Moving towards a world without oil, how can Taiwan’s petrochemical industry adapt?

Source:Getty Images

Petrochemical products, which have made their way into all facets of our lives, are about to see epochal change. With governments devising carbon tax schemes and the UN planning to restrict the use of plastics, the petrochemical industry is moving toward a “circular carbon economy”.

Views

Moving towards a world without oil, how can Taiwan’s petrochemical industry adapt?

By Kwang-yin LiuFrom CommonWealth Magazine (vol. 744 )

Amid the climate crisis, governments around the world are committing to “net zero” carbon emission targets in order to slow global warming. And in the petrochemical sector, which has played a leading role in the global economy for over a century, a green revolution is under way.

Industry impact

A new world that does not use mineral oil

Petrochemical products have become an indispensable part of our lives.

From the toothbrush we use after getting up in the morning, the clothes we wear, the shoes we put on, and the masks we don, to duvets, pillows and even vitamin supplements, all are derived from petrochemical raw materials.

This also pertains to the survival of humanity and our livelihoods.

The petrochemical industry consumes 30 percent of the energy consumed by the manufacturing industry worldwide. It uses up 12 percent of the global output in petroleum with an upward trend.

The petrochemical giants are looking for ways to survive in a world without fossil fuels. British oil and gas company BP has announced it will reduce oil and gas production by 40 percent within ten years and massively invest in renewable energies. In Taiwan the petrochemical industry plays a major role in the manufacturing sector, accounting for 11 percent of total sector output and 14 percent of its carbon emissions.

Carbon tax to push up prices, affecting exports

“The biggest challenge that Taiwan’s petrochemical industry is going to face in the next decade is CO2 emissions,” warns Lin Shu-hong, president of the petrochemicals conglomerate Chang Chun Group (CCPG), which posted revenue worth NT$400 billion last year. He predicts that, “once a carbon tax is levied, the situation will look bleak for exports of Taiwanese plastic products.”

Taiwan’s petrochemical industry exports 40 percent of its output. Thirty percent of these exports are shipped to the United States, the European Union, and Japan, which are all planning to introduce a tax on carbon emissions. The EU is going to take the lead next year. The Industrial Technology Research Institute (ITRI) estimates that in Taiwan petrochemical industry output worth more than NT$180 billion could be affected within the coming four years.

Carbon taxes put a price on the environmental cost of production, which means that petroleum products will no longer be cheap. “It would be quite naïve to expect products to become green without prices going up,” says Kin Wah Chay, managing director of BASF Taiwan.

Costs for the research and development of greener processes will eventually be passed on to downstream manufacturers.

UN declares war on plastics

At the United Nations Environment Assembly, which convened in Nairobi, Kenya, in early March, 175 countries endorsed a resolution that launched negotiations to draft an international convention to end plastic pollution.

On the agenda are restricting the production of plastics and banning single-use plastics. Negotiations for the legally binding agreement are expected to conclude in 2024.

(Source: Pei-Yin Hsieh)

(Source: Pei-Yin Hsieh)

“In the future, the circular use of carbon will be decisive for the survival of the petrochemical industry,” notes Liu Chih-chung, who is a division head at the Industry, Science and Technology International Strategy Center of ITRI.

The oil economy transitioning to a circular carbon economy

Carbon plays a key role in petroleum raw materials. It is also an important element in many chemical and plastic products. So-called circular carbon is carbon contained in recycled waste plastics, biomass and emissions from production processes that is used as raw material to replace carbon extracted from oil.

The ultimate goal of circular carbon is to never use a drop of freshly produced crude oil again but to recycle and refine existing petrochemicals to reuse them as raw material. As a result, the business model of the petrochemical industry would be profoundly changed to become a circular system involving up-, mid- and downstream industries.

“The reason this was not done in the past is that the cost was too high,” Liu points out.

However, when carbon emissions become costly, certain technologies for carbon capture and storage that were deemed too expensive in the past are now becoming increasingly commercially viable. Carbon could, for instance, be captured from emissions for use in chemical products, or plastic trash could be broken down into petroleum naphtha through pyrolysis technology.

Going circular to become carbon neutral is currently all the rage worldwide.

American beverage giant Coca Cola has pledged to recycle and reuse all packaging by 2030. On top of that, the company is working on increasing the share of recycled materials in plastic bottles to 50 percent.

In Taiwan, the Environmental Protection Administration demands that by 2025 plastic packaging, which amounts to 600,000 tons per year, must contain at least 25 percent recycled plastic granules.

“The times when 100 percent of raw materials stemmed from petroleum are over,” declares Charles Huang, founder and chairman of Circular Taiwan Network. Once the trend toward a circular economy is firmly established, materials will be sourced mainly through two channels: One is materials from carbon neutral biomass such as corn starch or other crops. The second is plastic recycling.

In Taiwan, the petrochemical industry is also morphing into a carbon magician, trying to turn the problem into the solution.

The first drastic change for the petrochemical industry is the energy transition.

At its sixth naphtha cracker complex in Mailiao, Yunlin County, in central Taiwan, the Formosa Plastics Group has launched a multi-billion Taiwan dollar project to fire its plants with natural gas instead of coal. Chen Bao-lang, chairman of Formosa Petrochemical Corporation, points out that the naphtha cracker complex will emit 60 percent less CO2 emissions thanks to the replacement of coal.

Under the plan, which has already been submitted for an environmental impact assessment, the three coal-fired steam generators at the Mailiao power plant, which produce 180 MW of power, will be decommissioned by 2025 and replaced by natural gas-fired generators with a capacity of 240 MW.

The second drastic change is turning carbon from emissions into a raw material to reduce the use of oil.

CCPG is not only the first company in the world to recycle CO2 from its production processes into acetic acid. The company is also able to purify carbon dioxide for use in the semiconductor industry, gaining a competitive edge over its industry peers.

The third drastic change is plastic recycling 2.0 to return trash into its source material, naphtha.

A growing number of brand manufacturers are demanding plastic recyclates. Scandinavian furniture chain Ikea, for instance, has announced plans to go circular by using only renewable and recyclable materials in its product range by 2030.

However, the reuse of recycled plastics is problematic because the resulting product is often effectively downcycled to a lower quality. Recyclates from PET bottles cannot be used to make new PET bottles but only to manufacture lower quality products such as flower pots. Therefore, chemical engineering companies around the world, including BASF from Germany and Eastman Chemical Company in the United States, are rushing to develop chemical recycling processes. With chemical recycling technologies, plastic trash can be converted into its source material, naphtha, and reused. This means that food boxes that have been chemically recycled can be made into food boxes again, thus realizing a “cradle to cradle” material flow.

The fourth drastic change is using biomass or air to replace petroleum-based foamed plastics.

Biomass plastics are becoming increasingly important for efforts to reduce the use of oil.

But the paper cups commonly used in Taiwan are laminated with a plastic layer that acts as a liquid barrier. This layer makes recycling difficult. At its plant in Canada, the Taiwan-headquartered LCY Chemical Corp. treats corn starch with a special enzyme to produce an alternative product to replace the plastic laminate. Hoping to end ocean pollution from styrofoam, the company has also developed a technology for producing a novel plastic foam that requires only half of the original amount of oil as raw material.

Taiwan’s headache

Corporations and government lack sense of crisis, fall behind internationally

Policy changes are effective in reducing the use of plastics.

Japan, which is notorious for its penchant for excessive packaging, launched an ambitious “Plastic Resource Recycling Strategy” in 2019. Its goal is to reduce disposable plastic waste by 25 percent by 2030 and to recycle all plastic garbage by 2035. Last summer, Japan began to levy a fee on single-use plastic bags. Meanwhile, 70 percent of consumers state they do not need plastic bags.

While recycled plastic can be used to make food packaging in the European Union and the United States, and such packaging is increasingly being adopted, legal restrictions undermine efforts to reduce the use of virgin plastic in Taiwan. It is not allowed to manufacture food packaging from recycled PET bottles. So while Taiwan boasts a PET bottle recycling rate above 90 percent, and the recycled granules are of top quality, they cannot be reused in food packaging to help reduce plastic waste.

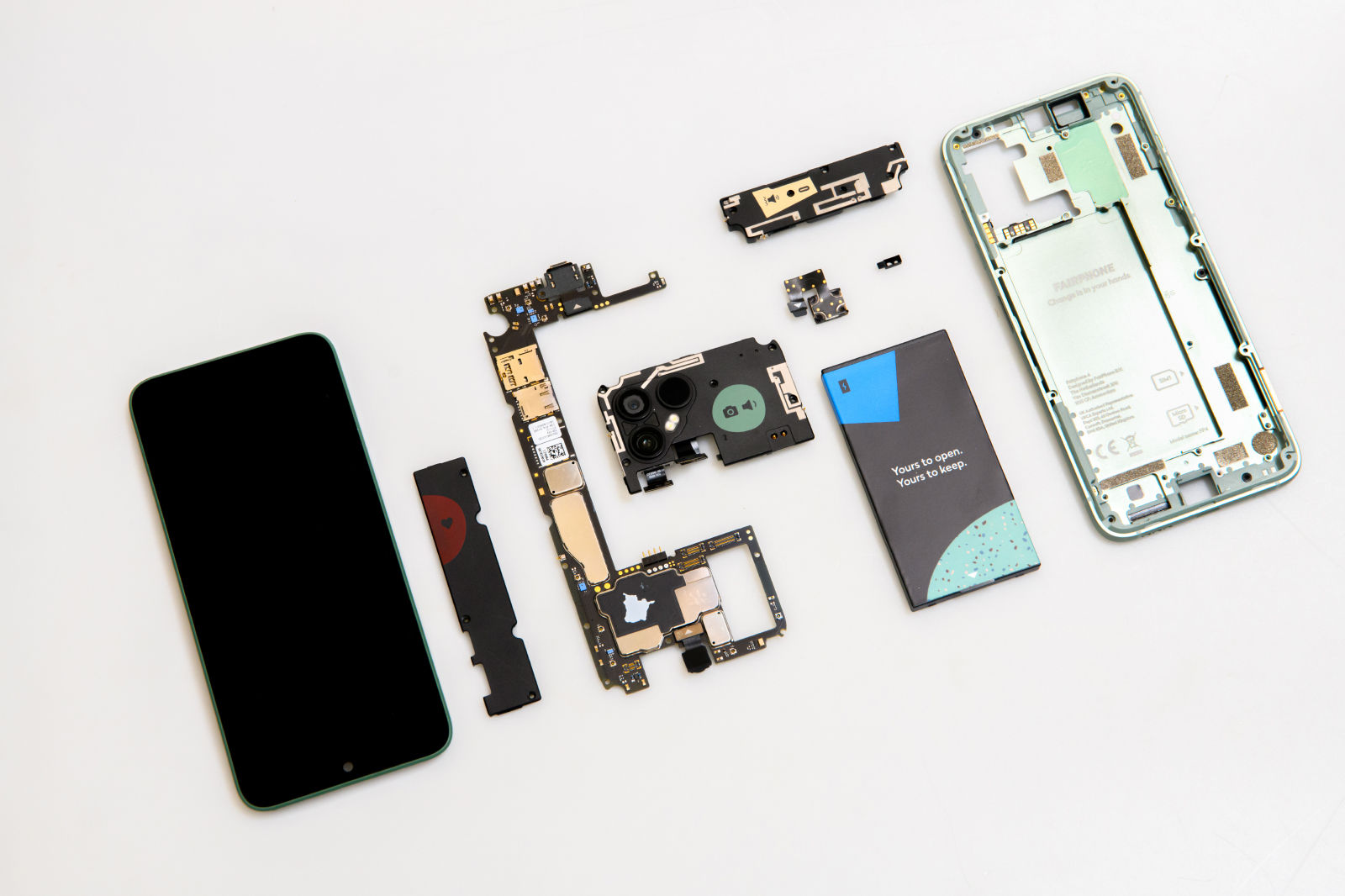

Sustainable smartphone with Taiwan R&D not available to Taiwanese buyers

Another irony is that consumers in Taiwan cannot buy a sustainable smartphone that has been developed with the help of Taiwanese manufacturers because it is not sold in the local market.

Fairphone, a startup in the Netherlands, is known for its modulized smartphone, designed for easy repair and prolonged use. This year, the company expanded its use of recycled materials, relying on support from its team in Taiwan.

As Oscar Chang, senior mechanics engineering manager at Fairphone, points out that the fourth-generation Fairphone already contains 63 percent recycled plastic. Meanwhile the company has joined hands with German chemical company Covestro AG to develop a back cover made of 100 percent recycled TPU (thermoplastic polyurethane).

(Source: Pei-Yin Hsieh)

(Source: Pei-Yin Hsieh)

At a price of around NT$16,000, more than 1 million Fairphones have been sold in Europe. In Germany and the Netherlands, demand even outstrips supply. “In Europe, sustainability has become a mainstream topic; many people are willing to put such values into practice,” explains Chang.

That the Fairphone is presently only being sold in Europe owes to the fact that Taiwanese consumers attach importance to a good price-performance ratio while environmental aspects take a back seat. Telecom operators fear that the sustainable smartphone would appeal only to an exclusive few, and have therefore not introduced it into their handset offerings.

A world that does not use oil seems set in the distant future. Yet we are without doubt firmly on a course from linear consumption to a circular model. Just how much we get involved decides how fast we transition to a less wasteful and destructive lifestyle.

Have you read?

♦ Chang Chun turns CO2 into chemicals

♦ The Edison of Petrochemicals

♦ TSMC’s bold net zero pledge: Cutting a Taipei’s worth of emissions

Translated by Susanne Ganz

Edited by TC Lin

Uploaded by Penny Chiang