Are Taiwan’s drone makers ready for action?

Source:Pei-Yin Hsieh

Drones have featured heavily in conflicts around the world, and Taiwan is hoping that locally made commercial-grade drones can gain traction domestically and internationally. CommonWealth Magazine looks at some of the key private players involved in the initiative.

Views

Are Taiwan’s drone makers ready for action?

By Ching Fang Wuweb only

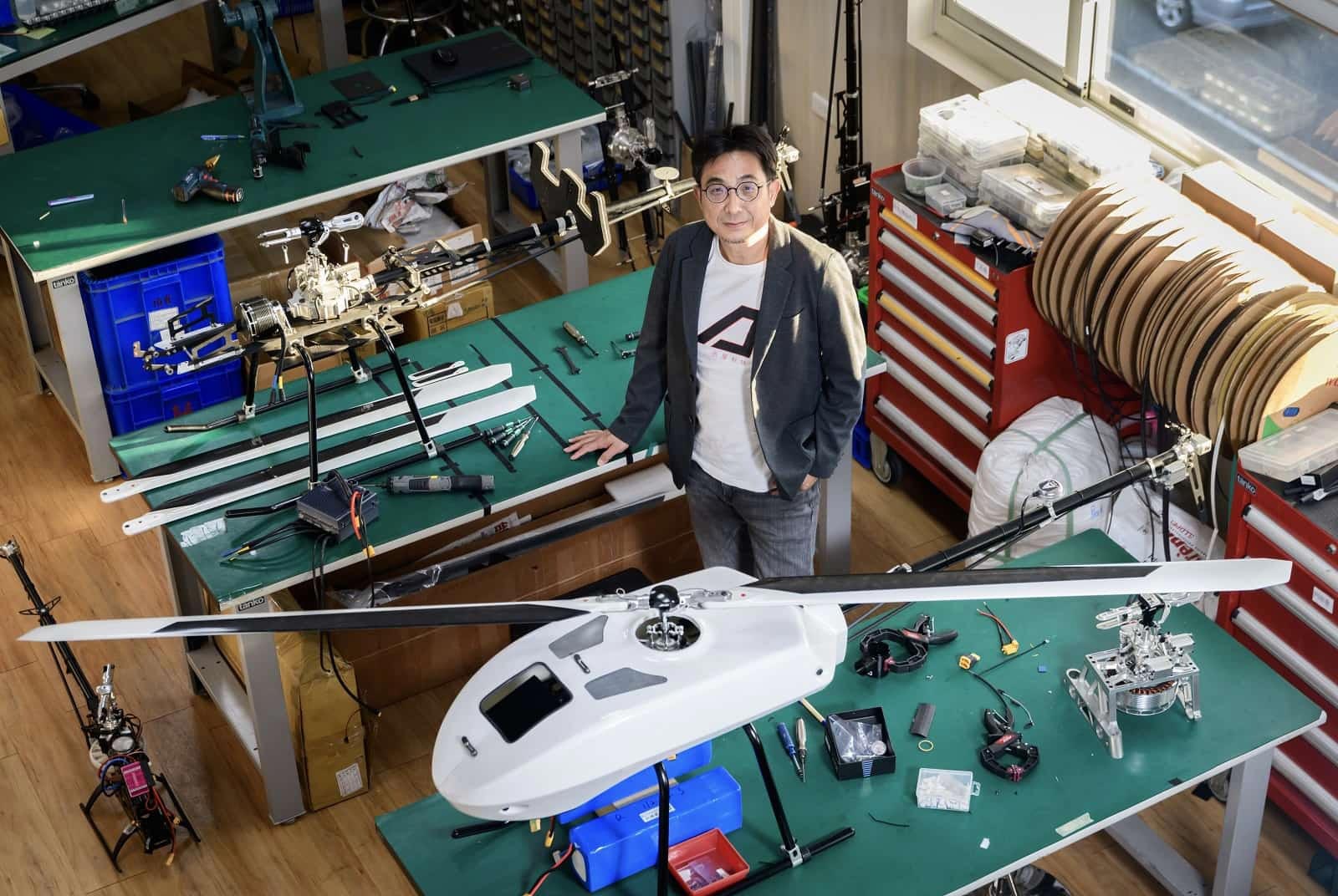

The chairman of Tai Shih Hobby Corporation (Gaui) Chuang Chung-ming (莊宗明) clutches a remote control device on the top floor of his corrugated steel factory in New Taipei’s Bali District, his eyes glued to a drone carrying a fuel tank and other heavy objects.

The chairman of Tai Shih Hobby Corporation (Gaui) Chuang Chung-ming. (Photo: Pei-Yin Hsieh)

The chairman of Tai Shih Hobby Corporation (Gaui) Chuang Chung-ming. (Photo: Pei-Yin Hsieh)

Chuang started playing with model airplanes when he was 12, but he is no longer making them for fun. Rather, his drones are now destined for important missions.

Two years ago, after Russia invaded Ukraine, the world saw commercial-grade drones emerge as a weapon capable of surprise attacks on the front lines, revving up the dreams of Chuang, other drone entrepreneurs, and Taiwan’s government.

First, the central government opened the Asia UAV AI Innovation Application R&D Center in Chiayi County in August 2022.

Soon after, the National Security Council, Ministry of Economic Affairs and Ministry of National Defense announced a tender for commercial-grade drones for military applications. The tender, Taiwan’s biggest drone procurement plan ever, was for more than 3,000 drones worth about NT$50 billion.

It was an important step in building up Taiwan’s military arsenal because commercial-grade UAVs can be produced more quickly and cheaply than military-grade aircraft.

But it also had the added advantages of encouraging domestic drone production to help Taiwan break free of China’s supply chain and supporting the sale of commercial drones to global markets.

In the initial stage of the tender process, aircraft developed by seven entities meeting the five categories of drones required by the Army and Navy passed functional tests, taking a step toward decoupling Taiwan’s production from China. Specifications for the next step in the process, the bidding on the large volume of drones, are expected to be issued at the end of December 2023.

For the biggest of the companies behind these five types of drones, Coretronic Intelligent Robotics Corporation (CIRC), it took eight years before it started to see any results.

Many other companies are vying to be key players in the unmanned aerial vehicle (UAV) supply chain the military hopes to nurture, as described below.

Gaui: Once Bigger Than DJI

In the initial prototype aircraft tender, Gaui teamed up separately with Evergreen Aviation Technologies (EGAT) and Geosat Aerospace and Technology on land-based reconnaissance drones that passed the military’s tests.

Gaui has built up its expertise over 27 years, starting with model aircraft, then moving into surveying and mapping drones and agricultural spraying drones before pursuing models for military applications.

At one point, Gaui teamed up with drone suppliers Align Corp. and Thunder Tiger to capture a 90 percent share of the global model aircraft market. In that era, the remote-control toy helicopters they shipped from Taiwan easily fetched over NT$10,000, and users flocked to them.

The chairman of Tai Shih Hobby Corporation (Gaui) Chuang Chung-ming. (Photo: Pei-Yin Hsieh)

The chairman of Tai Shih Hobby Corporation (Gaui) Chuang Chung-ming. (Photo: Pei-Yin Hsieh)

During the company’s heyday, Chuang even discussed the possibility of collaborating with Frank Wang (汪濤), the founder of Chinese drone giant DJI, but the initiative came to nothing because DJI’s multi-axis steering design was relatively simple, and the Chinese company did not need help from the outside.

The multi-axis drones of more than a decade ago did not have GPS or system integration; their only feature were gimbals on which cameras could be mounted. In 2010, Gaui beat out DJI in launching a multi-axis drone and shipped more than 30,000 units in a year.

“At that time, we were bigger than DJI, and our product was more stable,” Chuang said.

DJI soon came out with drones to compete in that market, but Chuang did not yet perceive the Chinese juggernaut to be a threat.

It was only when DJI decided to create an aerial camera drone by adding lenses to its UAVs that Chuang decided to revert back to the remote-control helicopters that were the backbone of his company. His group also began working with the National Chung-Shan Institute of Science of Technology (NCSIST), Taiwan’s main weapons research and development center, to study drone communications, and it also moved into the market for special commercial UAV applications.

Seven years ago, it began exporting surveying/mapping drones and agricultural spraying drones, and was selling about 400 to 500 of the agricultural drones to China a year.

Chuang believes that the chemistry Gaui has developed in its 20 years of collaboration with its suppliers has been critical to the company’s ability to rapidly develop and optimize the mechanics and structures of its UAVs.

Building a remote-control helicopter requires hundreds of components, and being short even one of them can cause a huge headache. For these small-volume, large-variety niche products, the willingness of suppliers to provide components is often more important than price.

Avix: Surveying the World’s Oil Fields, Mountains, Dolphins

Avix Technology Inc., another drone developer that got its start making model airplanes, is well-known in the field for its special purpose drones for specific functions.

“We’ll be going to India soon,” said Avix President Cooper Chang (張成榮) recently. His company will be discussing land surveying drones, which will be tested at altitudes of 3,000 meters in northern India.

The Indian customer sought out Avix because its technology has often powered the UAVs that have won military tenders in Taiwan, including for 20 rotary-wing drones purchased by the Coast Guard in 2018 and 2019 and 130 tactical short-range unmanned aerial reconnaissance vehicles purchased for more than NT$700 million by the Army in 2021.

Avix has also done well overseas, selling more than 20 specialized drones to Canada to monitor oil fields and icebergs and to Mexico to survey the movements of tuna and dolphins.

It is also one of the few UAV manufacturers capable of fully integrating their drones’ different systems and developing sub-system products, which is why the company’s drones can easily run into the millions of Taiwan dollars, and its sub-systems are not cheap. According to Chang, a gimbal can cost hundreds of thousands of Taiwan dollars, with the high price tag due not only to the materials used but also to development and system integration costs.

In recent years, Avix has installed motor and gimbal production lines, and brought in the Mitac-Synnex Group and wireless communications provider Gemtek as shareholders.

Taiwan UAV: Penetrating Allies’ Militaries

The only company to meet the standard for the Navy’s ship-launched surveillance drone under the military’s new commercial-grade drone guidelines was Taiwan UAV Co., which was founded 18 years ago to make flight control systems.

Taiwan UAV President Jonson Huang. (Photo: Chien-Ying Chiu)

Taiwan UAV President Jonson Huang. (Photo: Chien-Ying Chiu)

“These people who make UAVs are wired differently. They have a sense of mission, and are not into making money,” said Taiwan UAV President Jonson Huang (黃重生), whose main business is real estate.

About 10 years ago, he learned that Wu Chang-huei (吳昌暉), a fellow alum of the National Taiwan University Mountain Climbing Club and an associate professor of mechanical engineering at Yuan Ze University, was practically out of money and planned to shut down Taiwan UAV, which Wu had founded.

Unwilling to see the technology amassed over the 10-plus years Wu had run the company go to waste, Huang decided to take it over.

Taiwan UAV’s main expertise is in R&D, and it has considerable experience in drones for professional functions. From 2006 to the present, it has done jobs for the Environmental Protection Administration and the Coast Guard, taking on mountain disaster search and aerial photography projects, while also selling drones to Taiwan’s diplomatic allies.

Taiwan UAV’s ability to pass the recent prototype test in a single try stemmed from the dedication of its technology people, who have tested their drones’ wind-resistance capabilities by flying them into Taiwan’s seasonal northeasterly winds.

“The UAV industry is an honest industry. There are only two scores – 0 or 100,” Huang said, noting that the company has lost about 30 aircraft in testing as it constantly optimizes its designs.

Taiwan UAV is planning to increase its capital by NT$500 million to support its transition from R&D to commercialization of its products and build up its manufacturing capacity.

Taiwan Microwave Communications: Key Supplier to NCSIST

Taiwan Microwave Communications Co. Ltd. (TWMW) founder and Chief Technology Officer Joe Du. (Photo: Pei-Yin Hsieh)

Taiwan Microwave Communications Co. Ltd. (TWMW) founder and Chief Technology Officer Joe Du. (Photo: Pei-Yin Hsieh)

Taiwan Microwave Communications Co. Ltd. (TWMW) founder and Chief Technology Officer Joe Du (杜智賢) had previously worked at K-Best Technology Inc. and BlackMirror Technology Co. Ltd. before launching his own company, amassing more than a decade of experience in the field of UAV communications. Taiwan UAV used TWMW communications modules in its commercial-grade drones for Taiwan’s military, and the NCSIST has relied on the company for its flight termination systems for its weapons and drones.

High-power communications components needed by the military are often tightly controlled internationally, making them hard to come by, but Du was able to create a high-power module from general-power components. His innovation resulted in drones that were not only less likely to be hit by interference but also capable of destroying themselves if they lose contact with ground operators, preventing accidents.

InnoFlight: Developing the UAV Brain

Another important private company in the sector is UAV flight control system specialist InnoFlight Technology Ltd., hidden next to the elevated section of National Freeway No. 1 between Wugu and Yangmei in northern Taiwan. Of the seven types of commercial-grade drones that met the military’s requirements, four used InnoFlight’s flight controls, and its products are now being sold in Japan for use in land mapping and surveying UAVs.

Flight control systems, in essence a UAV’s brains, involve more than simply understanding the concept of flight. They also need electronic hardware technology and software controls, and this is where InnoFlight excels.

InnoFlight director Peter Pan. (Photo: Chien-Tong Wang)

InnoFlight director Peter Pan (潘健佑) participated in the NCSIST’s earliest UAV project and was responsible for the design of the aircraft’s body. Twenty years later, he launched his own business to make components for model aircraft, such as gyros and speed controllers, but later suffered through the collapse of the model aircraft market, seeing his annual revenue fall from NT$50 million to NT$10 million.

InnoFlight’s real strength is customization, and its customized niche products support the company’s team of roughly 10 people. Pan said certain clients want their UAVs to carry special instruments, and DJI is not an option because it does not customize its products. Trying to change DJI’s flight control software, Pan said, would have only a limited impact.

Taiwan Engine Power: Drone Engines of the Future

Chen Chih-tsao (陳志超), CEO of drone engine designer Taiwan Engine Power Co., Ltd. that was founded in November 2022, was hoping to develop Taiwan’s first home-grown UAV engine by the end of 2023.

Chen worked for scooter maker Motive Power Industry Co., Ltd. for 26 years, and worked on a project to develop “Chien Hsiang” suicide drones with the NCSIST for eight years before retiring from the company.

Chen said Chinese UAVs are mostly propelled by small or medium-sized battery-powered motors. But because existing battery technology does not support mid-sized or large drones with long flight ranges, those bigger drones will have to turn to engines, providing an opportunity to a major motorbike producer like Taiwan.

“Taiwan can beat China on UAV engines,” Chen suggested. Many of the UAV engines used overseas are built with Taiwanese components, all of them coming from an engine supply chain that he is extremely familiar with, he said, giving him hope for the future.

Have you read?

- Taiwan professor created a drone defense tower

- How aIn Taiwan, a national drone fleet rises from the ruins

- Taiwan Defense Minister: China won't take Taiwan in a fortnight

Translated by Luke Sabatier

Uploaded by Ian Huang