2013 Top 2000 Survey

Hidden Champions Transcend Gloom

Source:CW

CommonWealth Magazine's traditional Top 1000 Survey has been changed to the Top 2000 this year to recognize the under-the-radar medium-sized companies that are doing well despite a difficult economy.

Views

Hidden Champions Transcend Gloom

By Yueh-lin MaFrom CommonWealth Magazine (vol. 522 )

Taiwan's government released two reports at the end of April and in early May on the country's economy, and neither brought good news.

First, the Directorate-General of Budget, Accounting and Statistics (DGBAS) came out with the latest economic growth data on April 30. Hurt by flagging exports and sluggish private consumption, Taiwan's GDP grew only 1.54 percent in the first quarter, well below expectations.

As deflating an omen as that was for the short-term, the long-term economic outlook appeared just as gloomy after the DGBAS released its "Industry, Commerce and Service Census" for 2011 on May 3.

According to the census, the value-added ratio for Taiwan's manufacturing sector had fallen 5 percentage points over five years and the ratio for the country's benchmark information and electronics industry had declined 6.79 percentage points over the same period, explaining the sector's trend toward shrinking profit margins.

There may be a way, however, to shake these worrying trends. German management guru Hermann Simon, who pioneered the concept of "hidden champions," seemed to offer Taiwan a roadmap for its industrial restructuring in an interview with CommonWealth Magazine during the CommonWealth Magazine Economic Forum in January of this year.

In global competition, Simon insists, a country needs not only big companies, but also strong small and medium-sized companies exporting and competing globally.

Germany depends on over 100,000 strong small and medium-sized enterprises (SMEs) for 70 percent of its exports and employment, a phenomenon that has spurred a wave of interest among other countries over the past two years to learn more about the model.

Taiwan itself intends to shift its focus to searching for and supporting value-added hidden champions and elite SMEs.

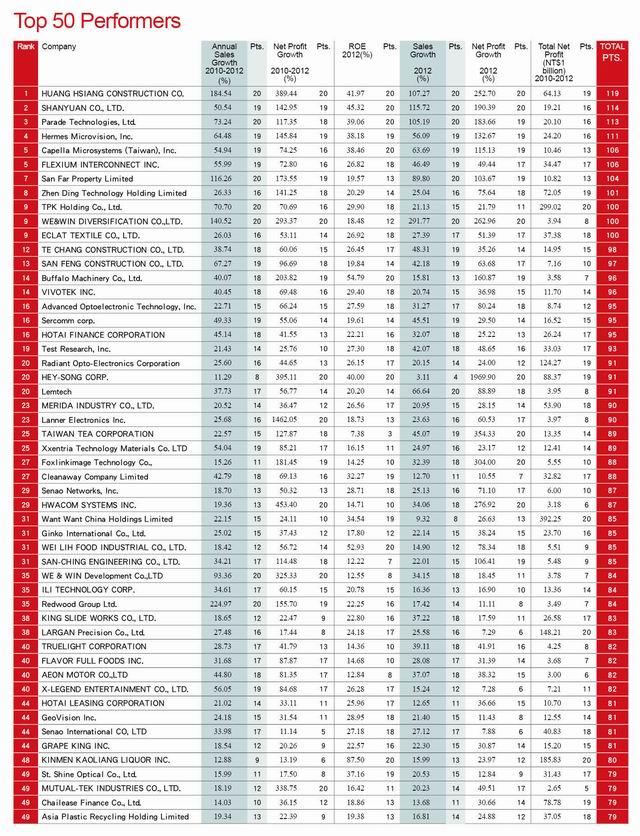

To unearth Taiwan's hidden champions and give global exposure to smaller, more inconspicuous companies that consistently generate outstanding results, CommonWealth Magazine has published its 2013 Survey of Taiwan's Top 2000 Enterprises, expanded from the original Top 1000 for the first time in the survey's 27-year history.

We used our extensive database to identify the companies that truly create added value and rank among the global leaders in their respective fields with the help of two basic indicators: successive years of positive revenue growth and double-digit profit margins.

Most of the companies that emerged at the top of the list possess certain "hidden" characteristics and rarely make headlines.

Steady and Profitable in a Storm

As of the end of 2012, seven different companies have clocked in truly impressive revenues and profit margins for five consecutive years, earning them the title of "super hidden champions." They are: food processor Want Want China Holdings Ltd., camera lens maker Largan Precision Co., electronic component manufacturer TXC Corporation, Yung Shin Pharmaceutical Industrial Co., ScinoPharm Taiwan Ltd., contact lens producer St. Shine Optical Co., and waste management company KD Holding Corp.

These leading companies all have the characteristics Simon said hidden champions share. They are ambitious and focused and committed to developing technology; and they pour their profits into R&D, have long-term outlooks and sell their products to the entire world.

Feng Chia University vice chairman Kao Cheng-shu, who has studied the growth of Taiwan's SMEs for much of his career, says he now sees most companies thinking about how to transform their operations and how their next generation of leaders will introduce more rigorous management thinking.

"In the past, the goal was to make money; companies took on whatever jobs they could get. Now they understand how to concentrate on a particular market," Kao says.

"There are only conventional products, not conventional industries, because new applications with boundless space for innovation always pop up."

One Taiwanese enterprise pushing the innovation envelope is Largan, which has now grown so big the term "hidden" hardly seems appropriate. This precision manufacturer produces camera lenses found in many types of mobile phones. Composed of six lenses no bigger than a grain of rice stacked together, Largan's finished lenses must maintain a surface roughness measured in ratios of 1 in 100 million. Then there is TXC, whose tiny crystals require 30 manufacturing processes to complete. St. Shine Optical, which is developing its own "global eye database," uses technology that is only a year behind Johnson & Johnson and is constantly upgrading. It is already Asia's biggest contact lens maker.

Others leading the pack are vertically integrated Zeng Hsing Industrial Co., which dominates the household sewing machine market; KD Holding, which earns an after-tax net profit margin of over 16 percent by getting rid of all kinds of waste; and car loan and rental service provider Taiwan Acceptance Corporation, the cash cow of the Yulon Group with revenue per employee of nearly NT$9 million that is now preparing to enter China's market.

SMEs: The Great Economic Stabilizers

"Electronics businesses usually consist of one big entrepreneur and many employees. The businesses are big but vulnerable to global risk. Strong SMEs, however, can stabilize society and help distribute income in a less polarized way while enhancing the stability of the national economy," says Sheng-yung Yang, the head of National Chung Hsing University's Department of Finance.

Elite SMEs usually have one overriding trait in common – they find and dominate market niches. "If a company does something that everybody is doing, it will inevitably end up competing on scale. But stable and profitable companies compete by elevating their added value," Yang says.

Because of Taiwan's small market size, the world is the natural battlefield of most Taiwanese companies from the day they are founded.

Eric Y.T. Chuo, the chairman of motion control specialist Hiwin Technologies Corp., observes that if Taiwanese manufacturers want to become hidden champions that pursue value, the main obstacle will be entrepreneurs who easily give in to the temptation of short-term profits and cannot bear being alone.

"If you want to constantly innovate, you have to instill a 'service culture,' you have to put a priority on development in new areas, and you have to help customers create value and forge your own added value that can be used by others," Chuo stresses.

Also, marketing and R&D must remain in a company's own hands, and the most difficult machine maintenance should be done in house, Chuo says.

"Only that way can you understand what the customer dislikes. When the financial crisis was at its worst in 2009, I did not cut my R&D and distribution/marketing budgets."

Su Chin-ho, president of Corporate Synergy Development Center, which guides the development of SMEs and creates business alliances, says companies' main sources of value are its customers. The key is figuring out how to satisfy customer needs. In his opinion, companies with value develop expertise in a particular field, accumulate energy, set standards and have an influential voice in the sector.

"Also, company CEOs cannot just talk about how long they'll be around while ignoring the business cycle," Su says.

Seizing the "Experience Economy"

Taiwan's deep-seated manufacturing sector is not the only one that has hidden champions; a small number of service businesses ended up near the top of CommonWealth Magazine's hidden champions list.

"Profit in the service sector is limited. If you don't move toward the 'experience economy,' there is no way for your profit margin to show double-digit growth," says Chung-jen Hsu, the chairman of the Commerce Development Research Institute.

Every link in the value chain, from raw materials and manufacturing to wholesaling and retailing, must generate profit, Hsu says. "Service sector companies must achieve a complete, integrated chain to be strong enough."

He cited the example of Japanese fast fashion brand Uniqlo. Only by controlling the entire process, from apparel manufacturing to marketing and retailing, and extending its core values throughout its value chain has Uniqlo emerged as an elite player in the service sector.

Stephen Su, the general director of the Industrial Technology Research Institute's Industrial Economics & Knowledge Center, believes that the biggest challenges facing Taiwan's elite SMEs and hidden champions are their small scale and the need to strengthen their international management capabilities.

"Even if a company is a hidden champion, by definition it has to become one of the top five in the world in its field. It cannot be hidden forever," Su says.

In addition, the companies will always be vulnerable to the accelerated speed of globalization, which cannot be combated simply with dedication and strength at home.

Economies may fluctuate just as flowers bloom and wither, but the fields controlled by high value-added hidden champions remain green and lush during both the light of day and the darkness of night. In Taiwan, a handful of companies have started to figure that out.

Translated from the Chinese by Luke Sabatier