What Message Is China Sending with Foxconn's Audit?

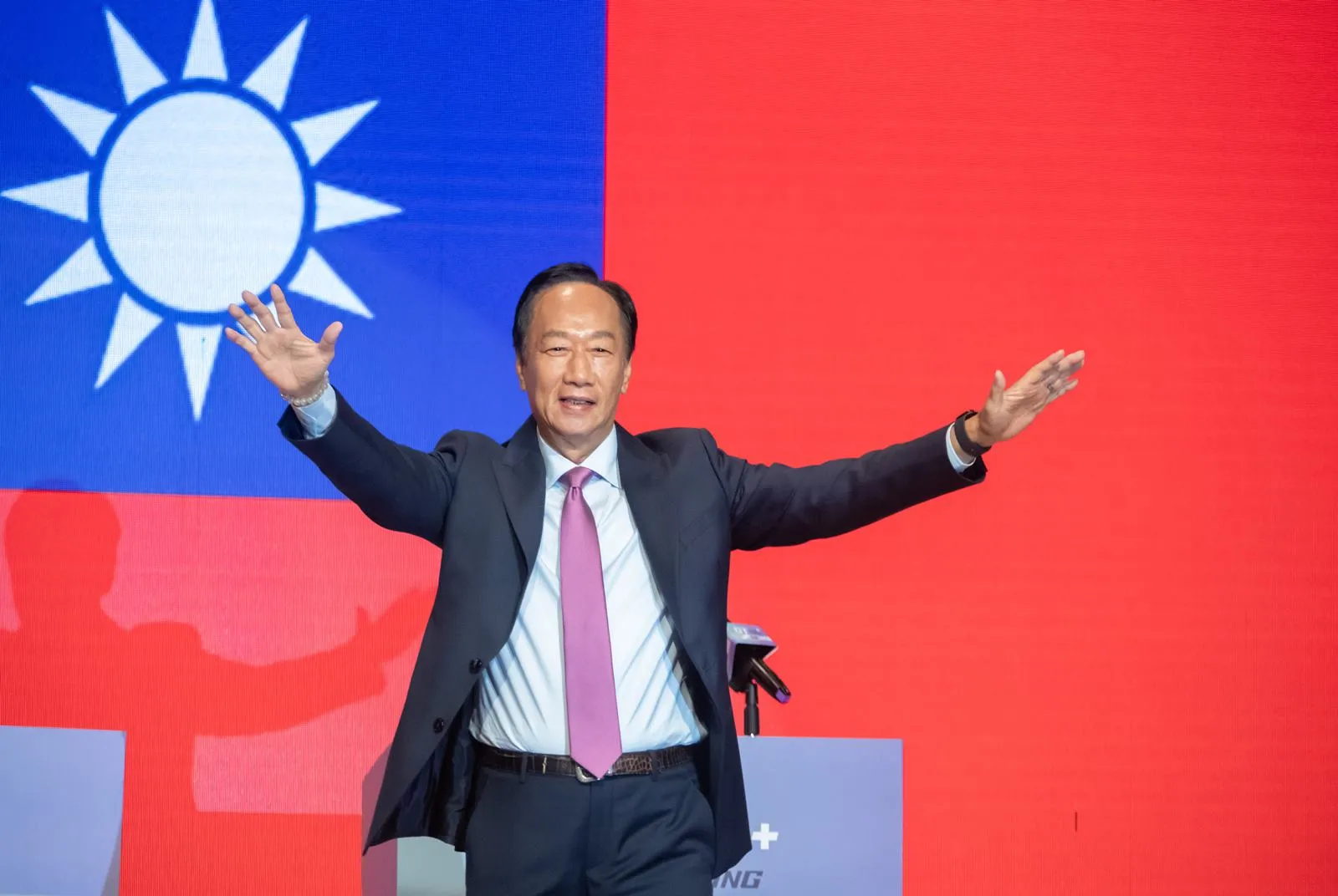

Source:Ming-Tang Huang

China has launched a large-scale tax audit of Foxconn’s operations around the country. What message is it sending to independent presidential candidate and Foxconn founder Terry Gou, and could the situation escalate?

Views

What Message Is China Sending with Foxconn's Audit?

By Silva Shih, Elaine Huangweb only

On October 22, China’s nationalistic Global Times exclusively reported that Chinese tax and natural resource authorities were investigating the factories of the Taiwan-based iPhone supplier, Foxconn, around China.

On the same day, Hon Hai Precision Industry Co., Ltd. (Foxconn’s name in Taiwan) filed a response with the Taiwan Stock Exchange, stating that it would "actively cooperate with the relevant units on the related work and operations," indirectly confirming the report.

However, a week later, Hon Hai founder Terry Gou (郭台銘), who is running for president in Taiwan as an independent, had still not commented on the news and had even brought his public campaign events to a halt.

The scale of the investigations, covering multiple provinces and involving more than one agency, was highly unusual.

"This was a relatively friendly warning," said Keith Zhai (翟琦), a former senior correspondent for The Wall Street Journal and a senior advisor to the strategic advisory firm Global Counsel. The fact that the message was delivered through the Global Times, one of the channels through which Chinese authorities communicate, rather than its Taiwan Affairs Office, indicated that the issue was sensitive, Zhai said.

"It obviously has something to do with Terry Gou’s candidacy," added a senior Taiwanese national security official.

Apart from reporting the opening of the investigations, the Global Times also cited an expert in delivering a political message.

The expert was quoted as saying that Taiwanese companies, including Foxconn, "should not only benefit from the development opportunities and dividends in the mainland but also shoulder corresponding social responsibilities. They should actively contribute to promoting peaceful cross-Strait relations and play a positive role in their continuous development."

Gou resigned as a board director of Hon Hai when he announced his candidacy for president and also stated back in 2019, when he stepped down as chairman of his company, that he would no longer be involved in Hon Hai’s daily operations.

But a wealth management executive familiar with corporate governance said Gou and Hon Hai are inextricably linked, whether in terms of their images or Gou’s holdings of the company’s shares. Even after Gou stepped down as chairman, "he was still like a shadow director, and his words and actions could not be separated from the company he founded," the executive said.

For Beijing to play this card now indicated that it carefully considered its timing.

The director of the Mainland China Affairs Division under Taiwan’s Chinese National Federation of Industries, Huang Chun-Chien (黃健群), said that when Gou went on the show of a major Taiwanese influencer known popularly as Kuan Chang “館長” four years ago, he angered Chinese public opinion by saying Hon Hai in China "is giving them [the Chinese people] food to eat."

Foxconn has about 400,000 workers in Zhengzhou alone, and about 300,000 in Shenzhen in southern China, making it an iconic source of jobs and tax revenue in China. (Source: Ming-Tang Huang)

Foxconn has about 400,000 workers in Zhengzhou alone, and about 300,000 in Shenzhen in southern China, making it an iconic source of jobs and tax revenue in China. (Source: Ming-Tang Huang)

When Gou announced his candidacy this year, Huang said, public opinion in China believed Gou had gone too far by touching on national sovereignty issues.

Just as importantly, eyebrows were raised in China when Tammy Lai (賴佩霞), Gou’s prospective running mate, had her application to renounce her U.S. citizenship approved in just over a month, considered to be unusually quick.

"China might have interpreted it as America intervening," said the Taiwanese national security official, and was left with no choice but to make a move.

The logic was that by "supporting" Gou’s candidacy, the U.S. would further split the already fractured opposition vote in Taiwan’s presidential elections and hand victory to Vice President Lai Ching-te (賴清德), the candidate of the ruling Democratic Progressive Party that China reviles.

That does not explain, however, why Beijing still dared to take on such a huge conglomerate, even if it was not the first time that Beijing has gone after a big Taiwanese company.

Its past actions against Chi Mei Corporation founder Shi Wen-long (許文龍) and Hai Pa Wang Restaurant Co. are among the best examples, and in the past two years, any company implicated in national sovereignty issues has been sanctioned by Beijing, regardless of its perceived political leanings.

| Year |

Company affected |

Background | Impact |

| 2005 | Chi Mei Corporation |

China’s National People’s Congress approves an “Anti-Secession Law” |

Founder Shi Wen-long announces his retirement and stresses he will “not pursue Taiwan independence” |

| 2016 |

Hai Pa Wang Restaurant Co. |

Taiwan’s presidential election |

Non-compliant product labels draw fines; the group issued a statement saying it “resolutely supports the 1992 consensus and that the two sides of the Taiwan Strait are both part of one China.” |

| 2021 |

Far Eastern Group |

Information became public showing that Far Eastern made political donations to both the blue and green camps. |

Fined 474 million renminbi for environmental and fire control violations and had its idle land seized; Chairman Douglas Hsu (徐旭東) issued a statement saying he “opposed Taiwan independence” and supported the 1992 consensus and one China principle. |

|

2023 |

Hon Hai (Foxconn) |

Months away from Taiwan’s presidential election year |

Cross-province tax and land use investigations |

But this case was different because of Foxconn and Gou’s statuses. In the past, Terry Gou was considered a VIP at the World Internet Conference, a meeting hosted and considered of great importance by Beijing. The Wall Street Journal even reported last year that a letter from Gou prodded China to ease its zero-COVID rules.

Also, China has come to depend on Foxconn, one of its biggest exporters and employers, to bring in foreign currency and employ its unemployed population. In cracking down on Gou and Foxconn, therefore, China had to take into account the possible economic as well as political consequences.

Foxconn’s economic importance to China cannot be overstated.

In a list of China’s top 100 exporters two years ago, three of the top five names were part of the Foxconn Group.

According to the value chain research firm Isaiah Research, the Foxconn Group has a presence in nearly 40 areas in China, reflecting its close economic connections to many local economies.

The conglomerate has 400,000 workers in Zhengzhou alone and another 300,000 workers in Shenzhen, and to many local governments, Foxconn stands out as an important employer and a source of tax revenue.

Yet, given Hon Hai’s size, a source familiar with Hon Hai’s inner workings said it was actually not that surprising that Beijing would conduct a tax audit of the company’s operations in China because of the country’s economic issues. The COVID-19 pandemic and lower revenues from dwindling land sales have left local governments in deep financial holes, and reports of local civil servants not being paid their salaries have been repeatedly popping up. In that context, Beijing might be looking for additional revenues.

An executive who has worked in China for years for a foreign tech company noted that even major domestic companies such as Alibaba and Tencent have had their taxes scrutinized by the authorities.

“The government needs money. By looking into your taxes, looking into your land, I’m letting you know that I left you off the hook for many years but now I need money and you need to pay a little more,” was how the executive described the government’s thinking.

Risks on the Rise Amid Policy Discord

Paradoxically, however, going after Foxconn is contradictory to Beijing’s stated goal of attracting investment from abroad.

An official with the Association of Taiwan Investment Enterprises in China observed that because of the U.S.-China trade war and the impact of the COVID-19 pandemic, local governments have been doing everything they can to keep Taiwanese companies around, turning 2023 into a year of incentives for Taiwanese ventures.

(Source: Commonwealth)

Even at the recently concluded Belt and Road Forum, Chinese President Xi Jinping announced that China was lifting restrictions on investment by foreign manufacturers, showing goodwill to overseas companies.

These contradictory policies represent the biggest operating risks for companies in today’s China.

“Right now, Chinese economic policies are inconsistent and have different timetables,” said Wang Guo-chen (王國臣), an assistant research fellow in the Chung-Hua Institution for Economic Research’s First Research Division, which focuses on China’s economy.

“On the one hand, they’re looking to attract investment, while on the other, they have enacted a broad Counter-Espionage Law and are now auditing Foxconn’s taxes. Everything is a contradiction.”

Even more significantly, this year is critical to China’s goal of stabilizing its supply chains.

Amid tensions between the U.S. and China and the emergence of a “China plus one” supply chain, Taiwan’s “big 5” contract manufacturers – Hon Hai, Quanta Computer, Compal Electronics, Pegatron Corporation, and Inventec Corporation – have been quietly pulling out of China over the past two years.

“It’s mainly because customers are asking [the companies] to do it,” said the general manager of a Taiwanese company in Apple’s supply chain.

At the request of Apple, for example, Hon Hai is expanding capacity at its plants in India, and HP and Dell have been trying to diversify their supply chain risk by having their Taiwanese contractors relocate some of their China capacity to Southeast Asia.

Even major Chinese companies are among the suppliers American brands are asking to diversify away from China.

Shenzhen-based Luxshare Precision Industry Co., the second biggest assembler of Apple products, has added AirPods manufacturing capacity in northern Vietnam, and Chinese acoustic components maker GoerTek moved production capacity out of Shandong to Vietnam in March 2023.

Keeping the Supply Chain Exodus in Check

“American brands are requiring the suppliers to pull out at least 40 percent of their capacity. That will have a major impact on China’s economy,” said a management consultant familiar with Taiwan’s high-tech supply chain.

To Beijing, which has recently emphasized “economic security,” this exodus has to be controlled.

A week before news that Foxconn was being audited, Apple CEO Tim Cook flew to Beijing to call on China’s Ministry of Commerce and Ministry of Industry and Information Technology and meet with Chinese vice premier and Politburo member Ding Xuexiang (丁薛祥).

It was the second time this year that Cook had publicly met with high-ranking Chinese officials, and he made it a point to emphasize that over 95 percent of Apple’s products were still made in China.

But what Cook did not say was also important, as iPhone production capacity gradually moves to India. Some outside observers suspect that Beijing’s move against Foxconn was intended as a message to both brands and contractors.

| 2022 | 2023 | 2024 | |

| China | 90-95% | 90% | 78-83% |

| India | 5-10% | 10% | 18-23% |

The message was: “You [Foxconn] want to move away. You need to control the pace at which that happens,” said an executive with a foreign tech firm in China.

On the other hand, some observers contend that the competitive edges of Taiwanese tech manufacturers in China are being eroded as domestic entities like Luxshare and BYD Co. benefit from generous government subsidies and develop cost advantages over their Taiwanese competitors.

With the writing on the wall, Taiwanese companies may not need the prodding of foreign brands to move capacity away on their own, according to that line of thinking.

Beijing Playing the Wrong Cards

In the two days after news of China’s targeting of Foxconn emerged, the share prices of Taiwan-listed Hon Hai Precision Industry and Hong Kong-listed Hon Hai Group subsidiary FIH Co., Ltd. both tumbled. But the stocks stabilized after that, suggesting that the market did not expect Beijing’s move to have much of a material impact on those companies’ operations.

Taiwanese companies and the supply chain also believe that the move was mostly focused on political symbolism.

Following the incident, there are two main issues to watch. First, will the scope of the investigations expand? If they escalate from tax audits and checks of land use to investigations into environmental practices and fire safety, it will signal that the stakes have gone up.

Next, once the investigations conclude, will there be substantive penalties?

“If the fine imposed on Foxconn is greater than that given to the Far Eastern Group, it will represent a clear heightening of political signals,” said the CNFI’s Huang.

Also important is how Terry Gou will respond.

Against the backdrop of the sensitive nature of cross-Taiwan Strait relations and tensions in U.S.-China relations, Foxconn, which is caught between American clients and Chinese production sites, has been forced to accept a “yellow card.”

Though China may feel that is an appropriate pressure point to play, what is clear is that it is only adding to the sense of unease felt by Taiwanese manufacturers and foreign investors, unease that may come back to haunt the Chinese economy.

Have you read?

- Having lost Hong Kong, Chinese reunite in Tokyo

- Cross-strait status quo a “ticking time-bomb” - former Singaporean Foreign Secretary

- Autocracy a major blow to Chinese technology: Yasheng Huang

Translated by Luke Sabatier

Uploaded by Ian Huang