which has a high carbon footprint, is the first to bear the brunt. (Source: Ming-Tang Huang)

Taiwan's exports in these industries are relatively low. Therefore, people did not notice the addition of terms such as "screws" and "bolts" in the announcement.

Two weeks later, the meeting minutes were published, and the carbon tariff scope included not only steel products but also products such as screws, nuts, and washers.

This will be a huge blow to Taiwan.

"On the one hand, the EU claims to love the Earth, but this is also a new trade barrier," said Tsai Tujin, Chairman of the Screw Industry Association.

Taiwan is the world's second-largest exporter of screws, with over 1,800 screw companies and nearly 40,000 employees. In 2022, the export value of the screw industry approached NT$200 billion (US$6.2 billion), of which one-fourth came from Europe, about NT$50 billion. Screw manufacturers say that if they do not meet the requirements of the carbon tariff, they will face up to an 8% loss in gross profit, which will be a huge impact.

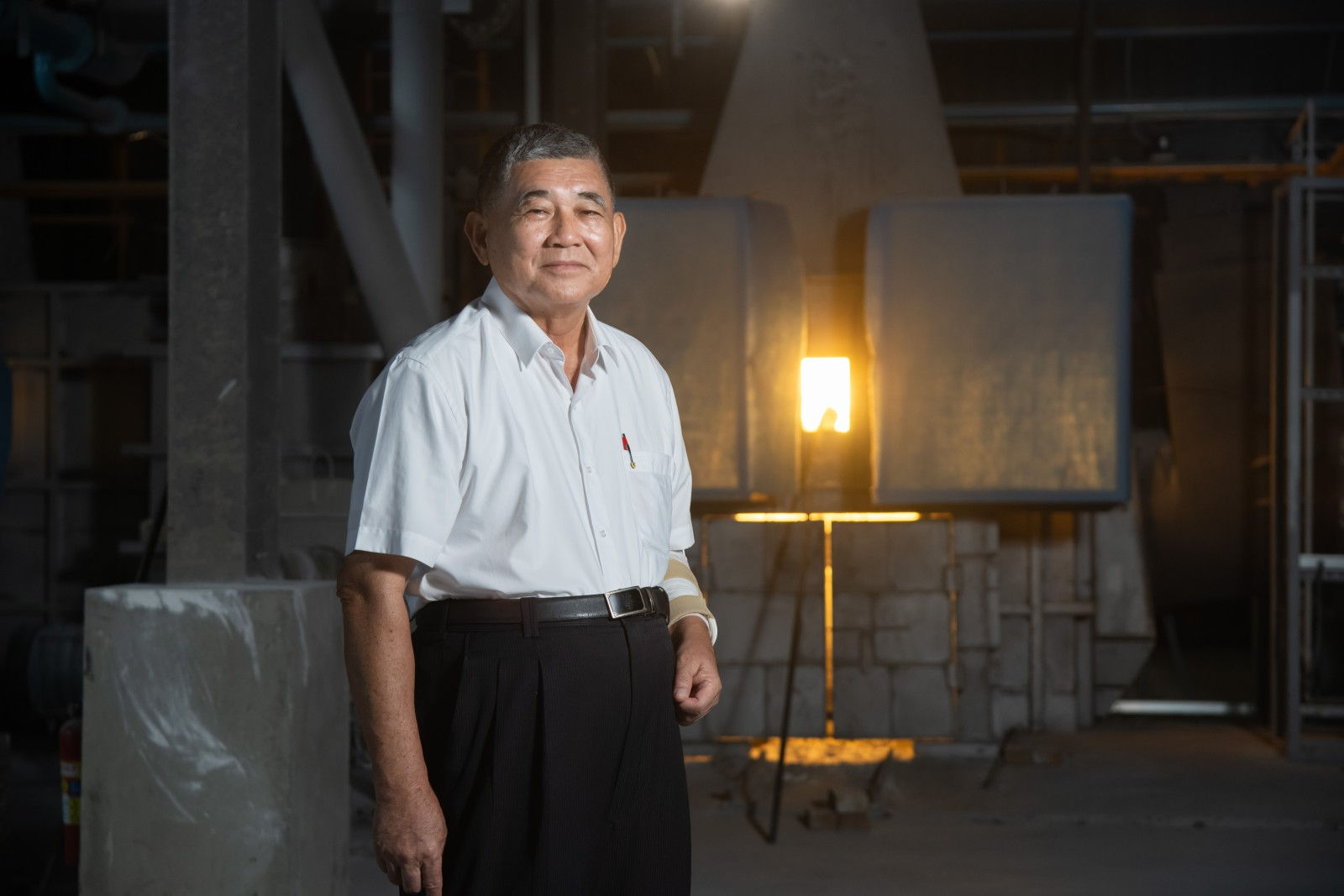

Tsai Tujin, Chairman of the Screw Industry Association. (Source: Ming-Tang Huang)

Tsai Tujin, Chairman of the Screw Industry Association. (Source: Ming-Tang Huang)

This carbon tariff incident demonstrates that Taiwan's export-oriented small and medium-sized enterprises will face an inevitable green barrier. The reason for the EU's proposed carbon tariff is that the carbon emissions quota for high-carbon industries within the region, such as steel, cement, and power plants, will gradually decrease from 2026 and be completely eliminated by 2034.

In order to prevent production costs from rising due to carbon tariffs and businesses relocating to low-cost countries without taxation, resulting in carbon leakage, the EU must impose import carbon taxes on high-emission products from outside its borders. The EU has also expanded the scope of carbon taxes to downstream industries in high-carbon industries, so even small steel products like screws will not be overlooked.

More challenges are yet to come. Lee Chien Ming, a professor at National Taiwan University's Institute of Natural Resources and Environmental Management, believes that after the EU sets the precedent, countries will accelerate legislation to vie for tax jurisdiction, and the actions of Taiwan's important trading partner, the United States, must be closely watched. The U.S. version of the carbon tariff, the "Clean Competition Act," has now entered the second reading stage and has a broader tax scope than the EU, including fossil fuels, refineries, petrochemicals, fertilizers, hydrogen, adipic acid, cement, steel, aluminum, glass, pulp, paper, and ethanol, all included in the draft.

"(The US) may take the lead in 2024 or 2025, and it won't be a trial; they want to be the leader," observed Chen Bao-lang, Chairman of Formosa Plastics. Americans always like to be ahead of others and are more stringent.

The EU carbon tariff decision shows that the scope of taxation in the EU and the United States may expand downstream. Chen believes that Taiwan's proportion of exports of petrochemical raw materials to the United States is low, but the US is likely to trace downstream, such as automotive plastic products.

Lee also mentioned other industries to watch out for, such as bicycles, plastics, and textiles.

When it was confirmed that screws were included in the tax range, the entire screw industry fell into panic. Ji Xiangying, a senior analyst at Metal Industries Research & Development Centre, said, "We were also very shocked."

Chen Mei-jung, Managing Director and Global Partner of Boston Consulting, said that many years ago, Boston Consulting was helping the German government and car manufacturers analyze how to decarbonize the entire automotive supply chain. However, because Taiwanese screw manufacturers rarely have direct contact with brands and instead sell their products to distributors, they have not yet realized that the pressure to decarbonize has already arrived at their doorstep.

As a current measure, Chen believes that screw communities should be more proactive and actively participate in the carbon reduction plans of their brand customers. "If you are still defending, you will be easily thrown out of the supply chain."

Starting from the southernmost point of Taiwan and heading north, crossing Kaohsiung and Tainan, alongside a provincial road covering just 20 kilometers, is home to over 700 screw factories. Seventy percent of Taiwan's screw exports come from this region.

Entering the factory of the 50-year-old Sheh Fung Screws Co., Ltd., the smart production line has just been put into use. Automated Guided Vehicles (AGVs) have replaced traditional overhead cranes, and electric stackers and AI-powered production lines have been introduced, making it different from the traditional screw factories with strong oil smells and dim lighting.

According to an exclusive survey by CommonWealth Magazine, Taiwan's small and medium-sized enterprises have relatively weaker capabilities in dealing with carbon reduction. A survey of the CommonWealth 100 Fast Growing SMEs revealed that 60% of enterprises have not completed carbon audits, 80% have not set carbon reduction goals, and 50% cited a shortage of talent.

The sudden impact of the carbon tax on the screw industry indicates that Taiwan's export-oriented small and medium-sized enterprises will inevitably face a green trade barrier.

The reason the EU has proposed a carbon tariff is that the carbon emission quotas for high-emission industries within the EU, such as steel, cement, and power plants, will gradually decrease starting in 2026 and be completely eliminated by 2034.

Take for example a screw manufacturer that sells to large automobile manufacturers like BMW, the gross profit margin for automotive screws is relatively high, at about 15% to 20%. If they do not meet the standards, the carbon tariff will consume 8% of the gross profit margin, which will have a severe impact.

During the survey, we interviewed some enterprises that are racing to reduce carbon emissions. For example, Copa Flange Fasteners Corp and Hu Pao Industries Co., Ltd. have begun conducting carbon audits and digital transformations. Copa has achieved optimization of the production process through smart production lines and energy consumption monitoring systems while also collecting carbon emissions data for the entire life cycle of screws. Hu Pao has introduced various carbon reduction measures, including recycling lubricating oil, using 3D drawing software, and testing steel made from recycled materials.

Sheh Fung is a successful case where digitization and carbon reduction are progressing simultaneously. In the early days, there was confusion between different departments, and reports from business units, production units, and finance units could not be reconciled. "Because we focused on different timeframes, we spent a lot of time on numbers, and there was no time to discuss the real issues," said Chen Junyan, General Manager of Sheh Fung.

In addition to the decreasing customer demand for smaller quantities and more varieties, Chen made up his mind to gradually move towards digitization and smart management in production and operations. To synchronize the data, Sheh Fung installed sensors on the machines, allowing real-time information to be shared between the field and managers.

Chen explained that installing sensors on the production line enables them to know which processes each screw has gone through and how much energy has been consumed. This can be used for management optimization, and energy consumption data also becomes the basis for calculating carbon emissions.

To reduce carbon emissions, Sheh Fung's General Manager, Chen Junyan, has gradually introduced electric transportation equipment, such as electric forklifts. (Source: Ming-Tang Huang)

To reduce carbon emissions, Sheh Fung's General Manager, Chen Junyan, has gradually introduced electric transportation equipment, such as electric forklifts. (Source: Ming-Tang Huang)

With a digital foundation, Seefeng can collect energy consumption data from the machines in the factory (Scope 1) and the factory's electricity consumption (Scope 2). Now, they are also preparing to collect the total carbon emissions for the entire life cycle of screw manufacturing, including materials, transportation, and shipping abroad (Scope 3).

The company does not rule out setting up a factory in Poland to reduce carbon emissions. "We have visited Poland. Assuming the EU requires our products to achieve carbon neutrality, the land and labor costs there are similar to Taiwan. Customers have actually discussed this issue with us, and carbon emissions will bring some changes to the future layout of production and manufacturing," said Chen.

Sheh Fung’s proactive deployment and consideration of various carbon reduction possibilities are essential. Chen said, "Customers didn't force us to do these things, but doing them benefits the customers. We hope to become partners with our customers."

Another proactive example is Hu Pao Industrial located in Tainan, where the second-generation Wang Wenxin recently became the General Manager.

Hu Pao is one of the few screw manufacturers that have set specific carbon reduction targets and have clear implementation plans. In addition to applying for various government programs, Hu Pao also collaborates with external consultants.

Behind each screw forming machine in Hu Pao, there is a connected pipeline for collecting oil and gas. "The recovered lubricating oil is very clean and can be recycled," said Wang.

Additionally, it has introduced 3D drawing software. Wang explained that in the past, the screw industry relied on manual drawings, but constant modifications often led to problems with mold dimensions. "The more precise the mold dimensions are, the longer its lifespan will be, the higher the yield will be, and the waste will be reduced."

Sprinting towards hydrogen steelmaking

Since steel was included in the carbon tariff program, everyone from the chairman to the R&D department heads at China Steel Corporation has been working tirelessly to reduce carbon emissions.

Over the past few months, CSC employees responsible for carbon auditing have expanded their work beyond the factory walls. They have reached out to steel and screw manufacturers downstream to assist those who are not yet capable of conducting carbon audits, helping them start from scratch. "We teach them how to conduct carbon audits step by step," said Chen Shou-dao, Deputy General Manager of the Production Department at CSC, who leads the "big guiding small carbon reduction team" in the steel industry.

The global iron and steel industry is in the midst of a carbon reduction war, and the results of China Steel's transformation will affect the fate of downstream industries such as iron and steel and screws. (Source: Chien-Tong Wang)

The global iron and steel industry is in the midst of a carbon reduction war, and the results of China Steel's transformation will affect the fate of downstream industries such as iron and steel and screws. (Source: Chien-Tong Wang)

CSC's carbon reduction efforts span four departments and involve the establishment of a carbon reduction and carbon neutrality promotion task force. Progress is reviewed every quarter. "After the chairman reports, we also have to report to the board of directors," said Cheng Ji-Chao, Deputy General Manager of the Technical Department at CSC.

Regarding the screw industry, Cheng said that China Steel Corporation is adding various alloys to steel materials and selling them to screw manufacturers. By adding these alloys, the manufacturers no longer need to go through the heat treatment process, as the material strength meets customer requirements, saving a production step.

However, this alone is far from enough.

Steel industries worldwide are racing to develop hydrogen-based steelmaking, and CSC is also engaged in research and development in this area. Chen Shou-dao explained that the principle of steelmaking involves the reaction of coal and iron ore's iron oxide in a blast furnace, removing the oxygen from the iron oxide to produce pure iron. However, the byproduct is carbon dioxide, becoming CSC's largest source of carbon emissions. If hydrogen is used instead, the byproduct would only be water. Therefore, steel plants worldwide are researching hydrogen-based steelmaking, hoping to develop carbon-neutral steel materials.

However, CSC is concerned about insufficient funding. Chen stated that a large Japanese steel company, one of the largest in scale, has already invested 500 billion yen in research and development, with another 5 trillion yen to be invested in the future for upgrading blast furnaces and other equipment.

Furthermore, the challenge lies in the fact that if hydrogen is to be used extensively, the most feasible option currently relies on imports. Japan has begun building hydrogen storage facilities and infrastructure for transporting hydrogen by ships. However, Taiwan's hydrogen energy policy is still in its infancy.

"If we can't make the transition, the screw industry won't be able to either. It will be disastrous for everyone. This is no longer just an environmental issue; it's an economic problem and even a matter of survival," Chen emphasized.

Overall, the speed at which Taiwan's screw industry is responding to carbon reduction is slower, and there is a risk of being excluded from the supply chain. Experts recommend that screw manufacturers accelerate the pace of carbon reduction upgrades, improve their energy-saving and carbon reduction capabilities, actively seek cooperation with the EU to meet the requirements of the carbon tariff, and that the government provide corresponding support and guidance to strengthen the carbon reduction capabilities of small and medium-sized enterprises, and promote industry upgrades and transformations to address the challenges brought by the carbon tariff.

In summary, the EU carbon tariff will have a significant impact on Taiwan's screw industry. Screw and fastener manufacturers should accelerate carbon reduction upgrades, improve their energy-saving and carbon reduction capabilities, and seek cooperation with the EU to ensure compliance with the carbon tariff requirements. The government should also provide support and guidance, promote industry upgrades and transformations, and help small and medium-sized enterprises cope with the challenges of the carbon tariff.

Have you read?

- What should Foxconn do about its money-losing Sakai plant?

- Why did Formosa Plastics build its own desalination facility?

Uploaded by Ian Huang