How Taiwan's auto lighting king Depo breaks into Europe

Source:Pei-Yin Hsieh

For Depo Auto Parts Industrial Co., Taiwan's leading vehicle headlight supplier, the past two years have been its best yet in nearly a half-century thanks to finally cracking the European auto market—but only after a grinding 5-year campaign of rejections.

Views

How Taiwan's auto lighting king Depo breaks into Europe

By Chen-Kang Kangweb only

The Changhua-based company hit record revenue of NT$18.5 billion (US$603 million) in 2022, while earnings per share for the first three quarters reached NT$10.45, nearly matching the full-year NT$10.86 of 2021. Depo is poised to set a new annual profit high.

At age 70, founder and CEO Hsu Hsu-ming still keeps a relentless schedule of meetings and overseas business trips, sometimes flying over 90 times in a year to woo customers.

But what has Mr. Hsu most excited is Depo's success in the past two years winning supply contracts from over 15 European car brands for original equipment manufacturer (OEM) parts—a stubborn market it had failed to penetrate meaningfully. Most notably, Depo landed an order for headlights from a prestigious British million-dollar supercar maker, making it the brand's first-ever Asian lighting supplier.

In the automotive aftermarket for replacement parts, Depo has long been one of the world's top suppliers with over 40,000 headlight products. But breaking into the OEM business supplying parts to automakers' new vehicle assembly lines had proved extremely difficult, with just a few clients like China's Chery and Honda.

"The auto parts industry is very insular, making it very hard to get into OEM," said Shiau Jui-sheng, a former auto analyst at Taiwan's Industrial Technology Research Institute.

The key force driving Depo's breakthrough was Mr. Hsu's son, Tyler Hsu, who took over the struggling OEM division generating less than 10% of revenue in 2015 at age 26. With no growth targets from the board, Hsu targeted Europe's low-volume premium brands as the easiest entry point given Depo's speciality in flexible, small-batch manufacturing for the aftermarket.

But opening those doors took incredible persistence. Hsu flew over 90 times in one year, writing hundreds of letters and even attending factory tours for tourists at times, all to get a foot in the door. He got rejected over 100 times.

"You have to be thick-skinned and use all kinds of methods to get meetings, otherwise just sitting in the office, how can you get to know those people?" Hsu said.

The breakthrough came in 2020 during the pandemic, when a struggling UK supercar lighting supplier went into a financial crisis. The automaker took a chance on Depo's persistent younger Mr. Hsu, and after successful samples the following year, awarded Depo its first order.

When the elder Mr. Hsu first heard the news, his initial reaction was "No way, he must have gotten tricked." But after the client's auditors visited Depo's factory, he realized his son had really landed the supercar deal.

That first order opened floodgates, with a stream of European automakers coming to Depo's small hometown factory in the Lukang township for visits and audits, especially after the pandemic eased. OEM sales have since doubled to around 20% of revenue from under 10%, with over eight dedicated production lines.

The European push also catalyzed an overdue digital transformation. When Tyler Hsu first joined in 2015, he was shocked to find production data was still tracked by hand-written logs. It underscored his realization that his father managed the factory by experience, making it hard to gain real-time visibility he needed.

"I battled with him for 3-4 years before he agreed to the first thing," the younger Hsu said, starting with a basic online approval system costing under NT$1 million to convince his thrifty father.

Over 6 years, Depo has invested over NT$1 billion in digitalization, including a new ERP system and connecting its aging machinery to monitoring systems, allowing production status to be tracked by mobile devices. Hsu says overall output has increased over 20% thanks to the efficiency gains.

For example, with over 100 plastic injection molding machines at the Lukang plant historically monitored by supervisors walking lines, the digitalization allows real-time tracking from a central location.

In addition to the IT overhaul, Depo has invested billions building major new plants in Taiwan and Thailand in the past few years to support projected growth for both its OEM and aftermarket businesses.

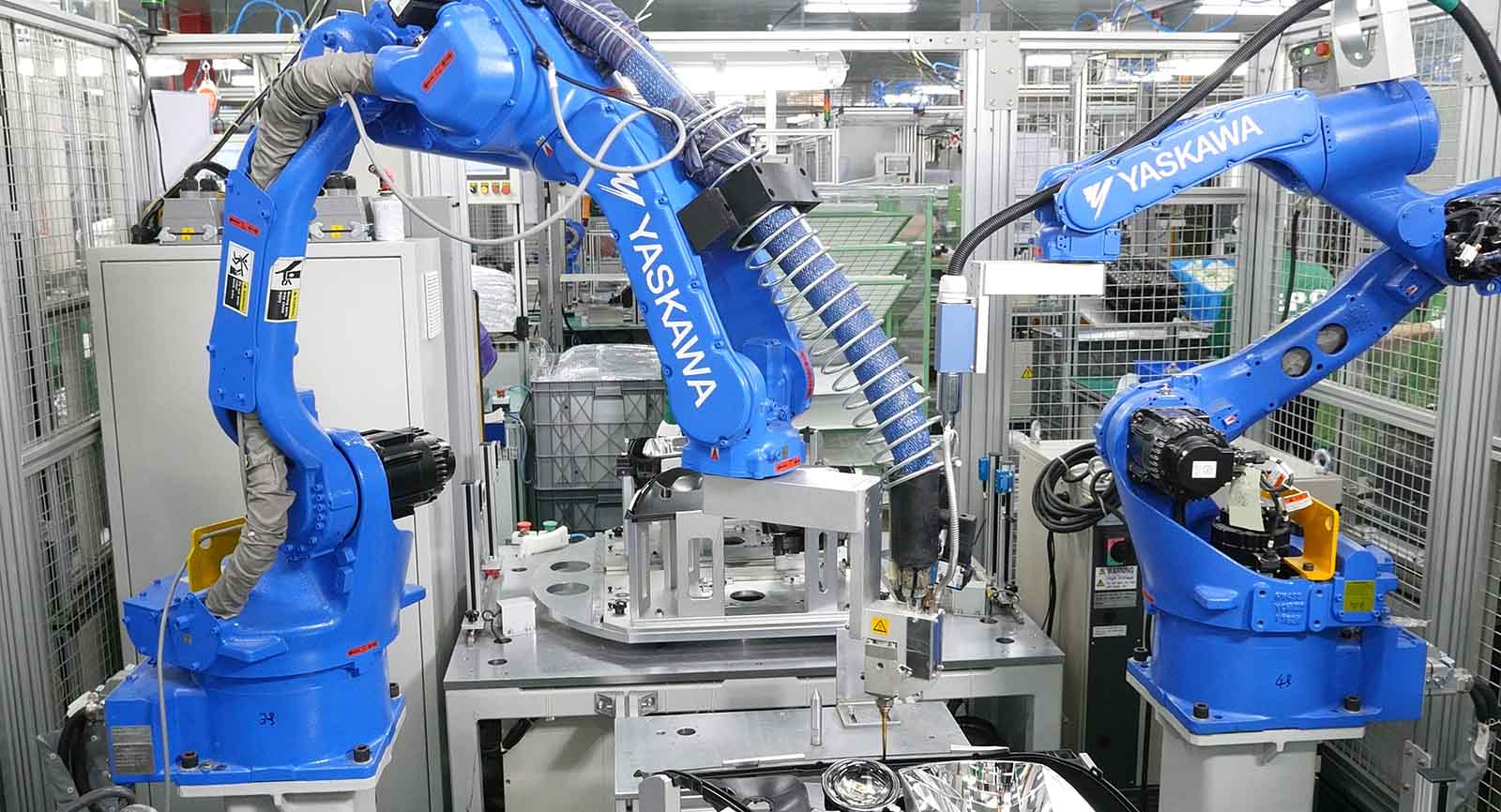

Depo transitioned successfully, and improved the production volume. (Source: Depo)

Depo transitioned successfully, and improved the production volume. (Source: Depo)

One potential cloud remaining is a long-running patent lawsuit brought by Mercedes-Benz in Taiwan in 2017. While Depo won a reversal at the Supreme Court last year sending it back to the Intellectual Property Court, a final ruling favoring Mercedes could spur other automakers to file similar lawsuits.

Mr. Hsu hopes Taiwan will adopt legal "repair clause" exemptions like in the UK and Germany allowing use of third-party parts. But an industry executive worries an unfavorable precedent would expose major aftermarket players like Depo, Tong Yang and TYC to expanded litigation risks.

From starting with just a suitcase going door-to-door for clients at age 23, Mr. Hsu has built Depo into an auto lighting powerhouse over half a century in the "difficult" industry. With his son now establishing a foothold in the long-sought European OEM business through years of persistence, Mr. Hsu can look forward to new horizons once the legal clouds clear.

Have you read?

- How Shein exports China’s “sinking market”

- Taiwan-made machinery is still sold in Russia, what can the manufacturers do about it?

- ‘Made by China’ Hiding in SE Asia: A 10-year analysis of Apple supply chain

Uploaded by Ian Huang