Exclusive Top 2000 CEO Survey on the Economic Prospects of 2020

Optimism over Taiwan at 9-Year High

Source:Chien-Tong Wang

Nearly three of four CEOs of Taiwan’s 2000 biggest companies are pessimistic about the global economy in 2020 after a year of uncertainty, even with the apparent easing of the U.S.-China trade war. So why did nearly 60 percent of them, or a nine-year high, feel bullish about Taiwan’s investment environment in the coming year?

Views

Optimism over Taiwan at 9-Year High

By Yi-shan Chen, Chuo-han YangFrom CommonWealth Magazine (vol. 688 )

Taiwan’s presidential and legislative elections will be held on Jan. 11, 2020, but let’s first hear what the people in charge of Taiwan’s biggest companies who actually decide worker pay levels, investor returns, and the willingness to invest are saying about the coming year.

Now in its 11th year, CommonWealth Magazine’s Top 2000 CEO Survey provides an overview of the near-term plans of Taiwan’s top executives at the end of every year. It has taken their pulse during the global financial crisis, the signing of an economic cooperation agreement (ECFA) with China, the European debt crisis, the Brexit shock, the election of Donald Trump as U.S. president and the U.S.-China trade war.

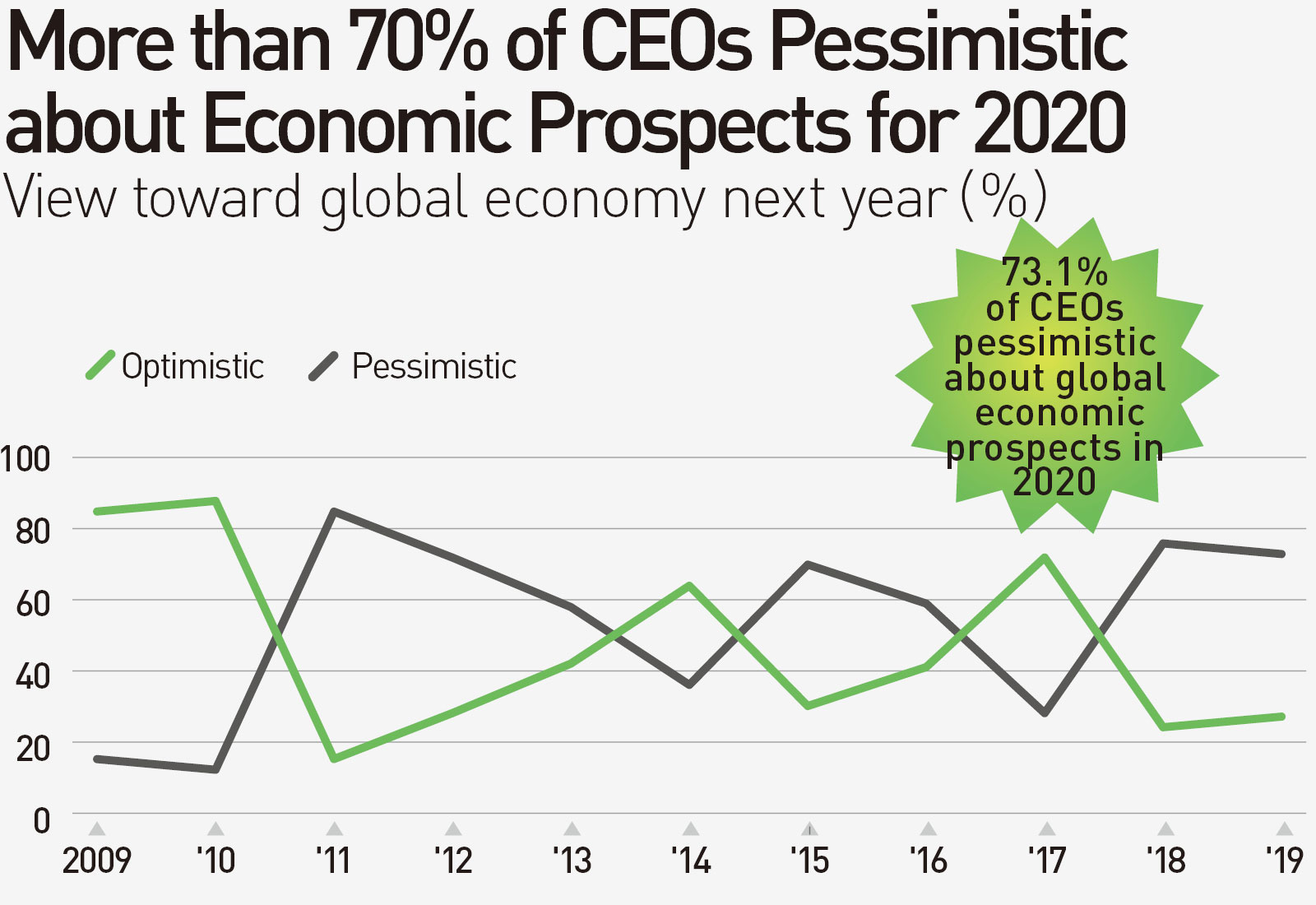

In looking to 2020, 73 percent of the top executives who responded to the survey were not optimistic about the global economy in the coming year, marginally lower than at the end of 2018.

The Global Economy: Pessimism High

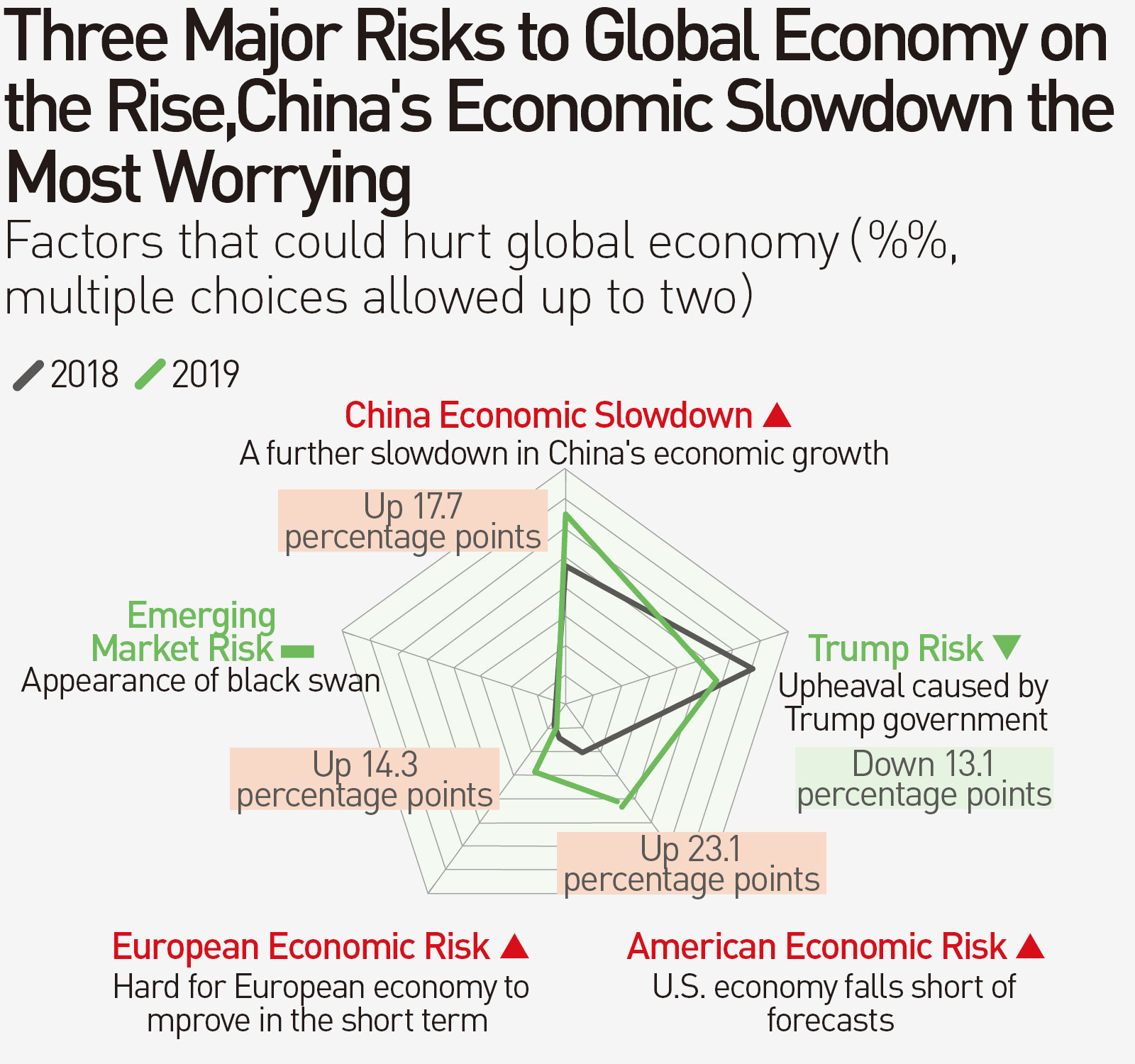

More executives in the manufacturing sector (78.1 percent) were pessimistic about the prospects for the global economy in 2020 than in any other sector, followed by those in the financial services sector (75 percent). What has these CEOs so worried? It turns out the slowdown of China’s economy has replaced the upheavel caused by the Trump administration as the biggest reason for concern.

“Actually, there were still 54.2 percent who were worried about the Trump factor, but that was lower than last year, indicating that top executives have gone from uncertainty over Trump’s temperament to accepting that Trump’s temperament changes all the time,” says Jack Huang, chief economist at SinoPac Financial Holdings.

China’s economic uncertainty now is casting the biggest cloud over global economic prosperity, according to Huang.

He believes that business leaders are gradually realizing that China’s economy has caromed from a 4 trillion Chinese yuan (NT$17.2 trillion) debt crisis to an asset bubble on the verge of bursting. They have also seen a straightforward tariff war between the U.S. and China evolve into a Huawei-driven tech battle, an exchange rate-driven trade battle, and a Hong Kong-driven human rights battle. In the future, there could even be battles over Chinese companies delisting in the U.S. and a ban on American pension funds investing in China.

“This has escalated into a full-blown tug-of-war between Washington and Beijing,” Huang says, arguing that as long as the hostilities expand, the uncertainty over China’s economy will only grow.

In 2019, smaller Chinese financial institutions Baoshang Bank, Bank of Jinzhou, and Harbin Bank and a Chinese conglomerate, the Founder Group, defaulted on their corporate debt, and the price of Tsinghua Unigroup’s debt fell to record lows, sparking fears of a possible chain reaction of corporate bond defaults. A high concentration of local debt is set to mature in the second half of 2020, only adding to the economic uncertainty in the coming year.

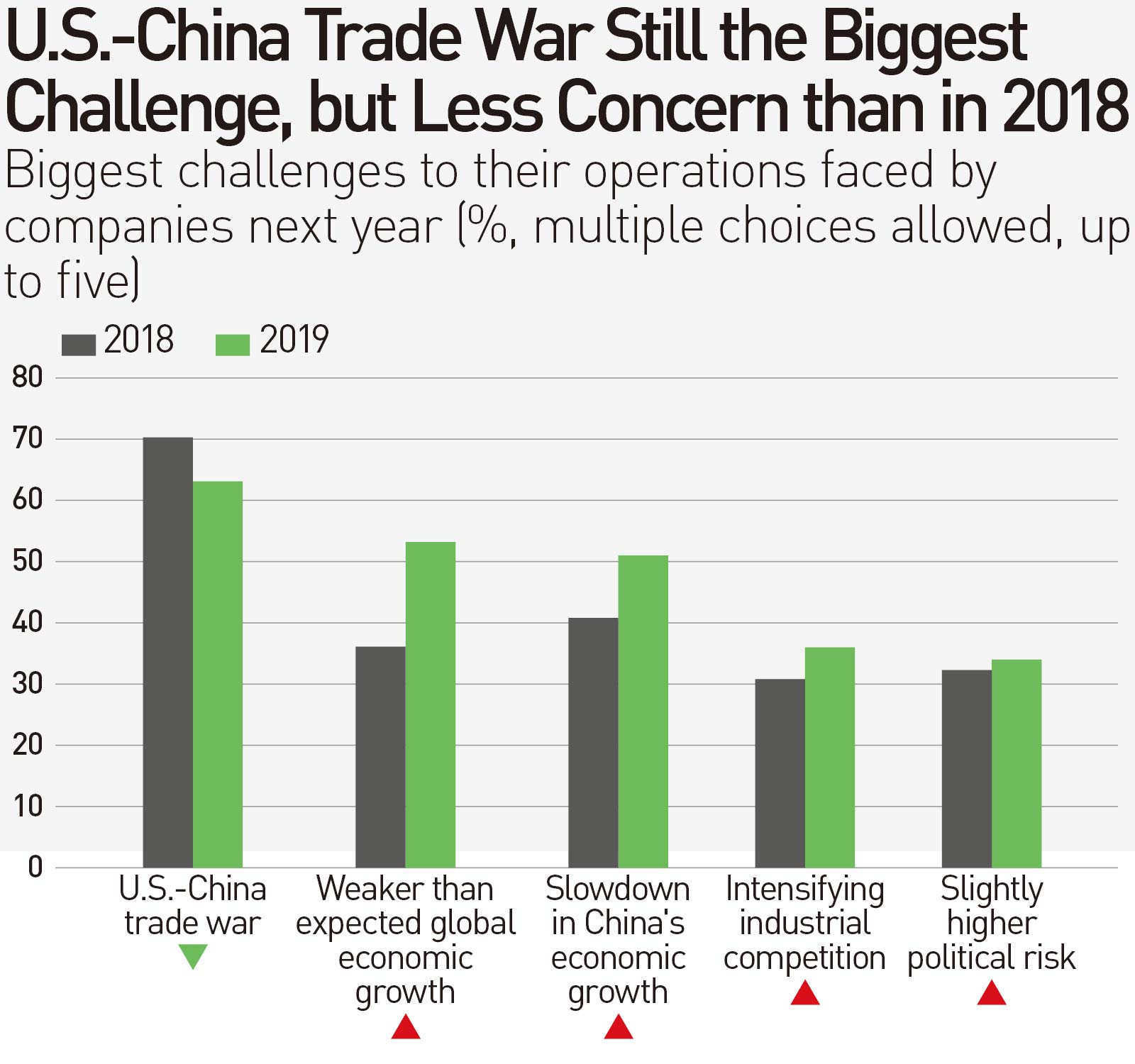

The U.S.-China trade war, weaker than expected global growth, China’s economic slowdown, increasing competition, and relatively high political risk were cited in the survey as the five biggest challenges companies expect to face next year.

One challenge that did not make the top five but was high on the list of the surveyed executives three years ago was the threat of industrial competition from China. At that time, the high profile investments made by Tsinghua Unigroup in Taiwan and the localization of China’s supply chain had 40 percent of executives citing the threat as a major challenge, but that fell to 20 percent this year.

Only 14% Benefiting from Trade War

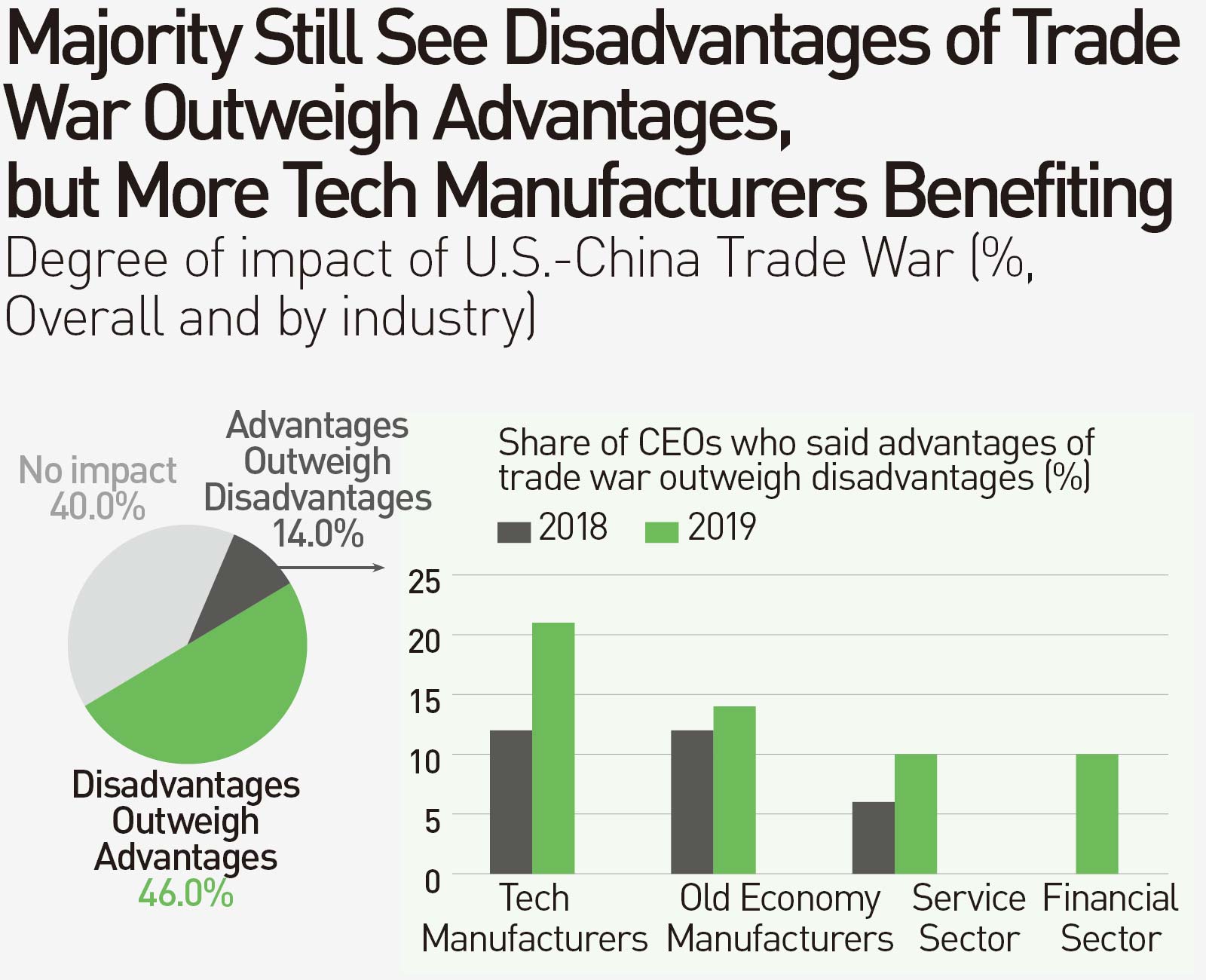

The U.S.-China trade skirmish remained the biggest challenge foreseen by Taiwan’s leading executives. After dealing with the consequences for two years, how did the survey’s respondents feel the trade war had affected them?

The answer: more of them felt they will have to dig in for the long haul.

Only 14 percent of all respondents believed that the trade war’s advantages outweighed the disadvantages, with executives in the high-tech manufacturing (20.5 percent) and old-economy manufacturing (13.7 percent) sectors most likely to feel that way.

The high-tech sector has clearly benefited from a “diversion effect” – the diversion of export orders from the U.S. that were to be manufactured and shipped from China to Taiwan to avoid punitive U.S. import duties on Chinese made goods. That has also helped the financial services industry by increasing the demand for financing from Taiwanese companies seeking to expand their production capacity in Taiwan.

At the same time, worried about the effects of the trade war, China has gotten an early start on preparing for 5G. From Huawei to the complete telecommunications industrial chain, companies have been building up inventories, giving a boost to Taiwanese manufacturers of telecommunications components and products.

Though some have benefited, 46 percent of the executives surveyed felt the disadvantages outweighed the advantages for several reasons – a decline in the willingness of consumers to spend, a fall in orders from China, and products for the U.S. market being hit by sanctions.

Have you read?

♦ Taiwan, Unexpected Beneficiary of US-China Trade War

♦ Made in Taiwan, Straight to the United States

♦ China's Big Money ≠ A Second TSMC

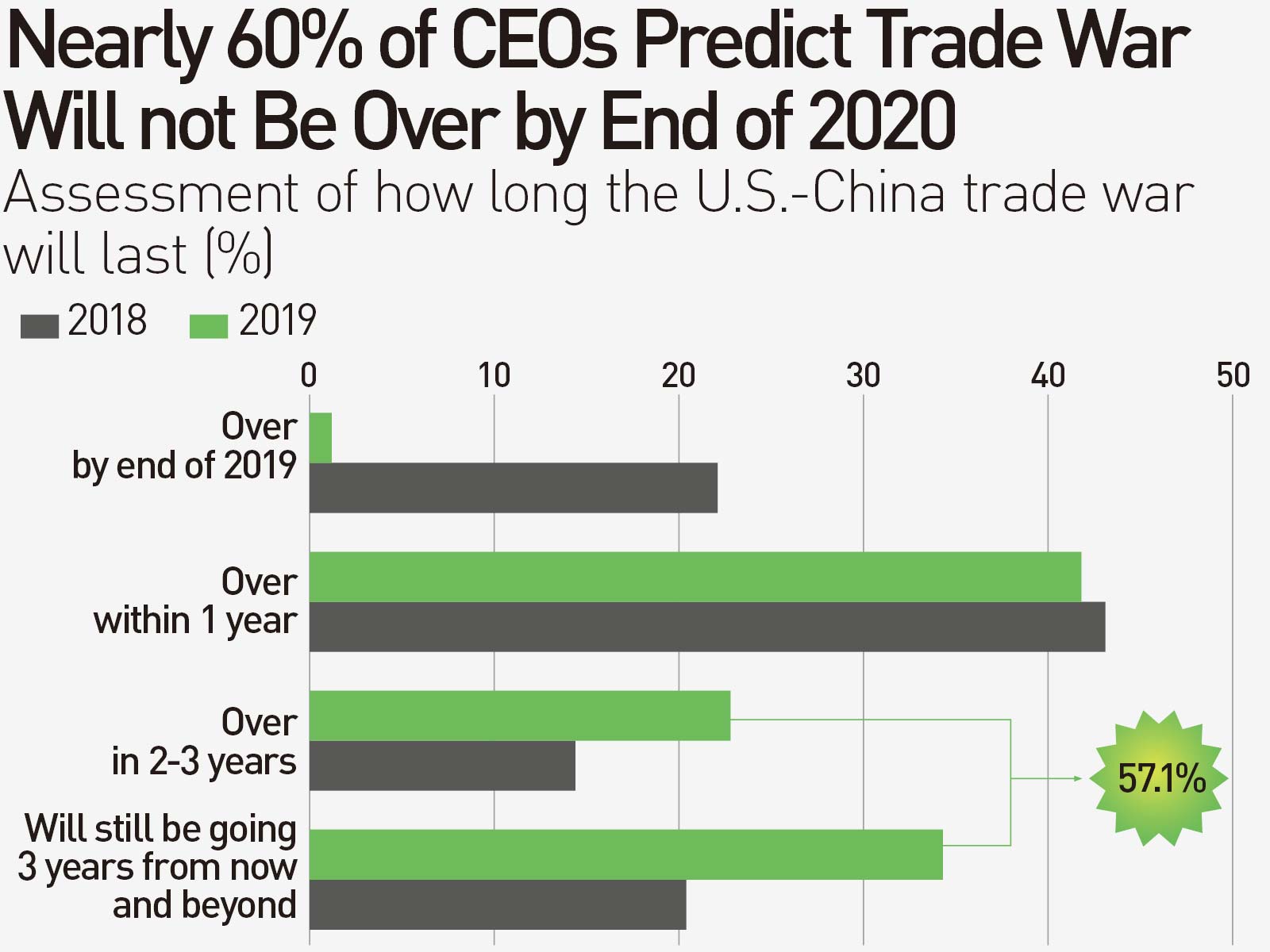

As for when the trade war will end, a majority of the executives generally expected the dispute to linger.

Some 41.8 percent of respondents felt there would be a truce before the U.S. holds its presidential elections in November 2020. But 57.1 percent said it would continue beyond then, 22 percentage points higher than in last year’s CEO survey.

Chaney Ho, co-founder and executive director of automation solutions provider Advantech, is one of those who sees the dispute extending into the future, despite a phase-one agreement the two sides reached in mid-December. He believes problems will linger in part because of the mistrust triggered in the U.S. and Europe by Chinese President Xi Jinping’s move to remove the two-term limit on his presidency.

Several academics believe the entire Western world’s view of China has changed, reflected in the bipartisan support shown in the U.S. Senate and House of Representatives for the Hong Kong Human Rights and Democracy Act, which was signed into law on Nov. 27, 2019. It supports pro-democracy protesters and requires that sanctions be imposed on Chinese or Hong Kong officials responsible for human rights abuses in Hong Kong.

To deal with a long-term tug-of-war, the CEOs are re-evaluating their positions, including looking more favorably at Taiwan as a place in which to invest.

The Tainan Technology Industrial Park has tried to sell or lease its unused land for many years, but after building on the land, factory sales and rentals have boomed. (Photo by Ming-Tang Huang/CW)

The Tainan Technology Industrial Park has tried to sell or lease its unused land for many years, but after building on the land, factory sales and rentals have boomed. (Photo by Ming-Tang Huang/CW)

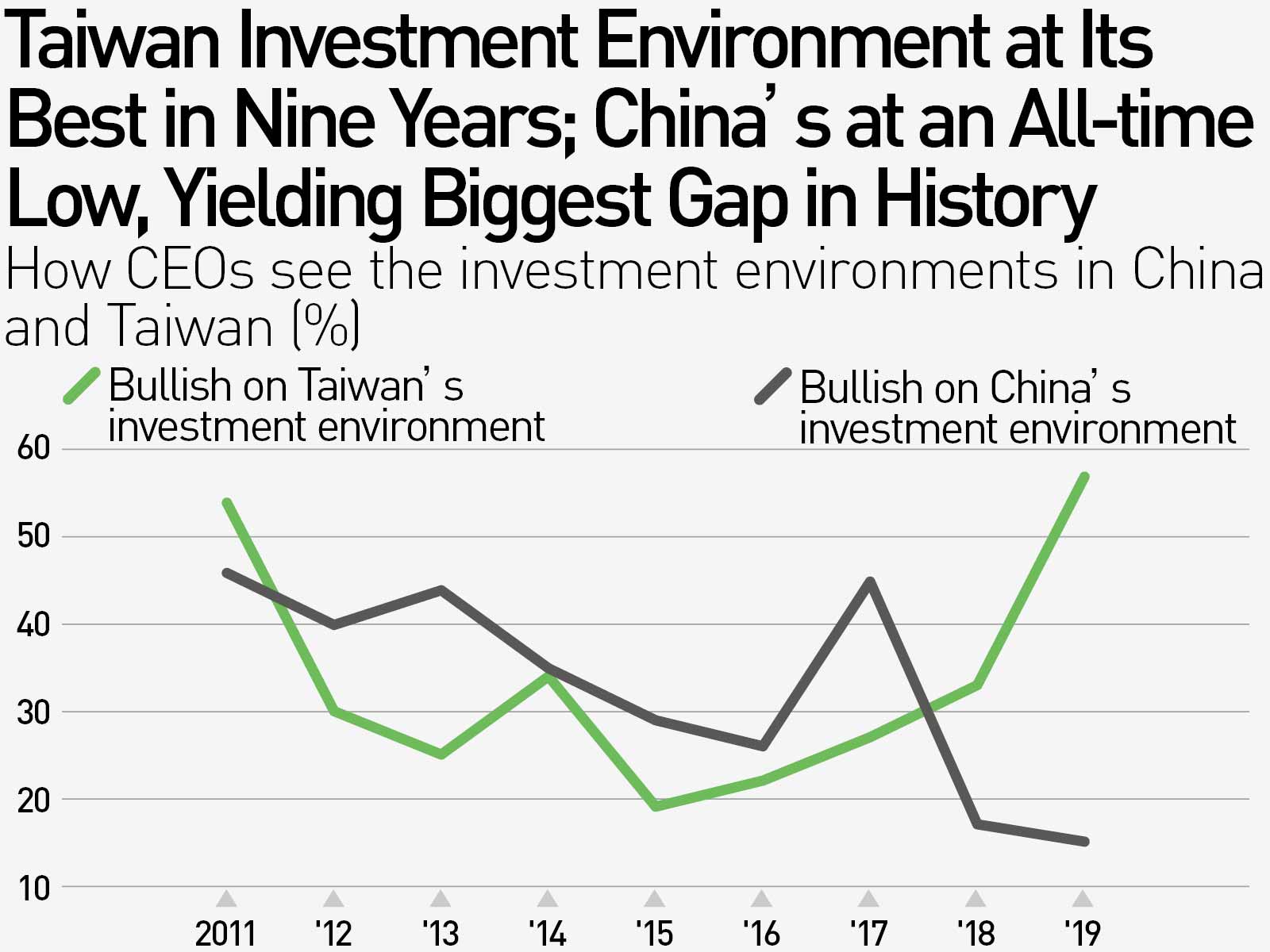

Taiwan Forecast: Nearly 60% Bullish on Taiwan

Since 2012, more respondents in the CEO survey have had a favorable view of China’s investment environment than Taiwan’s, but that changed in 2018 and continued in 2019. (Read: Top 2000 CEO Survey on the Economic Prospects of 2019: Southeast Asia Replaces Longtime Favorite China)

In this year’s survey, 56.7 percent of top business leaders were bullish on Taiwan’s environment, up 23.9 percentage points from last year and the first time in seven years that the bulls were in the majority.

Only 15.1 percent of top executives looked favorably on China’s investment environment, the lowest ever in the Top 2000 CEO Survey.

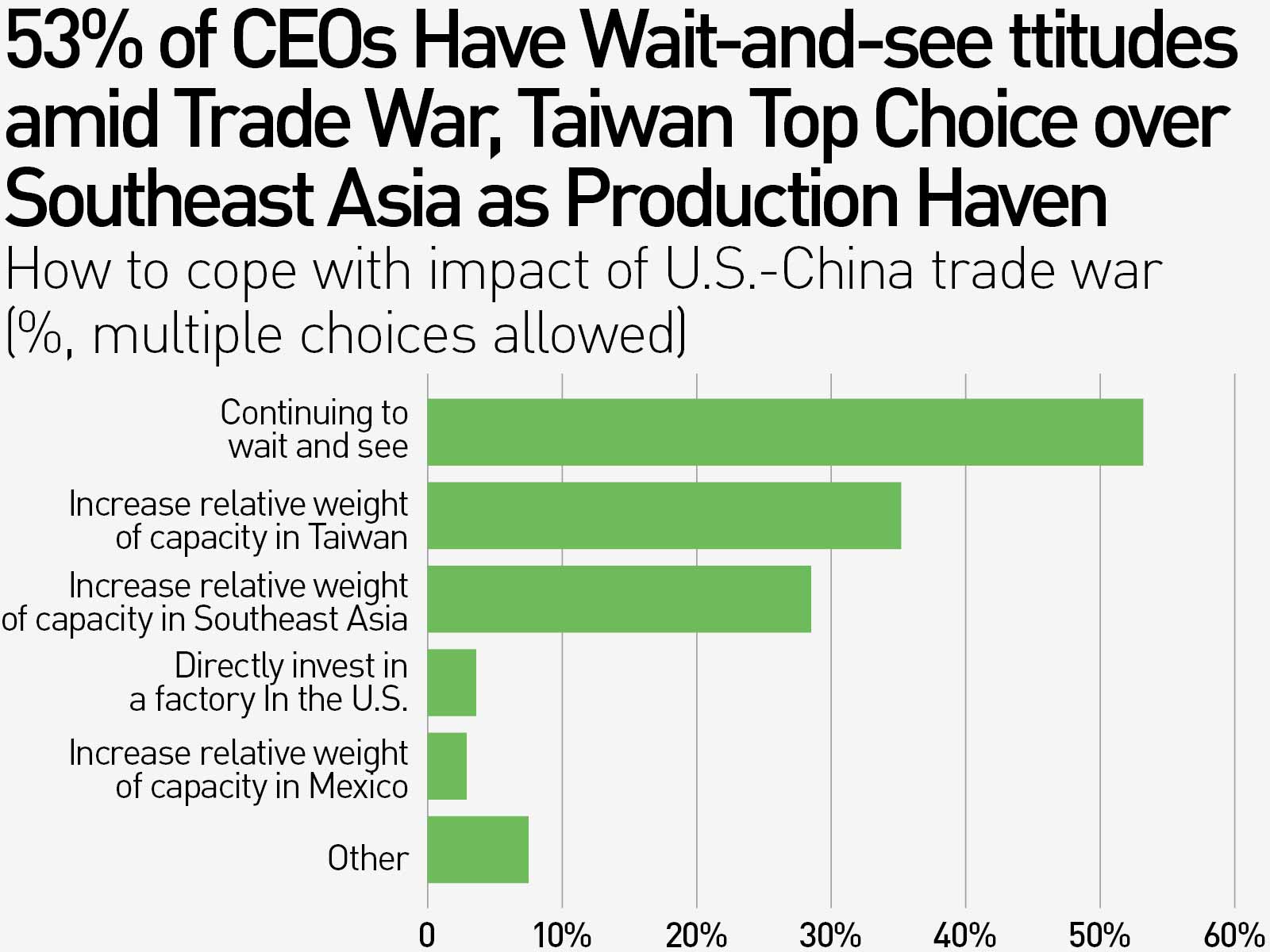

A key element influencing the trends is the growing belief that the conflict between the U.S. and China is likely to be long and drawn out. When asked how they would respond to the ongoing tensions, 53.3 percent of respondents said they would maintain a wait and see attitude, down nearly 10 percentage points from last year’s figures.

But 35.2 percent of the executives said they would increase their capacity in Taiwan and 28.5 percent said they would increase their capacity in Southeast Asia.

By industry, 50 percent of the heads of high-tech manufacturers surveyed planned to increase capacity in Taiwan, the highest percentage in any field, followed by the heads of old-economy, non-high-tech manufacturers at 33.8 percent.

“This is the moment when Taiwan’s value is being more recognized than ever by the market,” says David Tien, the chairman of PwC Taiwan Real Estate.

Over the past two years, the cost of renting land in Taiwan’s industrial parks and commercial office space in Taipei has started to go up because of demand from companies looking to actually use the space. Microsoft, Verizon Media, Google, Facebook and several foreign companies managing coworking spaces are increasing their investment in Taiwan, in some cases setting up R&D centers.

Sensing the opportunity for factory space in industrial parks, developers such as Huaku Development that had been focused on building residential projects have returned to buying land in industrial parks. Prices for such land range from NT$333,000 per square meter in the Wugu Industrial Park to NT$182,000 per square meter in the Hwa Ya Technology Park in Taoyuan and NT$85,000 per square meter in the Jhongli Industrial Park.

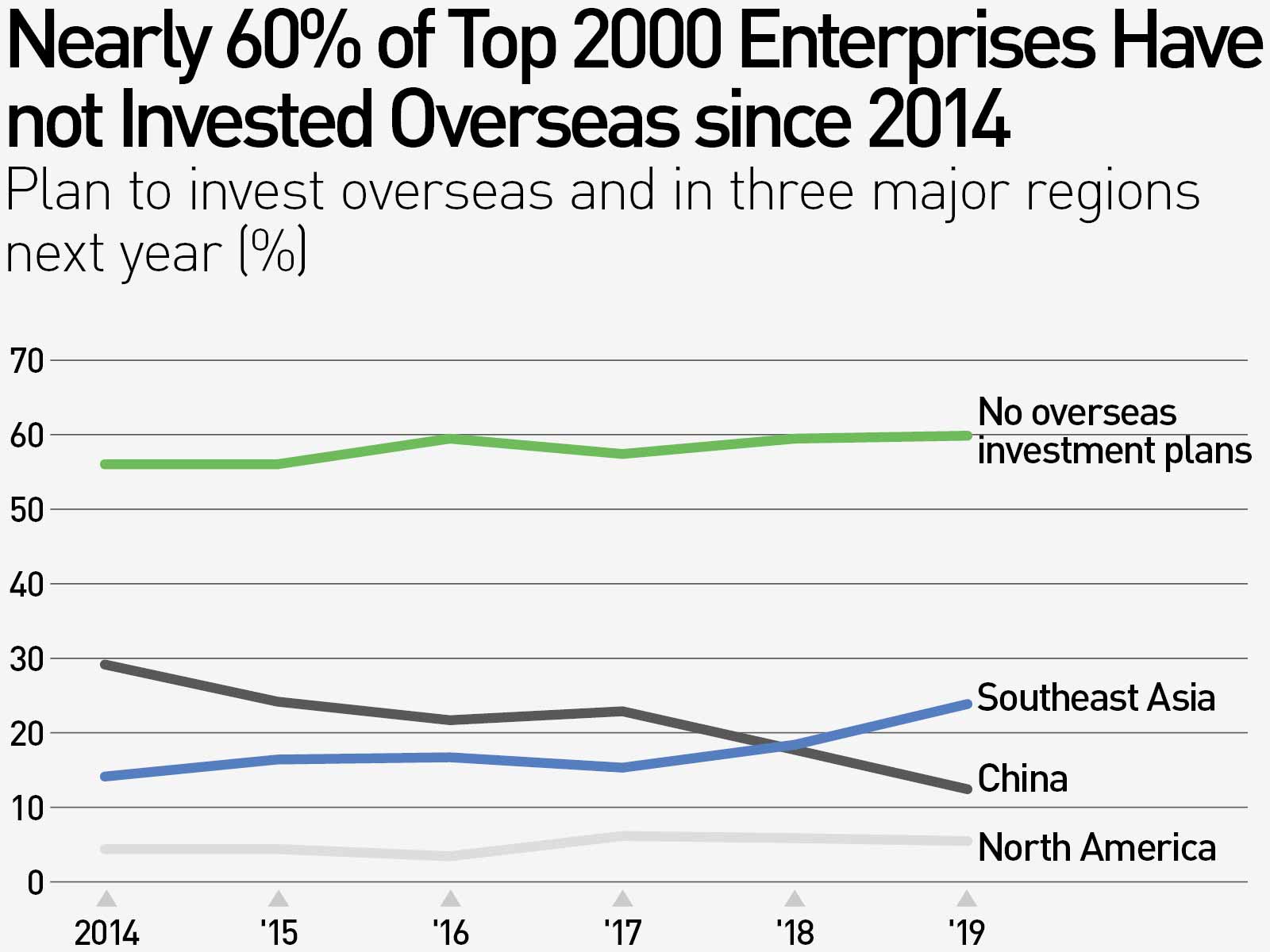

While it may be gratifying that Taiwan’s investment environment is once again drawing interest from the private sector, nearly 60 percent of Taiwan’s top 2000 enterprises have not invested overseas at all since 2014, and their long-term investment growth rate in Taiwan has remained relatively low. That raises the question of whether Taiwan’s larger companies have grown too conservative and lost some of their vitality.

Overseas Presence: Are Companies Tired?

When CommonWealth Magazine first conducted its Top 2000 CEO Survey in 2009, only 20 percent of respondents said they had no plans to invest overseas, and about half anticipated increasing their investment in China.

But the appreciation of the Chinese yuan, policies to upgrade or phase out industries, and rising labor costs led to a decline in willingness to invest in China starting in 2014. That year, the percentage of respondents saying they had no plans to invest overseas rose to 56 percent.

“Compared with going to China, going to Southeast Asia or another country that does not have a common language or culture is much more difficult. For many enterprises, if their technology was not good enough or the next generation has not been willing to take over the family business, they have invested at a slower pace,” Huang explains.

During that time, however, the Top 2000 companies also did not increase their investment in Taiwan.

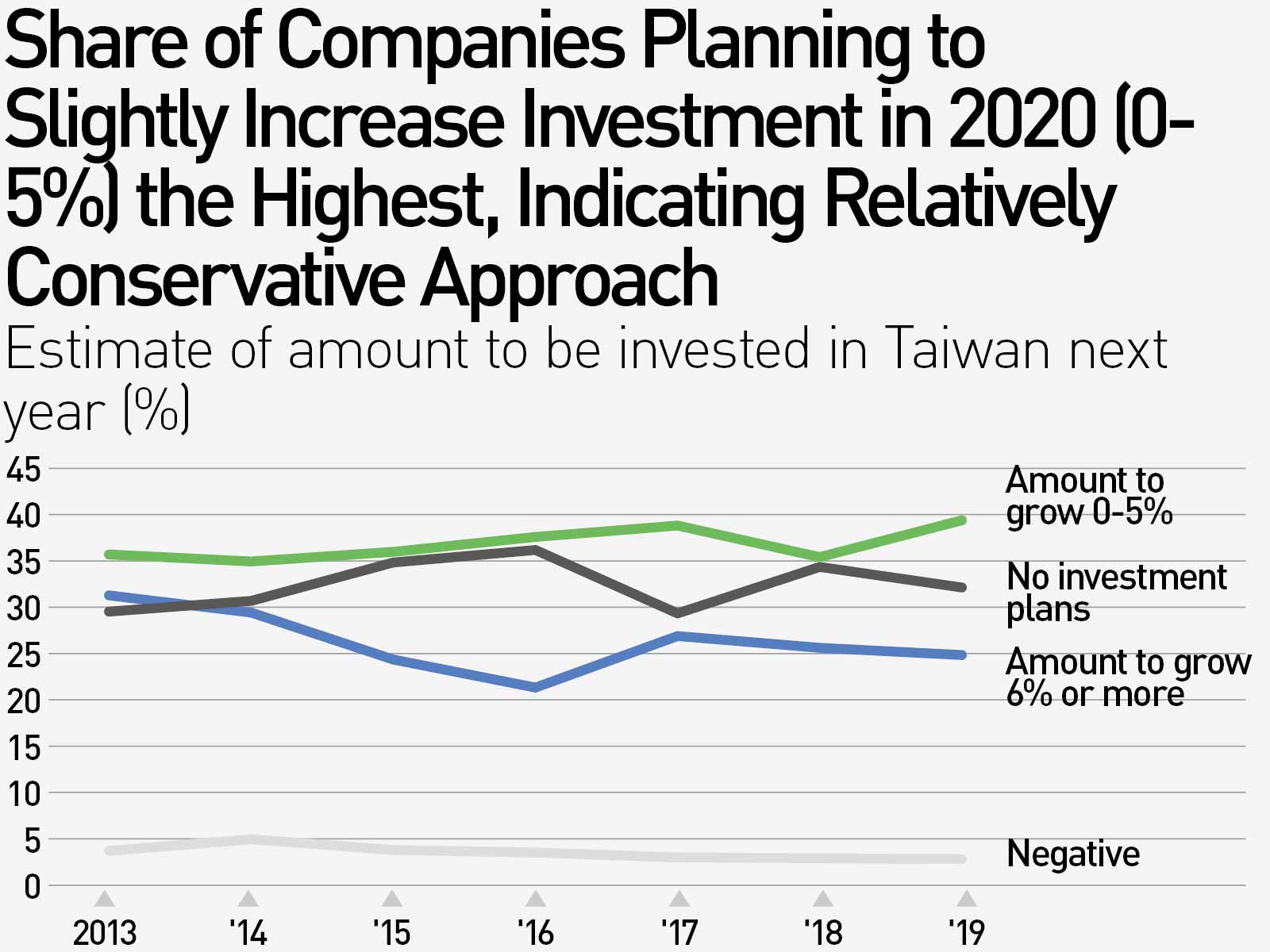

In every CEO survey over the past six years, roughly 30 percent of the executives said they had no plan to invest in Taiwan. This year, when asked how much they planned to invest in Taiwan in 2020, 39.5 percent of respondents said it would grow by less than 5 percent, even with the high praise for Taiwan’s investment environment. That was the most common response.

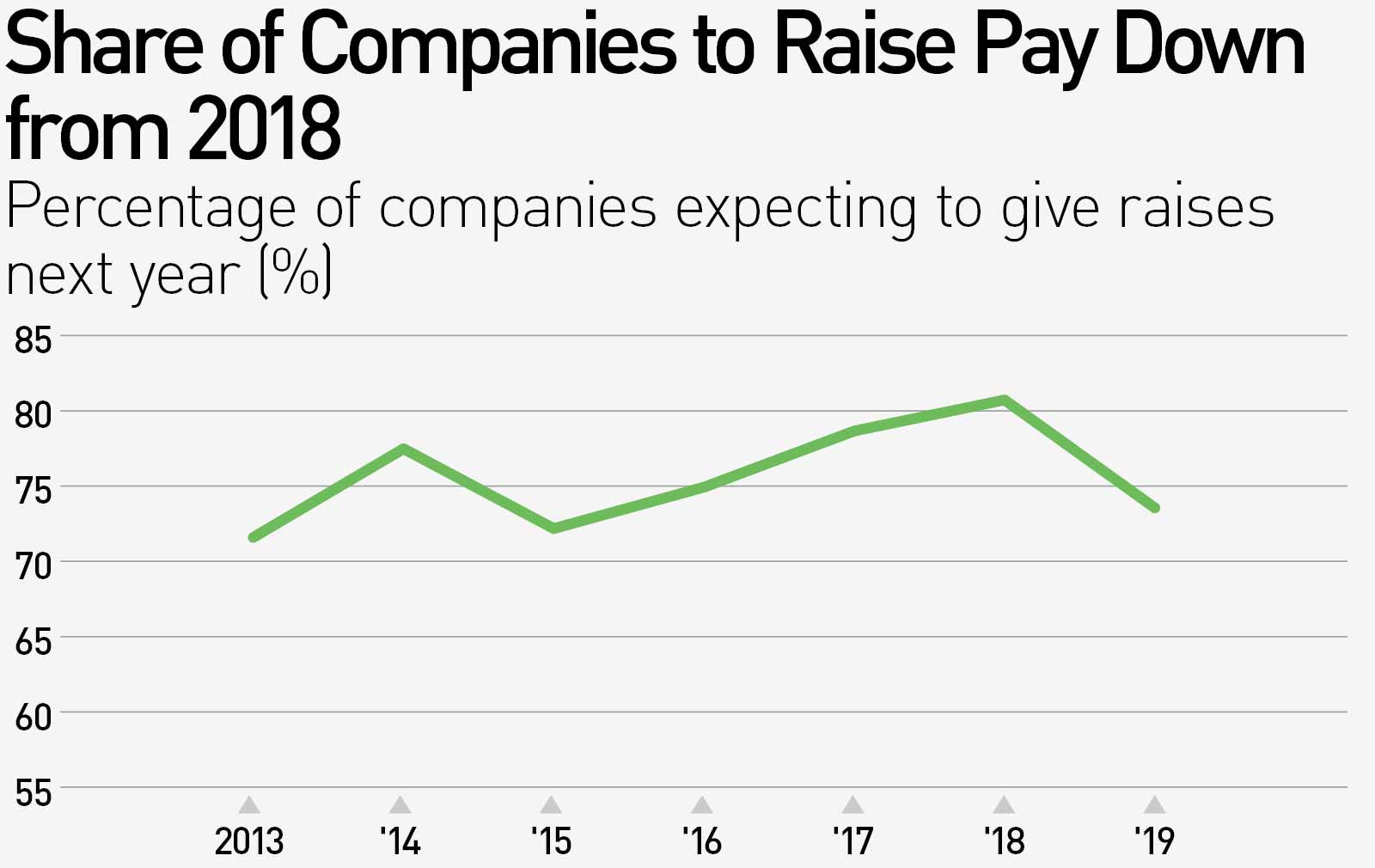

When asked if they would give raises to their employees in 2020, 73.5 percent of the executives said they would, but that was 7.3 percentage points lower than last year.

Corporate Outlook: Lower Profits, Fewer Raises

The thinking on pay raises reflects the general outlook for Taiwan’s biggest businesses.

One-third (33.2 percent) of the executives said as 2019 was coming to an end that their company’s sales would post negative growth. Among them, foreign enterprises and old-economy manufacturers have been the hardest hit. Half of the executives at foreign enterprises said their revenues were down, as did about 40 percent of the heads of the old economy producers, who cited fuel prices and steel prices and weakness in China as dragging revenues lower.

In terms of profits, 30 percent of respondents said profits were down, including 46.6 percent of the heads of foreign enterprises.

In 2020, more than 50 percent of Taiwan’s biggest enterprises intend to hire new workers, but the percentage willing to give raises is down 7.3 percentage points from a year earlier. (Photo by Chien-Tong Wang/CW)

In 2020, more than 50 percent of Taiwan’s biggest enterprises intend to hire new workers, but the percentage willing to give raises is down 7.3 percentage points from a year earlier. (Photo by Chien-Tong Wang/CW)

The executives were also asked what they felt were the biggest challenges of the current business and economic environment.

The top challenge, cited by nearly half (43.7 percent) of respondents, remained variables in cross-Taiwan Strait relations, followed by industrial transformation and upgrading, talent shortages, rising labor costs, and tepid domestic demand.

The respondents most concerned about cross-Taiwan Strait variables were not manufacturers with factories in China, as might have been anticipated, but executives in the service sector who have felt the pinch of Beijing blocking their citizens from visiting Taiwan, whether as part of tour groups or traveling independently.

The financial sector also expressed concern over the worsening of relations between Taiwan and China and the complete shutdown of communications between regulatory agencies on the two sides of the Taiwan Strait. Nearly half (47.5 percent) of service sector executives and 60 percent of financial executives surveyed cited relations with China as a challenge.

Industrial transformation and upgrading has ranked among the top two challenges in the CEO survey for eight straight years. Financial executives expressed particular concerns in this area in the survey, with the opening of three internet-only banks and changes in policies on open banking (which refers to allowing access to consumer banking and financial accounts through third-party applications) on tap in 2020.

Yet only through industrial transformation and upgrading can Taiwan solve its longstanding problems with stagnant wages. Research by Yang Tzu-ting, a faculty member at Academia Sinica’s Institute of Economics, shows that for the results of economic growth to be distributed to workers, the key is improving the terms of trade.

In other words, Taiwan needs to be able to produce innovative, value-added products or services that can command higher export prices. That translates to higher profits, which are essential to solving the low-wage dilemma.

The sequence is straightforward: from valuing Taiwan to investing in Taiwan, from economic growth to corporate profitability, from corporate profitability to distributing the benefits to workers. What this year’s Top 2000 CEO Survey ultimately indicates is that there still remains a considerable distance between “valuing Taiwan” and helping workers earn more.

【More economic prospects of Taiwan in 2020】

♦ In 2020, Taiwan’s Green Energy Will Power Tech Giants Like Apple and Google

♦ Unwrapping the Secret Behind the Multi-Million Dollar Faux Meat Industry

♦ With Discount Carriers on the Rise, Taiwan’s Aviation Industry Gets a Boost

About the Survey

The CommonWealth Magazine Top 2000 CEO Survey covered the biggest 1,350 manufacturers, 650 service businesses and 100 financial institutions in Taiwan and Taiwan’s 16 financial holding companies. The survey was conducted between Oct. 7 and Oct. 31, 2019 using questionnaires. After excluding enterprises that could not be successfully contacted or that refused to participate, a total of 1,470 questionnaires were issued and 793 were returned, a response rate of 53.95 percent. (Survey execution: CommonWealth Magazine Survey Center Jimmy Hsiung, Yu-hsuan Chang)

Translated by Luke Sabatier

Edited by Sharon Tseng