The Truth Behind Vietnam’s Friendshoring

Source:Pei-Yin Hsieh

As Vietnam emerges as an investment hotspot, driven by the friendshoring trend, what challenges do Taiwanese businesses encounter in frontline supply chain transitions? Additionally, what are the aspirations and obstacles facing the Vietnamese people?

Views

The Truth Behind Vietnam’s Friendshoring

By Silva ShihFrom CommonWealth Magazine (vol. 784 )

Located an hour south of the capital city, Hanoi, is the province of Hà Nam - the epicenter of electronics manufacturing in northern Vietnam. This industrial zone hosts several notable companies including internet communications equipment maker Wistron NeWeb. As Wistron plans to expand its facilities elsewhere, its neighbor JEOL is also setting roots by breaking ground in the area.

The plant expansion construction site in the industrial zone. (Source: Pei-Yin Hsieh)

The plant expansion construction site in the industrial zone. (Source: Pei-Yin Hsieh)

Lin Xuanjie, the CEO of Great Resources Group, presides over the Bac Ninh Chamber of Commerce. His company's specialty in factory construction has anchored him in Vietnam for over a decade. Surprisingly, during this period, he witnessed the Bac Ninh region in north Vietnam undergo explosive industrial growth, with property values more than doubling.

Chien Chih-ming, president of the Council of Taiwanese Chambers of Commerce in Vietnam, notes, “Plant projects that were delayed by Covid have resumed this year.” Moreover, membership in the northern Vietnam regional Taiwanese chamber has surged by 150 in the past two years.

This investment trend markedly differs from that of four years ago. Major electronics ventures that initiated manufacturing in China predominantly followed Hon Hai Precision’s path through China two decades ago. They bifurcated production between Guangdong and Guangxi, stretching to Hanoi and the Vietnamese coast.

However, currently, major electronics manufacturers are mushrooming in northern Vietnam at an unprecedented rate. Even Nam Định Province, primarily an agricultural hub, has announced land provisions for cultivation and celebrated a massive NT$3.6 billion investment from Quanta.

City view of ho chi minh city, Vietnam. (Source: Pei-Yin Hsieh)

City view of ho chi minh city, Vietnam. (Source: Pei-Yin Hsieh)

Vietnam - A Global Nexus

Given the dampened consumer demand in Europe and America and the incomplete scaling back of manufacturing, Vietnamese officials express concerns over achieving their GDP growth target of 6.5 percent. Yet, foreign investments remain robust.

A Taiwanese electronics director in Vietnam expressed, “Customers unequivocally demanded facilities in Vietnam, threatening a cessation of orders otherwise. How could we not comply?”

Northern Vietnam, due to its geographical closeness to China, has become the prime investment choice for the "China+1" strategy. This closeness enables a smooth labor division with Chinese factories.

But it's not only Taiwanese firms making moves in northern Vietnam. Luxshare Precision, a significant Chinese supplier to Apple, has expansion plans this year in Vietnam. Additionally, Vietnam's most extensive foreign investor, Samsung, continually augments its investment, recently earmarking $220 million for a new research and development center in Hanoi.

Vietnamese officials project foreign direct investment in 2023 to hit a five-year peak, placing the country third in the ASEAN region, trailing only Singapore and Indonesia.

"The entire globe has now forged ties with Vietnam," declares vice chairman of legal committee, Leif D. Schneider. While Vietnam has historically maintained numerous free trade agreements, there's a burgeoning opportunity for the country to position itself as an alternative to China's global manufacturing dominance.

US President Biden Boosts Semiconductors

In September, a US delegation led by President Biden visited Hanoi, culminating in a Comprehensive Strategic Partnership. Following this, American semiconductor titan Amkor announced a whopping 1.6 billion USD investment in Vietnam for a new semiconductor packaging factory in Binh Phuoc province.

Shortly after Biden's visit, rumors surfaced about a potential November visit by Chinese President Xi Jinping.

During a recent investment briefing, Do Nhat Hoang, the director-general of Vietnam's Investment Planning Ministry, elucidated Vietnam's aspirations: “We aim to develop semiconductors, high-tech sectors, renewable energy, the digital economy, and establish an international financial center here."

Presently, while Vietnam still leans on China for raw materials and intermediate goods imports, the dynamics are shifting. Over the last three years, as American companies increased their focus on Vietnam, Chinese companies began rebranding the country of origin on their products. Jerry Chen of PricewaterhouseCoopers Vietnam discovered that Vietnamese officials recently hinted at adopting strategies from China's playbook, which might include gradually banning processing trade. Chen opined, “That seems the only feasible method to ensure a steady capital inflow into Vietnam.”

Government officials are also ambitiously aiming to elevate the “made in Vietnam” brand while simultaneously fostering the advancement of local enterprises.

What's in Store for Vietnam?

VinFast, Vietnam's pioneering EV company to go public in the US, externally symbolizes the ambitious EV objectives of Vietnam’s premier conglomerate, Vin. They've actively sought international alliances, laying the foundation for Vietnam’s inaugural domestic electric vehicle. Yet, at its core, the Vin Group is strategizing to use this EV initiative as a flagship case to spur the development of a holistic EV production supply chain within Vietnam.

Nguyen Van Thanh, the former senior vice president of VinFast and the current CEO of GSM (Green and Smart Mobility Joint Stock Company), brims with ambition. At under 30, he fervently speaks of his mission to “amplify Vietnam’s national brand.”

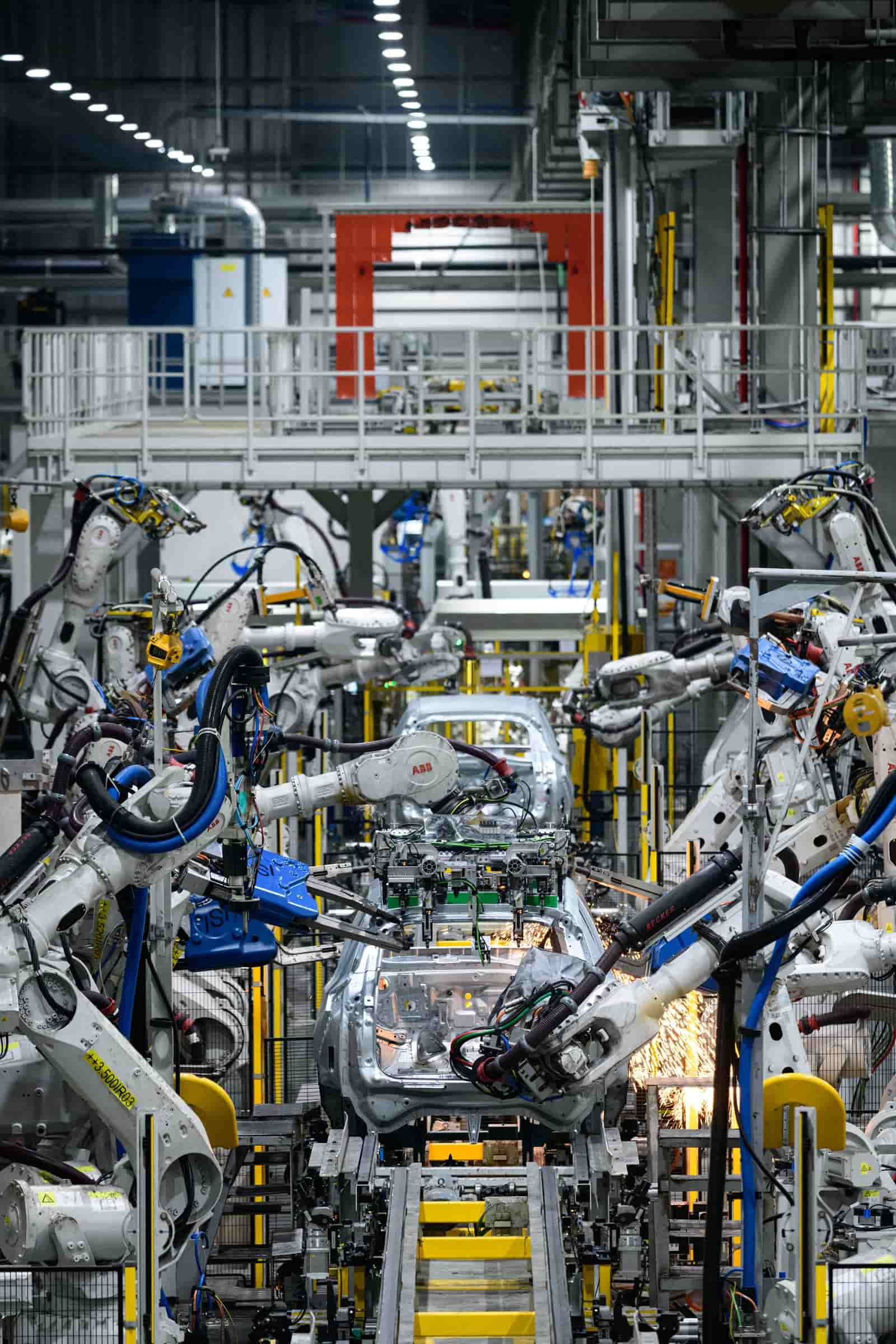

VinFast's assembly line. (Source: Pei-Yin Hsieh)

VinFast's assembly line. (Source: Pei-Yin Hsieh)

And Thanh isn't alone in this quest. Many young entrepreneurs, like those at Selex Motors (which received attention from Janet Yellen), perceive the establishment of Vietnam's national manufacturing brand as a patriotic duty.

However, this journey to upscale manufacturing isn't without hurdles. Corruption and inadequate infrastructure rank as the top impediments.

The sentiment among the Vietnamese people is captured by the saying: “China crosses the river by feeling the stones; Vietnam crosses the river by feeling China.” As a fellow socialist nation, Vietnam keenly observes and draws insights from China, unveiling a novel economic blueprint every five years.

Obstacle #1: Pervasive Corruption and Lacking Infrastructure

It took over ten years to build a single line of Hanoi's light rail, and only 13 kilometers were completed, and residents regarded it as a holiday tourist facility. (Source: Pei-Yin Hsieh)

It took over ten years to build a single line of Hanoi's light rail, and only 13 kilometers were completed, and residents regarded it as a holiday tourist facility. (Source: Pei-Yin Hsieh)

Since China embraced reforms, the performance of its local officials has been intrinsically tied to economic progress. Conversely, pockets of corruption and inertia still plague the local administrative landscape in Vietnam.

Kevin, a 26-year-old entrepreneur based in Hanoi, sardonically comments, “If you factor in the underground economy, Vietnam would have already clinched a spot among Southeast Asia's top three economies.”

Yet, administrative efficiency remains static, which in turn leads to infrastructural lags. Across Vietnam, it's commonplace to witness infrastructure projects, initiated over a decade ago, still in progress.

Due to the surging influx of manufacturers to northern Vietnam, the nation, traditionally reliant on hydropower, now grapples with the repercussions of climate change and aging power grids. Consequently, northern Vietnam endured an unanticipated power outage in May, severely denting factory output.

Moreover, what was once considered a boon – Vietnam’s young workforce – is increasingly becoming a concern for manufacturers.

Obstacle #2: Disproportionate Labor Force Distribution

During a recent trip to both northern and southern Vietnam by CommonWealth, discussions with entrepreneurs, academicians, and officials invariably steered towards Vietnam's glaring labor crunch.

Ho Chi Minh City has a vibrant life. (Source: Pei-Yin Hsieh)

Ho Chi Minh City has a vibrant life. (Source: Pei-Yin Hsieh)

While 60% of Vietnam's populace resides in the south, the majority of the manufacturing influx targets the north, leading to a palpable labor supply-demand mismatch.

Prof. Nguyen Thanh Trung of Vietnam's Fulbright University elucidates, "It may be challenging for outsiders to grasp, but Vietnam possesses a profound sense of regionalism. People are reluctant to relocate between the north and south. In fact, many would prefer seeking employment opportunities abroad."

Additionally, the hunt for high-tech talent in Vietnam has intensified. Chen Ho-hsien, affiliated with the Education Division of the Taipei Economic and Cultural Office in Ho Chi Minh City, reveals that Vietnam can currently produce only 90,000 STEM talents annually. This limited pool is being ardently pursued by both foreign tech giants and native Vietnamese software entities.

One Korean entrepreneur, with a 20-year tenure in Vietnam, candidly states, "Vietnam harbors grand aspirations, yet it lacks the foundational economic prowess China possesses. This makes Vietnam's journey to emerge as the next China quite arduous."

The other side of the rapidly developing Ho Chi Minh City. (Source: Pei-Ying Hsieh)

The other side of the rapidly developing Ho Chi Minh City. (Source: Pei-Ying Hsieh)

Navigating Vietnam's economic landscape is akin to its chaotic road traffic. Wang Kun-sheng, a Taiwanese business veteran with two decades in Vietnam, offers an analogy: "In Vietnam, unless you muster the courage, you'll never traverse a road. Drivers need to be perpetually vigilant – looking left, right, forward, and backward. Only then can one inch forward."

However, relying on unspoken understanding and adaptability doesn't translate into a sustainable national strategy.

For Vietnam to capitalize on the opportunities presented by the US-China trade dynamics, it must recognize that its most formidable challenge isn't external forces but its internal inefficiencies.

Have you read?

- Are Chinese EV brands poised to conquer Europe?

- Thailand's electric shift: The rise of Chinese EVs threatening Japan's legacy

- Taiwan's Hon Hai and EOI invigorate America's Rust Belt

Translated by David Toman

Uploaded by Ian Huang